There are many challenges associated with running a service-based business. Having sufficient cash flow to manage daily expenses and grow doesn’t need to be among them. Although it isn’t often discussed, service business factoring is one solution that can help. You’ll learn how it works and how to get started on this page.

Types of Service-Based Businesses

Invoice factoring is used more often in the B2B services sector. A few examples of companies that might leverage it include:

- Architects

- Bookkeepers

- Business process outsourcing companies

- Cleaners/ janitorial

- Coaches and consultants

- Corporate event planners

- Engineers

- Financial advisors

- Freight brokers

- Lawyers

- Maintenance

- Marketing agencies

- Public relations firms

- Security guard firms

- Telephone answering services

- Translation services

Common Service-Based Business Cash Flow Challenges

People in finance and business often reference “cash flow,” though the phrase may not even be on your radar. It refers to the total cash inflows (your receivables or invoices) and cash outflows (your payables or bills).

Cash flow is distinct from profit but is equally important. Your business may be profitable overall but still not have enough cash to cover payroll or other expenses at times. Small businesses are prone to this type of situation because they tend to have tighter margins, smaller cash reserves, and less access to resources than their counterparts. This is also why eight in ten small business failures are tied to cash flow issues, as the National Federation of Independent Business (NFIB) reports.

Cash flow management for the service industry can be even more challenging due to slow or inconsistent inflows and high outflows that can drain bank accounts quickly.

Seasonal Fluctuations

Some service-based businesses see seasonal fluctuations. For instance, bookkeepers and financial advisors often see an uptick around the end of the year and at tax time. Corporate event planners will often see an uptick during the holidays and conference season. That means you often need to ramp up labor and other expenses before the additional work and pay come in, which leaves a cash flow gap.

Erratic Revenue Streams

Occasionally, revenue streams can be quite volatile or unpredictable. For instance, marketing agencies and public relations firms sometimes joke about their markets being “feast or famine.” It isn’t easy to budget in these conditions. Businesses are often unprepared for unplanned expenses and sometimes even turn down work because they can’t afford the materials or labor to take it on.

Long Payment Cycles

Contracts in the service industry run the gamut. Some businesses bill once a month and then give their clients 30 days to pay. That can put a 60-day gap between outflows and inflows. Others, especially those that serve large corporations that require multiple signatures before an invoice is paid, may wait 90 or more days for payment.

High Fixed Costs

Operational costs for service-based businesses can be sky-high in some cases. For instance, a business process outsourcing firm will have a large rent or mortgage payment, utilities, and maintenance on equipment, plus payroll. This can be difficult to manage as it is but can seem impossible when ramping up for a new client or if equipment breaks down.

Regulatory Compliance

Many businesses and professionals must keep up with licensing, insurance, and more. Some are required to perform audits as well. It can be very expensive to remain compliant, especially when multiple expenses hit at once.

Invoice Factoring for Service-Based Businesses

Invoice factoring for service businesses is not your ordinary funding solution. While it provides cash and can help you address the issues described above, it offers benefits that are not typically associated with business financing.

How Invoice Factoring Works

Invoice factoring is not a loan. You’re selling your unpaid B2B invoices at a discount to a third party known as a factor or factoring company for immediate cash. Most businesses qualify, including newer companies and those with bad or no credit.

