All too often, the excitement of being offered a new contract or large order is quickly replaced by worries about the upfront costs. While large businesses have the reserves and credit access to seize emergency business opportunities, small and mid-sized businesses are routinely left behind. The good news is that it doesn’t have to be this way if you have unpaid business-to-business (B2B) invoices and reliable customers,

Factoring is Ideal for Use as Emergency Business Funding

When unexpected opportunities or financial challenges for businesses arise, timing is everything. Factoring gives you the ability to move quickly, even when your business’s cash flow is tied up in unpaid invoices. Unlike traditional financing, which requires a long application and approval process, factoring converts your receivables into usable cash within hours or days.

Let’s look more closely at some of the benefits of factoring services and why factoring is particularly well-suited for emergencies.

1. Immediate Access to Working Capital

One of the greatest factoring benefits is fast capital. When your business faces a time-sensitive opportunity, like taking advantage of bulk pricing, accepting a large order, covering an unexpected expense, or clearing other financial hurdles in business, waiting on customers to pay can mean missing out. In fact, more than 40 percent of business owners say cash flow issues have caused them to lose out on potential business opportunities, according to Xero surveys.

However, factoring unlocks funds that are already owed to you, allowing you to act fast.

- Quick Turnaround Times: Once you’re signed up, some factoring companies can provide funding on the same day you submit your invoice.

- Predictable Cash Flow: Because you control which invoices to factor, you can access funds as needed without disrupting other financial plans.

2. No Debt or Credit Risk

Factoring is not a loan. You are selling your invoices, not borrowing against them. That means no interest payments, no long-term obligations, and no effect on your business credit.

- Debt-Free Funding: Your business remains financially agile because you are converting assets you already own into cash.

- Credit Flexibility: The factor evaluates your customers’ creditworthiness, which makes this ideal if your business has limited or damaged credit.

3. Scalable for Growth or Crisis

Factoring automatically scales with your sales volume. The more business you do, the more working capital becomes available. That adaptability makes it just as useful in high-demand periods as it is during downturns.

- High-Growth Scenarios: You can fund large orders or enter new markets without taking on new debt.

- Emergency Coverage: If a client delays payment or an expense arises unexpectedly, factoring smooths over the gap without slowing operations.

4. Simplified Approval and Minimal Documentation

Traditional lenders often require extensive paperwork, collateral, and financial statements. Factoring companies focus on your customers’ ability to pay rather than your company’s balance sheet, which makes the process faster and simpler.

- Easy Qualification: Most businesses with B2B invoices can qualify, even startups.

- Streamlined Process: After initial setup, funding typically happens automatically once invoices are verified.

5. Strategic Leverage in Urgent Situations

Factoring turns potential setbacks into advantages. Businesses often use it to secure early-payment discounts from suppliers, prevent project delays, or lock in opportunities competitors might miss.

- Supplier Discounts: Paying suppliers early can sometimes qualify you for discounts, which offset factoring fees.

- Opportunity Capture: A construction firm, for example, might use factoring to purchase discounted materials after a price drop, something they could not do if waiting 60 days for client payments.

