Did you know that three in five small businesses struggle with cash flow issues, per Intuit surveys? In fact, nearly two-thirds say cash flow management is their greatest challenge, American Express reports. It isn’t easy to run your company effectively and grow without finding an additional source of working capital. Small businesses often use factoring and lending platforms in this situation, but they work differently and can benefit your company in unique ways. On this page, we’ll walk you through how they work, explore the advantages and disadvantages of each, and make a quick comparison between factoring and lending platforms so it’s easier to identify the best funding solution for your needs.

What is Factoring?

Factoring is a financial transaction where your business sells its invoices at a discount to a third party called a factor or factoring company. This gives your business immediate cash flow, allowing you to cover operational expenses, take on new projects, or grow the company.

Advantages of Factoring

- Immediate Cash Flow: Your business receives cash quickly, often within 24 to 48 hours, which can be vital for meeting short-term financial needs. Some factors even offer same-day funding.

- No Debt Incurred: Unlike loans, factoring does not add debt to your business’s balance sheet. It’s a sale of assets, not a borrowing.

- Improved Credit Management: Factoring companies typically provide credit checks on potential customers, helping your business avoid bad debt.

- Focus on Core Activities: By outsourcing accounts receivable management to the factoring company, your business can focus more on its core operations and growth strategies.

Disadvantages of Factoring

- Cost: Factoring can sometimes be more expensive than traditional financing methods. Use it strategically as needed to maximize profitability.

- Customer Perception: Some customers may view the involvement of a factoring company as a sign of financial instability. To dispel these myths, you may need to communicate critical benefits like boosting cash flow and the ability to serve them better.

- Loss of Control: Businesses may lose some control over their customer relationships since the factoring company often takes over the collection process. However, this isn’t too dissimilar from outsourced billing, and your customers can still contact you if they have concerns.

- Qualification Requirements: Factors typically require invoices to be free of encumbrances and your clients to be creditworthy. While this means it’s usually easier to qualify for factoring than other forms of funding, not all invoices or customers are approved.

What Factoring Looks Like in Practice

A small Arkansas manufacturing company with seasonal sales spikes might use factoring to manage cash flow during slower months. By selling invoices, the company gets immediate funds to cover payroll and inventory costs without waiting 30 to 60 days or more for customers to pay.

What Are Lending Platforms?

Lending platforms, often called peer-to-peer (P2P) lending or online lending marketplaces, connect borrowers directly with individual or institutional lenders. These platforms facilitate various types of loans, including business loans, personal loans, and short-term financing, often through an online process that is quicker and more accessible than traditional bank loans.

Advantages of Lending Platforms

- Accessibility: Lending platforms often have less stringent qualification criteria compared to traditional banks, making it easier for small businesses to obtain financing.

- Speed: The application and approval process is usually faster, with funds often disbursed within days.

- Diverse Options: These platforms offer a variety of loan products, from short-term loans to longer-term financing, allowing businesses to find a solution tailored to their needs.

- Competitive Rates: Because of the competitive nature of P2P lending, borrowers may find more favorable interest rates compared to traditional loans.

Disadvantages of Lending Platforms

- Higher Interest Rates for Riskier Borrowers: Businesses with lower credit scores may experience higher interest rates, which may be more expensive than traditional loans.

- Potential Fees: Some platforms charge origination fees, late payment fees, and other charges that add to the cost of borrowing.

- Limited Loan Amounts: Lending platforms may offer smaller loan amounts compared to traditional banks, which might not be sufficient for larger financing needs.Market Risk: The availability and terms of loans vary based on market conditions and investor interest.

What Lending Platforms Look Like in Practice

A California tech startup needing quick funding for a product launch might turn to a lending platform to secure a short-term loan. By doing so, they can expedite their project timeline without waiting for lengthy bank approval processes.

Factoring vs. Lending Platforms: Key Differences

Now that we’ve covered the background on each let’s take a look at the differences between factoring vs. lending platforms.

Nature of Financing

- Factoring: Involves selling B2B invoices to a factoring company at a discount. It’s not a loan but a sale of assets.

- Lending Platforms: Provide loans that must be repaid with interest over time. These loans can be secured or unsecured.

Speed of Funding

- Factoring: Provides immediate cash flow, often within 24 to 48 hours after selling the invoices.

- Lending Platforms: Generally offer faster funding than traditional banks, with funds disbursed within a few days to a week.

Qualification Criteria

- Factoring: Based on the creditworthiness of the business’s customers rather than the company itself. Businesses with poor credit but reliable customers can still qualify.

- Lending Platforms: Based on the business’s creditworthiness and financial health. Businesses with higher credit scores and stronger financials get better rates and terms.

