Trying to navigate factoring contract clauses? As is the case with most legal documents, your factoring contract spells out a number of things, including who pays for what, what steps must occur, and what happens when things don’t go as planned. It can make for some dense reading, especially if you’re unfamiliar with the types of terminology used.

One of the tricks to reviewing and assessing contracts quickly is to search the document for specific terms that might be dealbreakers or require further negotiation. In this guide, we cover some important factoring clauses to look for in your contract, explain what they mean in plain terms, outline why they’re there, and cover alternatives or negotiation points if something isn’t ideal for your business.

As always, you should defer to a legal expert when reviewing contracts to ensure your interests are well represented, and if you have questions. However, this guide will cover all the basics to help ensure you’re able to discuss your contract with awareness and confidence.

Advance Rate Clause

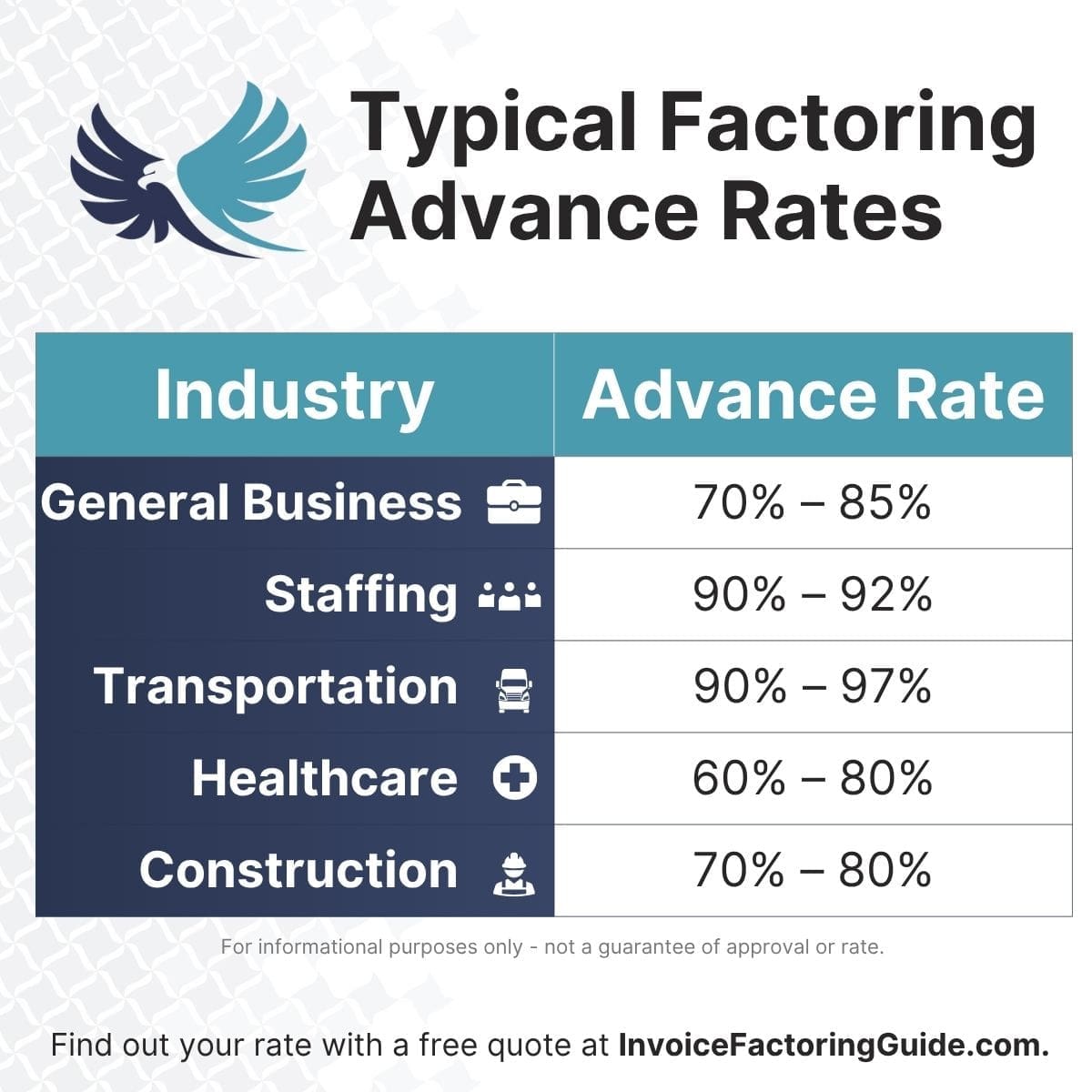

Factoring gives your business fast access to cash, but you don’t receive the full value of your invoice upfront. The advance rate clause in your agreement tells you how much you’ll receive right away. The figure is typically between 80 and 97 percent of the invoice’s value, depending on your industry and the risk profile of your customers.

