More than half of all small businesses report difficulties paying operating expenses, according to the latest Small Business Credit Survey. Growth-related expenses, seasonality, slow-paying clients, emergencies, and more can add to the complexities of managing your business finances. Most businesses need access to cash at some point or another because of this, and the most popular type of funding has historically been a conventional loan. However, loans are not viable for all businesses, and sometimes they’re not the best solution. On this page, we’ll break down invoice factoring vs. a bank loan; how each works, and how they compare in terms of approval process, cost, flexibility, and risk so it’s easier to see which is the more ideal funding solution for your business needs today.

Invoice Factoring Features and Benefits

Invoice factoring is like getting a cash advance on your outstanding invoices. Instead of waiting weeks or months for your customers to pay, you sell your receivables at a discount to a third party known as a factor or factoring company. Your business receives an immediate cash injection worth most of the invoice’s value upfront. Then, when your customer pays, you receive the remaining value of the invoice minus a nominal factoring fee. This addresses cash flow issues caused by a slow-paying client base, seasonality, rapid growth, and other concerns, all without taking on debt.

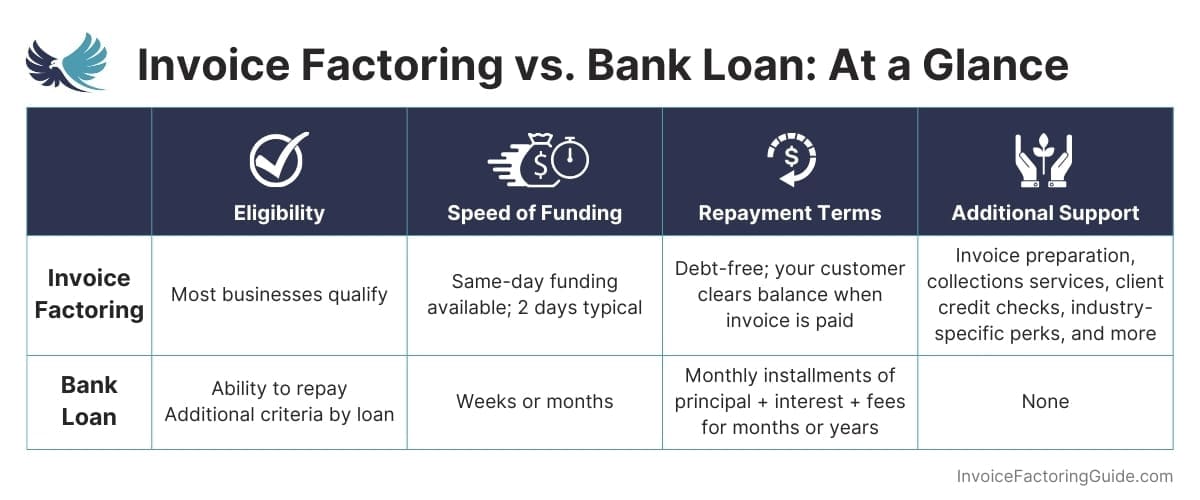

Most businesses qualify for this type of funding because factoring companies care more about the creditworthiness of the clients paying the invoices rather than your credit. Factoring is also unique because factoring companies routinely provide additional services that align with invoicing and collections or business support. For instance, most will run credit checks on your customers to reduce the risk of bad debt and collect payments from your clients to free you from chasing invoices.

For businesses looking for a flexible financing alternative, a factoring line of credit may be an ideal solution. Unlike traditional loans, this option provides continuous access to working capital based on your outstanding invoices, helping you manage cash flow without taking on debt.

Invoice Factoring vs. Invoice Financing

Sometimes, invoice factoring is confused with or referred to as invoice financing. While they both address cash flow challenges and involve B2B receivables, financing involves a third-party lender that leverages your invoices as collateral rather than purchasing them. In other words, with financing, you pay back what you borrow. With factoring, you aren’t borrowing anything, so there’s no debt to pay back.

