When your business faces unexpected expenses, experiences cash flow gaps, needs to purchase inventory, or wants to seize a time-sensitive opportunity, you might be tempted to make a beeline for short-term loans. However, the convenience comes at a cost, and not all businesses qualify. Thankfully, there are alternatives like invoice factoring. In this guide, we’ll explore both funding solutions individually, go over a detailed comparison of factoring vs. short-term loans, and cover next steps if you’re ready to get started.

Short-Term Loans: How They Work, Pros, and Cons

Short-term loans can be an attractive way for businesses to bridge temporary cash flow gaps. They promise quick access to funding when your business needs it most. But before you sign on the dotted line, it is important to understand how they actually work, what they cost, and why many companies eventually seek alternatives such as factoring.

How Short-Term Loans Work

A short-term loan is a type of financing designed to provide fast access to cash that you repay over a relatively brief period, usually three to 18 months. These loans are often used to cover temporary expenses such as payroll, inventory purchases, or equipment repairs.

You receive a lump sum upfront and repay it in daily, weekly, or monthly installments that include both principal and interest. The repayment schedule is much faster than traditional business loans, which can make them difficult to manage if your income fluctuates.

Structure of Short-Term Loans

While lenders may vary, most short-term business loans share similar features.

- Loan Amounts and Terms: Typically range from a few thousand dollars to several hundred thousand, with repayment terms that seldom exceed eighteen months.

- Repayment Frequency: Payments are often required daily or weekly through automatic withdrawals from your business bank account.

- Collateral Requirements: Some loans are secured by business assets or personal guarantees, while others are unsecured but come with higher costs.

- Interest Rate Type: The rate can be expressed as an annual percentage rate (APR) or as a factor rate, which is an alternative calculation that can make costs appear lower than they really are. Despite the name, it doesn’t relate to factoring, which we’ll cover in a moment.

Costs of Short-Term Loans

Short-term loans are known for their convenience, but that convenience comes at a premium. Interest rates alone can be as high as 75 percent APR, according to the Wall Street Journal. Common fees include:

- Origination Fees: A percentage of the total loan amount is deducted before funds are released.

- Processing or Maintenance Fees: Ongoing administrative costs that increase the total repayment amount.

- Prepayment Penalties: Fees that apply if you repay early, preventing you from saving on interest.

Qualification Process

Short-term lenders prioritize speed, often approving loans within 24 to 72 hours. The process usually involves:

- Application and Review: You submit basic business details, revenue data, and recent bank statements.

- Credit Check: Lenders assess both business and personal credit, though some accept lower scores.

- Cash Flow Verification: Consistent deposits and sales history matter more than long-term profitability.

Benefits of Short-Term Loans

Despite their cost, short-term loans do serve a purpose.

- Quick Access to Capital: You can often receive funds within days, allowing you to respond to urgent expenses.

- Flexible Use: Funds can be applied to nearly any business need, from covering slow receivables to purchasing inventory.

- Minimal Paperwork: Compared to traditional bank loans, the documentation requirements are relatively light.

Challenges with Short-Term Loans

The biggest challenges with short-term loans tend to emerge after the money hits your account.

- High Cost of Capital: High interest rates on SME loans and fees can dramatically increase the total repayment amount.

- Hidden Fees: As mentioned, hidden fees in short-term loans, such as early payoff charges, are sometimes buried in the fine print. Because of this, many businesses are unaware of the true cost until they’re already locked in.

- Frequent Repayment Schedules: Daily or weekly payments can strain cash flow, especially if customer payments are delayed.

- Debt Cycle Risk: Many businesses find themselves renewing or refinancing these loans to keep up with payments, which creates a revolving debt cycle.

- Credit Impact: Missed or late payments can hurt both business and personal credit scores.

Factoring: How it Works, Pros, and Cons

Factoring gives your business immediate access to working capital by converting unpaid invoices into cash. Instead of waiting up to 90 days for your customers to pay, you can sell those invoices to a factoring company and get most of your money right away. It’s straightforward and is one of the few working capital solutions that doesn’t put you in debt.

How Factoring Works

Factoring centers on the value of your accounts receivable rather than your credit history. A simple breakdown of the process is outlined below.

- Work: You deliver goods or services to your customer as usual.

- Invoice: You send the invoice to both your customer and the factoring company.

