Did you know that roughly half of all small business funding applicants do not receive full funding, according to the latest Small Business Credit Survey? In all, 28 percent receive just partial funding, and 22 percent are outright denied. The stats for business loans specifically are even more grim, with just 38 percent of applicants being fully approved. That leaves a lot of businesses in a tight spot by saddling them with enough debt to hook them into long-term payments with interest, but not enough cash to thrive. However, invoice factoring fills this gap and pairs well with other strategies, allowing underserved businesses to cover daily expenses and grow. In this guide, we’ll walk you through how factoring and other cash flow solutions can come together to provide you with a tailored fit that addresses your unique situation and goals.

Cash Flow Issues Are a Common Challenge

Three out of five businesses struggle with cash flow issues, according to QuickBooks surveys. Understanding why they happen and the impact they have on your business is a crucial step in eliminating them.

Why Cash Flow Problems Happen

Cash flow issues are often framed as emergencies, but in reality, they’re usually the result of predictable patterns. Let’s quickly review a few of the most common causes.

- Slow Customer Payments: If your clients are taking weeks or months to pay invoices, you’re fronting the cost of doing business without getting the cash in hand. This is especially common in industries like manufacturing, transportation, and staffing.

- Late Customer Payments: Roughly half of all B2B invoices are paid late, according to Atradius.

- Seasonal Revenue Cycles: Many businesses bring in the majority of their revenue during a specific time of year. If your income is uneven but your expenses are steady, you’re likely to hit cash flow gaps.

- Overexpansion: Growth is great until it outpaces your working capital. Businesses that hire quickly, open new locations, or invest in equipment without a matching cash strategy often find themselves stretched thin.

- Unexpected Costs: Equipment breaks. Vendors raise prices. A key customer pulls out. Surprises like these can drain your reserves fast if you’re not prepared.

- Tight Profit Margins: If your pricing model doesn’t leave enough room for overhead, even small delays in cash inflow can leave you struggling to cover payroll or inventory.

How Cash Flow Issues Impact Your Business

The symptoms of a cash flow issue may start small, like paying a vendor a few days late, but they can quickly snowball.

- Payroll Pressure: Missing or delaying payroll damages employee trust and opens the door to legal risks.

- Late Fees and Penalties: Vendors may charge interest or cut off service if you’re consistently late.

- Missed Opportunities: Without available cash, you can’t jump on quick-turn deals like discounted inventory or last-minute ad placements.

- Credit Dependence: If you rely heavily on credit cards or loans to plug cash flow gaps, you risk high interest charges and strained relationships with lenders.

- Stress and Burnout: This might sound personal, but it matters. Constantly juggling who gets paid and when creates mental strain that takes focus away from growth and strategy.

- Closure: As these issues mount, it becomes impossible to keep your head above water. Because of this, 82 percent of business closures are tied back to cash flow management issues, Forbes reports.

Developing a Strong Cash Flow Strategy is Essential for the Long-Term Health of Your Business

Cash flow is the backbone of every decision you make, from hiring and inventory to pricing and marketing. When you operate without a clear strategy, you’re reacting instead of leading. That kind of reactive behavior shows up in all sorts of ways.

- Last-Minute Decisions: Without a plan, funding becomes a scramble. You may end up taking on expensive debt or making deals that compromise long-term growth.

- Inconsistent Capital Access: Relying on a single source of cash, even if it’s been reliable in the past, puts your business at risk if that channel slows, tightens, or disappears.

- Short-Term Thinking: When cash is tight, it’s easy to focus on putting out fires. That kind of tunnel vision makes it hard to invest in things like expansion, tech upgrades, or team development.

The Role of Diversification

Many businesses develop a plan to address cash flow challenges, but they zero in on just one strategy. It’s essential to build beyond this and diversify your approach.

- Risk Reduction: If one solution slows down, others can step in. That means fewer interruptions, smoother operations, and more peace of mind.

- Stronger Negotiating Power: When you’re not overly dependent on a single vendor, lender, or funding method, you have more leverage and more choices.

