Banks love predictable businesses, but not every industry runs on steady cash flow and perfect credit. Factoring for high-risk businesses is the funding alternative that evaluates the strength of your invoices and the reliability of your customers. In this factoring guide, we’ll break down how it works, who qualifies, and what to watch for if you’re considering it.

What Counts as a High-Risk Business

When someone calls a business “high-risk,” they’re usually referring to the likelihood that it might experience cash flow problems, default on payments, or face operational challenges that make financial partnerships more complicated. It doesn’t mean you’re doing something wrong, but it does mean you’re carrying more financial uncertainty than other businesses do.

Common Factors That Make a Business High-Risk

Your business might be considered high-risk if any of the situations below apply to you.

- Unstable Cash Flow Patterns: Revenue varies dramatically from month to month or depends heavily on a few large contracts.

- Limited Time in Operation: Businesses that are newly established usually have less financial data to evaluate, which makes them harder to assess.

- Low or Damaged Credit History: A history of late payments, high debt levels, or no established credit can raise red flags.

- High Client Concentration: Relying on one or two clients for most of your revenue means a single loss could seriously impact your business. Because of this, factors keep an eye on customer concentration.

- Legal or Regulatory Exposure: Operating in heavily regulated sectors or ones with reputational risks can lead to stricter scrutiny.

- Long Payment Cycles: Industries where customers take 45 to 90 days or longer to pay invoices may be flagged as riskier.

Examples of High-Risk Industries

Some industries are more likely to be seen as high-risk due to how they operate.

- Construction and Contracting: In the construction industry, payments are often delayed, disputed, or tied to project milestones that can shift.

- Trucking and Freight Brokerage: Rates fluctuate constantly, and new carriers often lack financial history or reserves.

- Staffing and Temp Agencies: You pay employees weekly or biweekly, but staffing clients often pay on 30 to 60-day terms.

- Startups Across All Sectors: Without a track record or an established customer base, risk assessment becomes speculative.

- Healthcare Services: Billing tied to insurance reimbursement can be delayed, denied, or disputed, which makes revenue for healthcare businesses less predictable.

Why Traditional Financing Doesn’t Work for High-Risk Businesses

Traditional lenders such as banks, credit unions, and even many online lenders are cautious by design. Their approval models are built to minimize losses, which means they rely heavily on predictable data and low-risk profiles. If your business doesn’t fit that mold, even for reasons outside your control, it can be tough to get approved.

Short or Inconsistent Operating History

Lenders want to see at least two to three years of steady performance. New businesses or those with seasonal or volatile revenue patterns make it harder to project repayment capacity.

Low Business or Personal Credit Scores

Traditional lenders often look at both business and personal credit. If either one has missed payments, high utilization, or past delinquencies, it raises concerns.

Thin Cash Reserves

A low cash buffer signals that your business may not be able to withstand a downturn or pay off a loan in a tight month.

Industry Volatility

Some sectors, like construction, transportation, or certain types of retail, are considered risky due to economic sensitivity, legal complexity, or historical default rates.

Customer Payment Behavior

If your customers take a long time to pay or have a reputation for slow payments, lenders may see your receivables as less reliable.

Collateral Limitations

Many lenders require collateral. If your business doesn’t have valuable physical assets or if those assets are hard to value, it limits your options.

Tax or Legal Issues

Any history of tax liens, lawsuits, or regulatory actions can lead to immediate rejection, even if your current operations are solid.

What Sets Factoring Solutions for Risky Industries Apart

Understanding factoring for high-risk industries is simple. It’s not a loan. Instead of borrowing money and paying it back over time, you’re selling your unpaid invoices to a factoring company to get immediate working capital.

Factoring Works Differently

- You Issue an Invoice: After delivering your product or service, you send an invoice to your customer for payment.

- You Sell the Invoice to a Factoring Company: The factor buys your invoice and advances you most of the total, usually between 80 and 95 percent, within one to two business days.

