Stuck in that awkward place where your business is doing well, but your bank account doesn’t reflect it? Congratulations, you’ve officially graduated to what many would call “champagne problems.” Of course, any business leader who has been there knows they’re anything but superficial. It’s at this stage where many begin exploring financing options for small businesses, but there’s a bit of a learning curve. What you’re experiencing is a cash flow problem, and the solutions many businesses turn to are not a good fit for these types of situations.

Give us a few minutes, and we’ll walk you through the mechanics of cash flow challenges, common funding solutions, and how each one stacks up in situations like yours.

Cash Flow Challenges Call for Unique Small Business Financing Options

Cash flow problems don’t always mean your business is in trouble. In fact, they often show up when things are going well, such as when you’re taking on more work, landing bigger clients, or expanding operations. But even healthy growth can strain your cash reserves if money is going out faster than it’s coming in.

That timing gap is what sets cash flow issues apart. You might be profitable overall, but still struggle to meet day-to-day expenses. This is where many business owners run into trouble. The tools built for growth or capital investments often aren’t designed to help you manage short-term fluctuations. Cash flow challenges for small businesses need a different approach; one that’s fast, flexible, and built around how money actually moves through your business.

Causes of Cash Flow Problems

There’s no single reason a business runs into cash flow trouble. It’s often a mix of factors, and even well-managed businesses can find themselves in a tight spot. Some of the most common causes include:

- Slow Customer Payments: When you invoice customers on net 30 or longer terms, your business is carrying the cost of goods or services while you wait to get paid. The gap gets even wider when you have late customer payments.

- Seasonal Revenue Cycles: If your sales peak during certain months, it can be difficult to cover year-round expenses. The off-season can drain reserves quickly if it isn’t planned for.

- Unexpected Costs: Equipment failures, emergency repairs, inventory shortages, or one-time fees can hit hard, especially when timing is tight.

- Rapid Growth: Scaling up takes cash. If you land a major contract or expand your service area, you may need to hire staff, order supplies, or increase production before the revenue from that growth arrives.

- Tight Margins: Some businesses operate with little room for error. A short dip in sales or a small increase in costs can push them into the red temporarily.

The Impact of Cash Flow Issues on a Business

When cash flow is unpredictable, it puts the entire operation at risk. Even if the long-term outlook is strong, short-term pressure can limit your options and force you into making difficult decisions.

- Strained Relationships: Late payments to employees, suppliers, or landlords can damage trust and make future cooperation harder.

- Missed Opportunities: If you cannot invest in inventory, staff, or equipment when demand is high, you lose out on growth potential.

- Operational Disruption: Gaps in cash flow can delay payroll, slow down production, or force you to defer basic expenses like rent, insurance, or utilities.

- Higher Borrowing Costs: Many business owners turn to less ideal funding sources when cash is tight, which can increase debt and reduce long-term financial flexibility.

- Reduced Financial Stability: If cash shortages lead to missed payments or default, your credit standing may take a hit, limiting your ability to secure affordable financing down the road.

Apply Cash Flow Management Strategies Before Exploring Small Business Financing Options

Financing can bridge a gap, but it works best when paired with strong internal cash flow practices. Before seeking outside funding, take time to review how money moves through your business and where small adjustments could have a big impact.

Being proactive here improves your bottom line and shows lenders or funding partners that you’re managing the business with intention, which often leads to better terms, higher approval rates, and more sustainable financial decisions.

Apply Core Strategies First

- Review Invoicing and Collections: Make sure invoices go out promptly and follow up consistently. Clear payment terms and automated reminders can reduce delays. If you’re consistently being paid late, consider adjusting your terms or offering small incentives for early payment.

- Monitor Your Cash Flow Regularly: A weekly or even daily cash flow report gives you visibility into what’s coming in and going out. This helps you catch issues early and avoid last-minute decisions.

- Align Expenses with Income Cycles: Where possible, match your payment schedules to when revenue comes in. For example, delay nonessential spending during slower periods, or negotiate more flexible payment terms with suppliers.

- Build and Maintain a Cash Reserve: Even a small buffer can make a big difference. Setting aside a portion of revenue during peak months helps cover the shortfalls that may come later.

