From the ancient trade routes of Mesopotamia to today’s global markets, effective accounts receivable (AR) management has always been crucial for business success. Invoice factoring, with its rich history, remains a timeless solution that businesses rely on to ensure steady cash flow and operational efficiency. On this page, we’ll walk you through the benefits of effective AR management and why factoring for AR management is a top choice for businesses today.

Importance of Effective AR Management

Effective AR management is crucial for the financial health and operational efficiency of any business.

Maintains Cash Flow

- Ensures Liquidity: Timely collection of receivables ensures that a business has the cash needed to cover daily expenses, such as payroll, rent, and utilities.

- Reduces Cash Flow Gaps: Effective AR management helps avoid cash shortages that can disrupt operations or force a business to seek expensive short-term loans.

Minimizes Bad Debt

- Improves Collection Processes: Implementing systematic AR management processes reduces the risk of bad debts by ensuring timely follow-ups and collections.

- Credit Risk Assessment: Regular credit checks on customers help in identifying and mitigating the risk of non-payment.

Enhances Financial Planning

- Predictable Cash Flow: Effective AR management provides better visibility into cash flow, aiding in accurate financial forecasting and planning.

- Supports Investment Decisions: With a clear understanding of incoming cash, businesses can make informed decisions about reinvesting in growth opportunities.

Improves Customer Relationships

- Professionalism: Efficient AR processes reflect a company’s professionalism, fostering trust and reliability with customers.

- Negotiation Power: Good AR management allows businesses to offer better payment terms to reliable customers, enhancing customer satisfaction and loyalty.

Reduces Administrative Burden

- Streamlined Processes: Automated and well-organized AR systems reduce the administrative workload so the staff can focus on more strategic tasks.

- Error Reduction: Effective AR management minimizes errors in invoicing and payment processing, reducing disputes and delays.

Supports Growth and Expansion

- Working Capital Management: By optimizing the collection of receivables, businesses have more working capital available to invest in growth initiatives.

- Scalability: Effective AR management processes can scale with the business, ensuring continued efficiency as the company grows.

Invoice Factoring Explained

Invoice factoring is a funding method that allows businesses to convert their outstanding invoices into cash by selling them to a factoring company, also called a factor. This helps improve cash flow and ensures the business has the liquidity needed to continue operations and grow. It’s different from accounts receivable financing because it’s not a loan, so there’s no debt to pay back. An example of a typical factoring process is outlined below.

Invoice Creation

A business delivers services or goods to its customers and generates invoices with payment terms, such as net 30 or net 60.

Sell Invoices to a Factoring Company

The business selects the invoices it wants to factor and sells them to a factoring company. The business then submits the selected invoices to the factoring company, which verifies the invoices and the creditworthiness of the customers.

Receive Immediate Cash

Upon verification, the factoring company advances a significant portion of the invoice value, typically 60 to 95 percent, to the business. This advance provides the business with immediate cash. The factoring company charges a small fee for its services, which is deducted from the advance or the final payment.

Customer Payment

The customer pays the invoice balance to the factoring company per the original payment terms. After this, the factor sends the remaining balance to the business, after deducting their fees.

