It’s easy to think invoice factoring and revenue-based financing are the same. After all, both help you unlock capital that your business expects to receive as revenue in the near future. But the way these funding solutions work, including timelines, approval, and costs, couldn’t be more different. In this guide, you’ll get a complete breakdown of factoring vs. revenue-based financing, so it’s easier to see which one’s best for your business.

Invoice Factoring: A Comprehensive Overview

Cash flow gaps are a reality for most businesses. In fact, nearly three in five small businesses in the United States experience cash flow issues, according to QuickBooks research. These gaps are often caused by customers who take 30 to 90 days to pay. Meanwhile, your business still has bills to cover, employees to pay, and growth opportunities to act on.

Invoice factoring is one way to bridge that gap. Rather than waiting for your customers to pay their invoices, you sell the invoices to a factoring company. In return, you get most of the money upfront, usually within one business day. The factoring company then collects payment from your customer when the invoice is due.

It is not a loan. You are not taking on debt. It is simply a way to unlock the working capital that is already tied up in your accounts receivable.

We’ll explore the pros and cons of factoring and answer key questions like “What is factoring in finance?” and “How does factoring work?” below.

How Factoring Works

The process is straightforward and repeatable.

- You Deliver Goods or Services and Invoice the Customer: Your client receives a standard invoice with payment terms, just like always.

- You Sell the Invoice to a Factoring Company: The factor buys the invoice and advances you most of its value, typically around 90 to 95 percent.

- The Customer Pays the Factoring Company: When the invoice is due, your customer pays the factor directly.

- You Receive the Remaining Balance: Once the invoice is paid, the remaining five to ten percent is released to you, minus the factor’s fee.

Getting Approved for Factoring

One of the biggest advantages of factoring is that it is easy to qualify for, even for newer businesses or those with imperfect credit.

- Business-to-Business or Government Sales: Factoring is available to companies that invoice other businesses as well as government contractors.

- Completed Work: You must have already delivered the goods or services tied to the invoice.

- Customers with Strong Payment History: Approval is based primarily on your customer’s creditworthiness, not yours.

- Basic Documentation: You’ll typically need to provide invoices, customer contracts or purchase orders, and an accounts receivable aging report.

The factoring application process is quick. Most businesses are approved within one to three days.

How Factoring Fees Work

Factoring fees usually fall between one and five percent of the invoice value. Several factors influence the exact cost, including:

- Invoice Size and Volume: Larger or more frequent invoices often qualify for lower rates.

- Customer Creditworthiness: If your customers have strong payment histories, your fees may be lower.

- Payment Timeframe: The longer your customer takes to pay, the more the factoring fee may cost.

- Agreement Structure: Terms such as recourse versus non-recourse, or long-term versus spot factoring, can affect your rate.

If you want to reduce costs, ask about volume discounts, fast-pay incentives, or recourse factoring, which tends to carry lower rates. You can also factor only select invoices rather than your entire receivables.

Key Factoring Benefits

There are quite a few reasons business owners turn to factoring, especially during times of growth or uncertainty.

- Fast Access to Capital: You can receive funds in as little as one business day without going through a lengthy loan approval.

- No Debt or Monthly Payments: Because factoring is not a loan, there is nothing to repay.

- Flexible Qualification Criteria: Approval is based on your customers, not your business or personal credit.

- Built-In Collections Support: Most factoring companies follow up with your customers on their balances, saving your team time and effort.

- Scalable as You Grow: The more you sell, the more working capital you unlock through new invoices.

In short, factoring gives you predictable cash flow without creating new liabilities, which is a huge plus for businesses that want to scale sustainably.

Potential Disadvantages of Factoring

Like any funding option, factoring has its tradeoffs. Let’s take a look at a few common factoring agreement terms and details you need to know before signing up.

- Customer Notification: Your customer will usually be told that a third party is managing the invoice. This can feel awkward, especially if it is your first time factoring. However, many providers offer non-notification factoring, white-label, or soft-touch communication, so your customers still feel like they are dealing with you directly.

- Contracts and Commitments: Some factoring companies require long-term agreements or monthly minimums. You may be able to negotiate factoring terms like these. If flexibility matters to you, ask about spot factoring, which lets you factor one invoice at a time with no ongoing obligation.