- Built-In Flexibility: Business needs change. A diversified approach gives you the tools to scale up, pull back, or pivot without delay.

- Resilience During Disruption: Whether it’s a supply chain issue, customer default, or economic shift, having multiple funding paths in place helps you maintain control when the unexpected hits.

Invoice Factoring Supports Effective Cash Flow Management

If your business is waiting on unpaid invoices while expenses keep rolling in, invoice factoring is a practical and strategic way to unlock working capital.

Factoring gives you access to cash you’ve already earned. Instead of waiting weeks or more for your customer to pay, you receive most of the money right away by selling the invoice to a factoring company.

This approach doesn’t involve taking on debt. There are no repayment schedules, interest rates, or long application processes. You’re simply converting receivables into usable cash.

How Factoring Works

The factoring process allows you to access working capital from your accounts receivable by following a series of structured steps.

- Issue the Invoice: You send an invoice to your customer for completed work or delivered goods.

- Submit the Invoice to a Factoring Company: You provide the factoring company with the invoice and any necessary documentation, such as proof of delivery or a signed agreement.

- Verification and Approval: The factoring company confirms that the invoice is valid, the work was completed, and there are no known disputes.

- Customer Notification: The factoring company informs your customer that payment should be directed to them going forward.

- Advance Payment Issued: You receive a cash advance, typically between 80 and 90 percent of the invoice value, often within one business day.

- Remaining Balance Released: Once your customer pays the factoring company, the remaining amount is forwarded to you, minus the factoring fee.

The Role of Factoring in Cash Flow Management

When integrated into your broader strategy, factoring can help stabilize and grow your business in many different ways.

- Predictable Cash Flow: Factoring allows you to receive funds immediately, giving you control over cash flow regardless of your customers’ payment habits.

- Improved Liquidity: With faster access to revenue, you can reinvest in your business, cover payroll, buy materials, or respond to unexpected expenses.

- Support for Growth: When demand increases or large orders come in, factoring gives you the capacity to fulfill them without taking on new debt or stretching internal resources.

- Administrative Relief: Many factoring companies offer additional services like credit checks and collections, which can reduce your internal workload and minimize payment risk.

Where Factoring Fits

Factoring isn’t a one-size-fits-all solution. However, it is flexible and aligns well with many situations.

- As a Short-Term Bridge: Businesses often turn to factoring while waiting on loan approvals or during periods of rapid growth.

- As a Long-Term Strategy: Some companies use factoring on a recurring basis to keep cash flow steady and predictable.

- For Specific Accounts: You may choose to factor only certain invoices, such as those from slow-paying customers or large contracts with extended terms. This is known as “spot factoring.”