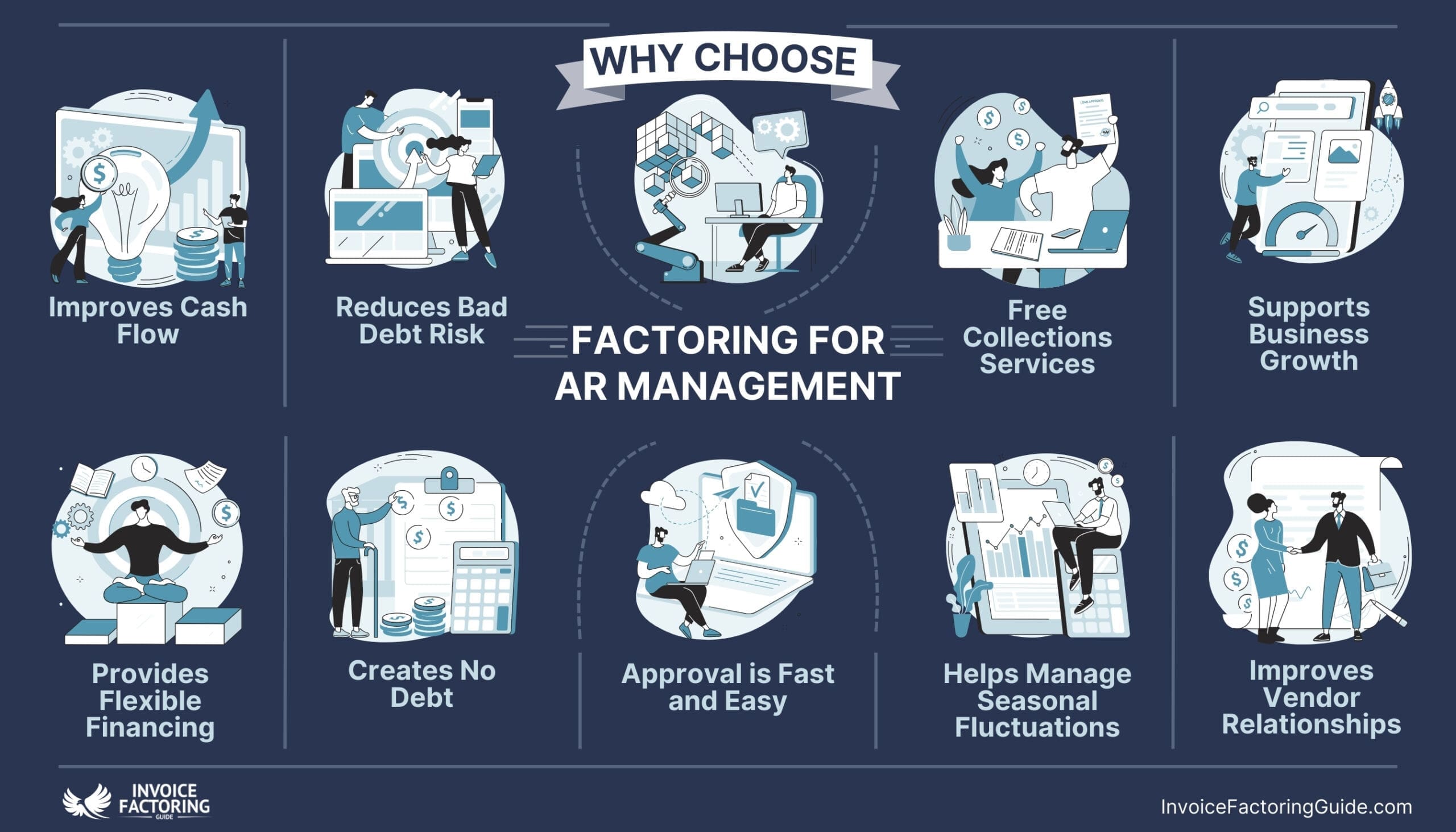

Why Businesses Choose Factoring for AR Management

Because there are many benefits of invoice factoring, it contributes to effective AR management in lots of unique ways.

Improves Cash Flow

If you’re exploring how to improve business cash flow, factoring is one of the most effective and efficient cash flow solutions for businesses. It provides instant access to capital by converting outstanding invoices into cash, helping businesses maintain steady cash flow.

Reduces Bad Debt Risk

Factoring companies run credit checks on the business’s customers and provide guidance on who to extend credit to and how much credit to extend. Businesses that follow these credit guidelines can reduce or eliminate bad debt risk. Businesses can also eliminate bad debt risk with non-recourse factoring. In these agreements, the factoring company absorbs the loss if the customer doesn’t pay their invoice. This is a crucial element in risk management in AR financing.

Free Collections Services

Businesses spend an average of 14 hours each week chasing payments, according to Intuit surveys. Because factoring companies collect on factored invoices they can eliminate this burden. Some offer invoice preparation as well, making accounts receivable outsourcing via factoring a strategic move.

Supports Business Growth

With immediate cash, businesses can reinvest in operations, purchase inventory, hire staff, and take on new projects without waiting for invoice payments. Factoring is also advantageous for startups, as there are many factoring companies for startups that understand the unique challenges they face.

Provides Flexible Financing

Factoring is unique even among alternative financing options because it scales with the business. More funds automatically become available as the value of the invoices grows. This flexibility makes factoring a key tool in short-term financing strategies and debt financing alternatives.

Creates No Debt

Unlike traditional loans, factoring is not a debt; it involves selling an asset (accounts receivable) and keeping the business’s balance sheet clean. This aspect makes it one of the most preferred business finance solutions.

Helps Manage Seasonal Fluctuations

Businesses experiencing seasonal sales variations can use factoring to manage cash flow during slow periods.

Approval is Fast and Easy

One of the main reasons factoring services for small businesses have become so popular is their accessibility. Even businesses that haven’t established strong credit yet and younger businesses can qualify.

Improves Vendor Relationships

With improved cash flow, businesses can pay suppliers on time or even early, potentially negotiating better terms or discounts. Improving liquidity with factoring ensures operations continue smoothly throughout the year.