Impact on Debt

- Factoring: Does not add debt to the business’s balance sheet, as it’s a sale of receivables.

- Lending Platforms: Adds debt that needs to be repaid, affecting the business’s balance sheet and financial ratios.

Costs

- Factoring: Costs include a discount rate on the invoice value, which can vary based on factors like the customer’s credit and the invoice amount.

- Lending Platforms: Costs include interest rates and various fees (origination, late payment, etc.), which can be higher for riskier borrowers.

Customer Relationship

- Factoring: The factoring company often takes over collections, which can impact customer relationships. The business might lose some control over how collections are handled.

- Lending Platforms: The business retains control over customer relationships and collections, as it is responsible for repaying the loan.

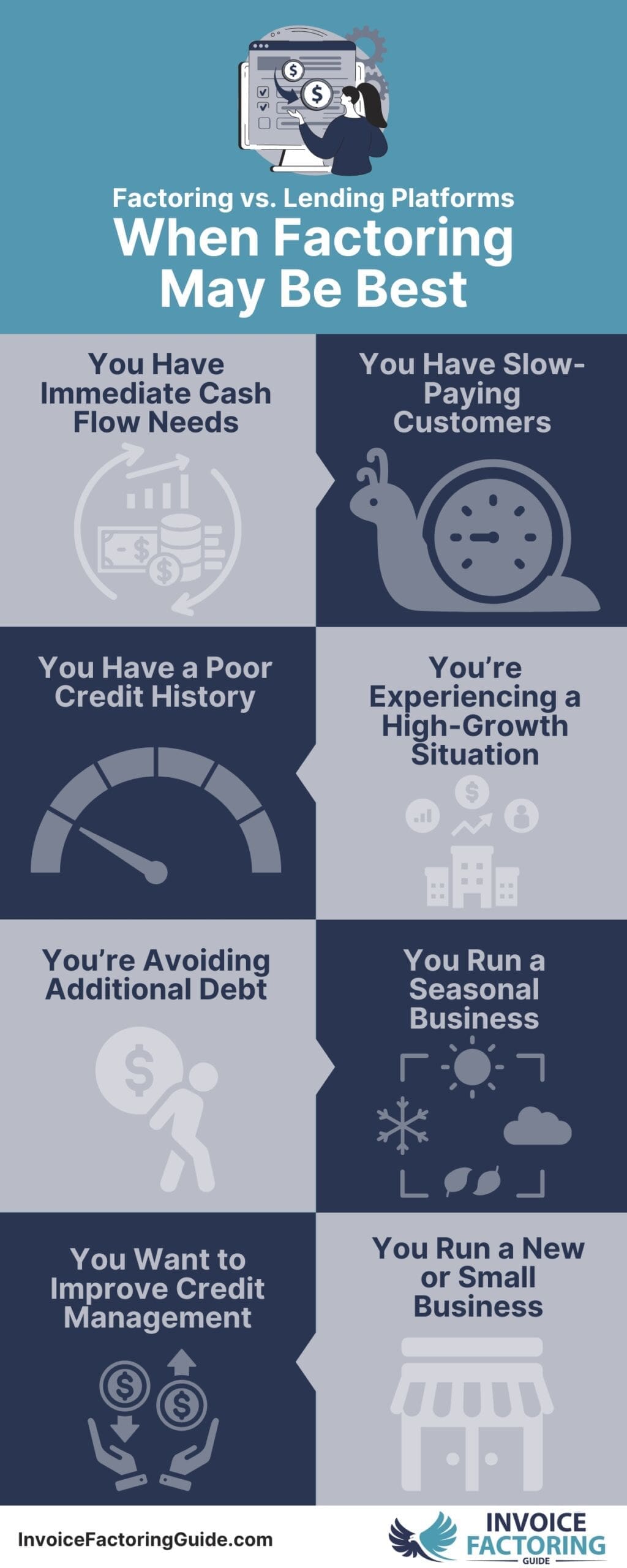

Factoring vs. Lending Platforms: When Factoring May Be the Better Fit

Invoice factoring and lending platforms shine in different ways, so there are many situations in which factoring may be the best fit for a business. If any of the following scenarios applies to you, you may want to shortlist factoring.

- Immediate Cash Flow Needs: When a business needs quick access to cash to address operational expenses, payroll, or inventory purchases without waiting for customers to pay their invoices.

- Slow-Paying Customers: If a business has customers who take 30, 60, or even 90 days to pay their invoices, factoring can provide immediate funds to bridge the gap.

- Poor Credit History: For businesses with less-than-perfect credit scores, factoring can be an attractive option because it relies on the creditworthiness of the customers, not the company itself.

- High-Growth Situations: When a business rapidly expands and needs continuous cash flow to take on new projects or orders, factoring can provide the necessary liquidity.