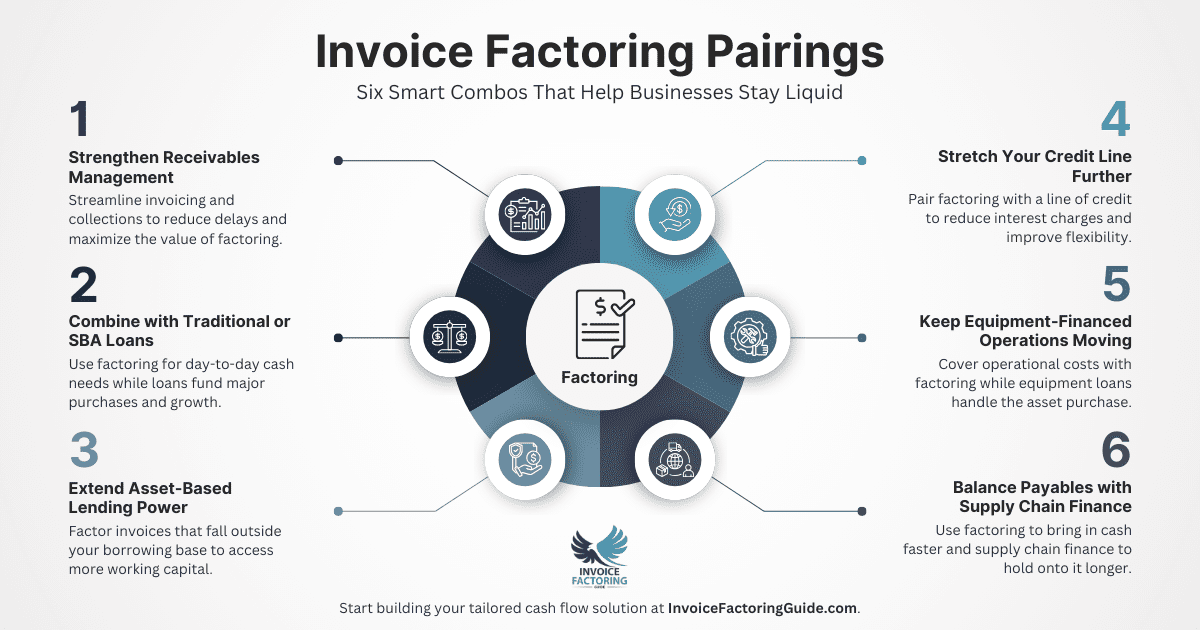

When used with intention, factoring gives you the freedom to operate from a position of strength instead of scarcity. It’s one of several tools available to help you manage your working capital more effectively. We’ll explore how it works alongside some of the most common options below.

Pairing Factoring with Improved Receivables Management

Receivables management refers to the systems and processes your business uses to issue invoices, enforce payment terms, and collect what’s owed. This includes everything from how clearly your invoices are written to how consistently your team follows up with late-paying customers.

Strong receivables management supports healthy cash flow on its own. But when paired with factoring, it becomes even more effective. Clean invoicing practices, accurate records, and active follow-up reduce delays and disputes, which speed up funding and improve your relationship with your factor.

Some of the biggest wins come from adjusting your terms. For example, shortening net payment windows or offering small discounts for early payment can reduce reliance on factoring. On the flip side, if you’re extending longer terms to attract larger clients, factoring helps you cover that gap without taking on debt.

How Factoring and Improved Receivables Management Work Together

- Faster Funding Turnaround: Accurate invoicing and clear documentation speed up the factor’s verification process, meaning you get cash in hand sooner.

- Lower Factoring Costs: Invoices that are less likely to be disputed or delayed tend to carry lower risk, and lower risk often translates to lower factoring fees.

- Fewer Customer Frictions: Professional receivables practices improve communication with clients and reduce confusion, which can lead to faster payment cycles overall.

- Scalable Infrastructure: As your business grows, solid receivables processes make it easier to manage more invoices and use factoring more strategically.

Considerations Before You Combine Factoring with Improved Receivables Management

- Internal Process Discipline: Factoring companies rely on your ability to issue clean, accurate invoices. If your internal systems are disorganized, you may experience funding delays or added scrutiny.

- Customer Relationships: If you’re using a factoring company that notifies your clients directly, make sure your invoicing and collections tone aligns with the professional standards your customers expect.

- Resource Allocation: Effective receivables management takes time. If your team is stretched thin, automating tasks like invoice generation or follow-ups can make this pairing more sustainable.

Pairing Factoring with Traditional and SBA Loans

Traditional business loans and Small Business Administration (SBA) loans offer lump-sum funding that can be used for a wide range of purposes, from equipment purchases to operating expenses. These loans are repaid over time with interest, and approval typically depends on credit history, business performance, and financial documentation.

Traditional loans are issued directly by banks or lenders. SBA loans, while also provided by private lenders, are partially guaranteed by the U.S. Small Business Administration, which makes them more accessible to businesses with limited credit history or collateral.

While both types of loans help strengthen long-term cash flow by injecting working capital into your business, loans are not always accessible or flexible enough for day-to-day fluctuations. Factoring fills these gaps.

How Factoring, Traditional, and SBA Loans Work Together

- Bridges the Timing Gap: Loans provide large sums of cash upfront, while factoring helps smooth out ongoing cash flow between receivables. This allows you to meet daily obligations while putting loan funds toward growth or large expenses.

- Reduces Loan Reliance: Using factoring to cover short-term needs means you may borrow less, and therefore take on less debt, when applying for a traditional or SBA loan.

