It’s said that taking venture capital (VC) is like adding rocket fuel to your company. You need to be aware it might explode, and not always in the way you hope. Invoice factoring is a solid alternative to business funding for startups as young as the seed stage, though your business must be operating and generating revenue through B2B invoices to qualify. On this page, we’ll walk you through how both types of funding work and their benefits, plus provide a comparison of venture capital vs. invoice factoring and outline some situations in which factoring may be the more ideal funding solution for startups.

Invoice Factoring for Startup Capital

Invoice factoring, also known as factoring, is a type of debtor finance. In essence, it’s a way for your business to manage its cash flow by selling its invoices, or accounts receivable, to a third party called a factor at a discount. This method allows you to receive funds immediately instead of waiting for your customers to pay their invoices, which could otherwise take 30, 60, or even 90 days.

How Factoring Works

Let’s start with a basic overview of how invoice factoring typically works.

- Invoice Creation: Your business sells goods or services to a customer and issues an invoice for those goods or services, with payment due at a later date.

- Factoring: Your business then sells this unpaid invoice to a factoring company at a discount. The factoring company assesses the credit risk of the invoiced customer and agrees to pay a certain percentage of the invoice’s face value to your business upfront.

- Immediate Payment: Once the factoring company approves the invoices for factoring, your business receives an advance, typically around 60 to 95 percent of the total invoice value, within a short period—often within 24 to 48 hours.

- Customer Payment: The customer pays the invoice directly to the factoring company by the due date.

- Settlement: Once the factoring company receives payment from your customer, it remits the remaining balance to your business minus a small factoring fee. This fee can vary depending on the volume of invoices factored, their risk, and other factors, but it generally ranges from one to five percent of the invoice value. Our factoring calculator can provide you with an instant estimate to help you understand your potential costs better.

Invoice Factoring vs. Invoice Financing

Although the phrases “invoice factoring” and “invoice financing” are often used interchangeably, they refer to different things. Both can provide your business with an immediate cash injection based on your receivables. However, factoring involves selling your receivables to a factoring company at a discount. It does not create debt, and your business has nothing to pay back because your customer clears the balance when they pay their invoice. Invoice financing, on the other hand, is a loan that uses your invoices as collateral. You pay the balance back in installments with interest.

Qualifications for Factoring

Requirements for factoring approval can vary depending on the factoring service provider. However, there are some standard qualifications that most businesses must meet.

- B2B or B2G Sales: The business should primarily sell goods or services to other businesses (B2B) or government entities (B2G). Factoring companies generally do not factor invoices for businesses that sell directly to consumers (B2C).

- Creditworthy Customers: The creditworthiness of the customers being invoiced is crucial because the factoring company collects payment from these customers. Therefore, the factoring company will assess the credit history and payment behavior of the business’s customers rather than the business itself.

- Invoices for Completed Work: Factoring companies typically require that the invoices submitted for factoring represent completed work or delivered goods. This is to ensure there’s no dispute over the invoice that could affect payment.

- Free of Encumbrances: The invoices should not be pledged as collateral for another loan or financing agreement. Factoring companies often require that the invoices they purchase are free of liens or other encumbrances.

- No Major Legal or Tax Issues: Businesses seeking factoring services should not be encumbered by significant legal problems or have outstanding tax liens. Such issues can complicate the factoring process and are usually a disqualifier.

- Minimum Volume: Some factoring companies set a minimum volume of invoices or a minimum dollar amount that they will factor. This threshold varies widely among companies but is set to ensure that the relationship is economically viable for the factoring company.

Benefits of Factoring

Invoice factoring offers several significant benefits and advantages, particularly for small businesses and startups that need to manage cash flow effectively or lack access to traditional bank financing.

- Immediate Cash Flow Improvement: Arguably, the most significant benefit of invoice factoring is quick access to cash. Your business can convert its outstanding invoices into liquid cash, usually within 24 to 48 hours. This rapid turnaround can be crucial for meeting payroll, restocking inventory, or taking advantage of growth opportunities without waiting for customers to pay.

- Easier Qualification than Traditional Loans: Factoring companies primarily focus on the creditworthiness of your customers, not your business’s credit score or financial history. This makes it easier for businesses with less-than-perfect credit, limited operating history, or those unable to provide collateral to secure financing.

- Not Debt: Since factoring is the sale of an asset (the invoice), it does not create debt on your business’s balance sheet. This can be a significant advantage if you want to maintain a clean balance sheet or avoid taking on new debt.

