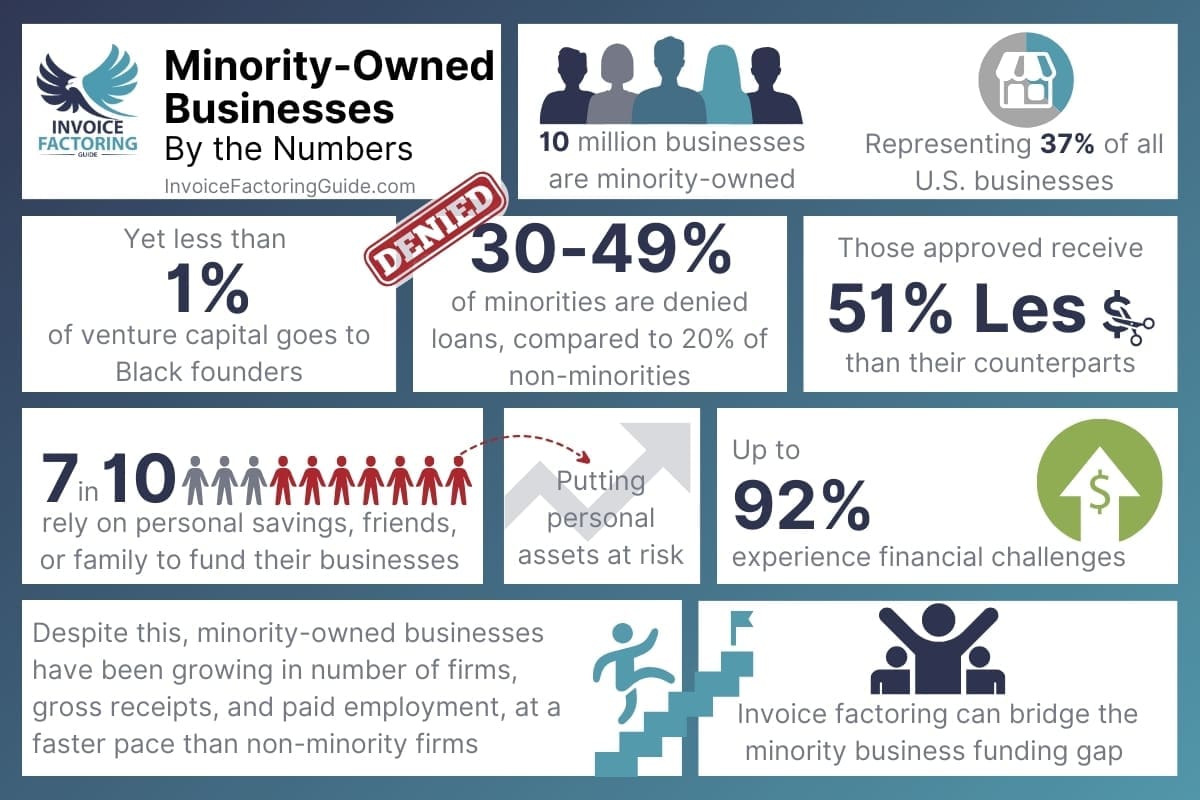

It’s no secret that minority-owned businesses are at a disadvantage when it comes to business funding. They’re less likely to be funded, receive less cash when funded, and pay more than other borrowers. However, there are ways to turn the odds in your favor. On this page, we’ll explore key financial strategies for minority-owned businesses to improve their fiscal health and growth. You’ll also get information on often-overlooked funding solutions, such as factoring for minority-owned businesses, which can provide you with capital when traditional methods don’t work.

Overcoming Financial Challenges in Minority Businesses

Minority-owned businesses often face significant financial challenges that can hinder growth and success. Whereas 79 percent of white-owned firms report experiencing financial difficulties, 85 percent of Hispanic-owned, 89 percent of Asian-owned, and 92 percent of Black-owned firms report challenges, per the latest Federal Reserve Banks Small Business Credit Survey: Report on Firms owned by People of Color.

Building Credit for Minority-Owned Businesses

Business credit refers to a company’s ability to acquire goods or services before payment is made, based on the trust that a future payment will be made. It’s separate from personal credit and focuses on the business’s financial history.

Strong business credit can lead to better loan terms, lower interest rates, and improved vendor relationships. It also helps when negotiating larger contracts and securing more favorable supplier terms.

Challenges for Minority-Owned Businesses

- Limited Access to Credit History: Many minority entrepreneurs start without a comprehensive financial history, making it difficult to establish credit.

- Systemic Inequities: Discriminatory lending practices and historical inequalities can limit access to traditional banking and credit services.