Leverage Factoring for AR Management

It’s easy to see why factoring can be beneficial for effective AR management but much of your experience depends on the factoring company you select. We’re happy to match you with a factoring company that offers competitive rates, understands your industry, and can help you maximize the benefits outlined here. To take the next step, request a complimentary rate quote.

Factoring for AR Management FAQs

Why do businesses choose factoring for accounts receivable management?

Businesses choose factoring to improve cash flow, reduce bad debt risk, and support growth. Factoring provides immediate cash from invoices, allowing businesses to cover expenses and reinvest. It also simplifies credit management and offers flexible financing without incurring debt.

What are the benefits of using invoice factoring for small businesses?

Invoice factoring helps small businesses by providing immediate cash flow, reducing the risk of bad debt, and enabling growth. It allows them to meet operational expenses, invest in new opportunities, and maintain smooth operations without waiting for invoice payments.

How does factoring improve cash flow for businesses?

Factoring improves cash flow by converting outstanding invoices into immediate cash. This ensures businesses have the liquidity needed to cover daily expenses, invest in growth, and avoid cash shortages that could disrupt operations.

What is the difference between recourse and non-recourse factoring?

Recourse factoring requires the business to buy back unpaid invoices or replace them. Non-recourse factoring shifts the credit risk to the factoring company, protecting the business from bad debts. Non-recourse typically has higher fees due to the increased risk to the factor.

Is invoice factoring a good option for startups?

Yes, invoice factoring is a good option for startups with limited credit history. It provides immediate cash based on customers' creditworthiness, supporting cash flow and enabling growth without needing traditional bank loans.

How much does invoice factoring cost?

Factoring costs vary but typically range from one to five of the invoice value. The fee depends on factors such as the customer's creditworthiness, the volume of invoices, and the industry's risk level.

Can invoice factoring help businesses with seasonal fluctuations?

Yes, invoice factoring helps businesses manage seasonal fluctuations by providing consistent cash flow during slow periods. This allows businesses to cover expenses, maintain operations, and prepare for peak seasons without financial strain.

What types of businesses typically use invoice factoring?

Businesses across various industries use factoring, including manufacturing, trucking, staffing, and professional services. It's particularly beneficial for businesses with long payment terms, high growth potential, or those experiencing cash flow challenges.

How quickly can a business receive funds through invoice factoring?

Businesses can typically receive funds within 24 to 48 hours after submitting invoices to the factoring company. The quick turnaround helps address immediate cash flow needs and supports ongoing operations.

What is the difference between invoice discounting vs. factoring?

Invoice discounting and factoring both provide businesses with immediate cash by leveraging unpaid invoices, but they operate differently. Invoice discounting allows businesses to retain control over their sales ledger and collection processes, whereas factoring involves selling the invoices to a factor, which then manages the collections.

What are factoring rates and fees?

Factoring rates and fees can vary widely depending on the industry, volume of invoices, and creditworthiness of the business's customers. Typically, fees range from one to five percent of the invoice value.

How can businesses use factoring as a financial tool?

Factoring can be used as a financial tool to improve cash flow, reduce bad debt risks, and provide immediate access to working capital. It supports business growth, allows for better financial planning, and helps manage seasonal fluctuations in sales.

What are the advantages of receivables financing?

Receivables financing offers several advantages, including improved cash flow, reduced risk of bad debts, and the ability to reinvest in business operations. It provides a flexible financing solution that grows with the business and does not add debt to the balance sheet. However, factoring may be a better solution for many businesses because it doesn’t create debt.

How does improving liquidity with factoring benefit businesses?

Improving liquidity with factoring ensures that businesses have cash flow to cover operational expenses, invest in new opportunities, and avoid financial strain during slow periods. This stability allows businesses to focus on growth and strategic planning.

What role does risk management in AR financing play?

Risk management in AR financing involves assessing the creditworthiness of customers and implementing strategies to mitigate the risk of non-payment. Financing and factoring companies often provide credit checks and advice on extending credit, which helps businesses manage their accounts receivable more effectively.

How do credit management solutions integrate with factoring?

Credit management solutions integrate seamlessly with factoring by providing businesses with tools to assess customer creditworthiness, monitor payment behaviors, and streamline collections. This integration helps businesses mitigate risks and enhance the efficiency of their AR management processes.

What are some strategies for working capital optimization using factoring?

Working capital optimization strategies using factoring include converting invoices into immediate cash, reducing the cash conversion cycle, and freeing up resources tied in receivables. By improving liquidity and ensuring steady cash flow, businesses can reinvest in growth and maintain operational efficiency.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300