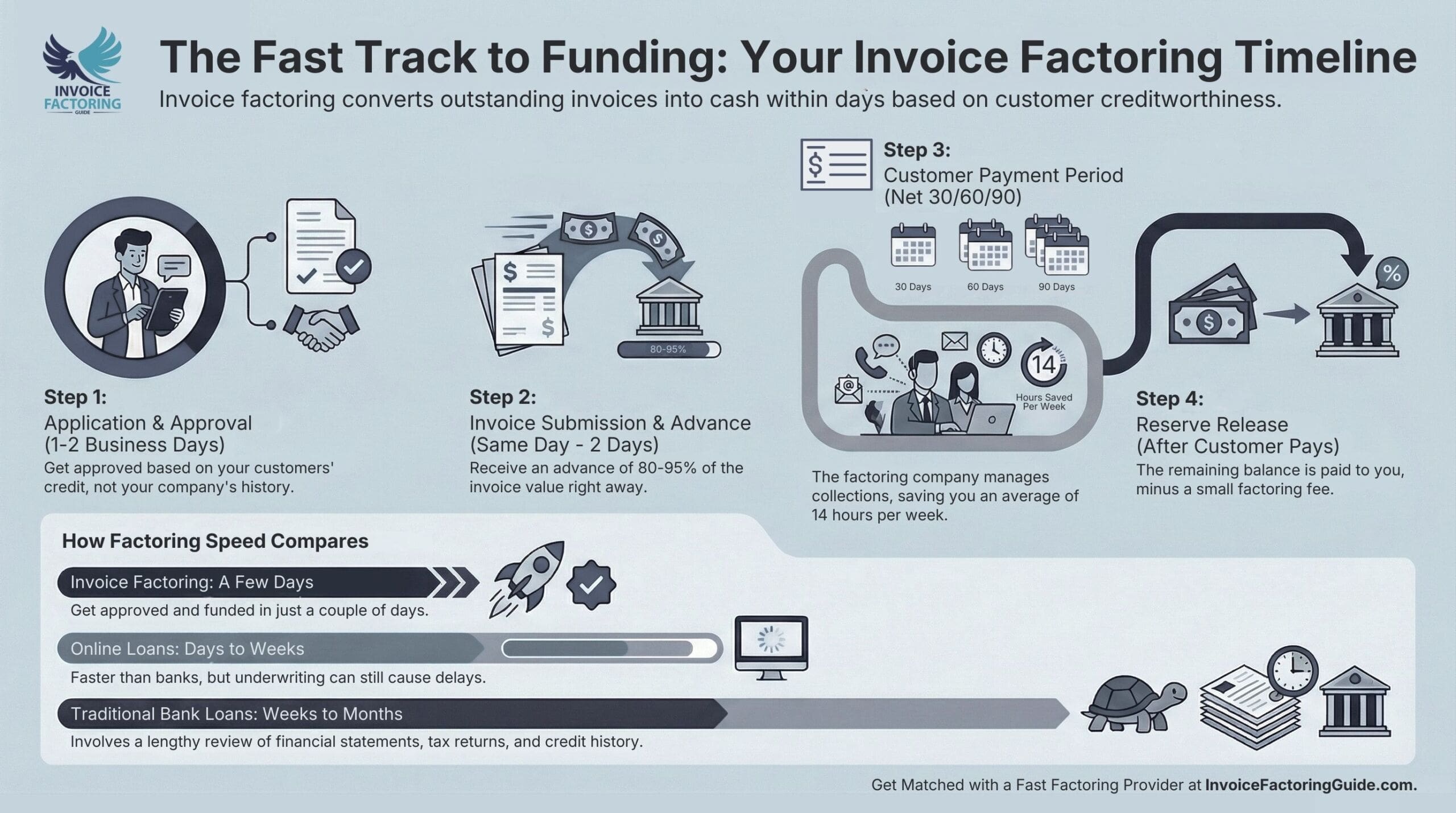

Invoice factoring is one of the fastest forms of business funding. In fact, the full payment process, even if you’ve never factored before, can be completed in just a few days. We’ll walk you through the full invoice factoring timeline and the conditions that influence it below.

The Invoice Factoring Timeline Moves Fast

Most people wondering about the factoring timeline have two questions: “How quickly can I get approved?” and “How fast can I get the funds?” The short answer is that you can get approved and funded within a couple of days, but they are separate processes, and their timelines are impacted by different factors. We’ll explore the full factoring timeline and where these activities fit in below.

Step 1: Application and Approval (1–2 Business Days)

The first step in the factoring timeline is getting approved to factor invoices. Most businesses qualify because approval is based on customer creditworthiness. Your customers are the ones ultimately paying the invoice, which is why their ability to pay matters more than your company’s length of time in business.

Some factoring companies can approve applications the same day, as long as you are prepared and have common business documents ready. It is also normal for the approval process to take a couple of days. In rarer cases, approval can take a week or longer, usually when there is a hiccup in the process, such as missing or incomplete information.

During this stage, the factoring company will:

- Verify Your Business: Basic details such as your business structure, industry, and operating status are reviewed.

- Review Your Invoices: Invoices are checked to confirm they reflect completed work or delivered goods and meet standard factoring requirements.

- Conduct Customer Credit Checks: Customer payment history and credit profiles are evaluated to assess the likelihood of timely payment.

