Did you know that you can negotiate your factoring contract? Unlike banks, which tend to rely on inflexible terms and clauses, factoring companies are typically more flexible and can help customize your agreement to your business’s needs. Below, we’ll explore what to review in your agreement and cover tips for negotiating factoring contracts, so you can build a relationship that works for you.

Key Factoring Agreement Terms to Review

Before we get into how to negotiate your factoring contract, let’s take a closer look at some of the terms and clauses you’re likely to see that will impact your factoring relationship and experience the most.

Advance Rate and Reserve

The advance rate and reserve will probably be the first thing you review because they influence the outcome the most.

- Advance Rate: The advance rate is the upfront percentage of your invoice you’ll receive. This usually falls between 80 and 95 percent, depending on your industry and the risk profile of your customers. For instance, trucking companies often see higher advances due to fast pay cycles and strong invoice documentation.

- Reserve: The factoring reserve is the amount held back until your customer pays. This is the remaining balance, minus fees, that the factor releases once they receive payment. Make sure you understand how and when reserves are paid out.

Invoice Factoring Fees and Pricing Structure

Beyond the advance, you’ll need to understand what you’re paying and how those fees are calculated.

- Fee Type: Is your factoring fee structure flat or tiered? Some factors charge a flat fee, such as three percent every 30 days, while others have a tiered structure that increases the longer the invoice goes unpaid.

- Billing Frequency: How often are fees applied? Weekly billing means higher costs if customers pay late. Monthly billing is more forgiving.

- Minimum Fee: Some contracts come with a minimum fee, or a base fee that’s charged no matter how quickly your customer pays.

Additional or Hidden Fees in Factoring Agreements

While most of what you’ll pay is tied to the core factoring fee covered above, sometimes there are additional fees for different things that can add to the total cost of factoring. Although many people refer to them as “hidden fees,” they’re usually spelled out in your contract. You just need to know what to look for.

- Setup Fees: These are usually charged at onboarding. Some are refundable, others are not.

- Wire Transfer Fees: There are sometimes fees associated with how you receive your funds. For instance, many factoring companies will send your money via automated clearing house (ACH) for free, but wire transfers may come with an extra cost.

- Credit Check or Due Diligence Fees: These are fees associated with assessing the creditworthiness of your customers. They’re more common in higher-risk industries or non-recourse agreements.

Contract Length and Termination Clauses

Most people don’t enter an agreement thinking about what will happen when they leave, which is why terms tied to ending the factoring relationship are easy to overlook. However, you should pay close attention to the termination of factoring clauses, as they define your options if you become unhappy with the service you’re receiving and want to switch factoring companies, or simply no longer have a need for factoring.

- Initial Term: This represents the length of the agreement. Some are month-to-month, while others may lock you in for a year or more.

- Automatic Renewal: The contract may renew unless you cancel within a set window. Look for the notice period required to end the agreement without penalty.

- Early Termination Fees: See if there are charges for ending the contract before the term is up. These fees can be flat, percentage-based, or tied to anticipated earnings the factor would have made.

- Notification Period: Even if you’re not tied into a long-term contract, most factoring companies require that you provide notice before you end the relationship. Windows are usually between 30 and 90 days. These give the factoring company time to close out your account and collect on remaining balances. When you submit notice, you aren’t generally permitted to submit new invoices for factoring, so it’s essential to know your window and time your cash flow accordingly.

Volume Requirements or Minimums

Even if you think you’ll factor regularly, seasonal slumps and other factors outside your control can impact invoice volume, so it’s important to know what happens if you’re factoring less.

- Monthly Minimums: Some contracts have a required dollar amount in invoices you must submit. If you fall short, you may pay penalties or “make-up” fees.

- Exclusivity Clauses: There may be requirements that all your invoices go through the factor. These limit flexibility and can cause issues if you only want to factor certain customers.

It’s worth noting that volume requirements and minimums are not inherently bad. This is true of most of the terms we’re covering here. In many cases, agreeing to them can set you up for lower rates. However, if they’re not a good fit for how you operate or you’re concerned that you’ll be negatively impacted by them, they’re something you may want to negotiate.

