Factoring can be a powerful tool for improving cash flow and maintaining stability while waiting on customer payments. But to make the most of it, it’s important to understand the various factoring fee structures. We’ll walk you through some of the most common ones below, cover additional fees you might experience, and walk you through how to minimize your total factoring costs, so you can keep more money in your pocket.

How Common Factoring Fee Structures Work

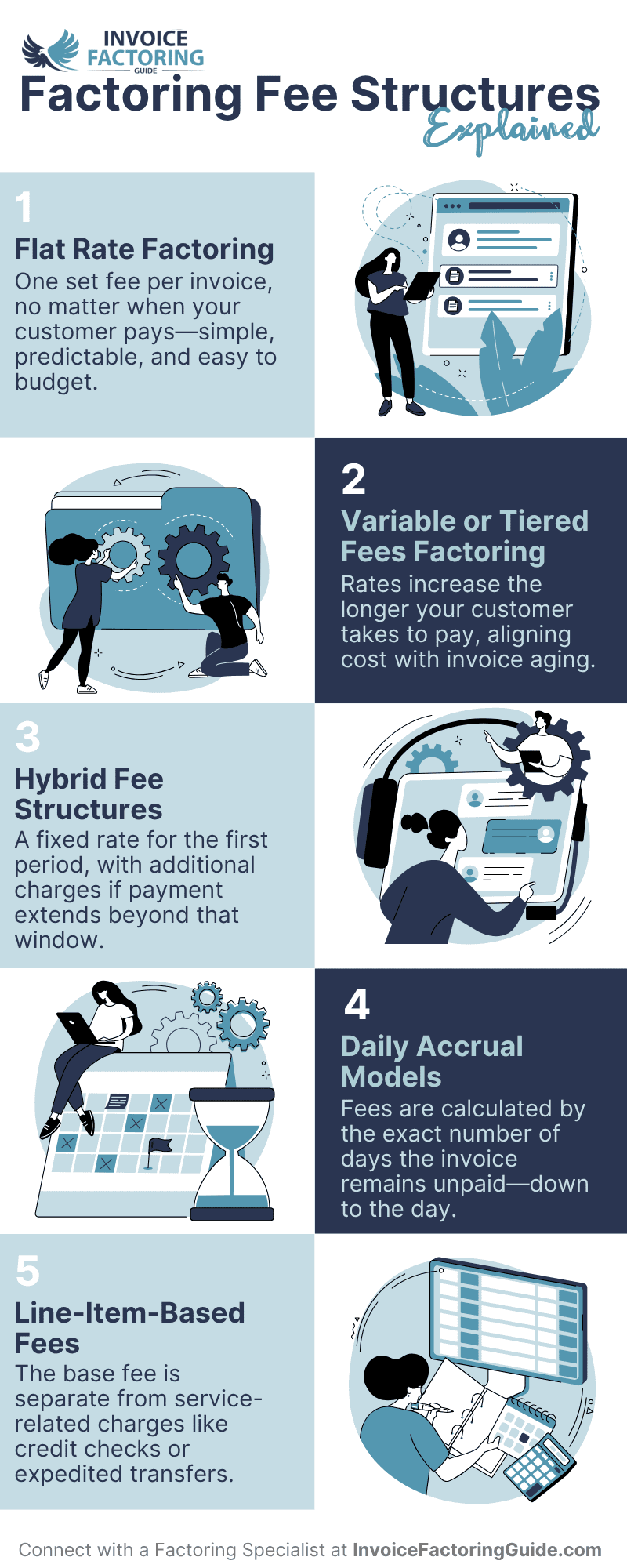

Factoring companies don’t all charge the same way. Fee structures vary based on the needs of different industries, customer payment timelines, and how closely a business wants its costs to reflect the time outstanding. While rates are often the focus, the structure behind those rates can significantly influence your total cost and your cash flow planning. Below, we’ll explore the most common factoring fee structures and how each one works.

Flat Rate Factoring

The flat rate model offers simplicity and predictability. A single fee is applied to each invoice, regardless of how quickly your customer pays.