Bank Loan Features and Benefits

A traditional bank loan involves borrowing money from a financial institution like a bank or credit union. The business receives the cash in one lump sum, then pays the balance back in installments, along with fees and interest. It’s a very transactional relationship rather than the partnership approach factoring companies take.

Factoring vs. Bank Loan Comparison

Now that we’ve covered the background on each let’s compare how factoring and traditional loans work.

Approval Process

More than a quarter of small businesses say credit availability is a problem, per the Small Business Credit Survey. This is likely because 21 percent receive no funding at all through traditional channels, and 26 percent are only partially funded. Qualifying for a conventional bank loan is a lengthy process in which your business, credit score, and more are scrutinized. Weeks or months may pass between applying and finally receiving cash.

Conversely, factoring has an easy and quick application process. You can be approved in as little as a day or two, even if you have a poor credit score or haven’t been in business long. Once a business is approved and submits an invoice for factoring, payment typically arrives in two business days. However, some factoring companies have accelerated programs that payout on the day an invoice is submitted.

Cost

Traditional loans use interest rates to calculate most of the cost of borrowing. These can range from about five percent to 20 percent or more. For instance, a borrower with a $50,000 SBA 7(a) loan will pay a base rate and additional rate that comes out to just over 11 percent interest right now, the SBA reports.

Traditional loans use interest rates to calculate most of the cost of borrowing. These can range from about five percent to 20 percent or more. For instance, a borrower with a $50,000 SBA 7(a) loan will pay a base rate and additional rate that comes out to just over 11 percent interest right now, the SBA reports.

That means a business with an SBA 7(a) loan that borrows $50,000 and has a five-year repayment schedule will pay around $15,602 in interest over the course of the loan. If the term is reduced to two years, the business will pay $6,069 in interest. If it’s repaid in one year, the total interest totals $3,099.

Calculating the cost of factoring is different because a factoring fee is used rather than interest. A typical factoring rate is between one and five percent of the invoice’s value. So, let’s say that a $50,000 invoice is factored, and the factoring rate is on the high end at five percent. The total cost comes out to $2,500.

This means you may pay considerably less if you’re only factoring the occasional invoice, though a traditional bank loan will cost less if you need a long-term funding solution.

Flexibility and Scalability

Bank loans are rigid in structure. The only way to obtain more cash is to qualify for a larger loan or refinance, which may be difficult due to the qualification process.

With factoring, the amount of cash you can access increases with the size of your invoices, so it scales with your business. You also have more control over funding. For instance, you can factor one invoice and then never factor again, or you can factor all your invoices, or you can factor occasionally. It’s up to you to do what’s best for your business.

Risks

In all, 42 percent of businesses obtained funds that need to be repaid in the past 12 months, according to the Small Business Credit Survey. Yet, nearly one-third of small businesses are having trouble making payments on debt. Despite their best intentions when obtaining the loans, issues like the rising cost of goods, services, and wages, uneven cash flow, and weak sales are creating serious financial challenges for them. This means their credit and potentially assets are at risk if they default.

Invoice factoring does not come with these same risks. Again, most factoring companies run credit checks beforehand, so the risk of client non-payment is incredibly low. However, you also have the option of working with a company that offers non-recourse factoring, which means the factor accepts the risk if your client doesn’t pay their invoice.

Factoring vs. Bank Loan: What’s Best for Your Business?

Bank loans remain a strong option if you qualify and need a long-term funding solution. However, factoring may be better if you:

- Don’t have strong business credit.

- Haven’t been open long.

- Don’t qualify for a business loan.

- Need a cash injection quickly.

- Don’t want to take on debt.

- Need short-term or flexible funding.

- Want to take advantage of additional solutions and benefits a factoring partner offers.

Get a Complimentary Invoice Factoring Quote

If factoring sounds like an option you’d like to explore more, we’re happy to match you with an invoice factoring company that meets your needs and offers competitive rates. Request a free rate quote to learn more or get started.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300