- The Factor Collects Payment from Your Customer: Your customer pays the factoring company directly, following the original terms of the invoice.

- You Receive the Remaining Balance: Once your customer pays, the factoring company sends you the rest, minus a small fee for the service.

Why Factoring is More Accessible to High-Risk Businesses

There are many reasons it’s easier to qualify for factoring than traditional loans.

- Customer Credit Matters More Than Yours: If your clients are creditworthy, you can often qualify, even if your own business is new, has a rocky history, or carries debt.

- No Long-Term History Required: Many factoring companies work with startups, seasonal businesses, or companies coming out of a downturn.

- No Hard Collateral Needed: The invoice itself acts as the asset. You don’t need equipment, property, or inventory to secure funding.

- Fast Approvals: Once you’re set up, funding can happen in 24 to 48 hours. That’s especially valuable if your business runs on tight margins or you’re juggling slow-paying customers.

Key Benefits of Factoring for High-Risk Businesses

Although many businesses leverage factoring regularly, it can be a lifeline for those in high-risk industries due to its unique traits.

- Improved Cash Flow Without Taking on Debt: You get paid upfront instead of waiting for client payments, which smooths out your income and helps you cover expenses.

- More Predictable Operations: With faster access to cash, you can pay staff, take on new jobs, buy materials, or reinvest in your business without hesitation.

- Better Supplier Relationships: Paying your own vendors quickly builds trust, improves terms, and may qualify you for early-payment discounts.

- Less Stress Chasing Payments: Many factoring companies handle collections for you. That frees up time and reduces the awkwardness of chasing clients for money.

- Scales With Your Sales: The more work you do and the more invoices you issue, the more funding you can access without reapplying or renegotiating terms.

Types of Tailored Factoring Plans for High-Risk Businesses Available

Factoring companies that work with high-risk businesses know that a one-size-fits-all contract rarely works. Instead, they’ll often customize terms to make funding both accessible and sustainable for your business.

Key Contract Elements That Can Be Customized

Factoring agreements usually include a few core components. These can be adjusted based on your business model, risk profile, and industry.

- Advance Rate: This is the percentage of the invoice you receive upfront. High-risk businesses might receive a slightly lower advance, often between 70 and 90 percent, depending on the risk level associated with your clients.

- Factoring Fee Structure: Fees can be flat or tiered. A flat rate might charge two percent every 30 days, while a tiered model could start with a higher initial fee and increase only if the invoice goes unpaid for a longer period.

- Recourse vs. Non-Recourse Factoring: In recourse factoring, you’re responsible if the customer does not pay. In non-recourse factoring, the factoring company takes on that risk, but fees are typically higher.

- Client-Specific Approval: You might not factor all your customers at once. Some factoring contracts allow you to factor only the clients that meet approval criteria or who have more reliable payment histories.

- Monthly Minimums and Commitment Length: Some factoring companies require a minimum volume of invoices each month or a long-term commitment. High-risk businesses can often negotiate lower minimums or short-term trial periods to prove themselves.

Flexible Plan Structures

Depending on your needs and your stage of growth, you might see factoring plans offered in a few different ways:

- Spot Factoring: Also known as single-invoice factoring, spot factoring lets you choose one invoice at a time to sell. This is ideal if you’re testing the waters or only need occasional cash flow support.

- Selective Factoring: You can also choose which clients or accounts you want to factor. This gives you control over factoring costs and keeps lower-risk clients in-house.

- Whole Ledger Factoring: With whole ledger factoring, the factoring company handles most or all of your receivables. This is often paired with accounts receivable management services, making it a good fit if you want to offload collections.

- Hybrid Arrangements: Some businesses negotiate a plan that starts with spot or selective factoring and builds into a larger contract as trust and volume grow.

Eligibility for High-Risk Business Factoring

Even though factoring companies are more willing to work with businesses that have financial challenges or operate in volatile industries, they still need to protect themselves from unnecessary losses. You’ll still need to meet certain requirements.

Core Requirements for Factoring

All businesses must meet certain basic criteria.