If your rate is two percent, and you factor a $20,000 invoice, your fee is $400. Whether the customer pays in 10 days or 40, the cost remains the same.

- Straightforward Pricing: The rate is set up front, so it’s easy to estimate costs.

- Ideal for Planning: You can factor invoices with confidence, knowing the fee will not change.

- Well-Suited for Fast Turnarounds: This model is especially common when invoices are paid promptly.

Variable or Tiered Fees Factoring

With the variable fee model, also called tiered fees factoring, the fee increases based on how long it takes your customer to pay. Rates are typically quoted in blocks, such as 30, 30, and 90 days.

You might be quoted 1.5 percent for the first 30 days, then an additional one percent for each 30-day period after. A customer who pays within 30 days results in a lower fee than one who takes 60.

- Aligns Cost with Time Outstanding: Your fee reflects the duration the funds are advanced.

- Encourages Faster Payments: This may align well with businesses that monitor aging reports closely.

- Scales with Payment Timing: You get more control over overall factoring costs.

Hybrid Fee Structures

Some factoring companies use a blended model, often combining elements of flat and variable pricing. This can offer the best of both worlds, depending on your needs.

For example, a factor might charge a flat two percent for the first 30 days, and then apply a smaller tiered rate for each additional period.

- Cost Control in Early Periods: You receive predictable pricing for invoices paid on time.

- Flexibility Beyond Initial Window: Additional fees only apply when payments extend past the initial term.

- Useful for Mixed Payment Cycles: It’s particularly effective for businesses with a variety of customer payment behaviors.

Daily Accrual Models

Instead of charging in blocks of time, the daily accrual model calculates fees based on the exact number of days your customer takes to pay.

A base daily rate is applied, and the final cost reflects the exact number of days funds are outstanding.

- Precision-Based Pricing: Fees are tailored to actual payment timelines.

- Detailed Reporting: This is often favored by businesses that prefer granular tracking.

- Transparency: You get clear visibility into how fees are applied, day by day.

Line-Item-Based Fees

When you have line-item-based fees, the factoring company separates the core factoring fee from any additional services provided. This structure is common when a business requires specific enhancements or value-added services.

You may be charged a base fee for factoring, with additional charges for items like same-day funding, customer credit checks, or account monitoring.

- Customizable Service: You can select the services most important to your operations.

- Clear Breakdown: It’s easier to identify where specific charges originate.

- Scales with Usage: Businesses only pay for what they use, which can improve cost efficiency.

Additional Factoring Charges You Might See

In most cases, the factoring fee is the core cost. However, some factoring companies apply additional charges depending on the services provided, how the agreement is structured, or how the account is managed over time.

These charges are not inherently bad. In fact, many of them reflect real services that protect your business or offer added convenience. However, it’s important to know what to look for, so you can understand your total cost and avoid surprises.

ACH or Wire Transfer Fees

Most factoring companies send your advances and reserve funds electronically. You may see ACH or wire transfer fees to cover the cost of sending funds to your account. ACH transfers are typically low-cost or free, while wire transfers may carry higher fees due to bank processing.

Credit Check Fees

As part of their diligence before agreeing to factor invoices, your factoring company will likely run credit checks on your customers. Some factors include the cost of this in the main rate, while others charge per check or per account.

Invoice Processing Fees

This charge applies when the factor manually processes or verifies invoices. It may appear if your billing process is not automated or if documents require review.

Same-Day or Expedited Funding Fees

While the standard turnaround for your factoring advance is typically 24 to 48 hours, some factors offer same-day deposits. There is often an extra fee for the expedited service.

Account Setup Fees

This one-time fee covers the cost of onboarding your business. It’s not always charged, but when it is, it usually reflects administrative and compliance reviews.

Minimum Volume Fees

If you commit to factoring a certain amount each month but fall short, you might see minimum volume fees. For example, if your agreement includes a $50,000 monthly minimum and you only factor $30,000, the fee may cover the shortfall.