- Higher Costs for Slow-Paying Customers: Because fees are time-based, the longer your customer takes to pay, the more it costs. You can minimize this by submitting invoices from customers who consistently pay quickly, or negotiating shorter payment terms with your clients.

- Not All Invoices Will Qualify: If you are billing a customer with a poor payment history or disputed charges, their invoices may be rejected. Keeping clean records and screening your customers in advance can help you avoid surprises. Your factoring company will also run customer credit checks, which can help guide your decisions on who to extend credit to and how much.

Revenue-Based Financing: A Comprehensive Overview

Revenue-based financing, sometimes shortened to RFB, is a way to raise capital by pledging a percentage of your business’s future revenue in exchange for upfront funds.

Unlike a traditional loan with fixed payments, your repayments fluctuate based on how much revenue you bring in. When sales are strong, you pay more. When sales dip, your payment amount drops, too.

This type of funding is often marketed to companies with high growth potential but limited access to traditional financing, such as newer businesses, e-commerce brands, or startups without significant assets.

We’ll explore the pros and cons of revenue-based financing and how it works below.

How Revenue-Based Financing Works

The structure is simple, though different from what many business owners are used to.

- You Receive an Upfront Lump Sum: This is typically a fixed amount, such as $50,000.

- You Agree to a Repayment Cap: Rather than interest, the lender applies a repayment multiple, which is usually between 1.1 and 1.5. If your advance was $50,000 and your repayment cap is 1.3, you’ll pay back $65,000.

- You Repay a Percentage of Monthly Revenue: The repayment amount changes based on your sales. If you have a slow month, you pay less. If you have a strong month, you pay more.

- Payments Continue Until the Cap is Met: Once the total repayment amount is satisfied, the obligation ends.

There’s no set timeline. Some businesses repay in six months, while others take a year or more, depending on revenue flow.

Qualifying and Applying for Revenue-Based Financing

Revenue-based financing is often easier to qualify for than traditional loans, but it still requires a strong foundation. Revenue financing eligibility is usually contingent upon:

- Consistent Monthly Revenue: Most providers look for $10,000 or more in recurring monthly revenue.

- Bank or Payment Processor Statements: You’ll usually need to provide several months of records showing sales activity.

- U.S.-Based Business Entity: Most providers only fund U.S. businesses that are legally registered and in good standing.

- Minimal Existing Liabilities: If your cash flow is already tied up in other loans or obligations, you may not qualify.

The timeline for approval is similar to a traditional business loan. Most businesses will hear back within two to four weeks.

How Revenue-Based Financing Costs Work

Revenue-based financing is not interest-based, but it can still be expensive if you’re not careful. Here’s how the cost typically breaks down.

- Flat Repayment Multiple: You repay a fixed percentage above the amount you borrow. Because most providers use a multiple between 1.1 and 1.5, you repay 11 to 50 percent more than you received.

- Variable Payback Period: Because your monthly payment is a percentage of your revenue, the timeline varies based on your sales.

- No Prepayment Discounts: Even if you repay early, you usually still owe the full repayment cap.

This structure favors fast-growing businesses with high margins. If your revenue slows, repayment stretches out, but the total cost remains the same.

Key Benefits of Revenue-Based Financing

For the right kind of business, revenue-based financing advantages can be very compelling. Let’s take a look at what’s involved.

- Flexible Payments Tied to Revenue: If sales slow, your payment shrinks to match. That can protect your cash flow during lean months.

- No Equity Dilution: You maintain full ownership of your business.

- Fast Access to Capital: Many revenue-based financing providers approve and fund within a few days.

- No Fixed Repayment Schedule: You are not locked into a strict monthly amount, which can be a relief if your income is variable.

- No Personal Guarantee Required: Many revenue-based financing agreements do not require personal collateral, depending on the provider.

Potential Disadvantages of Revenue-Based Financing

While revenue-based financing has its place, there are a few challenges to watch for.

- Total Cost Can Be High: While there is no interest, the flat repayment cap can result in an annualized cost that exceeds traditional loans or even factoring.

- Payments Still Add Up: Even though the payments flex, they continue until the full repayment cap is met. If you’re growing slowly, you may be paying for a long time.

- Not Ideal for Tight-Margin Businesses: Because the payback comes straight from revenue, thin margins can get thinner.