- Forecast Ahead: Look beyond this week or this month. A simple forecast, even if it’s just on a spreadsheet, can help you spot upcoming cash flow challenges and plan for them instead of reacting under pressure.

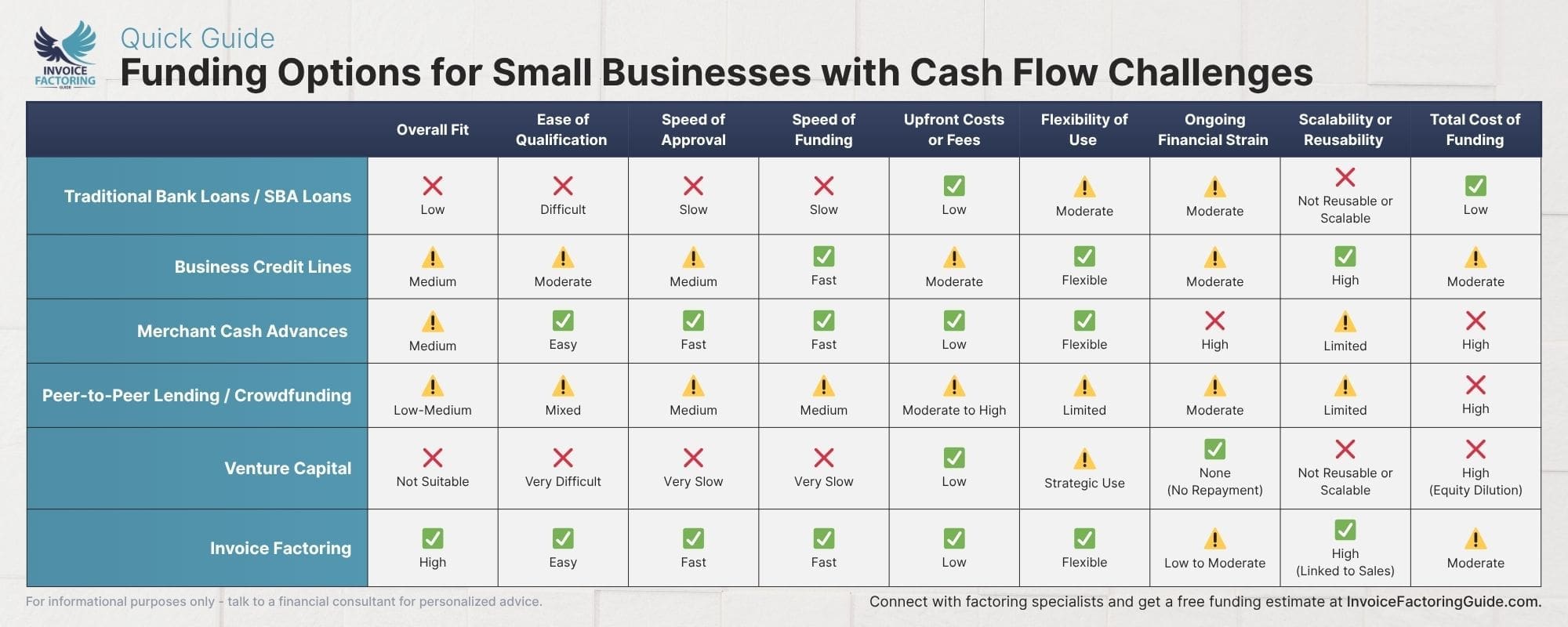

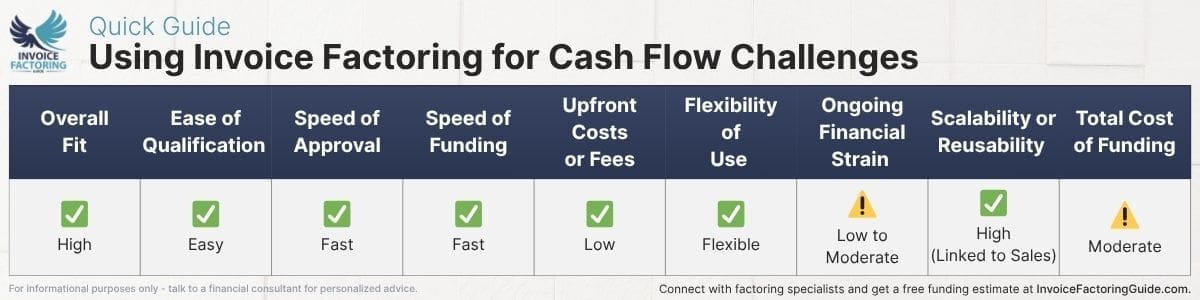

What to Look for in Financing for Cash Flow Challenges

Some funding options are built to help small businesses grow. Others are designed to help them stay afloat. When you’re dealing with a cash flow gap, the traits that matter most are the ones that affect speed, flexibility, and financial pressure. Before we break down the funding types, let’s take a closer look at the criteria that impact which is best for your situation.

Ease of Qualification

Qualification requirements vary widely. Some options require excellent credit, years in business, or collateral. Others have an easy approval process and focus on your sales history, invoice volume, or customer strength. If your business is already under financial strain, this can affect whether you’re able to access the funding at all.

Speed of Approval

Cash flow challenges often leave businesses struggling to cover payroll and other critical expenses. Meanwhile, some lenders take days or weeks to approve an application, especially if it requires document review or underwriting. Other funding sources use streamlined processes that return decisions within hours.

Speed of Funding

Depending on the solution you choose, it can take hours or weeks after approval before you see cash. Long delays can further strain your business when money is already tight.

Upfront Costs or Fees

Some funding products come with application fees, origination costs, or platform charges that reduce the amount of funding you receive, while others require payment before you get started. A select few have no setup costs and only deduct fees after funding is delivered.

Flexibility of Use

Some funding products restrict use to specific purchases or are tied to an investor’s strategic goals. Flexible options allow you to apply funds toward payroll, rent, supplies, or whatever areas are most urgent for your business.

Ongoing Financial Strain

The way a funding source affects your cash flow after disbursement is just as important as how quickly it delivers. Some options require fixed daily or weekly repayments that can be hard to manage. Others deduct fees in a way that aligns more naturally with how your revenue comes in.

Scalability or Reusability