Recourse vs. Non-Recourse Factoring

Five percent of B2B invoices are written off as bad debt in the United States, according to Atradius. While you’ll likely see less bad debt due to the credit checks performed by your factoring company, the risk is never eliminated entirely. The terms “recourse” and “non-recourse” in your factoring agreement relate to who takes on the risk if your customer fails to pay.

- Recourse Factoring: You’re responsible if the customer doesn’t pay. If the invoice goes unpaid beyond a set number of days, you’ll need to ensure the factoring company does not take a loss on it. Most factoring companies will have you replace the bad invoice with a newer clean one, though your contract will stipulate the exact process.

- Non-Recourse Factoring: In non-recourse factoring, the factor absorbs the loss if the customer defaults. This typically comes with higher fees and only covers specific events, like insolvency, not disputes or slow payment.

Payment Terms and Customer Communication

These define how payments are tracked and how your customers will interact with the factor.

- Notice of Assignment (NOA): The NOA is a letter informing your customers to pay the factor directly. Most agreements require notification, and it’s legally required.

- Lockbox or Bank Account Control: The factor may require payments to be sent to a bank account they control. This helps track incoming payments and release reserves promptly.

- Collections Procedures: Factoring companies typically collect invoice balances for you. Review how the factor handles late-paying customers. Ask whether they’ll notify you first, and how aggressive their collection efforts are. While most will simply provide professional follow-ups and then pass the invoice back to you if their attempts are unsuccessful, understanding their collections process will help ensure your customer relationships stay strong.