- Lack of Financial Education: Communities may lack resources or mentorship for building and maintaining business credit.

Strategies for Building Business Credit

- Split Personal and Business Finances: Open a dedicated business bank account to manage company funds separately from personal accounts.

- Leverage a Credit Card: Obtain a business credit card and use it responsibly to establish a credit history.

- Register Your Business: Ensure your business is legally registered and recognized (LLC, corporation, etc.), which can help establish credibility with lenders.

- Get an Employer Identification Number (EIN): An EIN from the IRS functions like a Social Security number for your business and is essential for building credit.

- Establish Trade Lines with Suppliers: Work with suppliers who report payments to credit bureaus. Paying invoices on time can help build a positive credit history.

- Apply for a D-U-N-S Number: A D-U-N-S number from Dun & Bradstreet is used to identify your business and track your credit history. Many lenders and suppliers require this number.

- Monitor Your Credit Reports: Check your business credit reports from major credit bureaus (Experian, Equifax, and Dun & Bradstreet) regularly to ensure accuracy and address any discrepancies.

- Build Relationships with Community Banks, Credit Unions, and Factoring Companies: These institutions may offer more personalized services and be more willing to work with minority-owned businesses than larger banks.

Programs and Resources for Minorities in Business

- Minority Business Development Agency (MBDA): Offers resources and support to help minority-owned businesses build credit and access financing.

- Small Business Administration (SBA): Provides various programs, including the 8(a) Business Development Program, which helps minority-owned businesses compete in the marketplace.

- Community Development Financial Institutions (CDFIs): CDFIs provide financial services and credit to underserved communities, including minority-owned businesses.

- Invoice Factoring Guide: Matches businesses with factoring companies that provide funding and can often help underrepresented groups when traditional lenders fall short.

Access to Capital for Minority-Owned Businesses

Access to capital refers to businesses’ ability to obtain funding for start-up costs, operations, and expansion. This funding can come from various sources, including loans, equity investments, and grants.

Challenges Faced by Minority-Owned Businesses

- Higher Denial Rates: Minority-owned businesses are likelier to be denied bank loans than non-minority counterparts. Whereas 22 percent of white-owned businesses are denied loans, 30 percent of Asian, 39 percent of Hispanic, and 49 percent of Black-owned firms are denied loans, per the Small Business Credit Survey.

- Smaller Loan Amounts: When minority-owned businesses receive loans, the amounts are often smaller, limiting their ability to invest in significant growth opportunities. Research shows minorities receive loans that are less than half the size of those awarded to non-minorities, MBDA reports. This is not because they request smaller loans, as 40 percent of white-owned firms receive full funding through traditional loans, while Black-owned firms are fully funded just 13 percent of the time, according to Small Business Credit Survey results.

- Higher Interest Rates: These businesses frequently face higher interest rates, increasing the cost of borrowing and putting additional financial strain on the company. For instance, minority firms pay an average of 7.8 percent interest on loans, compared to the 6.4 percent non-minority firms pay.

- Limited Network and Mentorship: Minority entrepreneurs may have less access to networks and mentors who can provide guidance and introductions to potential investors and lenders.

Strategies for Improving Minority Access to Capital

- Explore Diverse Funding Sources: Don’t limit yourself to traditional funding solutions.

- Credit Unions: Often offer lower rates and more personalized service than large banks.

- Community Development Financial Institutions (CDFIs): Provide affordable credit and financial services to underserved markets.

- Factoring Companies: Accelerate cash flow by providing advance payment on invoices. Work with most businesses that generate B2B invoices, including younger companies and those without solid credit.

Leverage Government Programs

- Small Business Administration (SBA) Loans: SBA-backed loans reduce risk for lenders, making them more willing to work with minority-owned businesses.

- SBA 8(a) Business Development Program: Helps disadvantaged businesses compete in the marketplace and access federal contracts.

- SBA Microloan Program: Offers small loans up to $50,000, often with more flexible terms than traditional lenders.

Seek Equity Investments

- Angel Investors: Wealthy people who provide capital in exchange for equity or convertible debt.

- Venture Capital: Firms that invest in high-growth potential businesses, though typically seeking significant equity stakes.

- Impact Investors: Focus on funding businesses that generate social or environmental benefits alongside financial returns.

Build Strong Relationships

- Networking: Join local business associations, chambers of commerce, and minority business networks to build connections with potential investors and advisors.

- Mentorship Programs: Engage with programs like SCORE, which provides free business mentoring and education.

Leverage Programs and Resources for Minorities

- MBDA Business Centers: Offer assistance in accessing capital and navigating the financing landscape.

