Many people know that factoring and financial health go hand-in-hand, but did you know that it can also improve your company’s liquidity? In this guide on factoring and liquidity, we’ll explore liquidity ratios, what each represents, and how factoring influences them, so you can get a clearer picture of what to expect when you factor.

Factoring: Basics and Overview

Factoring gives your business faster access to cash by turning unpaid invoices into working capital. Instead of waiting weeks or months for customers to pay, you receive most of the value upfront from a factoring company. This funding method keeps your cash flow steady and supports day-to-day operations while customers take their time to pay.

The Role of Factoring in Business Finance

Factoring fills an important gap in traditional business finance. While loans and credit lines depend on credit history or collateral, factoring focuses on the strength of your invoices. That difference makes it a practical option for companies that are growing quickly, facing uneven cash flow, or working with customers who take weeks or months to pay.

By converting receivables into cash, factoring strengthens liquidity and supports working capital. It also gives businesses more flexibility to manage expenses, invest in new opportunities, and maintain stability during slower payment periods.

How Factoring Works

The factoring process is simple once you understand the basic steps.

- Invoicing: Your business sells one or more unpaid invoices to a factoring company. These invoices act as the basis for your funding.

- Advance Payment: You receive an advance within a day or two. A typical advance rate is between 80 and 90 percent of the invoice value, though yours may be more or less depending on your factoring agreement.

- Collections: The factoring company collects payment directly from your customer when the invoice comes due.

- Reserve Payment: Once the customer pays, the factor sends you the remaining balance, minus a small fee for the service.

This approach shortens the time between completing a job and getting paid. It gives your business access to cash when you need it, rather than when your customers are ready to pay.

Factoring vs. Loans

Factoring and business loans can both help you improve cash flow, but the way they do it and how they impact your balance sheet are very different. Let’s take a look at some of the key differences.

- How Funding Works: Loans provide a lump sum or credit line that you repay with interest. Factoring gives you an advance on money your customers already owe, so you’re unlocking your own revenue instead of taking on debt.

- Approval Process: Loan approvals often depend on credit scores, collateral, and financial statements. Factoring decisions are based on the strength of your customers’ payment histories, which makes it easier for newer or rapidly growing businesses to qualify.

- Balance Sheet Impact: A loan adds debt that must be repaid over time. Factoring simply converts receivables into cash, keeping your balance sheet cleaner and your debt ratios lower.

- Flexibility: Loan limits are fixed once approved. With factoring, available funding grows as your invoicing increases, providing a scalable source of liquidity.

Both tools serve a purpose, but for businesses that want immediate cash flow and flexible access to working capital without long-term debt, factoring is often the simpler solution.

Benefits of Factoring for Businesses

Factoring strengthens your overall financial position in several key ways.

- Improves Cash Flow: The cash flow benefits of factoring are immediate. Instead of waiting weeks or months for customers to pay, you can use the advance to handle payroll, purchase materials, or take on new work.

- Supports Financial Stability: Maintaining steady access to funds creates financial stability through factoring relationships that expand as your business grows. The more invoices you generate, the more liquidity you can access.

- Reduces Risk: Reducing risk with factoring comes from shifting part of the payment responsibility to the factor. If a customer pays late, the factor handles the collection, keeping your working capital available for operations.

Liquidity: Basics and Overview

Liquidity reflects how easily your business can turn assets into cash to cover short-term expenses. It’s a snapshot of your company’s financial flexibility and its ability to keep operations running smoothly when cash inflows and outflows don’t line up perfectly.

What “Liquidity” Really Means

Liquidity measures accessibility, not just balance. A business can be profitable on paper yet still face challenges paying bills if its assets are tied up in inventory or unpaid invoices. The more quickly those assets can be converted into cash without losing value, the higher your liquidity.

The Importance of Liquidity for Small Businesses

Strong liquidity allows small businesses to stay agile. It helps cover payroll, replenish supplies, and take on new work without relying on short-term loans. Low liquidity can create a chain reaction of late payments to suppliers, missed opportunities, and added borrowing costs that cut into profit margins.

How to Measure Liquidity

Liquidity is measured by comparing what you own and can easily convert to cash against what you owe in the near term. These comparisons are expressed as liquidity ratios, which show whether your business has enough resources to meet immediate obligations. We’ll explore the importance of liquidity ratios and how they work next.

