Fintech solutions are redefining how small and medium-sized enterprises (SMEs) overcome cash flow challenges and access working capital. No longer bound by traditional lenders or outdated banking systems, businesses are turning to fintech-powered invoice factoring to unlock liquidity, automate receivables, and bridge funding gaps with speed and precision.

From AI-powered credit assessment to blockchain-backed smart contracts, today’s factoring platforms offer scalable, personalized financial services once unavailable to underserved markets.

As fintech opens the door to more tailored funding, choosing the right factoring company has become essential. The right partner helps businesses align financing with their unique goals and transform financial challenges into growth opportunities.

The Evolution of Fintech in Modern Finance

Fintech can be defined as technology, such as software or apps, used to facilitate or support financial management or complete financial transactions. Advancements in fintech have led to the emergence of digital banking, mobile payment platforms, and robo-advisors, providing individuals with convenient and personalized financial experiences. You may already be leveraging fintech when:

- Processing payments

- Analyzing finances

- Predicting cash flow

- Automating tasks

- Strengthening security

- Accessing capital

Revolutionizing Traditional Finance Methods

With fintech’s disruptive potential, traditional financial institutions must adapt and stay relevant in the ever-changing finance landscape. Whereas small businesses once relied almost exclusively on their personal savings or traditional bank loans, fintech has opened doors in areas like online lending, peer-to-peer services, venture capital, receivables funding, and more.

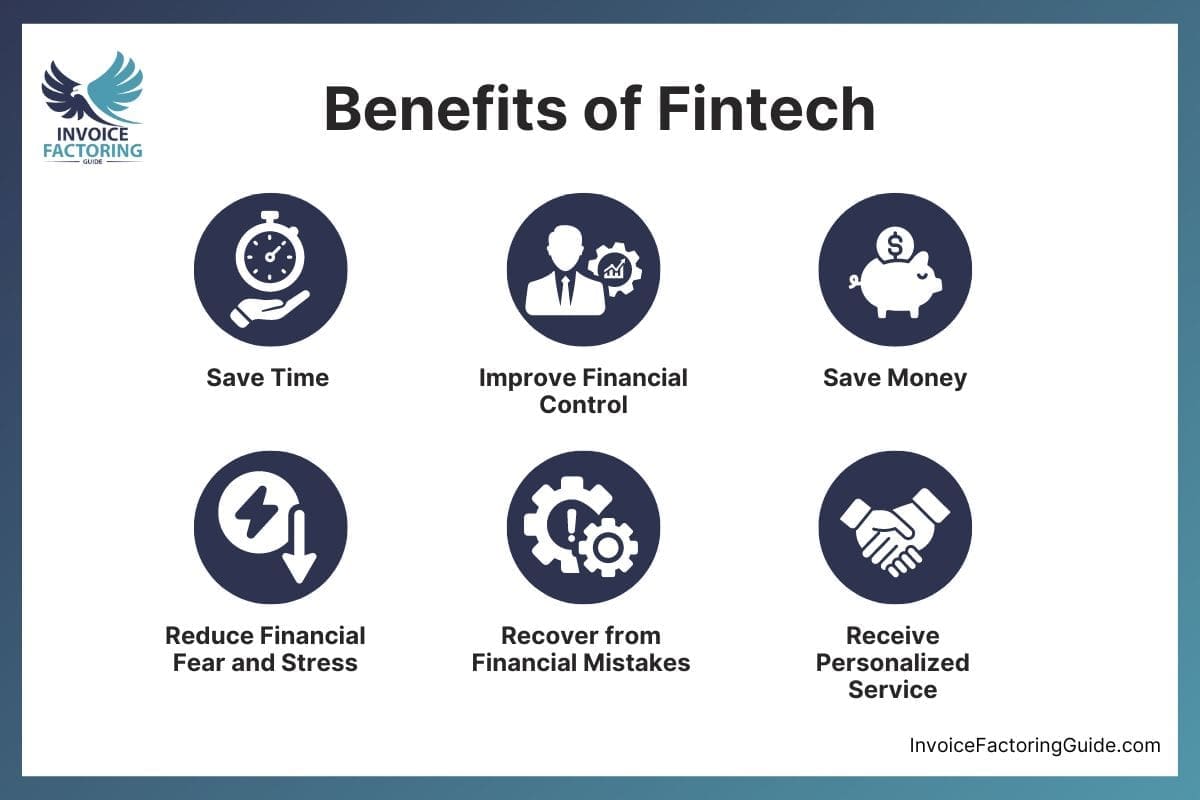

Benefits of Fintech

Businesses embrace fintech for a myriad of reasons, such as:

- Saving time

- Improving financial control

- Saving money

- Reducing fear and stress associated with financial management

- Recovering from financial mistakes

- Providing more personalized services

Challenges of Fintech

While the benefits of fintech make it a worthwhile endeavor, fintech companies and the brands that leverage fintech must also address the challenges associated with it, such as:

- Data security

- Regulatory compliance

- Lack of tech expertise

How Fintech Is Making Invoice Factoring a Strategic Bridge to Better Cash Flow

Invoice factoring has been around in many forms for thousands of years but has changed with the times. It allows businesses to unlock working capital that’s trapped in their unpaid invoices. Rather than waiting weeks or months to pay, businesses can get paid instantly by a factoring company. This helps bridge cash flow gaps, allows businesses to accept more work, and grow more easily.

The rise in fintech has helped shape factoring even more and is opening up additional doors for business funding. It has also contributed to the nearly four percent growth the industry has seen in just five years, as IBIS World reports.

The Role of Technology in Factoring and Supply Chain Finance

Because technology can be integrated at every step of the financial journey, it helps businesses maximize the benefits they receive from factoring in many ways.

For instance, businesses can use AI to predict cash flow more accurately. This makes it easy to spot potential cash flow shortfalls and take action before they become a problem. Factoring companies also run digital customer credit checks to reduce risk when extending credit.

The factoring process is also enhanced with technology. Many factoring companies provide online portals. These allow businesses to check the status of their invoices 24/7 and often upload their invoices for approval. Some factoring companies have taken this a step further and included automated approval of invoices to speed up payments.

Often, invoices are created digitally, reminders are automated, and customer collections are managed online. These advances help businesses collect quickly while improving customer service.

The Future of Factoring in the Age of Fintech

These days, some fintech companies are actually integrating invoice factoring into their products, either directly or by allowing invoice factoring companies to link into their software so that all financial data and processes are kept in one place.

This may make it easier for businesses to be proactive about their funding needs and improve access to capital. It can also potentially improve the speed of factoring and customer payments. The increased visibility is a boon for factoring companies, as it makes assessing risk and detecting fraud easier. As these things improve, businesses will also likely see cost reductions.

Challenges with Fintech-Driven Factoring

While most news is positive, businesses should be aware of this next wave in technology because it can have some drawbacks. For instance, as invoice generation and accounting software companies begin to integrate instant funding solutions in their platforms more, some businesses may feel forced to go with what’s available on the platform rather than searching for external third-party providers that may be a better fit or offer more competitive rates.

Privacy is an additional concern. Businesses procuring fintech software must read their contracts carefully and know how their data is used and with whom it is shared. If, for example, customer data is being shared with third parties, the businesses likely have some obligation to inform their customers about this. This transparency is addressed through traditional notification factoring, as the factoring company notifies clients that they’re collecting payments. Still, it may fall on the business’s shoulders to do when data sharing occurs on the back end as part of a fintech suite of tools.

Lastly, service may become a concern for some going forward. As platforms digitize and all transactions occur electronically, getting live human support as needed may become more challenging. Businesses that value human support will likely seek out factoring companies that provide a dedicated account manager who can guide them through things, provide assistance as needed, and offer tips and suggestions based on their experiences with similar companies.

Explore How Fintech and Invoice Factoring Can Support Your Business Needs

Presently, each factoring company handles technology in its own way. Some still operate via faxes and mailing paperwork, while others have entirely digitized the experience. Most are somewhere in between, leveraging technology to improve service and speed so businesses and their customers have a better experience overall.

As fintech reshapes financial services, businesses also need strategies to make the most of these tools. Implementing effective business cash flow management tips alongside modern factoring solutions can help your company improve liquidity, reduce delays, and scale sustainably.

If you’d like to be connected with a factoring company that leverages technology to provide a better experience for you, specializes in your industry, and offers competitive rates, request a complimentary rate quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300