- Outsourced Credit Management: Factoring companies typically handle the collection process for the invoices they purchase. This can save you time and resources, allowing you to focus on your core operations rather than managing accounts receivable and chasing down payments.

- Flexible Financing Option: Factoring agreements can be more flexible than traditional loans or lines of credit. You can choose which invoices to factor and when, which gives you more control over your financing needs and costs. There’s no need to factor all invoices, so you can manage your cash flow as needed.

- Scalability: As your business grows and invoices larger amounts to more creditworthy customers, you can factor more invoices for greater amounts of money. This scalability makes invoice factoring a viable option for supporting growth without the need to re-negotiate loan terms or limits.

- Risk Mitigation: Factoring companies run credit checks on your customers to assess creditworthiness prior to factoring. Applying the insights learned when extending credit reduces the risk of late payments and non-payment. Additionally, you can choose non-recourse factoring to mitigate the risk of bad debt further. In non-recourse factoring, the factoring company assumes the risk of non-payment by the customer.

- Improves Credit Terms with Suppliers: With improved cash flow from factoring, your business can negotiate better terms with suppliers, such as discounts for early payment. This can further enhance your company’s financial position and profitability.

- Value-Added Services: Factoring companies often offer additional services that can help your business save money or operate more efficiently. For instance, trucking and freight factoring companies may provide fuel discount cards, fuel advances, tire discount programs, and more.

- Expert Advice: By working with a factoring company that specializes in your industry, you can tap into a wealth of knowledge to help your business grow and potentially be linked with other resources that will help your business thrive.

Venture Capital for Startups

VC is a form of private equity and financing that investors provide to startups with a strong probability of growth in exchange for ownership or equity in the company. Unlike debt financing, where a loan must be repaid with interest, venture capital is invested in exchange for a stake in the company’s future. This type of financing is particularly popular among new companies or ventures with limited operating histories and is too risky for traditional bank loans or public markets.

How Venture Capital Works

Startups that want to scale operations, develop new products, or enter new markets often turn to venture capital for funding. These companies typically need more capital than what’s available through traditional loans or other early-stage financing methods like angel investors. Let’s review how venture capital normally works.

- Pitching to VCs: You pitch your business plan to venture capital firms or individual investors (VCs). This presentation must convincingly outline your business’s value proposition, market opportunity, growth potential, and competitive advantage.

- Due Diligence: Interested VCs conduct a thorough review or due diligence process. This involves analyzing your company’s management team, market size, products, business model, and financial projections. The goal is to assess the potential for significant returns on their investment.

- Investment Terms and Valuation: If the VC decides to invest, the following steps involve agreeing on a valuation for your business and the terms of the investment. This process determines how much equity the VC will receive in exchange for their investment. The valuation and terms are crucial, as they affect the ownership and control of the company post-investment.

- Funding Rounds: Venture capital investments often occur in rounds (Series A, Series B, Series C, etc.) as the company grows and needs additional capital. Each round comes with a new valuation, reflecting your company’s progress and potential.

- Active Involvement: VCs may take an active role in the company, offering expertise, mentoring, and access to their network of contacts. This involvement can be invaluable for young companies that want guidance and industry connections.

- Exit Strategy: Venture capitalists typically look for a return on their investment within five to ten years. This return usually comes from one of three exit strategies:

- Another company is acquiring your company.

- Your company is going public through an initial public offering (IPO).

- The VC is selling its stake to another private investor.

How VC Rounds Work

Venture capital funding is typically structured in rounds, with each round designed to meet the evolving needs of a growing business. From the initial seed stage to later expansion phases, each round has its characteristics, goals, and typical funding amounts.

Seed Funding

- Purpose: Seed funding is often considered the first official equity funding stage. It’s designed to help a startup develop its product, conduct market research, and cover initial operating expenses. Companies seeking seed funding are often in their infancy, typically ranging from being just an idea or prototype stage to having been in operation for up to 2 years.

- Typical Participants: Angel investors, early-stage venture capital firms, and sometimes friends and family.

- Typical Amount: Seed rounds can range from a few thousand to a few million dollars, with an average seed round in the U.S. being around $1 to $2 million, depending on the industry and potential growth.

Series A

- Purpose: Once a startup has developed a track record (an established user base, consistent revenue figures, or other key performance indicators), Series A funding helps it optimize its product offerings and scale its user base.