- No Early Payoff Discount: Even if you repay in half the expected time, you’ll still pay the full amount.

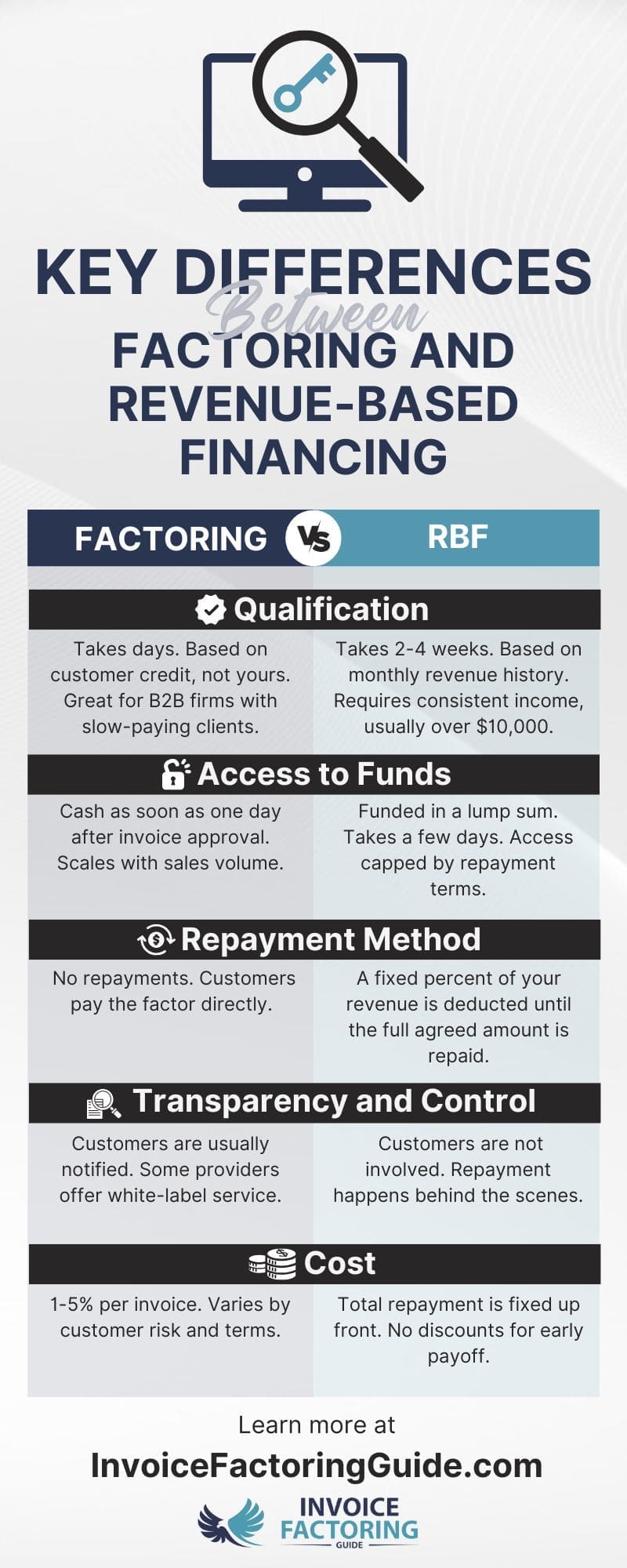

A Side-by-Side Comparison of Factoring and Revenue-Based Financing

Both factoring and revenue-based financing are flexible alternatives to traditional loans. They each offer quick access to capital and don’t require giving up equity. But that’s where the similarities end. They’re structured very differently and tend to serve different types of businesses with different needs.

If you’re trying to figure out which one is the better fit for your business, the key is understanding how each one works across the areas that matter most. We’ll explore some of those key differences between factoring and revenue-based financing below.

Qualification

Approval for factoring is based on your customers, not your credit score. If your business sells to other businesses or government entities, and your customers have a reliable payment history, you’re likely to qualify. This makes factoring accessible for newer companies or those with less-than-perfect credit.

Revenue-based financing, on the other hand, is based entirely on your business’s revenue. Most providers look for at least ten thousand dollars in consistent monthly revenue, verified through bank or payment processor statements. Your customer base isn’t part of the equation, but if your sales are unpredictable or seasonal, that could impact your eligibility.