- Avoiding Additional Debt: If a business wants to improve its cash flow without taking on additional debt or impacting its balance sheet, factoring is a viable solution.

- Seasonal Businesses: Businesses with seasonal peaks and troughs in revenue can use factoring to ensure steady cash flow during off-peak times.

- Improving Credit Management: Businesses that want assistance with credit checks and collections can benefit from the services provided by factoring companies, which often include credit management and collection services.

- New or Small Businesses: Startups and small companies that may not qualify for traditional business loans can use factoring to access needed funds based on their accounts receivable.

Explore the Fit of Factoring for Your Business

If it sounds like invoice factoring may be the ideal solution for your business’s cash flow needs, the next step is to connect with a pro. Request a complimentary rate quote to get started.

Factoring vs. Lending Platforms: FAQs

What is the main difference between factoring and lending platforms?

Factoring involves selling your business’s B2B invoices to a factoring company at a discount for immediate cash. It’s not a loan but a sale of assets. Lending platforms, on the other hand, provide loans that must be repaid with interest over time. These platforms connect borrowers directly with individual or institutional lenders. Factoring is reliant upon the creditworthiness of your customers, whereas lending platforms assess your business’s creditworthiness and financial health to determine loan approval and terms.

Which is better for my small business: factoring or a lending platform?

The best option depends on your business’s needs. Factoring is ideal if you need immediate cash flow and have reliable customers but possibly weaker credit. Lending platforms are better if you need a larger loan for long-term projects or growth and you have a strong credit history. Factoring provides quick cash without adding debt, while lending platforms offer diverse loan options.

How do factoring and lending platforms impact my business’s cash flow?

Factoring provides immediate cash flow by converting your unpaid invoices into cash within 24 to 48 hours, helping manage short-term operational needs. Lending platforms also improve cash flow, but through loans that must be repaid over time. While both can enhance liquidity, factoring does so without adding debt to your balance sheet. Loans from lending platforms improve cash flow by providing a lump sum upfront, which is repaid over time with interest, impacting future cash flows.

What are the pros and cons of factoring vs. lending platforms?

Factoring pros: immediate cash flow, no added debt, and easier qualification based on customers’ credit. Cons: higher costs, potential customer perception issues, and loss of control over collections.

Lending platforms pros: accessible financing, fast approval, and competitive rates for strong borrowers. Cons: adds debt, higher interest rates for riskier borrowers, and possible fees.

Choosing depends on whether immediate cash flow without debt or longer-term financing with debt fits your needs.

Can I use factoring if I already have a loan from a lending platform?

Yes, businesses can use both factoring and loans from lending platforms simultaneously. Factoring provides immediate cash by selling invoices, which doesn’t interfere with existing loan agreements. However, it’s crucial to review the terms of your loan and factoring agreement to ensure compliance and avoid conflicts. Using both can enhance cash flow and meet various financial needs, but it’s crucial to manage repayment obligations carefully to maintain financial stability.

How does the cost of factoring compare to using a lending platform?

Factoring costs include a discount rate on the invoice value, which varies based on the customer’s creditworthiness and invoice amount. This can be higher than traditional loan interest rates. Lending platforms charge interest rates and may include fees like origination and late payment fees. For riskier borrowers, lending platform rates can be higher. Factoring provides immediate funds without debt but at a higher cost while lending platforms offer loans with varied interest rates based on credit risk.

What types of businesses should use factoring instead of lending platforms?

Businesses with slow-paying customers needing immediate cash flow, those with poor credit but reliable customers, and companies experiencing rapid growth or seasonal fluctuations benefit most from factoring. Factoring is ideal for businesses that can’t qualify for traditional loans and prefer not to incur debt. It’s also suitable for businesses that want to outsource credit management and collections, focusing more on core operations while maintaining a steady cash flow.

How do I qualify for factoring versus a loan from a lending platform?

To qualify for factoring, your business should have creditworthy customers with unpaid B2B invoices. Factors assess the reliability of your customers to ensure they’ll pay their invoices. For lending platforms, your business’s credit score, financial health, revenue, and business plan are evaluated. Strong credit and stable financials improve your chances of securing a loan with favorable terms. Factoring focuses on customers’ credit while lending platforms consider your business’s overall creditworthiness.

How quickly can I get funding through factoring vs. a lending platform?

Factoring provides funding within 24 to 48 hours after selling your invoices, offering immediate cash flow. Lending platforms also offer relatively quick funding, typically within a few days to a week, depending on the loan approval process. Factoring is faster because it involves selling assets rather than undergoing a comprehensive credit evaluation. Lending platforms, while quick compared to traditional banks, still require time to assess the borrower’s credit and financial health.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300