- Receive Advance: The factoring company advances a percentage of the invoice value within one or two business days. This is often 80 to 90 percent of the invoice value, though it will vary based on the terms of your factoring contract.

- Factor Collects: Your customer pays the factoring company directly on the invoice’s due date.

- Receive Final Payment: Once payment is received, the remaining balance, called the “factoring reserve,” is released to you, minus a small factoring fee.

The process repeats as you continue to submit invoices, creating a consistent source of working capital that grows alongside your sales.

Structure of Factoring Agreements

Factoring arrangements can be flexible, but most share key structural elements as outlined below.

- Advance Rate: The percentage of the invoice value you receive upfront. Higher rates are common for businesses with reliable customers and consistent billing.

- Reserve Account: The remaining portion of the invoice is held until your customer pays.

- Factoring Fee: The service charge for advancing funds, typically expressed as a flat rate per 30-day period or a percentage of the invoice value rather than as interest.

These structures can be customized based on your industry, customer base, and cash flow needs.

Costs of Factoring

Factoring fees vary depending on volume, industry, and customer payment reliability. In most cases, factoring fees range from one to five percent of the invoice value.

For example, if you factor a $100,000 invoice with a two percent fee, your total cost is $2,000 for immediate access to the funds. The trade-off is clear visibility and predictable pricing. There are no compounding interest charges or hidden penalties.

Many businesses appreciate that factoring costs adjust with activity. You only pay for the invoices you choose to factor, which allows you to control expenses as cash flow stabilizes.

Qualification Process

Factoring approvals focus on the creditworthiness of your customers rather than your own. This distinction opens the door for businesses that might struggle to qualify for traditional financing. Most factoring companies review:

- Customer Credit History: The stronger your customers’ payment history, the better your rates.

- Invoice Quality: Factoring applies to completed, verifiable work that has been billed but remains unpaid.

- Business Stability: Steady operations, even with limited credit, demonstrate reliability.

Because the risk is tied to your customers’ ability to pay, decisions and funding often happen within 24 to 48 hours.

Benefits of Factoring for Business

Factoring is valued for its simplicity and reliability, plus it can serve as a core financial strategy rather than a short-term fix. Because of this, there are many factoring advantages for SMEs.

- Consistent Cash Flow: Because funding is based on receivables, businesses that improve cash flow with factoring have liquidity, even when customers pay slowly.

- Debt-Free Funding: You are selling an asset, not borrowing money, so no liability appears on your balance sheet. By avoiding debt with factoring, businesses can sometimes improve their credit and preserve available credit lines for large capital expenses.

- Fast Access to Funds: Initial approvals are easy and quick, and advances are often received within one business day.

- Scalability: Your access to working capital with factoring automatically grows along with your invoice volume.

- Credit Protection and Support: Many factoring companies provide customer credit checks, collections support, and reporting tools to help you manage customer risk.

Challenges with Factoring

Factoring offers clear advantages, but there are details worth understanding upfront.

- Tailored: Factoring only works for business-to-business (B2B) and business-to-government (B2G) contractors. You can’t factor invoices for the consumer market. Industries like trucking, manufacturing, and construction often leverage it.

- Cost Variability: Fees differ based on customer credit and payment terms. For lower-risk accounts, this remains competitive, but rates can rise for higher-risk customers.

- Customer Notification: In most cases, your customers are informed of the factoring relationship. The notification process is handled professionally and simply notifies customers where to send their payments. However, some businesses prefer to keep their factoring private.

- Process Adjustment: You will need to submit invoices and remittance details to the factoring company, though many modern systems automate this process.

Factoring vs. Short-Term Loans

Now that you understand factoring and short-term loans independently, let’s explore the key differences between the two.

Source of Funds

The first major difference lies in where the money comes from.

- Factoring: You sell existing invoices to a factoring company, receiving an advance on money your customers already owe. The funding is based on your accounts receivable.

- Short-Term Loan: You borrow money directly from a lender and agree to repay it with interest over a set period. The funding is based on your business’s creditworthiness and repayment capacity.

Repayment Obligation

Factoring and short-term loans also diverge in how repayment works.

- Factoring: There is no loan to repay. The factoring company collects payment from your customer, and you receive the remaining balance after fees.

- Short-Term Loan: You are responsible for repayment according to the loan schedule, which is typically managed in daily, weekly, or monthly installments.