- Business-to-Business (B2B) Invoices: You need to bill other businesses or government agencies. Invoices sent to individual consumers usually do not qualify.

- Invoices That Are Due within a Set Term: Most factors require invoices with net terms, like Net 30, Net 45, or Net 60. Long-term contracts or milestone-based invoices may require additional review.

- Creditworthy Customers: Your clients’ ability and history of paying on time are more important than your own credit. Factoring companies often run credit checks on your customers before approving invoices.

- Clear, Verifiable Work: The work or product must be delivered in full. If the invoice could be disputed, factoring companies may reject it or delay funding.

- No Major Legal Barriers: Open tax liens, bankruptcy proceedings, or legal disputes tied to receivables can disqualify you, though some factors will still work with you depending on the situation.

Additional Considerations for High-Risk Industries

If you’re in a high-risk industry, some additional details may come into play.

- Time in Business: While new businesses are not automatically disqualified, a few months of operating history is usually still required.

- Contract Terms or Payment History: In industries like construction, where pay cycles are slow or tied to approvals, the factor may request additional documentation before accepting invoices.

- Volume and Frequency of Invoices: Some companies only work with businesses that invoice regularly or meet a monthly minimum, but others offer spot factoring with no volume commitment.

- Industry-Specific Risk: If you work in legal services or another highly regulated space, you may need to seek out a factor that specializes in your industry.

Challenges in High-Risk Business Factoring

Factoring is easier to access than traditional funding, but there may still be challenges along the way.

Legal Aspects of Factoring for High-Risk Businesses

Factoring contracts are legally binding agreements. If your business already faces legal or regulatory complications, that can impact eligibility or terms.

- Contractual Obligations: Once you sell an invoice, you give the factor legal rights to collect payment. If your client disputes the invoice or refuses to pay, you will need to cover the loss. If the customer becomes insolvent, you may also still be responsible, depending on whether the agreement is recourse or non-recourse.

- Lien Conflicts: If a lender already has a lien on your receivables, you cannot factor those invoices until that lien is resolved or subordinated. This is common if you’ve used your accounts receivable as collateral on a prior loan.

- Regulated Industries: Some businesses may need to work with specialized factoring companies that understand the legal landscape. Standard factoring companies often avoid certain sectors due to regulatory risk.

- Jurisdiction Issues: If your customers are international or governed by different legal systems, the factoring company may decline the invoices or require additional documentation.

Risk Assessment in High-Risk Factoring

Factoring companies do their own due diligence. High-risk businesses face more scrutiny in certain areas.

- Customer Creditworthiness: The factor will evaluate the clients listed on your invoices. If your customer base includes startups, companies with late payment histories, or businesses in decline, that weakens your position.

- Invoice Validity: Any uncertainty surrounding the invoice, such as partial deliveries, change orders, or pending approvals, will delay funding or disqualify the invoice altogether.

- Dispute Risk: Industries prone to disputes, such as construction or custom manufacturing, often require extra steps to confirm that work is complete and accepted before invoices are eligible.

Credit Considerations for High-Risk Factoring

Your personal or business credit score is not the deciding factor, but it still matters, especially when you’re new to factoring.

- You May Be Offered Higher Fees: If your credit profile shows missed payments, recent bankruptcies, or high debt levels, the factor may increase your fee to offset risk.

- Recourse Agreements Are More Common: If your credit is weak or your clients are unproven, many factoring companies will offer recourse-only deals. That means you’re responsible if the client fails to pay.

- You Might Be Limited in Volume or Client Selection: Some factors will limit the number of clients you can factor or the size of invoices you can submit until you establish a stronger track record.

Other Common Challenges for High-Risk Businesses

- Customer Perception: In some industries, clients are unfamiliar with factoring. If the factor’s communication is aggressive or unclear, it may strain your customer relationships. Choosing a reputable, service-oriented factor helps you avoid this.