- Strengthens Loan Applications: If factoring improves your cash flow and financial stability, lenders may view your business as less risky, increasing your chances of approval and potentially improving your loan terms.

- Supports Growth Without Overleveraging: Loans are ideal for long-term investments. Factoring helps you operate smoothly in the short term without stacking additional loan payments onto your balance sheet.

Considerations Before You Combine Factoring with Traditional and SBA Loans

- Loan Covenant Restrictions: Some business loans include clauses that limit additional financing or require lender approval before factoring is allowed. Be sure to review your bank loan agreement or talk with your lender before proceeding.

- Repayment Obligations: Loans must be repaid on schedule, regardless of whether customers pay you on time. If you’re also factoring, make sure your cash flow planning accounts for both the loan payments and factoring fees.

- Application and Approval Timeline: Traditional and SBA loans can take weeks or months to secure. If you’re facing immediate cash flow needs, factoring may be the faster path, but it’s best to use both as part of a proactive, not reactive, strategy.

Pairing Factoring with Asset-Based Lending

Asset-based lending allows businesses to secure a line of credit or term loan by pledging assets as collateral. These assets can include accounts receivable, inventory, equipment, or even real estate. The amount you can borrow is tied directly to the value of those assets, and the lender typically performs regular audits to determine borrowing limits.

Unlike factoring, where specific invoices are sold and immediately converted into cash, asset-based lending keeps the receivables on your books. You maintain responsibility for collections and customer communication, but you gain access to cash through a revolving credit facility.

While asset-based lending offers more control over customer relationships, it requires more administrative oversight and is often better suited for companies with strong internal systems and a broad asset base.

How Factoring and Asset-Based Lending Work Together

- Improves Access to Capital: Factoring can supplement your available borrowing base, especially if your asset-based line doesn’t give you enough headroom to cover operating costs or take on new business.

- Supports Selective Receivables Management: If your asset-based lender excludes certain customers or invoices due to credit risk or age, you can factor those invoices separately to unlock cash that would otherwise sit idle.

- Provides Flexibility During Transitions: Some companies use factoring early in their growth journey and shift to asset-based lending as their balance sheet strengthens. Using both tools during a transition can prevent funding gaps.

- Enhances Cash Flow Consistency: Factoring delivers predictable, invoice-by-invoice liquidity. Asset-based lending provides revolving access based on the value of your full asset base. Used together, they help balance short-term needs and long-term financial strategy.

Considerations Before You Combine Factoring with Asset-Based Lending

- Potential Collateral Conflicts: If your receivables are already pledged as collateral in an asset-based facility, you may need lender approval to factor those same invoices. Clear documentation and lender communication are essential.

- Increased Oversight Requirements: Both asset-based lenders and factoring companies have reporting and compliance expectations. If you use both, you’ll need strong internal processes to manage those requirements without creating bottlenecks.

- Cost and Complexity: While the combination of tools can offer better coverage, it may also introduce additional fees and administrative complexity. The benefits are real, but they require coordination and financial discipline.

Pairing Factoring with Business Lines of Credit

A business line of credit gives you flexible access to capital, allowing you to draw funds as needed up to a predetermined limit. Unlike a term loan, which delivers a lump sum, a line of credit works more like a business credit card. You only pay interest on the amount you use, and once it’s repaid, the funds become available again.

Lines of credit are often used to cover short-term expenses like payroll, inventory, or vendor payments. Approval is typically based on your business’s creditworthiness, revenue, and financial performance, and the lender may require personal guarantees or collateral.

While a line of credit can be a valuable safety net, it may not provide enough support on its own, especially if your credit limit is too low, your draw window is closed, or your business needs a more predictable funding cycle. That’s where factoring can help.

How Factoring and Business Lines of Credit Work Together

- Expands Available Capital: If your line of credit is fully drawn or your limit is too low, factoring gives you access to additional working capital without needing to renegotiate terms or reapply.

- Improves Cash Flow Timing: Factoring fills in the gaps between invoice submission and customer payment, allowing you to use your line of credit more strategically—such as for growth initiatives or one-time expenses rather than day-to-day operations.