The advance rate is the portion of the invoice that the factoring company releases immediately. The rest is held in reserve and paid out later, once your customer pays, minus the factoring fee. It’s a key part of any agreement and plays a big role in shaping your overall cash flow.

Industries with fast billing cycles and fewer disputes tend to see higher advance rates. For example, trucking companies often qualify for rates as high as 97 percent. Meanwhile, service-based industries like staffing typically fall closer to the 80 to 90 percent range due to greater risk tied to disputes or timekeeping issues.

How the Advance Rate Affects Your Payment Terms

Advance rates are one of the most visible parts of your factoring deal, but they don’t stand alone. It helps to look at the importance of payment terms in factoring more broadly to understand what you’re signing up for fully. While we’ll cover many of these more in-depth later, a few other areas include:

- Reserve Release Timing: This refers to how quickly the remaining balance is paid after your client submits payment.

- Fee Deductions: This outlines whether fees are taken from the advance or deducted from the reserve.

- Customer Credit Thresholds: These are the minimum credit requirements your clients must meet to be eligible for factoring.

- Service Level Commitments: This includes any timing or communication standards the factoring company agrees to uphold.

All of these elements work together to shape your factoring payment terms. The advance rate clause is just one piece of the puzzle.

What to Consider Before Signing Your Agreement

The structure of the advance rate can vary, so make sure to ask:

- Advance Rate by Industry or Client Risk: Is this rate fixed, or does it depend on the customer I’m invoicing?

- Reserve Release Conditions: How long after payment will I receive the reserve balance?

- Fee Allocation: Are fees taken out of the advance or deducted from the reserve?

These kinds of questions are common when understanding factoring agreements and can help you avoid surprises later.

What to Do if You Need a Higher Advance Rate

If you’re concerned the advance rate won’t meet your needs, you might explore:

- Negotiated Terms: Some factoring companies will offer a higher advance rate for clients with strong financials or high invoice volume. See our guide on negotiating factoring agreements for help with this.

- Trade-Offs That Favor You: A slightly lower advance could come with faster funding or better service, which may be worth it in the long run.