Access to Funds

Factoring moves fast. Once you’re approved, you can typically receive funding in one business day, and you don’t need to wait for a new loan or reapply. As long as you’re issuing invoices, you can keep generating capital. And because factoring scales with your revenue, your funding potential grows as your business grows.

Revenue-based financing is funded as a lump sum, and most providers disburse the money within a few days of approval. However, the amount is capped up front and doesn’t grow automatically. If your funding needs increase, you’ll need to requalify or take out another advance.

Repayment

Factoring doesn’t require repayments from your business. Your customers pay the factoring company directly when the invoice comes due. There’s no loan on your books and no debt to manage.

In a revenue-based financing agreement, repayment is tied to your sales. Under traditional revenue-based payment terms, a percentage of your revenue is automatically deducted each month until the full agreed-upon amount is repaid. That can help ease pressure in slower months, but it also means that when you have a strong month, you’ll pay more.

Transparency and Control

Factoring typically requires notifying your customers that a third party is handling the invoice. That said, many providers offer white-label or soft-touch communication options to maintain your brand image. Some even offer non-notification factoring if privacy is a priority.

Revenue-based financing is completely behind the scenes. There’s no customer involvement at all, and the repayment process runs automatically based on revenue deposits, giving you full control over client relationships and communication.

Cost

Factoring fees usually range from one to five percent per invoice. The cost depends on the creditworthiness of your customers, your industry, and the structure of your agreement. You can reduce the rate by choosing customers with stronger payment histories, negotiating based on volume, or opting for recourse factoring.

Revenue-based financing doesn’t use interest, but it isn’t necessarily cheaper. You agree to a fixed repayment cap that’s typically 1.1 to 1.5 times the advance amount, so if you receive $100,000 at a 1.4 cap, you’ll repay $140,000 regardless of how fast you pay it back. That predictability can help with planning, but it also means there’s no benefit to paying it off early.

Examples of Factoring vs. Revenue-Based Financing in Action

To better understand how they differ, it’s helpful to look at some factoring examples and revenue-based financing examples side by side.

For the first example, imagine a staffing company that needs $50,000 to make payroll at the end of the week while it waits for client payments to come in. The business can choose factoring or revenue-based financing.

Factoring Example

With factoring, the approval process can be completed in just a couple of days. A staffing company would likely have a factoring rate of 1.15 to 3.5 percent, so we’ll set the factoring fee for this example at three percent. To ensure the business can access the full $50,000 it needs, it sells an invoice valued at $51,550 to the factoring company. The factoring company advances $50,000 the next day. The staffing company covers payroll on time and moves forward. In the background, the factoring company follows up on collections for the staffing company. When the customer pays the invoice 30 days later, the staffing company receives an additional $500. The remaining $1,550 is retained by the factor as the fee for its services.

Revenue-Based Financing Example

Conversely, let’s say the staffing company decides to use revenue-based financing to gain $50,000 for payroll. Whereas the factoring approval came through in a day or two, approval for revenue-based financing usually takes two to four weeks. At this stage, we already know the staffing company missed payroll while waiting for approval, but let’s say they continue anyway and eventually do get approved for $50,000. A 1.3 repayment multiple is then applied, meaning the business agrees to repay $65,000 total. It also agrees to share ten percent of its monthly revenue to repay the balance. The business receives $50,000 within a couple of days of signing this agreement. Assuming the business’s monthly revenue holds steady at $50,000, repayment takes about 13 months. By the end of the term, they’ve paid $15,000 in fees.

As you can see in this example, factoring was faster, more cost-effective, and helped the business move forward faster.

Factoring vs. Revenue-Based Financing: Which is Right for You

If your business qualifies for both revenue-based financing and invoice factoring, the right fit often depends on how your revenue flows, how quickly you need access to capital, and whether you want repayment flexibility or predictability. Below are some of the most common situations where factoring tends to outperform revenue-based financing.

When to Use Factoring vs. Revenue-Based Financing

- You Have Cash Flow Gaps Caused by Slow-Paying Customers: If your customers take 30 to 90 days to pay and it is putting pressure on your ability to meet payroll, purchase inventory, or take on new work, factoring gives you a way to bridge the gap without taking on debt. You get paid on your timeline, not theirs.