One-time funding may work in an emergency, but it doesn’t help if the same issue happens again. Some options are built to grow with your business or be used repeatedly, while others require a brand-new application or funding round each time.

Total Cost of Funding

Total cost includes interest, fees, and anything else that affects the actual amount you pay for access to capital. It may be deducted upfront, repaid over time, or realized through equity loss. Understanding the full cost structure helps put short-term relief in the right context.

Option 1: Traditional Bank Loans and SBA Loans

Traditional bank loans and those backed by the U.S. Small Business Administration (SBA) are often considered the best loans for small businesses. They tend to offer the lowest interest rates for well-qualified borrowers as well as the most predictable repayment terms, which makes them attractive for long-term planning. But when you are dealing with a cash flow shortfall, those same features may become obstacles. Long processing times and strict qualification standards can prevent these options from being useful when timing is critical.

How Traditional Bank Loans for Small Businesses Work

Traditional bank loans provide a lump sum of capital that is repaid in fixed monthly installments over a set term, typically with interest. The loan process starts with an application through a bank or credit union. Businesses are often asked to provide detailed financial statements, tax returns, and credit reports. Personal guarantees or collateral may also be required with bank loans.

Once approved, funds are deposited into the business’s bank account. Repayment begins shortly after. Bank loans are commonly used to support asset purchases, refinance debt, or fund financing for small business growth, but they are not designed for short-term operational gaps.

How SBA Loans for Small Businesses Work

SBA loans are issued by private lenders but backed in part by the Small Business Administration. The SBA guarantee reduces the lender’s risk and makes it easier for some businesses to qualify. Loan programs vary, but the most common options include 7(a) loans, 504 loans, and microloans.

The process follows a similar structure to traditional bank loans but often includes additional documentation and review steps to meet SBA standards. Terms are generally favorable, with low interest rates and extended repayment periods. Some SBA products are designed for working capital loans, while others support equipment or real estate purchases.