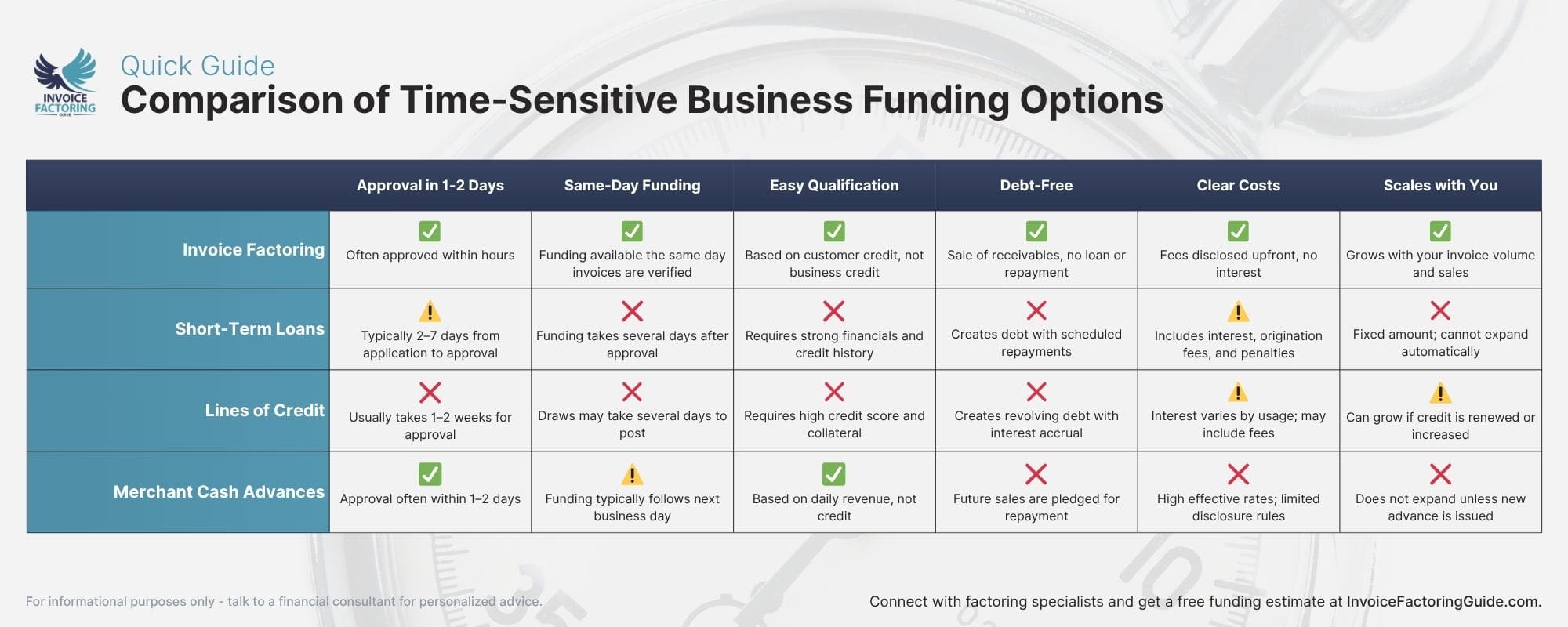

How Factoring Compares to Other Types of Time-Sensitive Business Financing

When your business faces a limited-time opportunity, your ability to move fast often determines success. Many owners immediately think of short-term loans, lines of credit, or merchant cash advances (MCAs). However, factoring provides a different kind of agility.

1. Approval Speed

Time is the biggest differentiator. Traditional funding sources rely on complex underwriting and credit evaluations that can delay access to funds.

- Factoring: If you have common business documents ready, some factoring companies can approve your application within hours and provide funding the same day you submit your invoice.

- Short-Term Loans: Even with online lenders, approval may take several days, and disbursement can take longer.

- Lines of Credit: Banks usually require strong financials and collateral, which adds time to the approval process.

- MCAs: If you already have a merchant services provider, you can be approved on the day you apply and receive funding within one to three days.

2. Qualification Criteria

When you need capital quickly, strict credit requirements can make traditional options unrealistic. Factoring shifts the focus from your business’s credit to your customers’ ability to pay.

- Factoring: Approval depends primarily on your customers’ creditworthiness and the quality of your invoices.

- Short-Term Loans and Credit Lines: Decisions rely on your financial statements, time in business, and credit score.

- MCAs: Approval is based on business revenue, not invoices or customer credit.

3. Debt and Repayment

Traditional financing adds liabilities to your balance sheet. Factoring does not. You are selling your receivables rather than borrowing against them.

- Factoring: There’s no debt to pay, so there’s no repayment schedule, no interest, and no long-term obligation.