- You Do Not Want to Rely on Sales History to Qualify: Factoring companies focus on your customers’ credit history, not yours. That makes it a strong fit if you want to avoid revenue-based qualification criteria or keep your sales data private.

- You Want Funding That Increases Automatically as Your Business Grows: Factoring scales with your revenue. As you bring in more sales and issue more invoices, the amount of working capital available to you increases automatically. There is no need to reapply or qualify for additional rounds of funding.

- You Prefer to Avoid Monthly Repayment Obligations Tied to Sales: With factoring, there is no fixed payment schedule, and nothing is deducted from your revenue. Your customer pays the factoring company directly, and your portion of the funds is released when the invoice is paid.

- You Need Fast Access to Working Capital without Waiting on Approvals: Factoring approvals often take just a few hours, and once you are set up, funds can be delivered in one business day or less. That speed can make the difference when you need to seize a time-sensitive opportunity or cover a short-term gap.

Get Started with Invoice Factoring

If you need faster access to capital than revenue-based financing can offer, want funding that grows alongside your sales without reapplying, or want to avoid an endless repayment cycle, invoice factoring is tough to beat. To explore the fit for your business and be connected with factoring companies that understand your needs, request a complimentary rate quote.

Factoring vs. Revenue-Based Financing FAQs

How does revenue-based financing work?

With revenue-based financing, you receive a lump sum upfront and repay it by sharing a percentage of your monthly revenue. Payments continue until you’ve repaid the agreed total, often 1.1 to 1.5 times the amount advanced. There’s no fixed timeline; repayment speed depends on your sales.

What’s the difference between revenue-based financing vs. equity financing?

Revenue-based financing lets you raise capital without giving up ownership. You repay a set amount from future revenue, and the lender has no control over your business. With equity financing, you sell shares in your company and may give investors influence over decisions and operations.

Which is better, factoring or revenue-based financing?

Factoring is often better if you invoice businesses or government clients and want fast, recurring access to capital without taking on debt. Revenue-based financing works best for companies with steady, card-based revenue. The better option depends on how you sell and how you get paid.

How high are revenue-based financing interest rates?

Revenue-based financing doesn’t use traditional interest rates, but the total repayment is often 1.1 to 1.5 times the amount borrowed. This can translate to an effective annual cost higher than many loans, especially if repayment happens quickly.

What are revenue-based financing repayment terms like?

Repayment terms for revenue-based financing are flexible. You repay a fixed amount, usually 1.1 to 1.5 times the advance, through a monthly percentage of your revenue. The timeline isn’t fixed. Repayment speeds up with higher sales and slows down when revenue dips.

Is revenue-based financing right for my business?

Revenue-based financing may be a good fit if your business has consistent revenue and strong margins. It’s often used by SaaS and e-commerce companies. If you invoice other businesses and want faster access to capital without fixed repayments, invoice factoring may be worth exploring, too.

What are some alternatives to revenue-based financing?

Alternatives to revenue-based financing include invoice factoring, business lines of credit, term loans, and merchant cash advances. Factoring is ideal for businesses that invoice other companies and want fast access to working capital without taking on debt or fixed repayment terms.

How are factoring interest rates and revenue-based financing interest rates different?

Factoring doesn’t charge interest. Instead, you pay a fee that’s typically one to five percent of the invoice value. Revenue-based financing also avoids traditional interest but uses a repayment cap, which can result in a higher effective cost, especially if the advance is repaid quickly.

Should startups use revenue-based financing or factoring?

Revenue-based financing for startups can be a good option if the business has steady monthly sales and wants to avoid equity dilution. Factoring may be a better fit if your startup sells to other businesses or agencies and needs capital before customers pay their invoices.

Should small businesses use factoring or revenue-based financing?

Factoring for small businesses is ideal when you invoice clients and want fast access to working capital without taking on debt. Revenue-based financing may work better if you collect frequent payments from customers and have consistent monthly revenue to support repayment.

How can I find the best revenue-based financing providers or factoring companies?

Look for trusted revenue-based financing companies or factoring firms with experience in your industry, transparent terms, and strong customer reviews. Many offer complimentary quotes to help you compare your options and find the best fit based on your revenue model and cash flow needs. If you’re specifically looking for factoring, Invoice Factoring Guide can match you with a factoring company to streamline your search.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300