Programs such as microloans for startups may be used by newer businesses, but these loans still require time to process and are rarely fast enough to resolve immediate cash flow needs.

Pros and Cons of Bank Loans for Cash Flow Issues

- Difficult to Qualify For: Most banks require strong credit, at least two years in business, and solid financials. Businesses experiencing a cash flow problem may not meet those standards. In fact, just 39 percent of businesses receive the level of funding they need overall, and 32 percent are outright denied, according to the latest Small Business Credit Survey.

- Slow Approval: The application and underwriting process can take several weeks, especially when additional steps are required for SBA review.

- Delayed Access to Funds: Even after approval, disbursement may take several more days, making these loans a poor fit for urgent financial needs.

- Minimal Upfront Costs: Origination fees are typically low and deducted from the loan amount, meaning there is little to no out-of-pocket cost to get started.

- Limited Flexibility in Some Cases: Bank loans may come with restrictions on how the funds can be used. SBA loans tend to allow more flexibility, especially for day-to-day operational needs.

- Fixed Repayment Structure: Monthly payments remain the same regardless of your income. That predictability can be helpful, but it may add pressure if cash flow remains tight.

- Not Designed for Repeat Use: Loans are issued in a single lump sum. If additional funds are needed later, a new application is required.

- Low Overall Cost for Qualified Borrowers: When used as startup financing solutions or for long-term planning, these loans offer some of the lowest interest rates available.

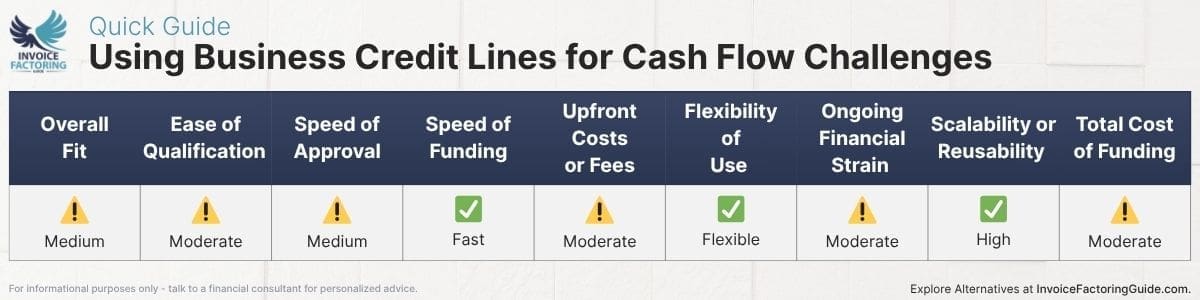

Option 2: Business Credit Lines

A business line of credit offers flexibility that traditional loans often lack. Instead of receiving a lump sum, you get access to a set amount of revolving credit that you can draw from as needed. That makes it well-suited for managing short-term cash flow gaps, provided it’s in place before the need becomes urgent. Understanding how these accounts work, and what their limitations are, can help you decide if they’re a good fit for your business.

How Short-Term Business Lines of Credit Work

A business line of credit gives you access to a set credit limit that you can draw from, repay, and draw from again. You only pay interest on the amount you use, not the entire credit line. Most lenders offer both secured and unsecured credit lines, with secured lines typically offering better rates or higher limits.

To qualify, lenders typically look at your business’s credit history, revenue, and time in operation. A strong application may allow you to qualify without collateral, but securing a line of credit with poor credit often requires backing the credit line with business assets or a personal guarantee.

Interest rates are typically variable, and repayment terms vary depending on the lender. These credit lines are commonly issued by banks, credit unions, and online lenders. While they function similarly to business credit cards, credit lines tend to offer higher limits, lower interest rates, and more flexible repayment structures, especially when tied to business income.

Pros and Cons of Business Credit Lines for Cash Flow Issues

- Moderately Accessible to Small Businesses: While not as difficult to qualify for as traditional loans, most lines of credit still require decent credit and proof of consistent revenue. Businesses in early stages or under financial stress may face limited options.

- Approval is Quicker Than Traditional Loans: Banks and online lenders often approve credit lines within a few days, though the process may take longer if collateral is involved.