- Short-Term Loans: Fixed repayment terms, interest accrual, and potential penalties for early payoff. Annual percentage rates (APRs) can reach 75 percent, per the Wall Street Journal (WSJ).

- Lines of Credit: Ongoing interest costs and renewal requirements that can change over time. APRs can climb as high as 100 percent.

- MCAs: MCAs are technically a sale of future receivables, but function like high-cost short-term loans. A portion of your credit card sales, usually 10 to 20 percent, is held back until the balance is repaid. APRs can exceed 100 percent, often making them one of the most expensive forms of funding available.

4. Cost Transparency

Factoring fees are usually straightforward and are just a small percentage of the invoice value, while loan interest can vary depending on rate fluctuations or missed payments.

- Factoring: Clear, predictable fees based on invoice volume and client risk. These are usually between one and five percent of the invoice value.

- Loans: Variable costs due to compounding interest, origination fees, and penalties.

- Lines of Credit: Interest accumulates on borrowed amounts and may include maintenance fees.

- MCAs: Fee structures can be complicated, and total costs are often unclear.

5. Flexibility in Use

Factoring aligns naturally with opportunity-based funding because it scales with your sales activity and can be used as needed.

- Factoring: Choose which invoices to sell and when, providing immediate flexibility.

- Loans: Lump-sum structure limits adaptability once the funds are received.

- Lines of Credit: Can provide ongoing access but usually require consistent credit reviews and renewals.

- MCAs: Can function like a line of credit, but are often handled as a lump sum.

How to Leverage Factoring for Emergency Business Opportunities

When timing is critical, having a clear plan for using factoring can make all the difference. The steps below outline how to approach short-notice opportunities methodically, from recognizing when to act to securing funds and putting them to work efficiently.

Step 1: Identify the Opportunity and Timing

The first step in leveraging factoring for emergency business opportunities is to recognize when speed matters most. Opportunities that require immediate action often come without warning, such as when a supplier offers a limited-time discount, a customer requests an urgent bulk order, or a piece of essential equipment suddenly becomes available at a great price. In each of these cases, cash flow determines whether you can act or have to pass.

Factoring allows you to respond decisively, but only if you recognize the window of opportunity in time.

How to Identify an Emergency Opportunity

An emergency opportunity is not always about solving a crisis. Sometimes, it is about acting fast to gain an advantage. These scenarios often share a few key traits:

- Short Decision Window: You need to commit within days or hours to secure pricing, materials, or labor.

- Immediate ROI Potential: Acting now creates measurable gains, such as profit from resale or long-term client growth.

- Existing Revenue Gap: Your funds are temporarily tied up in unpaid invoices, but your customers are creditworthy and payments are predictable.

Step 2: Assess Available Cash and Working Capital

Once you identify an opportunity worth pursuing, the next step is to evaluate your business’s current financial position. Understanding how much working capital you already have and how much more you will need will help you determine if factoring is the right move and which invoices to submit.

Factoring is most effective when used strategically. Rather than factoring everything at once, you can choose specific invoices that close the exact funding gap for your opportunity.

How to Assess Your Current Liquidity

Getting a quick financial snapshot can help you understand your position before reaching out to a factoring company.

- Open Invoices: Add up the total value of unpaid invoices owed by customers with strong payment histories. These represent your most immediate source of potential funding.

- Available Cash: Review your cash on hand and reserves. Determine how long these funds can sustain your daily operations if used toward the new opportunity.

- Immediate Obligations: List upcoming payroll, rent, or supplier payments to ensure essential expenses remain covered.

- Funding Gap: Subtract available cash from your total need for the opportunity. This number indicates how much to factor.

Step 3: Calculate Funding Needs

After reviewing your cash flow and available working capital, the next step is to determine exactly how much funding you need to seize the opportunity. This ensures that factoring is used efficiently and that you maintain a healthy financial balance after funding is received.