Qualification Criteria

Each option uses a different approach to determine eligibility.

- Factoring: Approval is based primarily on your customers’ credit reliability and the quality of your invoices. Businesses with limited credit history or high growth can still qualify.

- Short-Term Loan: Approval depends on your business’s credit score, financial statements, and cash flow stability. Lenders typically review both business and personal credit history.

Cost Structure

The cost of capital is measured differently for each product.

- Factoring: Fees are charged as a percentage of the invoice value, often ranging from one to five percent of the invoice value. There are no compounding interest charges.

- Short-Term Loan: Costs are expressed as an annual percentage rate or factor rate, and fees can raise the effective cost substantially. Some lenders charge origination or prepayment penalties as well.

Collateral and Liability

Collateral requirements can affect how much risk your business assumes.

- Factoring: The invoices themselves serve as collateral, and in non-recourse agreements, the factoring company assumes most of the credit risk.

- Short-Term Loan: Lenders may require business assets or personal guarantees to secure repayment, which can place more liability on the borrower.

Impact on Balance Sheet

How each option appears on your financial statements is another important distinction.

- Factoring: Because you are selling an asset rather than incurring debt, factoring does not create a loan liability. It may even improve your balance sheet ratios.

- Short-Term Loan: Borrowed funds appear as debt and must be repaid, which can affect leverage and credit capacity.

Customer Involvement

The role of your customers differs between the two.

- Factoring: Customers usually pay the factoring company directly, though some arrangements allow payments to pass through your business first.

- Short-Term Loan: Customers remain uninvolved; you continue managing all receivables and payments internally.

Flexibility and Scalability

Flexibility is another defining difference.

- Factoring: Funding grows with your sales volume, since more invoices create more available capital.

- Short-Term Loan: The loan amount is fixed at origination. To access more capital, you must apply for a new loan or refinance.