- Volume Commitments: Some contracts require you to factor a certain number or dollar value of invoices each month. This can be hard for seasonal or unpredictable businesses to maintain.

- Fee Complexity: Rates are not always transparent. Some companies advertise low factoring fees but add charges for things like credit checks, collections, or early termination.

- Internal Readiness: If your invoicing is disorganized or delayed, it can create problems. Factoring works best when your paperwork is clean and your billing process is consistent.

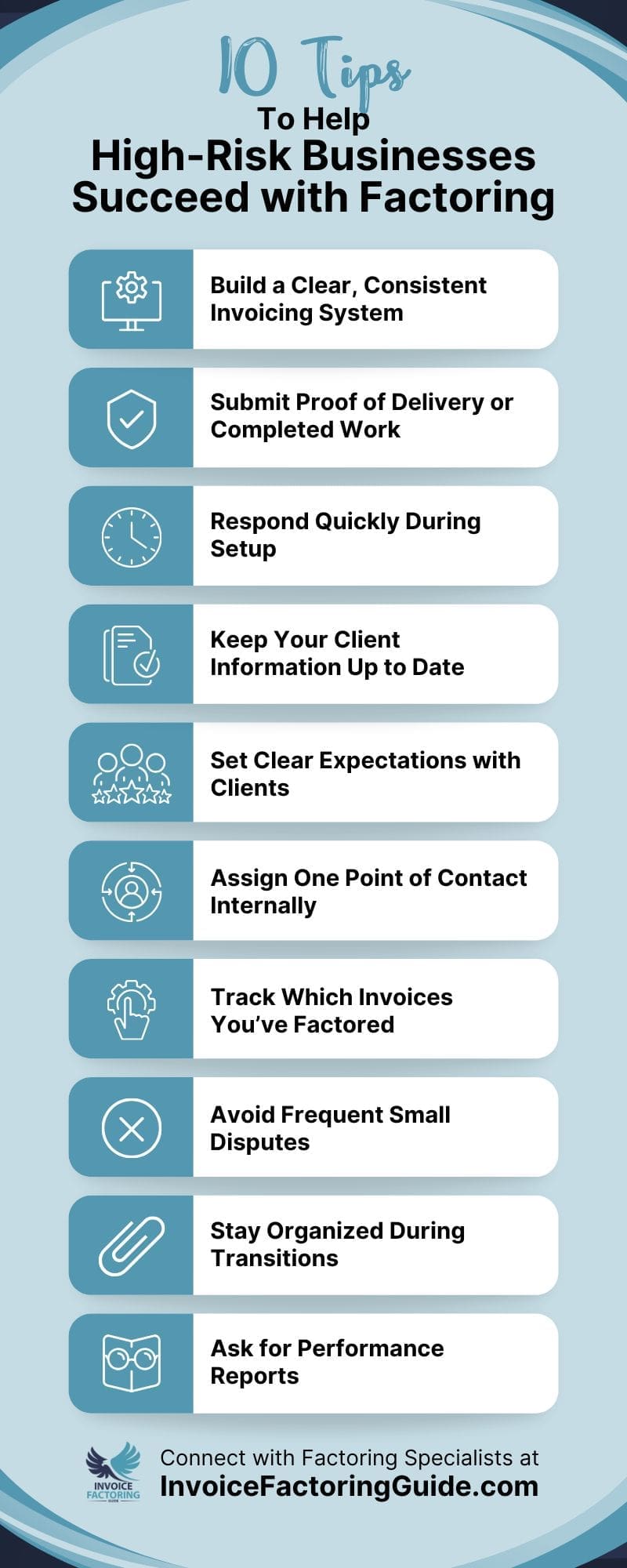

Tips to Help High-Risk Businesses Succeed with Factoring

Following a few best practices can help streamline the approval process and ensure everything goes smoothly after.