Step 2: Invoice Submission and Advance (Same Day to 2 Business Days)

Once your account is approved and set up, you can begin submitting invoices for factoring. It’s important to note that your payments will be broken into two parts. The first payment is the factoring advance. It’s usually between 80 and 95 percent of the invoice value. This is the portion you receive right away, often as an automated clearinghouse (ACH) payment to your bank account or by wire. ACH tends to be the most common method of payment, and it will generally hit your bank account within one or two business days. Some factoring companies offer expedited service by wire and can have your payment sent the same day you submit your invoices.

During this stage:

- You’ll Submit the Invoice or Other Documents: Once you finish work for a customer, you’ll create an invoice, then send it to your customer and the factoring company, usually through an online portal. If you work in a unique industry, you may be able to submit alternate documents instead of an invoice. For instance, staffing factoring companies will often accept timesheets, oilfield factoring companies may accept field tickets, and trucking factoring companies may accept a signed bill of lading (BOL).

- The Factor Verifies the Invoice: Invoice or document details are confirmed, often by verifying amounts, terms, and customer acknowledgment.

- You Receive the Advance: A percentage of the invoice value is deposited directly into your business bank account.

Step 3: Customer Payment Period (Based on Invoice Terms)

Your customer then pays the invoice according to the agreed payment terms. This period is driven by your customer relationship and billing terms, such as net 30, net 45, or net 60. During this time, the factoring company manages the receivable, handling the full collection process on your behalf.

It’s worth noting that the average mid-sized business spends 14 hours per week chasing invoices, according to Intuit. With the factoring company managing this for you, that’s time you get back.

Step 4: Reserve Release (After Customer Payment Clears)

The portion of the invoice that you don’t receive upfront is known as the factoring reserve. This is retained by the factoring company until your customer pays the invoice. After their payment clears, you receive the reserve, minus your factoring fee.

Factoring is Faster Than Most Quick Business Funding Options

Factoring often moves faster than other business funding options because it relies on invoices and customer payment strength rather than a deep review of your business finances. Many funding products marketed as “fast” still involve underwriting steps that stretch timelines well beyond a few days.

Traditional Business Loans Can Take Months

Traditional business loans usually have the longest timelines. Banks and credit unions review financial statements, tax returns, debt obligations, and credit history before issuing a decision. Even when a loan is approved, funding can take additional weeks.

For businesses that need working capital tied to current invoices, this pace often feels disconnected from day-to-day cash flow needs.

Online Term Loans and Lines of Credit Often Take Days or Weeks

Alternative and online lenders usually move faster than banks, but approval and funding still take time. These products rely on underwriting models that assess business revenue, cash flow trends, and credit profiles.

While some lenders advertise rapid decisions, funding timelines commonly stretch beyond several business days, especially for larger amounts or newer businesses.

Merchant Cash Advances Can Fund Quickly but Operate Differently

Merchant cash advances (MCAs) are often approved and funded quickly. Instead of invoices, these products are based on future credit card sales and are repaid through daily or weekly holdbacks that amount to a percentage of sales.

Although MCAs can pay out as fast as factoring does, and have an easy approval process too, they come with some big drawbacks, such as high fees and fluctuating payments. These aspects often make it harder to manage cash flow and predict when the balance will be paid off, unlike factoring, which does not create debt.

You Can Speed Up the Factoring Process Even More

While factoring is already fast, there are a few simple ways businesses tend to keep approval and funding timelines on track.

Have Common Business Documents Ready

Factoring approval moves more smoothly when standard business documents are readily available. These typically include formation documents, identification, and basic company details that allow the factoring company to complete its initial review without delay.

Submit Clear, Complete Invoices

Invoices that clearly reflect completed work, accurate amounts, and standard payment terms are easier to review and verify. Make sure your invoices are factoring-ready to reduce the need for follow-up and help funding move forward without interruption.

Work with Customers Who Respond to Verification Requests

Invoice verification often includes confirming details with your customer. When customers respond promptly or follow established verification procedures, funding timelines tend to stay short.

Understand the Factor’s Funding Schedule

Each factoring company has its own processing cutoffs and payment methods. Knowing when invoices are reviewed and when payments are issued ensures you have realistic expectations for when funds will reach your bank account.

Get Matched with a Fast Factoring Provider Now

When speed matters, you don’t have time to research and call a list of factoring companies either. We’re happy to match you with a vetted factor to help you start accelerating your cash flow right away. There is no cost for our service. Just share a few details about your business to get started.

FAQs on the Invoice Factoring Timeline

How quickly can you get funded with factoring?

Many businesses receive funding within hours after submitting an approved invoice. In other cases, funds arrive within one to two business days, depending on invoice verification steps and payment method. Once your account is established, ongoing funding often follows the same predictable timeline.

How long does invoice factoring take?

Invoice factoring often takes a few days from application to first funding. Approval typically takes one to two business days, and funding can follow shortly after. The total timeline depends on invoice review, customer credit checks, and verification requirements.

What is the average factoring processing time?

On average, factoring approval takes one to two business days, while funding can happen the same day an invoice is submitted. Some businesses experience slightly longer timelines if additional documentation or verification is required, especially during initial setup.

What is the timeline for invoice payment?

With factoring, you receive an advance shortly after submitting an approved invoice. The remaining balance, known as the reserve, is released after your customer pays the invoice. Payment timing depends on your customer’s terms, such as net 30 or net 60.

What is the process of invoice factoring?

Invoice factoring begins with approval based largely on customer creditworthiness. After approval, you submit invoices for funding and receive an advance. When your customer pays the invoice, the factoring company releases the remaining balance minus the factoring fee.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300