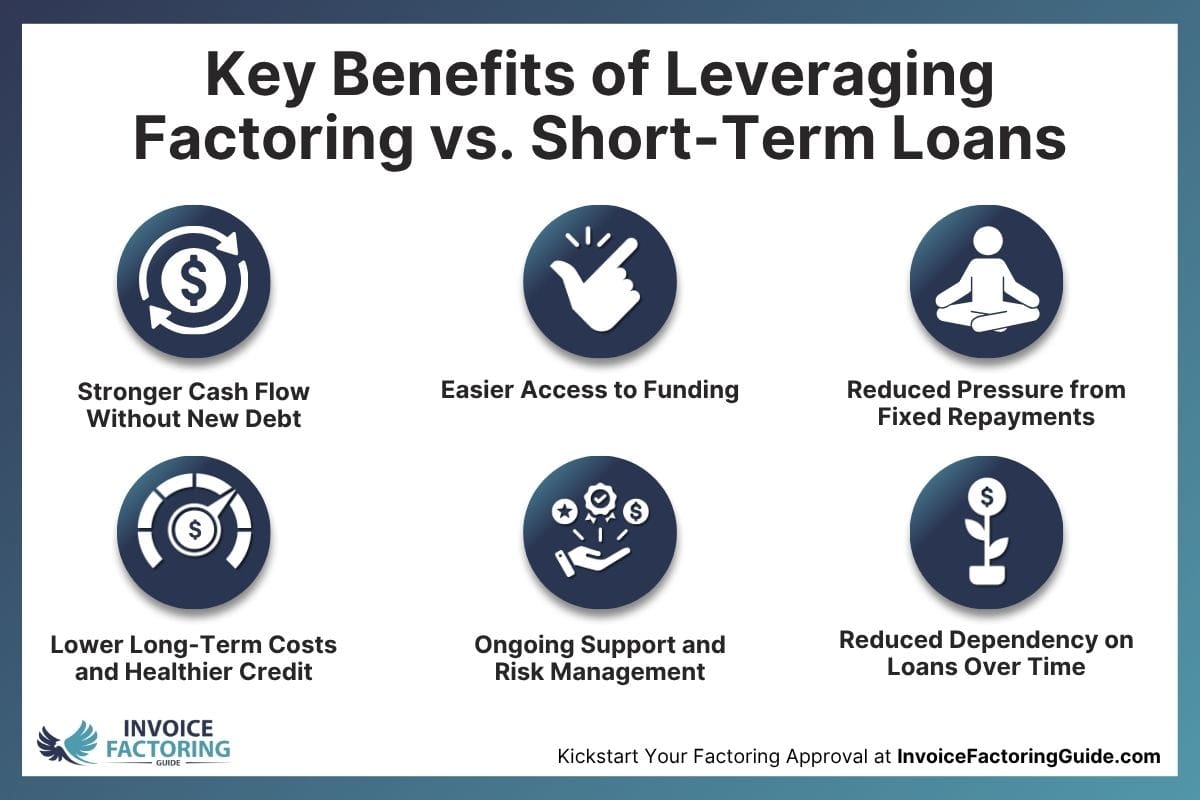

Benefits of Using Factoring to Replace Loans

Once you understand the structural differences between factoring and short-term loans, the advantages of choosing factoring as a funding method become clear. Factoring provides ongoing working capital while supporting healthier financial management, operational stability, and long-term growth.

1. Stronger Cash Flow Without New Debt

Factoring gives your business an immediate cash advance based on invoices that are already owed. Instead of adding liabilities to your balance sheet, you are converting receivables into usable funds. This means you can pay suppliers, meet payroll, or pursue new contracts without taking on debt or increasing leverage.

2. Easier Access to Funding

Many businesses that struggle to qualify for traditional loans can easily qualify for factoring. Because approval is based on your customers’ credit history, not your own, even newer companies or those recovering from financial setbacks can access funding.

3. Reduced Pressure from Fixed Repayments

Short-term loans require regular payments regardless of when your customers pay you. Factoring eliminates that pressure by tying funding directly to your receivables cycle. You get paid faster, and repayment occurs naturally when your customer pays the invoice.

This alignment between revenue and cash flow can help your business maintain steadier operations, even during periods of delayed customer payments.

4. Lower Long-Term Costs and Healthier Credit

Factoring costs are transparent and based on actual usage, which helps your business plan more effectively. Because you are selling an asset rather than borrowing funds, factoring does not increase your debt ratio or reduce borrowing capacity for future needs.

This distinction—factoring vs. borrowing—is especially valuable for businesses that want to strengthen their credit and build financial resilience.

5. Ongoing Support and Risk Management

Modern factoring companies do more than provide cash flow. Many offer services that help protect and streamline your business operations, such as:

- Credit Screening: Checking your customers’ payment history before you extend credit.

- Accounts Receivable Management: Handling invoicing, collections, and remittance tracking.

- Non-Recourse Options: Absorbing most of the loss risk if your customer fails to pay.

These value-added services can significantly reduce administrative strain while improving financial predictability.

6. Reducing Loan Dependency Over Time

For many businesses, factoring is a stepping stone toward financial independence. As factoring stabilizes cash flow, your reliance on short-term borrowing naturally decreases. With steady working capital, you can pay down existing debt, negotiate better terms with suppliers, and strengthen your credit position for the future.

In short, factoring supports reducing loan dependency while giving you the agility to reinvest in growth.

Tips for Getting Started with Factoring as a Financing Solution

Getting started with factoring is straightforward, but understanding how to approach it strategically will help you maximize value, minimize costs, and build a long-term financial advantage for your business.

1. Understand Your Cash Flow Goals

Before applying for factoring, define what you want it to accomplish. Are you looking to smooth out cash flow between billing cycles, fund growth, or phase out short-term debt? Clear objectives make it easier to select the right structure and volume for your needs.

Review your accounts receivable aging report to identify which customers pay slowly and how much cash is tied up in unpaid invoices. This will help you estimate how factoring could impact your working capital.

2. Evaluate Industry Experience

Factoring companies often specialize in particular industries such as transportation, staffing, manufacturing, or professional services. Working with one that understands your industry ensures they can anticipate typical challenges and structure agreements to fit your payment cycles.

For example, a freight factoring company will understand fuel costs, freight billing, and broker payment timelines better than a generalist. They may also provide access to things like free load boards, fuel advances, or fuel discount cards.

3. Choosing a Factoring Partner

When selecting a factoring partner, look for more than competitive rates. You are entering an ongoing financial relationship, so service quality, communication, and transparency are equally important. Consider these factors when evaluating potential partners:

- Reputation and Longevity: Established firms with a proven record in your industry offer stability and reliability.