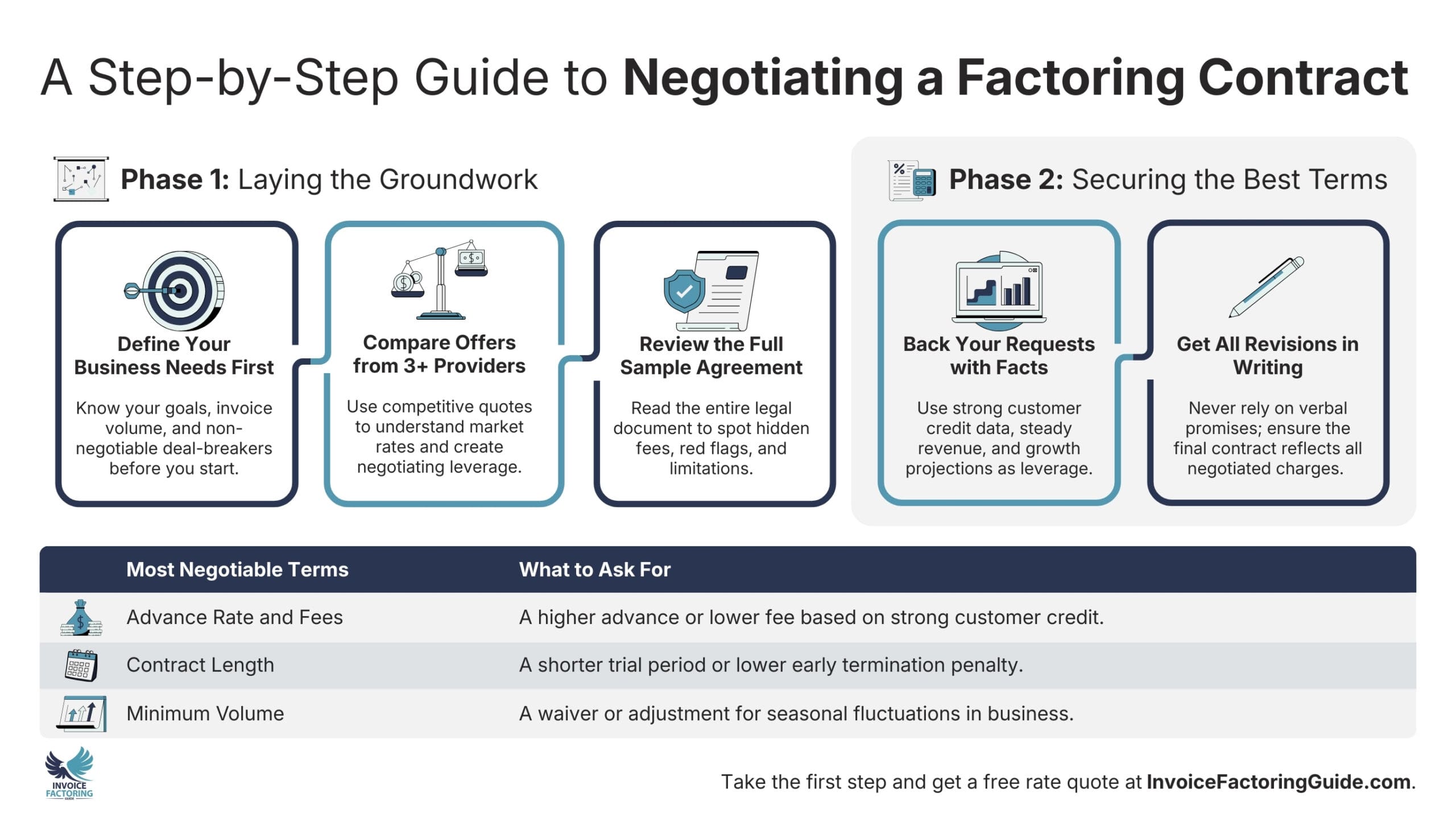

How to Negotiate a Factoring Contract: Step-by-Step Instructions

Even if you’ve never negotiated a financial contract before, these steps will walk you through what to do, when to do it, and what to watch out for.

Step 1: Get Clear on Your Business Needs

Before you talk numbers or terms, take some time to assess what you want factoring to do for your business.

- Define Your Goals: Know whether you’re looking to solve a short-term cash flow issue, support rapid growth, or create more predictable working capital.

- Map Out Volume and Frequency: Estimate how many invoices you plan to factor each month and how often you expect to need funding.

- Identify Deal Breakers: Decide in advance what you are not willing to compromise on, such as contract length, personal guarantees, or minimum volume commitments.

Step 2: Request a Sample Agreement

Before any negotiations begin, you should know what a standard contract looks like from the company you’re considering.

- Review the Full Contract: Go beyond the rate quote and read the actual legal agreement to spot red flags, fees, and limitations.

- Ask for Clarification Early: If you see something you do not understand, ask about it upfront before it becomes a sticking point later.

- Look for Flexibility: Use this early version to gauge how open the company is to customization.

Step 3: Compare Offers from Multiple Providers

Shopping around is a powerful negotiation tool. You want to understand the market range and uncover better terms through competitive positioning.

- Get Quotes From at Least Three Companies: This helps you compare pricing structures, fees, and contract terms side by side.

- Evaluate Total Value: A lower fee may come with stricter terms or fewer services, so weigh everything together.

- Use Other Offers Strategically: Mentioning that you’re reviewing other proposals can often lead to concessions or improvements.

Step 4: Focus on the Most Negotiable Terms

Some contract elements are more flexible than others. Focus your efforts on the areas where you are most likely to get better terms.

- Advance Rate and Fees: Many companies will adjust your advance rate or fee schedule if your customers have strong credit or you expect consistent volume.

- Contract Length and Termination Clauses: If you’re concerned about being locked in, ask for a shorter trial period or a lower early termination fee.

- Minimum Volume Requirements: If you expect fluctuations or seasonal drops, request a waiver or adjustment to the monthly minimum.

- Exclusivity Clauses: Push for the freedom to factor only certain customers or invoice types if that’s how your business operates.

Step 5: Back Your Requests with Facts

To negotiate effectively, you need to give the factor a reason to accommodate you. Show them you’re a low-risk, high-potential client.

- Provide Customer Credit Information: Strong-paying customers reduce risk for the factor, which often results in better terms.

- Demonstrate Consistency: If your business has steady revenue or contracts in place, point that out as a sign of reliability.

- Project Future Growth: Let them know if your factoring volume is likely to increase, especially if your current need is on the lower side.

Step 6: Get Revisions in Writing

Once you’ve agreed to updates or changes, make sure they are reflected in the final contract before you sign anything.

- Request a Revised Agreement: Do not rely on verbal confirmations. Always request a clean, updated version of the contract that reflects the negotiated terms.