- Typical Investors: Venture capital firms that specialize in early-stage investing.

- Typical Amount: Series A rounds typically range from $2 million to $15 million. However, the average has been increasing, with many deals now in the $10 million to $20 million range due to increased competition and larger fund sizes.

Series B

- Purpose: Series B rounds are about taking businesses to the next level, past the development stage. Companies that reach this stage are well-established, and the funding is used to expand market reach, increase product lines, or even acquire other companies.

- Typical Investors: A mix of existing investors and new venture capital firms that focus on later-stage investing.

- Typical Amount: Series B rounds can range widely but often fall between $20 million to $60 million.

Series C and Beyond

- Purpose: By the time a company is seeking Series C, D, or even E funding rounds, it is typically looking to scale rapidly, enter new markets, or finance significant acquisitions. These rounds are about scaling as efficiently as possible.

- Typical Investors: Late-stage venture capitalists, private equity firms, and sometimes hedge funds or banks.

- Typical Amount: These rounds can see funding of $50 million or more, with no upper limit. It’s not uncommon for these rounds to reach into the hundreds of millions, especially for companies with proven business models poised for international expansion or planning for an IPO.

Special Cases

- Bridge Rounds: Sometimes, a company finds itself in need of an extra infusion of cash between traditional rounds. These are often referred to as bridge rounds and are designed to get a company to its next major milestone or funding round.

- Growth Rounds: These are typically larger rounds aimed at companies looking for major expansion or to solidify their market dominance before going public or being acquired. The amounts can vary significantly based on the company’s valuation and the investment’s goals.

The amount of money raised at each stage depends on various factors, including the startup’s valuation, the industry sector, the current economic climate, and the level of investor interest. Startups in high-growth fields like technology and biotech often raise more substantial amounts due to the high costs associated with research and development and market expansion.

Qualifications for Venture Capital

Qualifying for VC funding is different from traditional financing or invoice factoring. Some of the typical requirements and attributes that make a company more attractive to venture capitalists are covered below.

- Innovative Business Model or Product: VCs are typically interested in companies that offer innovative solutions, products, or services with the potential to disrupt or create significant advancements within their markets.

- Strong Market Potential: Companies that can demonstrate a large or rapidly growing market for their product or service are more likely to attract VC interest. VCs are looking for businesses that can scale and capture a significant market share.

- Competitive Advantage: Startups with a clear competitive advantage, such as proprietary technology, intellectual property, or a unique business model, are more appealing to VCs. This advantage should be sustainable over time to fend off competitors.

- Talented Management Team: A strong, experienced, and committed management team is crucial. Venture capitalists invest in people as much as in ideas, so having a team with a proven track record, industry expertise, and the ability to execute the business plan is essential.

- Scalability: The business must have the potential for high scalability, meaning it can grow revenue significantly without a corresponding increase in costs. VCs are interested in companies that can scale their operations and sales efficiently.

- Clear Path to Profitability: While immediate profitability is not always a prerequisite, there must be a clear and credible path to profitability. Businesses need to present realistic financial projections that show potential for high returns.

- Exit Strategy: Venture capitalists are typically looking for a return on their investment within a 5 to 10-year timeframe. Companies must have a plausible exit strategy, such as the potential for an acquisition or the ability to go public through an IPO.

- Cultural Fit: VC firms often look for companies that fit their investment philosophy, areas of expertise, and values. This cultural alignment can be as important as the financial prospects of the business.

It’s important to note that attracting VC funding is highly competitive. Only a tiny percentage of businesses seeking venture capital actually secure funding. Preparation is critical: startups must have a compelling pitch, a well-developed business plan, and solid proof of concept or traction in their market. Networking can also play a significant role; introductions to VCs through trusted mutual contacts can help get your foot in the door.

Benefits of Venture Capital

Leveraging venture capital (VC) funding can offer transformative benefits for startups and growth-stage companies, particularly those aiming to disrupt markets or scale rapidly. Here are some of the most significant advantages of securing VC investment.

- Significant Capital Injection: VC can provide substantial financial resources that are often not accessible through traditional loans. This capital can fuel growth initiatives like market expansion, product development, and scaling operations.

- Mentorship and Expertise: Venture capitalists often bring a wealth of experience and knowledge to the companies they invest in. They can offer strategic advice, mentorship, and operational guidance to help navigate the challenges of scaling your business.