- Reduces Interest Accrual: Because factoring provides cash based on actual revenue, it may reduce how often you tap into your credit line. That can lead to lower interest charges and more breathing room.

- Provides Backup During Tight Credit Cycles: If your lender reduces your available credit due to market conditions or a dip in performance, factoring offers an alternative that’s based on receivables, not credit scores.

Considerations Before You Combine Factoring with Business Lines of Credit

- Lender Restrictions: Some lenders prohibit factoring if your receivables are pledged as collateral. You’ll need to review your agreement or request a carve-out for specific invoices or customers.

- Cash Management Discipline: Having access to both tools can tempt businesses to overspend or rely too heavily on short-term funding. Be intentional about how and when you use each option.

- Cost Comparison: While lines of credit often offer lower interest rates than factoring, they don’t solve slow payments. Using both allows you to balance cost and speed, but it requires a clear understanding of your margins.

Pairing Factoring with Equipment Financing

Equipment financing allows you to purchase or lease business-critical equipment by spreading the cost over time. This can include anything from trucks and machinery to computers and specialized tools. The equipment itself typically serves as collateral, which helps reduce the lender’s risk and often results in more favorable terms.

This type of financing preserves your working capital for other expenses and is especially useful for businesses in asset-heavy industries like manufacturing, construction, and transportation.

However, equipment financing only covers the cost of the equipment, not the ongoing operational needs that come with using it. That’s where factoring can play a supporting role.

How Factoring and Equipment Financing Work Together

- Frees Up Cash for Operations: While your equipment loan covers the purchase, factoring gives you access to working capital for payroll, maintenance, materials, or fuel, keeping everything else running smoothly.

- Supports Faster ROI: With factoring covering your day-to-day expenses, the equipment you financed can start generating income right away without straining your cash flow.

- Improves Financial Flexibility: Pairing the fixed repayment schedule of equipment financing with the on-demand funding of factoring allows for better overall cash planning.

- Reduces Pressure on Credit Lines: By using factoring for working capital needs, you avoid maxing out your line of credit or credit cards, reserving those tools for unexpected expenses or growth opportunities.

Considerations Before You Combine Factoring with Equipment Financing

- Fixed vs. Variable Costs: Equipment financing comes with predictable payments. Factoring fees vary based on invoice value, customer credit, and payment speed. Be sure your financial model accounts for both.

- Capital Allocation Discipline: Financing equipment can make it easy to justify additional purchases. Pairing it with factoring requires careful planning to ensure revenue generated by the equipment supports both funding tools.

- Loan Agreement Terms: Some lenders may include clauses that limit other financing arrangements. Review your contract to confirm whether factoring is permitted while equipment is under lien.

Pairing Factoring with Supply Chain Finance

Supply chain finance (SCF), also known as reverse factoring, is a financial solution that allows your suppliers to get paid early, often through a third-party financier, while you extend your own payment terms. It’s typically driven by the buyer (your business), which sets up the program to strengthen supplier relationships and optimize working capital.

Unlike invoice factoring, where you sell your own receivables, supply chain finance gives your vendors faster access to funds based on your credit profile, not theirs. This creates a win-win scenario: your suppliers get paid sooner, and you preserve your cash longer.

Used alongside factoring, supply chain finance can create a more stable, efficient cash flow ecosystem across both sides of your balance sheet.

How Factoring and Supply Chain Finance Work Together

Creates a Full Cash Flow Buffer: Factoring helps you speed up incoming payments. Supply chain finance helps you slow down outgoing ones. Together, they give you more control over the timing of cash movements.

- Strengthens Supplier Relationships: By giving suppliers early payment options, you build goodwill and reduce the chance of supply chain disruptions, especially in uncertain economic conditions.

- Preserves Internal Liquidity: While your vendors are getting paid, you’re still holding onto your cash longer. That means more capital stays available for reinvestment or operational use.

- Improves Financial Agility: Combining both tools gives you the flexibility to manage cash more proactively, respond to changing demand, and maintain stability during seasonal or cyclical shifts.