- Double Check All Terms: Re-read the final agreement to ensure your changes are properly captured, and there are no new provisions you missed.

- Ask Questions One More Time: If anything still feels unclear, get clarification in writing to protect yourself later.

Additional Tips and Best Practices When Negotiating Factoring Contracts

Next, let’s take a look at some lesser-known strategies that can give you more control, reduce friction, and help you avoid misunderstandings after the agreement is signed.

Ask About Customer Experience and Onboarding

The factoring process affects your customers, so it’s important to know what to expect behind the scenes.

- Request a Sample NOA: Ask to see a sample Notice of Assignment so you know how your customers will be informed and what it looks like from their perspective.

- Understand the Onboarding Timeline: Find out how long it will take for the first invoice to fund after the contract is signed. In some cases, it may take several days to complete verifications and credit approvals.

- Ask if Customers Will Be Contacted: Clarify whether the factoring company will contact your customers directly during the onboarding process and how those communications are handled.

Clarify How Disputes and Chargebacks Are Handled

Disputes are one of the biggest reasons a factor may not fund an invoice or may reverse funding.

- Ask About Dispute Policies: Request a clear explanation of how disputes are defined and what happens if a customer refuses to pay in full.

- Negotiate Dispute Resolution Timeframes: See if you can negotiate a longer window to resolve customer issues before the invoice is charged back to you.

- Understand How Short-Pays Are Treated: If a customer pays less than the full amount, make sure you know whether the factor still charges full fees or credits a portion back to you.

Confirm What Support You’ll Receive

Factoring companies offer different levels of service and may communicate with you in different ways.

- Find Out Who Manages Your Account: Ask whether you’ll have a dedicated account manager or work with a rotating support team.

- Ask About Communication Channels: Make sure you understand how and when you can get support, by phone, email, portal, or text, and what turnaround time to expect.

- Inquire About Reporting Access: See if you’ll have access to a client portal and whether reports can be customized for your internal accounting needs.

Verify What Happens During Periods of Inactivity

Even if you factor regularly, there may be times when you slow down or stop entirely. Your contract should account for that.

- Check for Dormancy Clauses: Some contracts include fees or auto-termination clauses if you stop factoring for a set period, such as 60 or 90 days.

- Ask if You Can Pause the Agreement: Inquire about the possibility of putting your account on hold during slow periods without triggering penalties.

- Understand Reactivation Procedures: If you stop factoring for a while, ask what steps are needed to start again and whether that comes with any fees.

Explore Customization Opportunities

Many business owners do not realize that factoring contracts are often more flexible than they appear.

- Request Fee Caps: If you’re in a tiered fee structure, ask if they’ll cap your fees after a set number of days to help with budgeting.

- Negotiate Grace Periods: Some factors will offer a short grace period on fees if a payment is only a few days late, especially with customers who usually pay on time.

- Tailor the Recourse Window: If you are factoring invoices with long payment cycles, see if the recourse period can be extended beyond the typical 90 days.

Get a Jumpstart on Your Factoring Contract Negotiation with a Free Quote

If you’re ready to explore your factoring options, the next step is seeing what terms you’re offered. To get started, request a free rate quote.

FAQs on Negotiating Factoring Contracts

Are factoring contract terms negotiable?

Yes, most factoring contract terms are negotiable. While some companies offer set-rate programs, many will adjust fees, advance rates, contract length, or volume requirements based on your business’s risk profile, customer base, and factoring volume. Always ask for revisions in writing and compare offers to strengthen your negotiating position.

Which business factoring agreement clauses can be negotiated?

You can often negotiate advance rates, factoring fees, contract length, early termination fees, monthly minimums, and recourse periods. Some companies will also adjust exclusivity clauses or offer custom onboarding terms. The more stable your business and customer base, the more flexibility you may have when negotiating these points.

What are the best strategies for negotiating factoring agreement terms?

Start by outlining your goals and getting sample contracts from multiple providers. Compare offers and focus negotiations on fees, volume commitments, and flexibility. Back your requests with customer credit quality and projected volume. Always ask for updated agreements in writing and clarify how disputes, delays, and collections are handled.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300