Factoring is flexible, but that flexibility is most valuable when you know your numbers. By understanding how much to factor and which invoices to use, you can maximize the benefits while minimizing fees.

How to Determine Your Ideal Funding Amount

Start by outlining the total financial requirement for the opportunity, then narrow it down to the portion that needs external funding.

- Total Project or Purchase Cost: Add all related expenses, such as materials, labor, freight, or short-term equipment rentals.

- Available Internal Funds: Subtract the cash and reserves that you can allocate without disrupting essential operations.

- Funding Shortfall: The remaining balance represents the amount to cover through factoring.

Choosing the Right Invoices to Factor

Selecting the right invoices can speed up funding and improve cost efficiency. A few things to keep in mind when evaluating factoring invoices include:

- Customer Creditworthiness: Choose invoices from dependable customers with strong payment histories, as these typically receive better advance rates.

- Invoice Age: Newer invoices are preferred because they are less likely to require verification delays.

- Invoice Value: Match the invoice total to your specific funding need rather than factoring more than necessary.

Step 4: Choose the Right Factoring Partner

As you choose a factoring company, evaluate potential partners based on factors that align with your goals and timing.

- Industry Expertise: Some factors specialize in specific industries, such as trucking, manufacturing, or staffing. Industry experience helps them understand the payment cycles, risks, and common invoice structures you deal with.

- Speed of Funding: In urgent situations, the ability to fund within 24 hours of approval is critical. Ask how quickly they process initial applications and recurring invoices.

- Transparency of Fees: A reputable factor clearly outlines advance rates, service fees, and any reserve requirements before you sign.

- Customer Service and Communication: In emergencies, you need responsive communication. Ask about dedicated account managers and real-time support options.

- Recourse vs. Non-Recourse Options: Decide whether you prefer to retain responsibility for unpaid invoices and have a recourse factoring agreement or transfer that risk to the factor with a non-recourse factoring agreement.

Step 5: Submit Invoices and Get Funded

Once you have selected a factoring partner, the next step is to submit your invoices for funding. This is where planning pays off. By having clear, verified invoices ready to go, your business can often receive cash within a day.

Factoring companies specialize in fast turnarounds, but efficiency depends on how organized you are at this stage.

How the Process Works

The process is straightforward once your account is set up. Most reputable factoring companies use secure online portals to streamline submission and approval.

- Invoice Submission: You send copies of unpaid invoices along with any supporting documents, such as purchase orders or proof of delivery.

- Verification: The factoring company confirms that the goods or services were delivered and that the customer accepts the invoice amount. This is known as invoice validation or invoice verification.

- Funding: Once verified, the factoring company advances a percentage of the invoice value, often between 80 and 95 percent, directly to your bank account, sometimes within twenty-four hours.

- Customer Payment: Your customer later pays the factoring company based on the original invoice terms.

- Reserve Release: After payment clears, the remaining balance, called the reserve, is released to your business, minus the fees.

Step 6: Allocate Funds Strategically

After receiving your advance, the next step is to use the funds intentionally to ensure the opportunity delivers maximum return. Factoring gives you the ability to act fast, but how you allocate that cash determines whether it drives profit, stability, or both.

When your business faces an emergency or sudden opportunity, the goal is to invest those funds where they will have the greatest impact.

Prioritize Based on the Opportunity

Direct your funding toward activities that directly support the project, order, or deal that prompted the need.

- Inventory or Materials: Use funds to purchase inventory or raw materials that increase production capacity or allow you to accept new orders.

- Labor and Operations: Cover payroll, overtime, or contractor expenses needed to fulfill contracts quickly.

- Equipment or Repairs: Address urgent maintenance or invest in short-term equipment rentals that keep operations running.

- Supplier Discounts: Take advantage of early-payment or bulk-purchase discounts to reduce overall costs.

Avoid Common Missteps

Factoring is most effective when it fuels growth rather than patching unrelated financial holes. Using the cash for expenses outside of the opportunity can limit future liquidity.