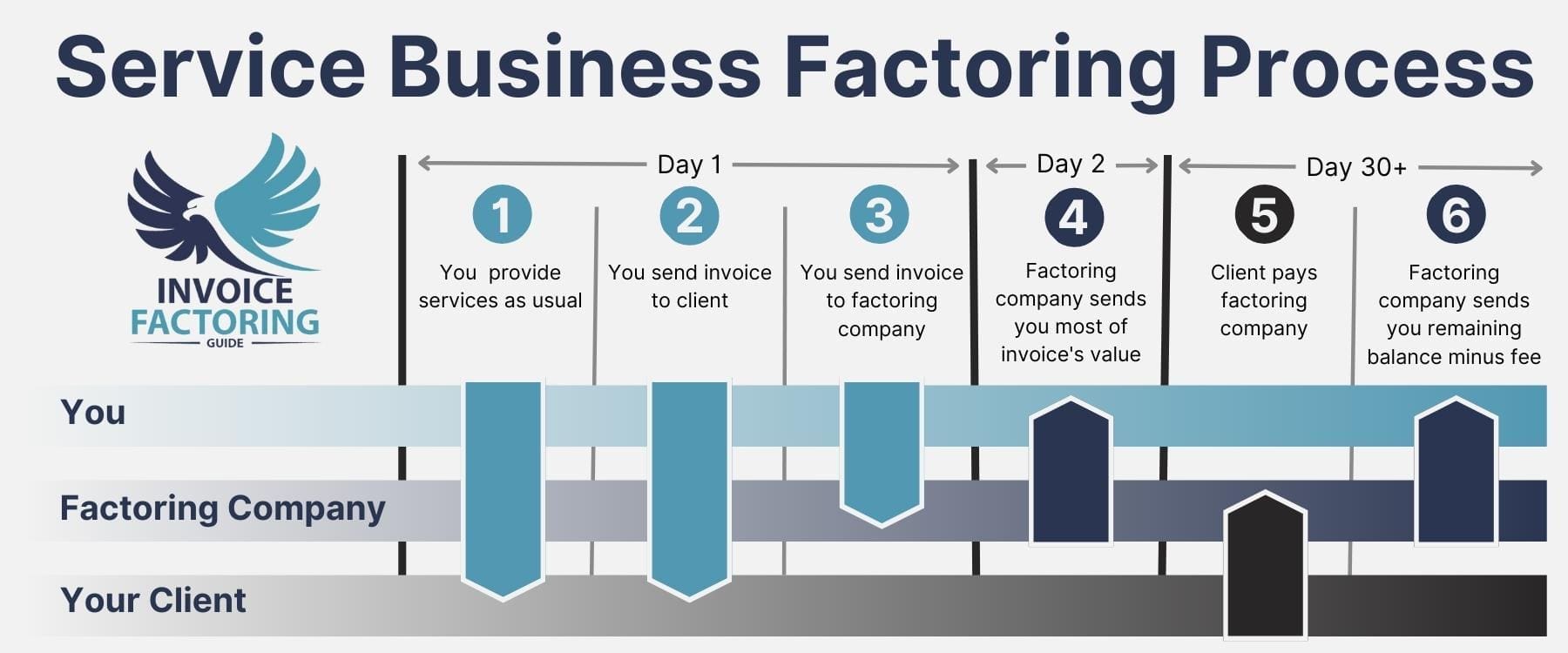

The Invoice Factoring Process

Although each factoring company operates uniquely, the factoring process usually follows the same steps.

Step 1: Sign up with an invoice factoring company and provide services as usual.

You’ll provide basic business documents, and the factoring company will confirm you qualify. They’ll also check into any clients with invoices you’d like to factor and provide some guidance on how much credit you can safely extend to them. If you’re organized and supply the documents quickly, some factoring companies can get you approved on the day you apply, while others may take up to a week.

Step 2: Bill your clients.

The way you work doesn’t change. Keep providing services and bill your clients as usual.

Step 3: Submit your invoices.

Submit any invoices you’d like to factor to your factoring company.

Step 4: Receive payment.

You’ll receive most of the invoice’s value right away. The amounts vary but are usually between 60 and 96 percent. Cash is typically deposited into your bank account via ACH, which takes about two business days, though some factoring companies offer same-day payments.

Step 5: Keep moving forward.

You can spend your factoring cash however you wish. Your factoring company will wait for payment from your client.

Step 6: Receive the remaining sum.

When your client pays their invoice, the factoring company will send you the remaining sum minus a small factoring fee that’s usually between one and five percent of the invoice’s value.

Benefits of Invoice Factoring for Service Providers

Now that we’ve covered how it works, let’s examine what makes factoring unique.

Your cash flow becomes more consistent and predictable.

With factoring, you know exactly when you’ll receive payment, so you can budget and spend more confidently.

You can pivot quickly.

Factoring is an on-demand cash flow solution, so you can tap into it to ramp up or cover unexpected expenses whenever you need.

You remain in control.

Some funding solutions require you to give up board seats or some control of your company. Although your factoring company will likely behave like a business partner and connect you to resources whenever possible, you maintain total control of your business.

You can focus on running your business more.

Your factoring company will collect for you, so you can spend less time chasing invoices. Some also offer invoice preparation and other services to save you more time and money.

How Factoring is Different from Traditional Lending Options

Most small businesses that try to obtain funding apply for bank loans. Below, we’ll quickly compare loans to factoring so it’s easier to understand how factoring works and when it’s most beneficial.

You’re more likely to get approved for factoring.

A little more than half of all small businesses receive all the funding they request, according to the latest Small Business Credit Survey. Many more are dissuaded from applying due to the low odds of approval. Low funding rates are par for the course when small businesses approach banks. They’re geared more toward larger loans from which they can earn more money with less risk. Although they will sometimes lend, they scrutinize everything about the business, including credit, time in business, and other details, before they approve anything.

Invoice factoring doesn’t work this way at all. It’s not a loan, and your client is the one paying the invoice. Therefore, factoring companies care more about the creditworthiness of your client than your creditworthiness. Getting approved for factoring is easy.

Factoring pays out faster.

There’s lots of red tape with loans. A bank loan can take weeks or months to get approved and paid out. With factoring, the payout is immediate. It’s hours or days, not weeks or months.

Your funding scales with you.

Bank loans payout in a lump sum, so you must apply for another loan if you need more cash. Even lines of credit don’t readily scale with your business as it grows. With factoring, the amount you receive is based on the value of the invoices you submit, so your funding automatically grows with you.

You have greater flexibility.

You’re in control of when you factor and which invoices you factor. That gives you more control over your cash flow and costs.

Factoring is debt-free funding.

Most forms of funding put your business in debt. This can be worrisome, especially if you’re dipping into credit cards and other forms of financing with high-interest rates. Some businesses become buried and unable to climb out of debt. Conversely, factoring doesn’t create debt. There’s nothing for you to pay back.

Get a Free Factoring Quote for Your Service-Based Business

It’s essential to work with a factoring company that understands the nuances of your business. At Invoice Factoring Guide, we’re happy to match you with a factoring provider that supports businesses like yours and offers competitive rates. Request a complimentary rate quote to learn more or get started.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300