Renewal Fees

Some agreements automatically renew after a year and may include a renewal fee. These are more common in longer-term contracts.

Non-Recourse Fee Add-Ons

In most cases, you’ll have a non-recourse factoring agreement. That means if a client fails to pay their invoice, your business is responsible for ensuring the factoring company does not take a loss. However, you may also be offered a recourse factoring agreement in which the factor absorbs the loss in specific situations. Because the risk is greater for the factor, non-recourse factoring fees are slightly higher than recourse factoring fees.

Early Termination Fees

Some, but not all, factoring contracts require you to stay with the company for a set period of time. If you leave before then, you may face early termination fees. Be sure to review termination clauses carefully, especially if you expect changes in your funding strategy.

How to Ensure You’re Getting Factoring Fee Transparency

A low rate on paper doesn’t always mean a low total cost. Some factoring companies bundle services into one simple fee. Others quote a base rate and layer in additional charges later. To evaluate an offer fairly and avoid “hidden” factoring fees, you need a clear view of both the rate and how it’s applied.

Ask the Right Questions Up Front

It’s easy to focus on the quoted rate, but that’s just one piece of the puzzle. A few direct questions can help determine whether the structure is straightforward or if additional charges may apply.

- What services are included in the quoted rate? Make sure the quote covers all expected services, such as credit checks, account management, and collections support.

- How is the rate structured? Ask whether it’s a flat rate, tiered, daily, or hybrid. This will help you calculate your likely costs over time.

- Are there any additional fees or charges? Request a breakdown of all possible charges, even if they are not expected to apply in your case.

- When does the fee clock start? Some factors begin charging on the invoice date, others on the funding date. That difference can impact your total fee.

Review a Sample Funding Scenario

Ask the factoring company to walk you through a real-world example using one of your invoices. This gives you insight into how fees are applied and whether there’s anything unexpected in the process.

- Look for Line-Item Clarity: The example should include each component of the cost, not just the main fee.

- Request a Written Summary: Get the sample scenario in writing so you can compare it across providers.

Read the Agreement Carefully

Contracts vary widely. Even if your initial quote seems competitive, the details in the agreement matter.

- Pay Attention to Contract Length: Some agreements auto-renew or include penalties for early termination.

- Check for Minimum Requirements: Look for volume minimums or time commitments that might affect your flexibility.

- Verify Fee Triggers: Understand what actions, like expedited funding or late customer payments, might result in extra charges.

Look for Clarity in Reporting

Once you’re working with a factoring company, clear reporting is part of ongoing transparency.

- Consistent Invoicing: You should receive clear statements showing fees applied to each invoice.

- Online Portals: Many modern factors offer online dashboards that break down fees and account activity in real time.

- Customer Support: Make sure there’s someone available to answer questions if a charge doesn’t make sense.

Work with a Reputable Provider

Finally, fee transparency often comes down to the integrity of the factoring company. A quality factoring partner will treat transparency as a priority, not something you have to ask for.

- Strong Reputation: Look for reviews and testimonials from businesses in your industry.

- Clear Communication: The best factors explain their pricing structure clearly and openly from day one.

- Alignment with Your Goals: A transparent partner will help you understand when factoring is a good fit and when it isn’t. Some will even offer other types of funding, such as asset-based loans, commercial credit cards, or equipment leasing and financing.

How to Minimize Factoring Costs

Factoring can give your business the financial flexibility it needs to grow, but like any financial service, the way you use it directly impacts how much it costs. Fortunately, there are several practical ways to reduce your overall expense without sacrificing the benefits of fast, reliable funding, and make factoring fees work for you.

Choose the Right Fee Structure for Your Customers’ Payment Behavior

Start by matching your factoring model to your customer base. If your customers pay consistently within 30 days, you may benefit more from a tiered or daily accrual model than a flat rate.

- Align the Structure: Choose a fee model that reflects your actual receivables timeline.

- Review Payment Histories: If your customers have strong payment habits, you may be able to negotiate better terms.