- Networking Opportunities: VCs typically have extensive networks within the business and investment communities. They can facilitate introductions to potential customers, partners, and additional investors, which can be invaluable for a growing company.

- Credibility and Brand Visibility: Securing VC funding can significantly enhance a company’s market credibility. It signals to customers, partners, and future investors that the business has been vetted and deemed worthy of investment by knowledgeable investors.

- Market Access and Expansion: The capital and support provided by VCs can enable companies to enter new markets or accelerate their penetration into existing ones. This can help startups achieve a critical mass of users or customers more quickly than they might on their own.

- Support with Follow-on Funding: Venture capitalists can provide or facilitate additional rounds of funding as the company grows. Their ongoing support can be crucial in navigating the startup through various growth phases to eventual profitability or an exit.

- Exit Strategy Support: VCs are experienced in crafting exit strategies, whether through an acquisition or an initial public offering (IPO). Their expertise and networks can play a pivotal role in achieving a successful exit, benefiting both the founders and the investors.

However, it’s essential to recognize that leveraging VC funding also comes with its set of challenges and considerations. Startups typically give up equity and some degree of control over their business when accepting venture capital. Moreover, VCs expect high returns on their investments, which can put significant pressure on the company to grow rapidly, often prioritizing speed over sustainability.

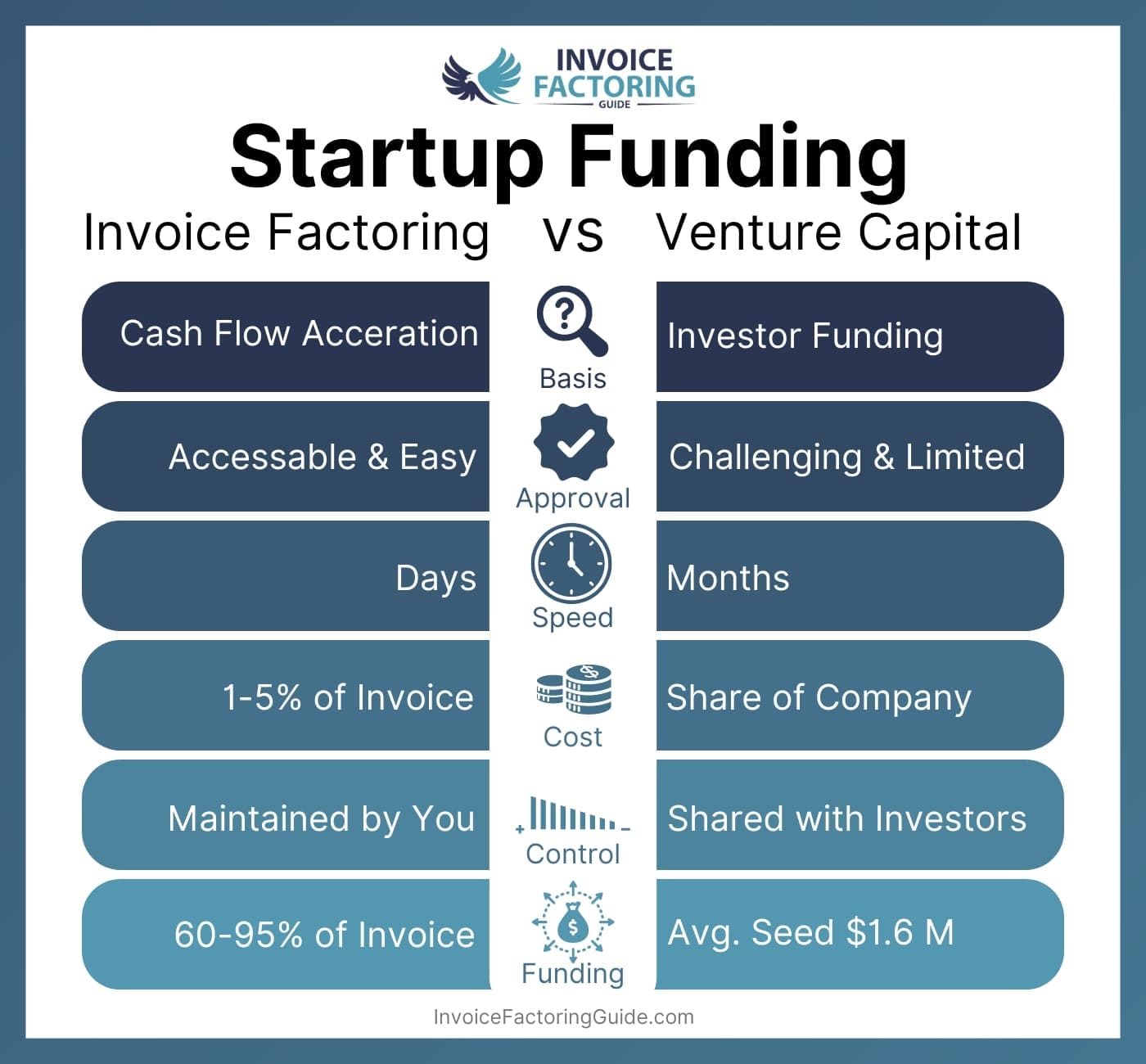

Factoring vs. Venture Capital for Startups

Understanding the differences between factoring and venture capital can make it easier to decide which financing option is better suited to your needs. Below, we’ll take a look at some of the key differences.

Nature of Financing

- Invoice Factoring: This is a form of debt financing where businesses sell their accounts receivable (invoices) to a third party (a factor) at a discount to improve cash flow immediately. This method does not involve selling equity or taking on debt in the traditional sense. It is more about managing cash flow efficiently.

- Venture Capital: VC is equity financing, where capital is exchanged for ownership shares in the company, along with an active role in company management. VCs invest with the expectation of a high return on their investment through the company’s growth and eventual exit (sale or IPO).

Impact on Cash Flow and Debt

- Invoice Factoring: Provides immediate liquidity by allowing businesses to convert outstanding invoices into cash, usually within a few days. This helps manage the cash flow without adding traditional debt to the balance sheet, as the money received is not a loan but an advance against invoices.

- Venture Capital: Offers large sums that can significantly boost a company’s growth trajectory. However, it does not solve short-term cash flow problems directly and involves dilution of ownership.