Factoring Fee Structures

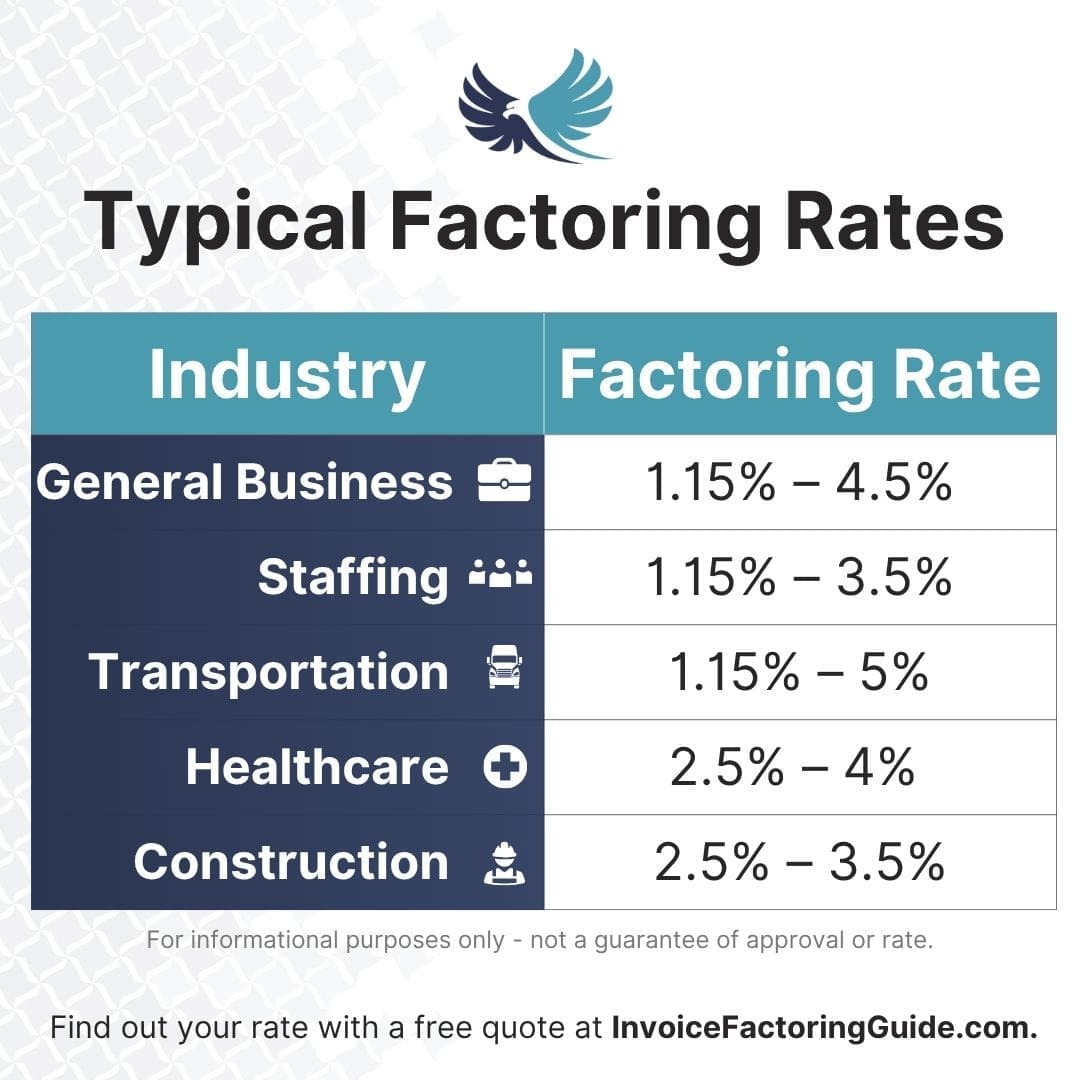

Factoring fees are typically expressed as a percentage of the invoice value, but what you’re actually paying for can vary significantly depending on the provider and agreement. Understanding the factoring fee structure in your contract helps you get the most value from the arrangement.

The Basics: What You’re Paying For

Most factoring companies charge a discount fee, which covers the cost of providing the advance. This fee is often structured in one of two ways:

- Flat Fee: A single fee is applied to the invoice, regardless of how long your customer takes to pay. This is easier to predict but may be more expensive for short payment cycles.

- Tiered or Variable Fee: The fee increases based on how long it takes your customer to pay. These are sometimes quoted as “one percent every ten days,” or similar models.

What Drives the Total Cost of Factoring

With that said, the total cost of factoring is comprised of more than just the base fee. Your agreement may include additional charges that are easy to overlook, especially if you do not review the full factoring fee structure closely. These are often referred to as hidden fees in factoring contracts. Although not all factoring companies charge them, they can include:

- Invoice Processing Fees: These are charges for each invoice submitted, regardless of size.

- ACH or Wire Transfer Fees: These cover the cost of sending your funds and can vary based on your preferred payment method.

- Credit Check or Due Diligence Fees: Some factors charge for evaluating your customers’ creditworthiness.

- Minimum Volume Penalties: If your business does not factor a set volume each month, you may be charged a shortfall fee.

How to Compare Factoring Fees and Offers the Right Way

It’s common for businesses to compare providers based solely on quoted fees, but those numbers rarely tell the full story. When comparing factoring fees, you should also consider:

- Fee Structure Type: A lower flat fee might still be more expensive than a well-structured variable rate.

- Funding Speed and Flexibility: Faster access to capital or fewer restrictions might justify a slightly higher cost.

- Contract Terms: Pay attention to things like minimum commitment periods, termination clauses, and reserve release schedules.

What to Ask Before You Sign Your Agreement

Before committing, ask your factoring company to explain all fees line by line. Specifically:

- Complete Fee Breakdown: What charges should I expect beyond the base rate?