- Funds Are Available Quickly After Approval: Once the account is open, you can access funds almost immediately. This makes lines of credit a practical tool for managing short-term gaps.

- Costs Are Modest but Vary by Lender: Some lenders charge setup or maintenance fees, while others only charge interest on the amount borrowed. Reviewing terms carefully is key to understanding the real cost.

- Highly Flexible Usage: You can use the funds for any business-related expense, such as payroll, rent, supplies, or vendor payments. This is one of the key advantages of lines of credit compared to more restrictive lending products.

- Repayment Can Create Strain if Revenue Drops: Interest-only payments are common during the draw period, but repayment expectations shift over time. If revenue dips, managing repayment can still become difficult.

- Built-In Reusability is a Major Benefit: As you repay what you borrow, the funds become available again. There’s no need to reapply or reopen an account with each use.

- Total Cost Depends on Usage and Terms: Interest rates are often higher than loans but lower than business credit cards, especially if you have strong financials. If used responsibly, the total cost can remain relatively low.

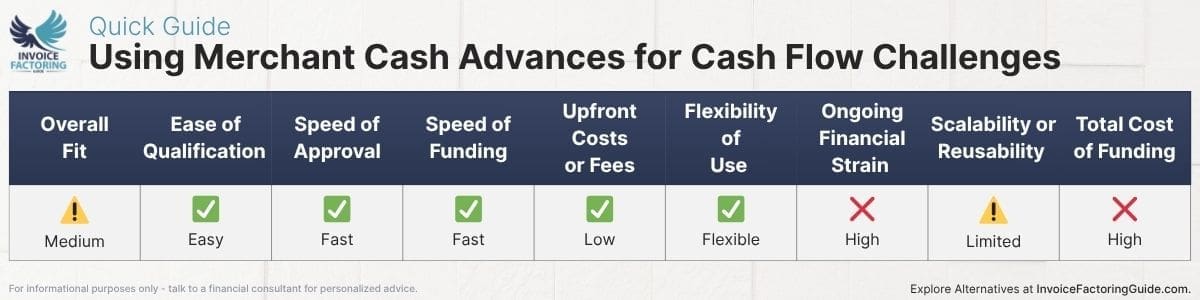

Option 3: Merchant Cash Advances

Merchant cash advances (MCAs) are often marketed as fast, flexible funding for businesses with inconsistent or limited credit history. While they can provide quick relief during a cash flow crunch, they come with some of the highest costs of any financing option. It’s important to understand how MCAs are structured and why their ease of access often comes at a steep price.

How Merchant Cash Advances Work

A merchant cash advance is not a loan. It’s a lump sum of capital given to your business in exchange for a percentage of future sales. Repayment is made daily or weekly, typically through automatic deductions from your credit card transactions or overall revenue.

Qualification is generally based on sales volume rather than credit score, which makes it a more accessible form of alternative financing for businesses with weaker credit. The approval process is fast, often taking just one or two business days.

Factor rates, rather than interest rates, are used to calculate cost. For example, if you receive $20,000 with a factor rate of 1.3, you’ll repay $26,000, regardless of how quickly you pay it off. That repayment is taken directly from your daily income, making it predictable in structure but potentially burdensome in practice.

Because they are designed to work with incoming revenue, bridging financial gaps with merchant cash advances may feel simple at first, but the day-to-day impact often builds quickly.

Pros and Cons of Merchant Cash Advances for Cash Flow Issues

- Easy to Qualify for: MCAs rely on your business’s recent sales, not your credit score or collateral. That makes them accessible even when other lenders turn you down.

- Very Fast Approval Times: Many MCA providers offer same-day or next-day approvals with minimal documentation, making this one of the fastest funding types available.

- Funds Are Disbursed within Days: Once approved, the advance is usually deposited into your account in one to three business days, which makes it highly responsive to urgent cash flow needs.

- Upfront Costs Are Minimal: There are typically no setup fees or out-of-pocket costs. The provider earns its return through the factor rate applied to your advance.

- Flexible in How Funds Are Used: You can apply the capital toward payroll, rent, inventory, or anything else your business needs. This is one of the most notable merchant cash advances advantages, especially for businesses with immediate gaps to cover.

