If you’re like most business owners, you’re probably not feeling excited about the upcoming year. Optimism among small business owners has yet to return to pre-pandemic levels and still sits ten points below the 50-year average, per National Federation of Independent Business (NFIB) surveys. However, businesses that remain resilient and successfully navigate difficult conditions tend to perform better in the long run, have more substantial growth, and outperform their peers when the difficulties subside. With this in mind, our business New Year resolution list spans finance, operations, and people-related areas that can help you make the most of today and build toward a stronger future.

1. I Will Update My Business Plan and Strategic Plan

Around 70 percent of businesses have a detailed business plan, complete with goals and a plan to help the business reach them, Yahoo Finance reports. This is a good start because these plans are vital to success. Companies that leverage them grow 30 percent faster than their peers, per Bplans. However, many create their business and strategic plans with a specific need in mind, such as when officially forming the business or obtaining financing, and don’t touch them again.

Your plans should guide your daily decisions, so reviewing and updating them regularly is essential. However, given how much the economy and customer behavior have shifted over the past few years, yours may need significant overhauls if they’ve been neglected.

2. I Will Make Financial Projections for the Upcoming Year

Eight in ten small business failures can be traced back to cash flow issues, NFIB reports. It can be challenging to predict what sales will be or when cash will come in when the economy is uncertain, but projections are crucial to identifying gaps or potential issues. The more you work with yours and update them to align with changing conditions, the easier it will be for you to predict how shifts will impact your business.

3. I Will Review My Financial Reports Weekly

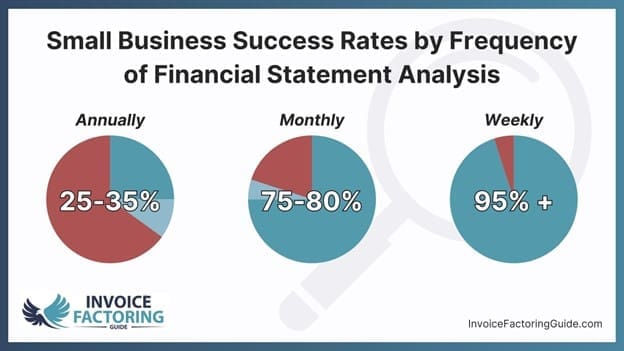

Businesses that analyze financial statements weekly have a 95 percent or greater success rate, compared to 75 to 80 percent of those who review monthly and 25 to 35 percent of those who review annually, Washington SBDC research shows. Block out time on your schedule each week to review your:

- Balance sheet

- Cash flow statement

- Income statement (profit and loss)

- Accounts payable report

- Accounts receivable report

4. I Will Write Out My Business Budget

Keeping a rough estimate of your budget in your head isn’t enough. Businesses with a documented budget are more likely to stick to it. Writing it down may also help you think about money differently and consider how each expense contributes to reaching your goals. Yet, only about half of all small businesses create a documented budget, Clutch reports. If you don’t already have yours, set aside time to make it happen.

5. I Will Make Professional Development a Priority

The number of skills required to perform a job increases by 10 percent each year, Gartner reports. Make upskilling and reskilling a priority for yourself and your team. It’ll help ensure your skills stay current and can boost morale.

6. I Will Build Scalability into the Fabric of My Company

Automation and AI are today’s buzzwords because they can save considerable time and money. However, scalability is a bigger concept than these alone. It involves thinking through your company structure and processes to identify ways to manage things efficiently and effectively as your volume and headcounts grow.

That might mean creating clearly defined departments and roles within your company even if you’re not ready to hire yet, outsourcing certain duties as you scale, bringing in helpful technology, and more.

Set aside time to evaluate your options and work with your team to find new opportunities. Laying the groundwork now will help you avoid many growing pains and allow you to benefit from streamlined operations today.

7. I Will Find and Retain Good People

Two in five small business owners say they have job openings that are difficult to fill, per NFIB. Nearly one-third are raising compensation to help alleviate the issue and make it easier for employees to handle higher costs due to inflation. In addition to evaluating your pay, take time to review and improve your:

- Benefits packages

- Hiring process

- Training and onboarding

- Performance management program

- Mentorship opportunities

This will help you attract and retain talented people who can help your business grow.

8. I Will Make Time for Myself

Long hours and burnout remain a problem for most entrepreneurs. It’s not uncommon for business owners to work 70 or more hours each week. But, what many don’t realize is that there’s almost no point in working more than 55 hours because productivity declines significantly, Stanford researchers say. They found that people who work 70-hour weeks complete the same amount of work that they would have if they’d put in 55 hours. Excess hours also come with other issues, such as stress and health concerns. So, do yourself and your company a favor: take care of yourself.

This looks different for everyone, but keeping reasonable hours, having dedicated days off, and “clocking out” at a specific time each day is a good start.

9. I Will Connect with Others More

In the hustle and bustle of our everyday lives, it’s easy to go on autopilot. However, nurturing relationships is also essential to our well-being and good for business. Map out a plan that helps you keep in contact with the people who matter most to you, such as:

- Employees

- Customers

- Suppliers

- Peers

- Family and friends

Block out time on your calendar to help you meet your goals here. For employees, it might mean scheduling more one-on-ones or teambuilding time. For customers, you may want to mark out periods for surveys and phone calls or create automated follow-ups. Perhaps a quarterly meeting with suppliers to discuss goals and opportunities will help keep your relationship strong. You know your tribe. Do what works for you to make sure you stay connected.

10. I Will Monitor Cash Flow and Be Proactive

If you’re following up with the other financial resolutions, cash flow will already be on your radar. We’ve talked about cash flow a few times here because managing it successfully is one of the best things you can do to ensure the long-term health of your company. That’s because businesses can be profitable and still run out of cash. Moreover, most businesses experience cash flow gaps as they’re growing.

Keep tabs on your cash flow. Accelerate and increase your inflows by invoicing and collecting quickly. Slow and minimize your outflows by reducing expenses and keeping on track with your bills. And, if you predict that your business might have a cash flow shortfall, be proactive and get funding before you need it. It can be the difference between moving forward or rejecting work, cutting back, and downsizing.

Strengthen Your Business with Invoice Factoring

Invoice factoring accelerates payment on your B2B invoices and doesn’t create debt your business has to pay back, so it’s ideal for bridging cash flow gaps and funding growth initiatives. It’s also flexible. You can set it up now and not use it until needed. To learn more or get started, request a complimentary factoring quote.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300