- Billing Timeline: When are fees assessed, and how are they deducted?

- Cost Triggers: Are there any conditions that increase the rate, such as late customer payments?

Even experienced businesses benefit from reviewing these details. If you’re unsure, this breakdown of how to make factoring fees work for you offers helpful strategies for keeping costs manageable.

Recourse vs. Non-Recourse Factoring Terms

One of the most common factoring contract clauses you’ll come across is the distinction between recourse and non-recourse factoring. This determines who is ultimately responsible if your customer fails to pay the invoice.

What Recourse and Non-Recourse Actually Mean

- Recourse Factoring: You’re responsible for repaying the factoring company if your customer doesn’t pay. This is the most common structure and typically comes with lower fees.

- Non-Recourse Factoring: The factoring company absorbs the loss if your customer fails to pay due to insolvency. This usually costs more and is only available in select situations.

Your factoring contract will specify whether it’s a recourse or non-recourse agreement. Watch for the wording here, as many non-recourse deals only cover a narrow set of defaults, like bankruptcy, and not defaults for issues like invoice disputes.

How Recourse Terms Affect Your Business

One in ten B2B invoices becomes uncollectable, according to Atradius. That’s a meaningful loss rate, especially for businesses operating on tight margins. If you frequently work with new customers or clients with uncertain credit histories, non-recourse factoring may offer peace of mind, even if it comes at a higher cost.

Recourse Clauses Benefits

Recourse factoring is widely used for a reason. It offers:

- Lower Fees: Because you’re taking on more of the credit risk, you usually pay less.

- Wider Approval: More businesses and invoices qualify under recourse terms.

- Greater Flexibility: These agreements often allow you to factor a broader mix of clients and invoices.

Non-Recourse Agreements Risks

Non-recourse factoring can sound like a safety net, but it comes with trade-offs:

- Limited Coverage: As mentioned, many contracts only apply non-recourse terms if your customer declares bankruptcy.

- Stricter Client Vetting: The factoring company will be more selective about which invoices it accepts.

- Higher Costs: Fees are typically higher to account for the added risk to the factor.

Buyback or Repurchase Obligation

When customers don’t pay their invoice and you have a recourse agreement, or you have a non-recourse agreement, and the reason for default is not covered by your contract, a buyback or repurchase obligation clause will come into play.

What Buyback or Repurchase Clauses Address

This clause states that if an invoice remains unpaid after a certain number of days, often between 60 and 120, you may be required to repurchase it from the factoring company. In most cases, this doesn’t mean writing a check. Instead, the factor typically deducts the unpaid amount from your next reserve release or offsets it against future invoices.

Why Factoring Companies Include Buyback and Repurchase Clauses

This clause is designed to protect the factoring company from long-term exposure. Factoring is not a collections service. It’s a short-term cash flow tool. If the factor is still holding unpaid invoices several months out, they’re no longer functioning in that short-term role.

With that said, buyback and repurchase clauses are usually set up in a way that makes it easier for the business to comply, since you’re not generally expected to come up with a lump sum. The key is to know what will happen if one of your invoices goes unpaid and be ready to address the concern in a way that complies with your contract.

What to Clarify Before You Sign Your Contract

Buyback clauses can be structured in different ways. Ask:

- Trigger Conditions: How many days past due must the invoice be before a buyback is triggered?

- Repurchase Process: Will I be invoiced for the buyback, or will it be offset against future payments?

- Exceptions: Are there any conditions, such as disputes or partial payments, that exempt me from the obligation?

Customer Approval Process

When you factor invoices, your customers become part of the evaluation process. That’s because the factoring company needs to feel confident that they’ll pay, not just that your business can issue invoices.

This step, often called the customer approval process, is central to the credit approval process in factoring. It has nothing to do with your business’s credit score. Instead, the factor performs credit checks on the companies you invoice to determine whether those invoices are eligible for funding.

What the Factor is Looking for When Evaluating Your Customers

Factoring companies evaluate your customers much like a lender would assess a borrower. According to the credit checks feature overview, this may include:

- Credit Scores and Payment Histories: Past behavior with other vendors is a key signal.

- Days Sales Outstanding (DSO): Customers with consistent, timely payments are usually favored.