- Daily or Weekly Repayments Can Drain Cash Flow: Because payments are tied to sales, they come out frequently, even on slow days. This can add pressure, particularly if revenue drops unexpectedly.

- Not Designed for Ongoing Use: Each advance is a standalone agreement. If you need more capital later, you’ll have to apply again and often pay off the first advance before receiving another.

- Total Cost is Among the Highest: Factor rates can result in effective annual costs well above traditional financing. While MCAs may help in a pinch, they are one of the most expensive ways to access fast capital.

Option 4: Peer-to-Peer Lending and Crowdfunding for Small Businesses

Peer-to-peer lending and crowdfunding are often grouped together because both bypass traditional banks and rely on public or decentralized funding sources. These models have grown in popularity over the past decade as more small businesses seek out alternative financing solutions. While both can help raise capital, their reliability and cost vary widely, and they are rarely the fastest or most predictable way to resolve a cash flow issue.

How Peer-to-Peer Lending and Crowdfunding for Small Businesses Work

With peer-to-peer lending for businesses, you borrow directly from individual investors instead of going through a bank. Applications are submitted through peer-to-peer lending platforms, which match businesses with investors based on criteria like loan size, risk profile, and industry. These platforms often charge origination fees, and interest rates can vary significantly based on your creditworthiness.

Crowdfunding, in its typical form, is not a loan. You create a public campaign asking supporters to contribute money toward a goal. Rewards-based crowdfunding may offer incentives in exchange for support, while equity crowdfunding involves giving up partial ownership in your business. These campaigns require time, marketing, and a compelling story to succeed.

In both cases, funds may take days or even weeks to collect, and there’s no guarantee your campaign will succeed or your loan will be fully funded.

Pros and Cons of Peer-to-Peer Lending for Cash Flow Issues

- Qualification is Mixed Across Platforms: Some platforms have strict credit and revenue requirements, while others focus more on business potential. Crowdfunding is open to anyone but offers no certainty of success.

- Approval Times Are Moderate: Peer-to-peer applications may be reviewed within a few business days. Crowdfunding campaign timelines are often longer and require planning and outreach in advance.

- Funding Speed Depends on the Method: Peer-to-peer loans may fund within a week if quickly matched with investors. Crowdfunding campaigns often take several weeks to reach their goal, if at all.

- Upfront Costs Can Vary Widely: Most peer-to-peer lenders charge an origination fee deducted from the funding. Crowdfunding platforms take a percentage of funds raised and may involve external costs like marketing, video production, or copywriting.

- Flexibility Depends on Platform Rules: Peer-to-peer loans are typically used for general business expenses. Crowdfunding campaigns usually define specific uses to attract support, which can limit how you apply the funds.

- Repayment May Still Strain Cash Flow: Peer-to-peer loans must be repaid with interest, often on a fixed schedule. This can be difficult if your revenue remains unstable during the repayment period.

- These Options Are Not Easily Repeatable: Crowdfunding campaigns are not designed for frequent use. Peer-to-peer platforms may allow repeat borrowing, but only after successful repayment and under new terms.

- Total Cost is Often Higher Than Expected: While interest rates on peer-to-peer loans may be competitive for well-qualified borrowers, they can rise quickly for higher-risk profiles. Crowdfunding involves percentage fees and indirect costs, which can add up even if no loan repayment is required.