- Local and State Grants: Many states and cities offer grants and low-interest loans specifically for minority-owned businesses. Research local economic development agencies for opportunities.

Why Minority Businesses Choose Factoring

Invoice factoring is a financial strategy that many minority-owned businesses choose due to its numerous benefits. Here’s an in-depth look at why invoice factoring is particularly appealing for minority businesses.

Immediate Cash Flow

Invoice factoring involves selling outstanding invoices to a factoring company at a discount in exchange for immediate cash. This gives businesses working capital without waiting for customers to pay their invoices.

- Quick Access to Funds: Instead of waiting 30, 60, or even 90 days for customer payments, businesses receive cash within a few days or sometimes even on the same day the invoice is submitted.

- Improved Cash Flow: This steady cash flow helps cover daily operational expenses, payroll, and inventory purchases, reducing financial stress.

Easier Approval Process

Minority-owned businesses often face stricter scrutiny from traditional lenders, who focus heavily on credit scores and lengthy credit histories. Additionally, banks typically require substantial collateral, which many small businesses may not have. Factoring offers several advantages, such as:

- Focus on Receivables: Factoring companies base their decision on the creditworthiness of the business’s customers, not the business itself. This makes it easier for companies with limited credit history to qualify.

- No Collateral Needed: Since the invoices themselves serve as collateral, businesses don’t need additional assets to secure funding.

Additional Benefits of Factoring for Small Businesses

In addition to improving cash flow in minority businesses and offering an easy approval process, factoring offers additional benefits for small businesses.

Factoring as a Business Growth Strategy

- Investing in Growth: With improved cash flow, minority-owned businesses can invest in growth opportunities such as marketing, hiring staff, or purchasing new equipment.

- Seizing Opportunities: Accessing funds quickly allows businesses to take advantage of unexpected opportunities or large orders without worrying about cash constraints.

Debt-Free Financing

- No Debt: Factoring is not a loan, so businesses don’t incur additional debt on their balance sheets. This can be crucial for maintaining financial health and credit scores.

- Less Risk: Without the burden of repayment schedules and interest, businesses can manage finances more effectively and avoid the risks associated with traditional loans.

Outsourced Credit Management

- Collection Services: Factoring companies handle the collections process, saving businesses time and resources. This can be especially beneficial for small businesses with limited administrative staff.

- Credit Checks: Factoring companies perform credit checks on customers, providing valuable insights and helping businesses make informed decisions about extending credit.

Get Started with Invoice Factoring for Diverse Businesses

If your business needs funding to grow and thrive, invoice factoring can help. To kickstart the approval process, request a free rate quote.

Factoring for Minority-Owned Businesses: FAQs

What is invoice factoring, and how does it work?

Invoice factoring involves selling outstanding invoices to a factoring company in exchange for immediate cash, improving cash flow and allowing businesses to operate smoothly.

Why is invoice factoring beneficial for minority-owned businesses?

Invoice factoring provides quick access to funds, has an easier approval process than traditional loans, helps manage cash flow, and doesn’t add debt to the balance sheet.

How does invoice factoring improve cash flow for minority-owned businesses?

By converting unpaid invoices into immediate cash, businesses can cover operational expenses, invest in growth opportunities, and avoid cash flow shortages.

What challenges do minority-owned businesses face in accessing traditional financing?

Minority-owned businesses often face higher denial rates, smaller loan amounts, higher interest rates, and stricter collateral requirements from traditional lenders.

How can minority-owned businesses qualify for invoice factoring?

Factoring companies focus on the creditworthiness of a business’s customers rather than the business itself, making it easier for companies with limited credit history to qualify.

What are the long-term benefits of using invoice factoring for minority-owned businesses?

Sustained cash flow, business stability, improved credit history, and the ability to invest in growth and expansion are long-term benefits of using invoice factoring.

Are there specific programs that help minority-owned businesses with access to capital?

Yes, programs like the SBA 8(a) Business Development Program, SBA Microloan Program, and Community Development Financial Institutions (CDFIs) offer support and financing options. Invoice Factoring Guide can also help minority-owned businesses find the right invoice factoring company for their needs.

How does invoice factoring differ from a traditional loan?

Invoice factoring is not a loan; it involves selling invoices for immediate cash, doesn’t add debt, and typically has a simpler approval process focused on customer creditworthiness.

What resources are available to help minority-owned businesses build credit and access capital?

Resources include MBDA Business Centers, SBA programs, local and state grants, and networking and mentorship opportunities through business associations. Additionally, the Invoice Factoring Guide offers guides, articles, and access to top factoring companies to help minority-owned businesses expand their knowledge and access to capital.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300