- Industry and Size: Larger or more established businesses are often seen as lower risk.

If a customer does not meet the factoring company’s criteria, their invoices may be declined or factored under less favorable terms.

How the Customer Approval Process Works

Many factoring companies handle this process quickly, and some offer online systems where you can check a customer’s credit in real time or request approval before onboarding a new client. Businesses that understand the value of thorough credit vetting often use this step proactively, not just to get invoices approved for factoring, but to avoid taking on risky customers in the first place.

In some cases, ongoing approvals are required for each invoice. In others, you’ll receive a credit limit for each approved customer, allowing you to factor multiple invoices without reapplying.

What to Ask Before You Sign Your Agreement

Approval processes may vary from one factoring company to the next. Be sure to clarify:

- Approval Timelines: How long does it take to get a customer approved?

- Limits and Expirations: Do approvals expire, and is there a cap on the amount I can factor per customer?

- Support: What happens if a good customer gets denied? Can I appeal or submit additional documentation?

This process gives the factor a way to manage risk while helping you make more informed decisions about who you extend credit to. When it’s handled transparently, it becomes a valuable tool.

Term Length and Factoring Termination Clause

When signing a factoring agreement, most business owners focus on fees and advance rates. But the factoring contract duration and the terms that govern how and when you can exit the agreement are just as important.

How Term Length Impacts Your Agreement and Business

Factoring contracts are often set up for six or 12 months, but some auto-renew without much notice. Others may come with a rolling term that restarts every time you submit a new invoice. If you’re not aware of the renewal structure, you could end up locked in longer than expected.

This is where the factoring termination clause comes into play. It spells out how much notice you need to give and what happens if you terminate the agreement early.

Common Termination Triggers and Costs

Termination clauses vary by provider, but the most important things to look for include:

- Notice Period Requirements: Many providers require 30 to 120 days’ written notice to end the agreement.

- Termination Fees in Factoring: Some agreements include flat fees, while others charge a percentage of your average monthly volume or remaining contract value.

- Minimum Commitment Shortfalls: If you agreed to factor a certain amount and fall short, you may owe a penalty.

How to Protect Yourself from Term Lengths and Termination Clauses

Many of these issues can be avoided by reviewing the clause up front and asking the right questions. To help with avoiding exit costs in contracts, consider:

- Requesting a Trial Period: Some factoring companies will offer a short-term trial or waive termination fees under certain conditions.

- Negotiating the Notice Window: A shorter notice period gives you more flexibility.

- Getting Terms in Writing: Even if your sales rep says “there’s no fee,” insist on seeing it in the contract.

If you’re thinking about exiting your factoring agreement, it’s worth reviewing the termination clause to understand how the terms could affect your timeline and costs.

Minimum Volume Requirement

Some factoring agreements include a minimum volume requirement, which obligates you to factor a set dollar amount of invoices each month or over the full contract term. If you fall short, you may be charged a fee based on the difference, whether you needed the funding or not.

Why Factors Have Minimum Volume Requirements

Factoring companies often build their pricing around expectations of regular volume. When volume drops, it can affect their return on investment. A minimum volume clause protects them from onboarding a client who only factors occasionally but still demands support, credit checks, and account management.

The issue is not the clause itself; it’s when businesses don’t realize it’s there or misunderstand how it’s enforced. Seasonal businesses, those with irregular invoicing patterns, and newer companies may struggle with minimum volume clauses the most.

What to Watch for in Volume Requirements

Before signing, ask:

- Monthly or Annual Target: Is the requirement based on a monthly average, rolling total, or full-term commitment?

- Shortfall Penalty Structure: What happens if I do not meet the volume? Is there a fixed fee or a percentage-based penalty?

- Exemptions or Flexibility: Can volume dips be waived for slow months or known seasonal cycles?

These terms may also be embedded in other parts of the contract, such as pricing schedules or default provisions, so a careful review is essential.

What to Do if You’re Unsure About Your Volume

If your invoicing is unpredictable or if you want to keep your options open, you may prefer an arrangement with no long-term commitment. For instance, spot factoring allows you to fund invoices on a one-off basis, with no volume requirements or contract lock-ins. While fees may be slightly higher, it can be a smart fit for businesses that value flexibility.