Submit Accurate, Clean Invoices

Factoring companies charge based on the invoice amount and how long it takes to get paid. Delays caused by invoice errors can cost you.

- Avoid Disputes and Deductions: Ensure your invoices are factoring-ready. Always double-check invoices for accuracy before submission.

- Provide Supporting Documentation: Clear records help the factor validate and fund faster.

- Invoice Immediately: The sooner you invoice, the sooner the factor can advance funds and the sooner the customer can pay.

- Automate: Consider using accounting software like FreshBooks, Xero, or QuickBooks to speed up the process and boost accuracy.

Build Strong Customer Payment Practices

The faster your customers pay, the less time your receivables are outstanding, and the lower your cost if you’re using a tiered or daily model.

- Set Clear Payment Terms: Make sure customers understand expectations.

- Follow Up Promptly: Roughly half of all B2B invoices are not paid before the due date, according to Atradius. Automated reminders and early follow-ups help keep payments on track.

- Incentivize On-Time Payment: Consider early pay discounts or other positive reinforcement.

Factor Selectively

You do not need to factor every invoice. Many companies only factor those that take longer to pay or would strain cash flow without immediate funding. This is known as spot factoring.

- Prioritize High-Value or Slow-Pay Invoices: These are often the ones where factoring brings the most value.

- Review Monthly Needs: Adjust how much you factor based on cash flow forecasts and seasonal trends.

Negotiate Contract Terms Carefully

Some fees are fixed, but others, like minimums, renewal fees, and early termination clauses, can be negotiated before you sign.

- Understand All Terms: Read the full agreement and ask questions about anything unclear.

- Compare Offers: Look beyond the base rate to assess total cost and flexibility.

- Ask for Customization: If your payment cycles are strong, some factors may adjust your rate or structure.

Maintain a Good Relationship with Your Factor

Your factoring company is a financial partner. A strong, professional relationship may give you access to better pricing, more flexible terms, and additional services down the line.

- Be Transparent About Your Needs: Let your factor know if your business is growing or if you anticipate changes.

- Stay Organized: Provide documents and respond promptly to reduce delays and keep your account in good standing.

Discuss Your Options with a Factoring Specialist

While our invoice factoring guide covers much of what you need to know and our factoring calculator can provide you with an instant estimate, the best way to understand how factoring aligns with your business needs and what your total costs will be is to speak with a factoring specialist who can provide you with personalized information. Request a free quote to get started.

FAQs on Factoring Fee Structures

How do factoring fees work?

Factoring fees are the cost of receiving an advance on your unpaid invoices. The fee is typically a percentage of the invoice total and may be structured as a flat rate, tiered rate, or daily accrual. Some agreements also include service-related charges outlined in the factoring contract.

What’s the difference between flat and tiered factoring rates?

Flat rates charge a single fee regardless of when your customer pays. Tiered rates start lower and increase based on how long the invoice remains unpaid. Tiered structures may offer lower costs if customers pay quickly, while flat rates provide consistency and easier forecasting.

Why does my factoring fee increase over time?

In a tiered or daily accrual model, factoring costs rise the longer your customer takes to pay. This structure reflects the time the factor’s funds are tied up. Reviewing your agreement can clarify when fees are applied and whether a flat-fee option might better suit your business.

What are typical costs in a factoring contract?

Factoring contract costs usually includes the base fee for advancing funds plus any add-on charges. Common additional costs cover credit checks, same-day funding, wire transfers, or volume shortfalls. Requesting a full fee schedule before signing helps ensure transparency.

Which factoring fee structure is best for my business?

That depends on your customer payment behavior and cash flow needs. If customers pay quickly, a tiered or daily model may offer savings. If you need cost predictability, flat rates are often easier to manage. Some businesses benefit most from a hybrid structure.

How do I calculate the total cost of factoring an invoice?

Multiply your invoice value by the factoring rate, then add any applicable service charges. For tiered or daily models, factor in the number of days the invoice remains unpaid. Reviewing a sample funding scenario from your provider is the best way to estimate total cost.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300