- Overextension: Do not factor more invoices than necessary; it raises costs without increasing benefits.

- Debt Substitution: Avoid using factoring proceeds to pay off long-term debts that require structured repayment.

- Operating Drift: Keep your focus on short-term gains tied to the specific opportunity.

Step 7: Track ROI and Plan Ahead

The final step in leveraging factoring for business opportunities is to analyze your results and plan for the future. Factoring provides immediate liquidity, but its real value comes from how well it positions your business to handle future opportunities with confidence and control.

Tracking your return on investment (ROI) can help you determine whether the decision to factor achieved its intended outcome and guide how you use factoring going forward.

How to Measure the Return on Factoring

Evaluate both the financial and operational impact of the opportunity you funded.

- Profit Margin Improvement: Compare the total gain from the opportunity, such as increased revenue, discounts captured, or new contracts, to the cost of factoring.

- Turnaround Efficiency: Measure how quickly your business turns invoices into results. If you delivered a project or fulfilled an order faster than competitors, that advantage has measurable value.

- Customer Growth: Note any lasting relationships or repeat orders that came from the opportunity.

- Operational Stability: Assess whether factoring helped you maintain payroll, meet obligations, or prevent disruptions during a critical moment.

Planning for Future Opportunities

Once you understand how factoring is performed for your business, consider how to integrate it into your broader financial strategy.

- Establish an Ongoing Relationship: Maintain your account with the factoring company so funds are readily available the next time an opportunity arises.

- Identify Patterns: Track which situations make factoring most profitable, such as seasonal spikes or supplier promotions.

- Refine Decision Criteria: Use insights from past transactions to determine which invoices to factor next time for the best results.

Get a Head Start on the Factoring Application Process

If you’re trying to get funding for an urgent business matter, you probably don’t have time to search for them all to find the best one. We can get you to the front of the line by matching you with a factoring company that offers easy approvals and fast funding. To get started, share a few details about your business.

FAQs on Using Factoring for Urgent Needs

Why are factoring and cash flow management important for urgent business needs?

Strong cash flow allows your business to respond quickly to new opportunities or emergencies. Factoring supports this by converting unpaid invoices into usable funds right away. Together, these tools help you stay flexible, cover immediate expenses, and maintain stability without slowing growth.

Is factoring helpful in avoiding debt in business growth?

Yes. Factoring is a debt-free form of funding because you are selling invoices, not borrowing money. It allows your business to access cash without taking on repayment obligations or interest, supporting growth while keeping your balance sheet clean and credit position strong.

If I have a business emergency, what hidden costs in factoring should I expect?

Reputable factoring companies are transparent about their fees, which typically include a service charge or discount rate. Potential extra costs may arise from wire transfers, invoice minimums, or customer disputes. Reviewing your factoring agreement carefully helps ensure there are no surprises.

How can I avoid over-reliance on factoring?

Use factoring strategically for opportunities or short-term gaps rather than daily operations. Monitor cash flow, plan for reserves, and reassess your funding mix as your business grows. Factoring works best when paired with long-term financial planning and disciplined budgeting.

What’s the best way to get emergency funding for your business?

The best approach depends on timing and eligibility. Factoring is ideal when you need funds quickly because it provides access within days based on existing invoices. Other methods, like loans or lines of credit, may suit longer-term needs but take more time to process.

If I use factoring once for an emergency, do I have to keep factoring?

No. You can use factoring as a one-time solution or on an as-needed basis with spot factoring. Many businesses factor only during busy seasons or when facing temporary cash flow gaps, then return to normal operations once payments from customers catch up.

Can I set up a factoring account now and not use it unless I have an emergency?

Yes. Many businesses establish a factoring relationship before they need it. This preparation allows faster access to funds in an emergency since the approval process is already complete, giving your business a ready safety net when opportunities or challenges arise.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300