- Technology and Processes: Automated portals for invoice submission and payment tracking save time and reduce errors.

- Customer Service: Access to a dedicated account representative can make daily operations smoother.

A partner who aligns with your goals can become an extension of your finance team rather than just a funding source.

4. Negotiating Factoring Terms

Once you have identified a preferred provider, focus on negotiating factoring terms that work for your business. While many terms are standard, there is room to tailor agreements. Key items to discuss include:

- Contract Length: Short-term agreements offer flexibility, while longer contracts may provide better rates.

- Minimum Volume Requirements: Some providers expect a set amount of invoices per month or quarter.

- Recourse vs. Non-Recourse: Choose based on your customers’ payment reliability and your comfort with risk.

- Advance Rates: The percentage of invoice value you receive upfront.

- Fee Structure: How and when fees are applied, including any additional charges.

A transparent conversation about these terms helps prevent misunderstandings later and builds a foundation for a healthy partnership.

5. Prepare for Implementation

Once your factoring agreement is in place, make sure your internal team is ready to integrate the process. Assign someone to manage invoice submissions, confirm payment updates, and maintain communication with your factoring company.

Modern factoring platforms make this easy, with automated uploads, status alerts, and reporting dashboards that reduce administrative work.

Kickstart Your Factoring Approval

Shorten your timeline to approval and let Invoice Factoring Guide match you with a provider that understands your business. To get started, request a complimentary rate quote.

FAQs on Factoring and Short-Term Loans

Is short-term financing more risky for my business?

Yes. Short-term financing carries higher risk because repayment periods are compressed, leaving less time to recover from revenue fluctuations. The cost of capital is also higher, which can reduce profitability. If managed poorly, short-term debt can lead to ongoing borrowing cycles that weaken overall financial stability.

What is the interest rate on a short-term loan?

Interest rates for short-term business loans vary widely based on credit quality and lender type. Traditional banks may charge single-digit rates, while online lenders can reach up to 75 percent annual percentage rate. Always review the full cost, including fees and repayment frequency, to understand the true borrowing expense, and consider alternatives like invoice factoring.

What is short-term financing in business?

Short-term financing refers to any funding arrangement designed to meet immediate or temporary cash needs, typically repaid within three to 18 months. Common examples include short-term loans, merchant cash advances, and lines of credit. These products help manage working capital gaps but can carry higher costs than long-term funding options. Many businesses use invoice factoring in place of short-term financing because it doesn’t create debt and is often more affordable.

How do short-term loans affect financial stability?

Short-term loans and financial stability are closely linked. While these loans can provide fast relief during cash shortages, their high costs and frequent repayment schedules can disrupt long-term stability. Relying on them too often may lead to recurring debt cycles that limit your business’s ability to maintain consistent growth and liquidity.

How does factoring help businesses avoid high-interest short-term loans?

Factoring provides immediate access to working capital without borrowing. By advancing cash against unpaid invoices, your business can cover expenses and invest in growth without taking on debt. This reduces the need for high-interest short-term loans and creates a more predictable, sustainable source of funding tied to your receivables.

Can factoring improve cash flow more effectively than short-term borrowing?

Yes. Factoring aligns cash flow with your sales cycle. Instead of repaying a loan on a fixed schedule, you receive funds as invoices are issued and repaid when customers pay. This flexibility supports healthier cash flow management than short-term borrowing, where rigid repayment terms can create unnecessary financial strain.

What types of businesses benefit most from replacing short-term loans with factoring?

Businesses with delayed customer payments, such as trucking, staffing, manufacturing, or wholesale distribution, often gain the most from factoring. These industries rely on steady cash flow to cover ongoing expenses. Factoring allows them to access working capital quickly, stay current on obligations, and continue growing without turning to short-term loans.

Does factoring impact my credit score the same way a short-term loan does?

No. Factoring is not a loan, so it does not appear as debt on your credit report or affect your credit utilization ratio. In contrast, short-term loans increase total liabilities and can influence your credit score if payments are missed or balances remain high over time.

How quickly can a business transition from using short-term loans to factoring?

The transition is typically fast. Once your factoring application is approved, initial funding can occur within 24 to 48 hours. Many businesses use factoring to repay existing short-term loans and stabilize cash flow, allowing them to move away from debt-based financing within their first few funding cycles.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300