Exclusivity Clause

The exclusivity clause in a factoring agreement gives the factoring company the exclusive right to purchase all, or a specified portion, of your receivables. In practice, that means you cannot use another funding source or factor selected clients or invoices elsewhere without violating the agreement.

Why Exclusivity Clauses Exist

Factoring companies take on risk when they advance funds against your receivables. To protect that investment, they want to ensure they’re seeing the full picture of your receivables and cash flow. Exclusivity helps prevent situations where a client double-pledges invoices or splits funding across multiple providers in a way that increases risk.

How Exclusivity Clauses Impact Your Agreement and Business

The exclusivity clause can limit your flexibility, especially if your funding needs shift during the term of the agreement. For example, if you secure another financing option or want to factor only a specific set of invoices, this clause could prevent you from doing so without renegotiating or facing penalties.

Before signing, clarify:

- Scope of Exclusivity: Does this apply to all receivables or just specific clients or invoice types?

- Exceptions or Carve-Outs: Are there any conditions under which you can use another funding source?

- Duration: Does the clause apply for the full contract term or only while a balance is outstanding?

Understanding the structure of the exclusivity clause gives you a clearer sense of how much control you’ll retain and whether the agreement supports your long-term plans.

Reserve Account and Release Timing

We touched on factoring reserves earlier when covering advance rates, but it’s worth exploring on its own, as the way a factoring company handles reserve release timing can significantly impact your day-to-day operations. Even if the reserve itself is expected, the timing of its return varies widely and is often buried in the fine print.

Why You Should Check for Release Clauses

Some factoring companies release reserve funds the same day your customer pays. Others wait several business days or hold reserves longer under certain conditions. That delay might not sound like much until it slows down your ability to cover payroll or restock inventory.

What to Clarify in the Agreement

This is one of those legal clauses in factoring agreements that often gets overlooked. Before you sign, be sure to ask:

- Release Timeline: After your customer pays, how long until the reserve is released to you?

- Discretionary Holds: Can the factoring company delay that release, and under what conditions?

- Fee Deductions: Are fees taken from the reserve, the advance, or both?

Notification vs. Non-Notification Terms

When you factor an invoice, your customer may or may not know about it. The difference comes down to whether your agreement uses notification or non-notification terms. These terms directly affect how payments are collected and how your relationship with your clients is managed.

What Notification and Non-Notification Mean in a Factoring Agreement

- Notification Factoring: Your customers are informed of the factoring arrangement through a notice of assignment. They’re directed to send payment directly to the factoring company. This is the standard approach, as it gives the factoring company greater control over collections and reduces risk, which often translates to lower fees or faster funding.

- Non-Notification Factoring: Your customers are not notified. Payments still go to you or are routed through a lockbox account in your business’s name, even though the factor is managing the funding behind the scenes.

How Notification and Non-Notification Terms Impact Your Agreement and Business

While notification terms are common, some businesses worry that informing clients will raise questions or give the impression that they’re in financial trouble. But that’s rarely the case. In many industries, factoring is so common that customers expect these notices and don’t think twice about them.

Still, confidentiality in factoring agreements can be important in certain situations. Businesses that are navigating mergers, new customer relationships, or competitive industries may prefer a more discreet approach. In those cases, non-notification factoring may be worth exploring if your business and customer base meet the factor’s stricter qualification criteria.

What to Ask Before You Sign Your Contract

Be sure to clarify:

- How Customers Are Informed: Will the notice be sent once or with each invoice?

- Payment Routing: Will payments go directly to the factor or through an account in your name?

- Eligibility for Non-Notification: Is this option available to you, and if so, under what conditions?

The right setup depends on your industry, your customer relationships, and how important privacy is to your operations.

How Security Interests Like UCC Filings Fit In

In many factoring agreements, especially those using notification terms, the factoring company may file a UCC-1 financing statement to secure its interest in your receivables. This is standard practice across the industry.

The filing does not give them control over your entire business. It simply ensures they have a legal claim to the invoices they’ve purchased. This kind of filing is one example of how security interests in factoring help reduce risk and reinforce collection rights.

If you’re concerned about how this might affect your ability to get other financing, ask whether the UCC filing covers all receivables or only those factored.