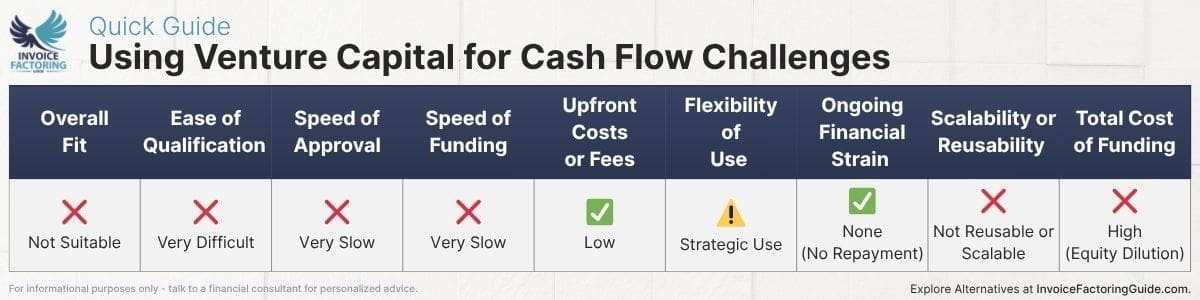

Option 5: Venture Capital

Venture capital (VC) is often discussed as a growth driver for startups, but it is rarely a practical solution for short-term cash flow issues. While it can provide a large injection of capital, the process is complex, highly selective, and typically focused on businesses with scalable growth potential. Less than one percent of entrepreneurs receive venture capital, according to Forbes. If your goal is to bridge a funding gap or stabilize operations, other options are likely a better fit.

How Venture Capital for Small Businesses Works

Venture capital involves raising money from investors in exchange for equity in your company. Unlike a loan, this funding does not require repayment, but it does require giving up partial ownership. VC firms usually invest in businesses they believe have the potential for rapid growth and a clear exit strategy, such as acquisition or IPO.

The process often includes multiple rounds of due diligence, business valuation, and investor negotiations. It can take months to secure funding, even if you’re successful. In some cases, early-stage funding may come from small business angel investors rather than formal VC firms. Other businesses may pursue small business investment funds, which are sometimes managed by government-backed or mission-driven groups with different investment criteria.

In all cases, venture capital is highly competitive and generally not intended for working capital needs or operational gaps.

Pros and Cons of Venture Capital for Cash Flow Issues

- Qualification is Extremely Selective: Most small businesses will not meet the growth profile, market opportunity, or scale expectations required to attract venture capital. Even qualifying for a pitch meeting can be a challenge.

- Approval Timelines Are Long: Securing venture capital takes months. The process involves due diligence, legal review, and negotiation. It is not a fast path to funding.

- Funding Takes Time to Arrive: Even after approval, the release of funds may be tied to milestones or closing procedures. This creates delays that are not compatible with urgent cash flow needs.

- There Are No Upfront Fees: While the process can be resource-intensive, there are typically no application or setup fees paid to the investor. However, legal and advisory costs may be incurred during negotiations.

- Use of Funds is Often Strategically Guided: Investors expect capital to be used for growth, not for resolving short-term operational problems. Use of funds may be influenced or constrained by investor input.

- No Repayment, But Long-Term Pressure Remains: There are no scheduled payments, but investors expect aggressive growth. This can create pressure to prioritize scaling over stability.

- Not Intended for Reuse: Venture capital is issued in rounds. If additional funding is needed later, the business must secure another round, often under new terms and with further equity dilution.

- Total Cost Is High Due to Equity Loss: While there are no loan payments or interest, the ownership you give up can become far more valuable over time. Equity financing may cost more in the long run than traditional debt.

Option 6: Invoice Factoring

For businesses that invoice other businesses, unpaid receivables can tie up large amounts of working capital. Invoice factoring provides a way to unlock that capital quickly, without taking on debt. Unlike many funding options, factoring is designed specifically for solving cash flow gaps, making it one of the few tools that aligns closely with the problem at hand.

What is Invoice Factoring and How Does it Work

Invoice factoring allows a business to sell its unpaid customer invoices to a third-party company called a factoring company in exchange for an immediate advance, typically between 80 and 95 percent of the invoice value. Once the customer pays the invoice in full, the factor returns the remaining balance, minus a small factoring fee.

The application process is relatively simple and focuses more on the creditworthiness of your customers than on your business. There are no monthly payments or interest charges. Instead, fees are deducted from the final payout. This structure provides quick access to funds for small businesses that can’t afford to wait weeks or months for payment.

While sometimes confused with loans, factoring as a financing option is distinct because it doesn’t add debt to your balance sheet. It’s also not the same as invoice discounting, which keeps control of the receivables with the business rather than the funding provider.

Industries Benefiting from Invoice Factoring

Invoice factoring is especially useful in sectors where payment terms are long and operational expenses continue regardless of when clients pay. Many construction companies use factoring to cover payroll and material costs while waiting for progress payments. Businesses in the trucking industry often rely on factoring to stay liquid between deliveries and invoice collection.