Requirements and Accessibility

- Invoice Factoring: Generally requires that a business has creditworthy B2B customers and invoices for completed work. It’s relatively easy to qualify for as the focus is on the value and collectability of the invoices, not the financial strength of the business itself.

- Venture Capital: Requires startups to demonstrate a scalable business model, high growth potential, and a strong management team. It is typically more challenging to secure due to high competition and stringent evaluation criteria. Only 0.05 percent of startups get VC funding, HubSpot reports.

Funding Amounts

- Invoice Factoring: Businesses receive up to 95 percent of each invoice factored upfront. This can amount to a few thousand dollars or hundreds of thousands of dollars, depending on the invoice and terms.

- Venture Capital: The median amount for seed funding is around $1.6 million, per Statista. Early VC funding rounds sit around $5 million.

Cost and Control

- Invoice Factoring: The cost is the discount rate applied to the invoices, usually ranging from one to five percent of the invoice value. Businesses retain complete control over their operations, though they must manage customer relationships carefully as the factor takes over the collection process.

- Venture Capital: Means giving up a portion of equity and typically some level of control over business decisions. This can mean significant involvement by VCs in business operations and strategic decision-making.

Suitability

- Invoice Factoring: Best suited for businesses that need immediate cash flow solutions, have thin margins, and whose growth is limited by slow-paying customers. It is ideal for companies in industries where long payment terms are standard, such as manufacturing, wholesale, and oilfield services.

- Venture Capital: Suited for high-growth potential businesses that need substantial capital to scale quickly and are willing to manage the complexities of having an investor involved in strategic decisions. It is ideal for tech startups, biotech, and other sectors with high capital requirements and high-return potentials.

When Invoice Factoring May Be Better for Startups

Factoring for startups may be the better solution if any of the following applies to you.

- Immediate Cash Needs: Businesses need quick access to cash without the lengthy due diligence process.

- No Equity Dilution: Owners want to retain complete control of their business without sharing equity.

- Credit Enhancement: Using the creditworthiness of their customers to finance operations.

- Flexibility: Ability to choose which invoices to factor based on immediate cash flow needs.

Fund Your Startup with Invoice Factoring

If your startup is already generating revenue and has unpaid B2B invoices, factoring may be your ideal funding solution. Like VC, it doesn’t create debt you need to pay back, but it also doesn’t diminish your ownership or control of the company. To learn more or get started, request a complimentary factoring quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300