Build a Clear, Consistent Invoicing System

Ensure your invoices are factoring-ready. They must include all the essential details, such as invoice number, issue date, due date, payment terms, and detailed line items. Incomplete or inconsistent invoices slow down approval and raise questions about how you operate. If you aren’t already leveraging accounting software like QuickBooks, Xero, or Zoho Books, consider investing in it, as it can tackle most of this for you and improve invoicing efficiency.

Submit Proof of Delivery or Completed Work

If your business delivers physical goods or services that could be disputed, include signed delivery receipts, work completion forms, or time logs. These serve as evidence that the invoice is valid and collectible.

Respond Quickly During Setup

During onboarding, the factoring company may ask for customer lists, sample invoices, business formation documents, or tax ID verification. Delays here send a signal that your back office may not be reliable.

Keep Your Client Information Up to Date

If your customer changes billing addresses, contact info, or payment practices, update the factor immediately. Outdated information can stall payments and create unnecessary friction.

Set Clear Expectations with Clients

Unless you’re working with a company that specifically offers non-notification factoring, your customers will be informed that the factor is involved and where to send payments. Most will already be familiar with the process, but it helps eliminate confusion if they hear it from you and understand that your decision to factor allows you to offer them extended payment terms.

Assign One Point of Contact Internally

Designate a specific person on your team to manage communication with the factoring company. This prevents miscommunication and ensures that someone is always available to handle documentation or approvals.

Track Which Invoices You’ve Factored

Keep an internal record so you don’t accidentally resubmit invoices or follow up on payments that are already in the factor’s hands. This also helps with reconciliation during tax time or audits.

Avoid Frequent Small Disputes

If your customers regularly push back on minor issues or your team frequently makes billing errors, it may lead the factoring company to reconsider your eligibility. Clean, dispute-free invoicing makes you a lower-maintenance client.

Stay Organized During Transitions

If you switch factoring companies or change any part of your payment process, be meticulous. Confirm that UCC filings are released, notify clients of the new remittance address, and avoid overlap between providers.

Ask for Performance Reports

Some factoring companies offer monthly or quarterly reports showing payment trends, average days to pay, and customer risk flags. You may even have access to them at any point through an online portal. Use these insights to make smarter decisions about which clients to prioritize or let go.

Get Personalized Information from a Factoring Specialist

There are a lot of nuances to factoring as a high-risk business, simply because contracts are often tailored to your unique needs and situation. The best way to find out what factoring might look like for your company is to speak with a factoring specialist. If you’d like to explore it more, let us know.

FAQs on Factoring for High-Risk Businesses

Which industries are considered high-risk for factoring?

Industries like construction, trucking, staffing, and healthcare are often considered high-risk due to slow payment cycles, frequent disputes, or regulatory complexity. Defining high-risk businesses in factoring comes down to how predictable their payments are and how reliable their customers tend to be.

Why do traditional lenders reject high-risk businesses?

Lenders prefer stable revenue, strong credit, and collateral. High-risk businesses often lack these, which makes banks view them as too unpredictable to finance through loans or credit lines.

How does factoring work for high-risk businesses?

Factoring converts unpaid B2B invoices into immediate cash. It’s based on your customer’s ability to pay, not your credit, which makes it a more practical funding option for businesses labeled high-risk.

What are the benefits of invoice factoring for high-risk industries?

Factoring provides fast access to cash, reduces reliance on loans, and helps cover expenses even when clients pay slowly. It also grows with your sales volume over time.

Can startups or new businesses qualify for factoring?

Yes, if they issue B2B invoices and their customers have solid credit. Many factoring companies work with businesses that have only a few months of history.

Are there special contracts for high-risk businesses in factoring?

Yes. Terms like advance rates, fees, and recourse options can be customized based on your industry, invoice reliability, and client risk level.

What credit score is needed for a high-risk business to qualify for factoring?

There’s no set score. Your customer’s credit matters more than yours. Many high-risk businesses qualify even with low or limited credit history.

How can a high-risk business improve its chances of getting approved for factoring?

Keep your invoicing accurate, submit proof of completed work, respond quickly to document requests, and work with creditworthy customers to build trust with the factoring company.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300