Lockbox or Payment Redirection Requirements

If your factoring agreement includes notification terms, it will likely also require you to direct customer payments to a specific account, usually controlled by the factoring company. This is commonly known as a lockbox arrangement.

How a Lockbox Works

A lockbox is a third-party account where your customers send payment for factored invoices. While it may carry your business’s name, the account is monitored and managed by the factoring company. The funds are applied to outstanding invoices and then disbursed according to your agreement’s terms, covering fees, releasing reserves, and forwarding any remaining balance to you.

In some cases, the factoring company will simply require payment to be made directly to them rather than using a formal lockbox. Both structures serve the same purpose: giving the factor direct control over collections.

Why Factoring Companies Include Lockbox Clauses

This clause reduces risk for the factoring company. By directing payments to a controlled account, they can ensure customer funds are received promptly and applied accurately. It also avoids confusion in situations where multiple invoices are being funded at once or where reserve tracking is involved. At the same time, many businesses appreciate this because it frees them from collections processes and gives them back a significant number of hours each week to devote to growing the business.

What to Clarify Before You Sign Your Agreement

Before agreeing to payment redirection, ask:

- Account Ownership and Branding: Will the lockbox or redirected account be in your business name or the factor’s?

- Impact on Customers: What will your clients see when they pay? Will it feel seamless or cause confusion?

- Scope of Use: Will the lockbox apply only to factored invoices or all customer payments?

While this clause may seem like a small administrative detail, it has a direct impact on how your customers experience billing and how smoothly your collections process runs.

Fee Deduction and Dispute Rights

Most factoring companies deduct their fees automatically, either from the advance or the reserve, before releasing funds to you. This is standard practice. But your agreement should also address what happens if you dispute a fee or believe the deduction was made in error.

How Fee Deductions Typically Work

Factoring agreements usually spell out where the fee comes from, when it’s deducted, and how the total amount is calculated. What’s less often discussed upfront is your ability to challenge those deductions if something seems off.

For example, what if the factor applies a higher fee than expected because it considers a payment late, but your records show otherwise? Or what if an additional charge appears for something you did not agree to, like credit monitoring or invoice handling fees?

These situations highlight why factoring client rights and dispute resolution in factoring are essential.

What to Look for in the Agreement

Even well-intentioned providers can make mistakes or apply policies inconsistently. Your contract should clearly outline:

- Notification of Fees: Are you alerted before fees are deducted, or only after the fact?

- Right to Dispute: Can you contest a fee, and if so, what is the process for doing so?

- Timeline for Resolution: Is there a timeframe in which disputes must be raised and resolved?

These may sound like minor administrative points, but they fall under the broader category of factoring contract legal implications and can affect your ability to recover withheld funds or protect your margins.

How Default and Legal Protection Clauses Impact Your Business

If a dispute escalates, whether over fees, late payments, or reserve holds, it may trigger one of the default clauses in factoring agreements. These clauses can allow the factoring company to withhold future funding, apply additional penalties, or even terminate the contract early.

Being proactive about protecting yourself from legal disputes starts with understanding how fee deductions work and how your rights are defined in the agreement. If anything is unclear, ask for clarification in writing before signing, and document any concerns that arise after funding begins.

Audit and Inspection Rights

Your factoring agreement may include a clause that gives the factoring company the right to audit your records or inspect your financials. While this might sound invasive at first glance, it’s typically meant to confirm the accuracy of the invoices being purchased, not to review your entire business.

What Audit and Inspection Clauses Usually Cover

This clause often grants the factor permission to:

- Review of Receivables: The factor may request access to your accounts receivable records to confirm invoice details.

- Verification of Delivery: They may check that goods or services tied to factored invoices were delivered as agreed.

- Dispute Documentation: They may inspect communications or files related to customer disputes or payment issues.

- Confirmation of Customer Contracts: The factor may verify the existence and status of any agreements with clients whose invoices are being factored.

Audits can be conducted remotely or on-site, and in most cases, they are scheduled in advance. However, some agreements include language that allows for spot checks, especially if there’s a default or suspected breach.

Why Factoring Companies Include Audit and Inspection Clauses

Factoring companies are advancing funds based on your invoices. If something goes wrong, such as duplicate invoicing, misstated balances, or withheld customer disputes, they may be left holding the risk. Audit rights allow them to confirm that the receivables are legitimate and enforceable.