The model also fits well for temporary staffing agencies and government contractors, where large invoice amounts are common but payment cycles are slow.

Pros and Cons of Leveraging Invoice Factoring for Cash Flow Issues

- Easy Qualification Compared to Traditional Loans: Approval depends more on your customers’ ability to pay than your own credit score, making it easier to get approved, even for businesses with limited credit history.

- Fast Approvals and Turnaround Times: Applications are often reviewed within one to two business days, and many companies provide funding the same week.

- Funding is Released Quickly After Invoicing: Advances are typically delivered within 24 to 48 hours after invoices are submitted, making factoring one of the most reliable tools for improving cash flow in real time.

- Upfront Costs Are Minimal or Nonexistent: Most factoring companies don’t charge setup fees. Their earnings come from a percentage of the invoice, deducted only after your customer pays.

- Use of Funds is Not Restricted: Businesses can apply the advance to payroll, rent, materials, or other pressing needs without lender approval or justification.

- Repayment isn’t Required from the Business: Because the factoring company collects payment directly from the customer, there are no fixed payments pulled from your account during slow periods. Because of this, it’s often used along with other growth financing tools and cash flow solutions.

- Factoring Grows with Your Revenue: As your invoice volume increases, the amount of available funding increases too, without requiring you to reapply or renegotiate terms.

- Costs Are Moderate and Vary by Agreement: While factoring can be more expensive than a traditional loan, it’s typically more affordable than merchant cash advances or short-term lending products.

Close Your Cash Flow Gap with Factoring

If you’re experiencing cash flow issues, solutions that can truly deliver are few and far between. However, factoring can provide quick access to cash as needed without putting your company in debt. To take the first step, request a free rate quote.

FAQs on Financing Options for Small Businesses with Cash Flow Issues

Is qualifying for a bank loan with limited cash flow hard?

Yes. Lenders usually require strong financials and consistent revenue. Limited cash flow can signal risk, making approval unlikely. Alternative solutions like factoring don’t rely on your cash flow history for approval.

What are the best equipment financing options when you’re struggling with cash flow?

Traditional equipment loans may be hard to qualify for if cash flow is tight. Leasing or using invoice factoring to free up working capital can offer more flexibility during lean periods.

What is the best financing option for small business cash flow problems?

The best option depends on how quickly you need funds and whether you can qualify. For many, invoice factoring works well because it turns unpaid invoices into immediate cash without adding debt or requiring strong credit.

Can invoice factoring help improve cash flow for small businesses?

Yes. Factoring gives you fast access to cash by advancing payment on outstanding invoices. It’s especially helpful when customer payments are delayed but expenses cannot wait.

How fast can a small business get cash flow funding through a merchant cash advance?

Some MCAs fund within one to three days, but repayment terms are often aggressive. If you invoice clients, factoring may offer similar speed with less daily financial strain.

Is a business line of credit good for managing cash flow gaps?

It can help if you already have one in place. However, qualifying can be difficult, especially during a crunch. Businesses with slow-paying customers may find factoring more accessible.

What are the pros and cons of using peer-to-peer lending for cash flow needs?

Peer-to-peer loans are easier to access than bank loans but can still take time to fund and may come with higher rates. They also add debt, unlike factoring.

Are SBA loans useful for solving short-term cash flow issues?

Not usually. SBA loans take time to process and are best for long-term growth. For urgent cash flow needs, faster options like factoring may be a better fit.

What type of funding is best for small businesses with slow-paying customers?

Invoice factoring is often the best option because it’s built specifically for this issue. It gives you access to funds tied up in unpaid invoices without waiting for payment.

Can a startup with poor credit get cash flow financing?

Startups with limited or poor credit may struggle with loans. Some factoring companies focus more on your customer’s payment history than your credit, making approval easier.

What’s the difference between a working capital loan and invoice factoring for cash flow?

A working capital loan adds debt with set repayment terms. Invoice factoring gives you immediate access to funds from unpaid invoices, with repayment tied to your customer’s payment.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300