Considerations Before You Combine Factoring with Supply Chain Finance

- Program Eligibility: Supply chain finance programs often cater to larger companies or those with strong credit. If you’re a smaller business, you may need to work through a third-party platform or fintech provider to gain access.

- System Integration Requirements: Both factoring and SCF involve multiple parties and data sharing. Make sure your invoicing systems and internal processes can support the added complexity.

- Customer and Vendor Communication: Since both tools involve third-party funders, clear communication with your customers and suppliers is essential to avoid confusion or concerns about financial stability.

Develop a Tailor-Fit Cash Flow Management Strategy

When you combine factoring with other cash flow solutions strategically, you’re building a more resilient, responsive business. Each tool has a role to play. The key is understanding how each solution fits into your broader strategy so you can align your strategy with real business needs, and not just apply short-term fixes. If it sounds like invoice factoring may be an ideal solution for your needs, request a complimentary rate quote.

FAQs on Combining Factoring and Cash Flow Solutions

What invoicing tools work best if I’m factoring?

Tools that generate professional, trackable invoices, like QuickBooks, Xero, or FreshBooks, help streamline the factoring process. Look for platforms that support automated follow-ups, integrate with your CRM, and allow easy document sharing. This reduces verification delays and makes it easier for your factor to fund you quickly.

Do I still need to chase invoices if I factor them?

That depends on the factoring agreement. In a non-recourse arrangement, the factor typically handles collections. In a recourse setup, you're still responsible if the customer doesn’t pay. Even with non-recourse factoring, maintaining good communication with clients can help prevent disputes and ensure faster processing.

Should I change payment terms when using a factoring company?

Possibly. Many businesses extend longer terms to attract bigger clients and then factor those invoices to maintain cash flow. Others shorten terms to reduce reliance on factoring altogether. If factoring is part of your strategy, align your terms with your cash flow goals and your factor’s advance timing.

Can I use factoring and negotiate longer payment terms with suppliers?

Yes, and it can be a smart move. While factoring helps speed up your incoming cash, extended terms with suppliers slow down your outflow. That combination gives you more breathing room. Just be careful not to delay payments so long that it damages vendor relationships or triggers late fees.

How do I manage payables and receivables together with factoring?

Start by forecasting both inflows and outflows weekly. Factoring gives you predictability on the receivables side. Use that predictability to time your payables strategy, whether that means paying early to earn discounts or holding off to maintain liquidity. A cash flow dashboard or integrated accounting software can help.

Is it smart to delay vendor payments if I’m already factoring invoices?

Only if it’s part of a deliberate strategy. Factoring improves liquidity, but abusing vendor terms can hurt relationships or lead to supply disruptions. Prioritize critical vendors, communicate clearly, and use the cash from factoring to stay ahead of essential obligations, especially during high-volume or seasonal periods.

Can I use automation to manage cash flow if I’m factoring?

Absolutely. Automation tools can streamline invoicing, track customer payments, and flag delays. When paired with factoring, this creates a real-time view of your cash flow. You can also automate approvals, upload documentation to your factor, and track funding timelines, making the entire process more efficient.

How do I combine invoice factoring with other cash flow strategies?

Use factoring for short-term needs while applying other strategies, like tightening expenses, adjusting pricing, or improving forecasting, to stabilize your business long-term. The key is integration: don’t treat factoring as a standalone fix. Use it as a bridge while you improve the systems that drive your overall cash position.

Should I fix cash flow issues before using a factoring company?

You don’t need to fix everything first, but you should understand what’s causing the problem. Factoring can stabilize cash flow quickly, giving you the space to fix deeper issues like delayed invoicing, high overhead, or inefficient collections. Used strategically, it’s both a solution and a support system.

Can I use factoring as part of a lean or just-in-time model?

Yes. Factoring works well in lean environments where cash flow must match production or delivery schedules. It helps cover materials, payroll, or fulfillment costs without holding excess inventory or borrowing heavily. Just make sure your operations are tight, because lean models leave less room for errors or payment delays.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300