This is one of several factoring liability clauses designed to minimize risk and protect the factor’s ability to recover payment. For your business, it reinforces the importance of maintaining clean, well-organized records.

What to Look for in Your Agreement

Before signing, review how audit rights are described. Specifically:

- Scope: Does the clause limit access to receivables and payment data, or is it broader?

- Frequency and Notice: Are there limits on how often audits can occur, and will you be notified in advance?

- Conditions: Can the factor perform an audit at any time, or only under specific circumstances?

This is one of those factoring contract legal terms that may never come into play, but if it does, you’ll want to know exactly what was agreed to. Clear boundaries protect both parties and help ensure the relationship remains professional and respectful.

Personal Guarantee Clause

In some factoring agreements, the company may ask for a personal guarantee, a clause that makes a business owner or executive personally responsible for repaying the factoring company if the business cannot. This clause is more common than many business owners expect, and while it can feel risky, it’s often part of the standard underwriting process.

Why Personal Guarantees Are Used

Factoring companies extend funding based on expected customer payments, but if those payments do not come through, and if the reserve or repurchase process does not cover the shortfall, they may use the personal guarantee to recover remaining losses.

As outlined in our overview of personal guarantees in factoring, the goal is not to target your personal assets but to ensure accountability and discourage fraud or negligence. Still, it’s important to understand the legal and financial implications before signing.

What the Guarantee Might Cover

The clause may apply broadly or only under certain conditions. Be sure to clarify:

- Scope of Liability: Are you responsible only if there’s fraud, or in all cases of nonpayment?

- Release Conditions: Can the guarantee be removed after a period of on-time performance?

- Collection Rights: What steps can the factor take to enforce the guarantee?

Industry Norms and Compliance Considerations

While not all factoring companies require personal guarantees, many do, especially for newer businesses or clients with higher perceived risk. These clauses are often part of industry standards in factoring, and their use does not necessarily reflect poorly on your business.

Still, they are legally binding. If the clause is unclear or feels overly broad, it’s worth reviewing it with legal counsel. This is one of those moments where compliance in factoring contracts means knowing exactly what you’re agreeing to and what rights you may be waiving.

Get a Free Personalized Factoring Quote

One of the recurring themes that emerged as we explored factoring contract essentials is that factoring agreements are unique. Each factoring company operates a little differently, and businesses may receive distinct terms based on their industry, risk, and other considerations. From there, you can often request specific adjustments to the contract. For instance, now that you understand the various terms and how they work together, you may be able to negotiate higher advances or lower rates. But this all starts with connecting with an experienced factoring company.

We can streamline your search by matching you with vetted factors. To take the next step, request your free personalized factoring quote.

FAQs on Key Factoring Contract Clauses

What happens if I want to cancel my factoring agreement early?

Canceling early may trigger fees, notice requirements, or penalties depending on your contract. To avoid surprises, review the termination clause before signing. Understanding the potential contract termination impact can help you plan ahead and ensure you’re not locked into terms that no longer serve your business.

What should I look for in factoring contract clauses?

Focus on terms that affect your control, costs, and flexibility. That includes contract length, termination conditions, fee structures, and personal liability. Each of these clauses shapes how factoring fits into your business and how easy it is to change course if your needs shift.

Are factoring contract clauses negotiable?

Yes, many factoring contract clauses can be negotiated, especially if your business has strong financials or invoice volume. Key areas to discuss include advance rates, reserve release timing, termination fees, and personal guarantees. Always get agreed-upon changes in writing before signing.

How do factoring contract clauses affect legal risk?

Clauses around termination, defaults, and liability can expose you to legal or financial consequences. Understanding what triggers enforcement and how disputes are handled can help you manage risk. It’s a good idea to review these with legal counsel if anything is unclear.

Do all factoring companies use the same contract clauses?

No. While many clauses are common across the industry, the language and enforcement vary. Some providers offer more flexible terms or waive certain requirements. Comparing contracts side-by-side can reveal differences that affect cost, control, or long-term fit.

Why do factoring agreements have so many clauses?

Factoring companies use contract clauses to manage risk, outline funding terms, and clarify expectations. These clauses protect both sides but can be complex. Reviewing the full agreement carefully helps ensure you understand your rights and responsibilities before entering the relationship.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300