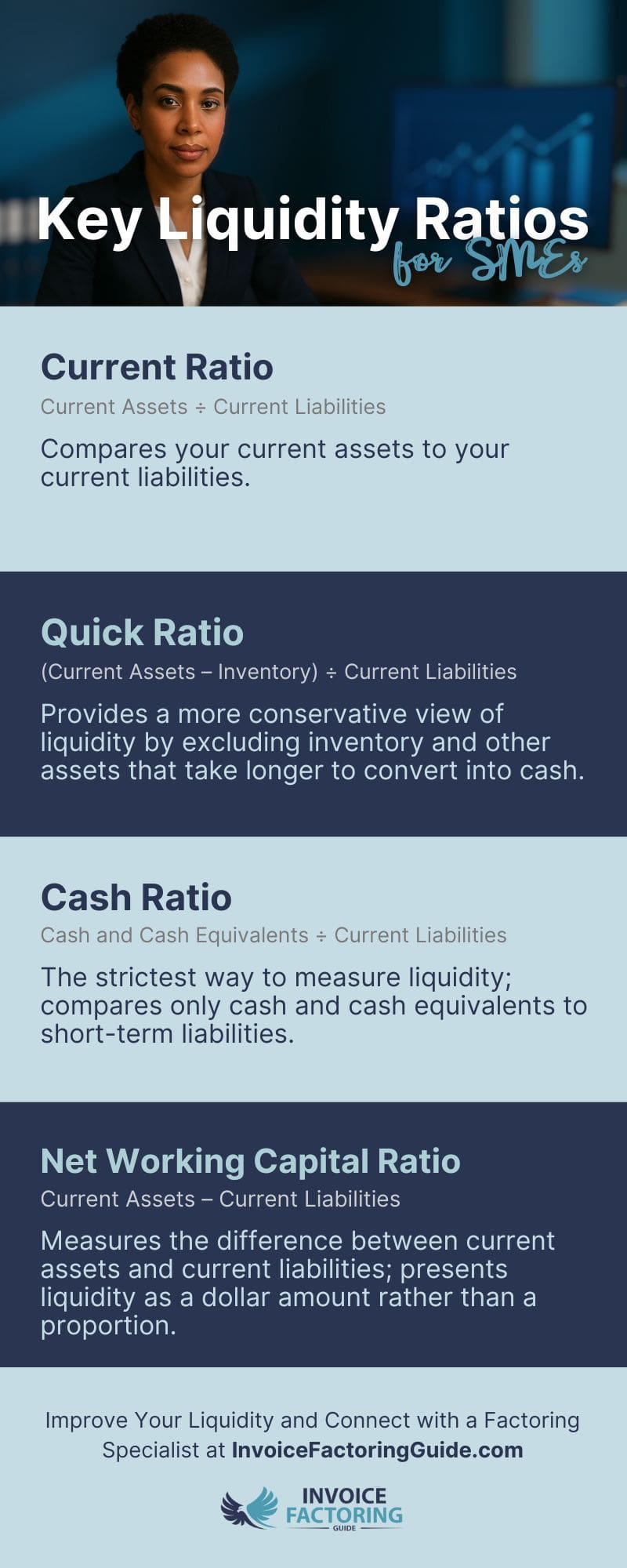

Key Liquidity Ratios for SMEs

Liquidity ratios help measure short-term financial health by showing whether your company can meet obligations as they come due. For small and medium-sized enterprises (SMEs), these ratios offer a straightforward way to track financial stability and identify early signs of cash strain. Understanding them supports better business decision-making with liquidity ratios that highlight both strengths and potential risks.

Current Ratio / Working Capital Ratio

Formula: Current Assets ÷ Current Liabilities

The current ratio, also known as the working capital ratio, compares your current assets to your current liabilities. It shows whether your business has enough resources to cover short-term debts.

An ideal ratio varies by industry, but a figure above one generally indicates that your company can meet its obligations comfortably. The importance of current ratio analysis lies in what it reveals about liquidity and efficiency. A consistently low ratio may signal that cash is too tight, while an excessively high one might suggest underused assets that could be reinvested for growth.

Quick Ratio / Acid Test Ratio

Formula: (Current Assets – Inventory) ÷ Current Liabilities

The quick ratio, or acid-test ratio, provides a more conservative view of liquidity by excluding inventory and other assets that take longer to convert into cash. It focuses on what you can access quickly, such as cash, marketable securities, and receivables.

Understanding quick ratio trends helps you identify whether your company can withstand short-term challenges without needing to liquidate inventory or seek outside funding. A healthy quick ratio means you have immediate resources available when they’re needed most.

Anything less than a 1.0 quick ratio is unhealthy, as QuickBooks reports. A 1.0 to 1.5 is considered healthy, and 1.5 to 3.0 is considered very healthy. However, if your quick ratio is over 3.0, it may mean your business is not putting its quick assets to work and could be missing out on opportunities.

Cash Ratio / Cash Asset Ratio / Absolute Liquidity Ratio

Formula: Cash and Cash Equivalents ÷ Current Liabilities

The cash ratio, also known as the cash asset ratio or absolute liquidity ratio, is the strictest way to measure liquidity. It compares only cash and cash equivalents to short-term liabilities.

Few small businesses keep a high cash ratio, but it gives a clear view of your immediate liquidity cushion. With cash ratios explained in this context, it becomes easier to see how much flexibility your business truly has if revenue slows or expenses rise unexpectedly.

Net Working Capital Ratio

Formula: Current Assets – Current Liabilities

The net working capital ratio measures the difference between current assets and current liabilities. Unlike the previous ratios, it presents liquidity as a dollar amount rather than a proportion.

This ratio highlights whether your business is operating with a positive or negative cushion of liquid assets. A positive figure indicates strength and flexibility, while a negative one suggests a potential strain on operations.

Factoring and Liquidity Ratios Explained

Factoring and liquidity are closely connected. When a company sells its receivables to a factoring company, it replaces an asset that might take weeks or months to convert into cash with funds that are available almost immediately. This shift changes how several key liquidity ratios behave and, in most cases, improves them.

Understanding the impact of factoring on liquidity helps you see where those improvements occur and how they translate into stronger short-term financial performance.

How Factoring Impacts Current Ratio

The current ratio compares all current assets to current liabilities. Factoring often increases the ratio because receivables are converted into cash. The change strengthens the business’s ability to cover near-term obligations without relying on loans or credit lines.

However, the improvement depends on how the funds are used. If the cash advance is immediately spent to pay down liabilities, the current ratio may stay stable rather than increase. For most companies, maintaining visibility into factoring and current ratio trends provides valuable insight into whether liquidity is improving over time.

How Factoring Impacts Quick Ratio

The quick ratio focuses on the most liquid assets, including cash, receivables, and marketable securities. Because factoring accelerates the conversion of receivables into cash, it generally raises this ratio. The effect of factoring on quick ratio performance is especially clear for companies that depend heavily on customer payments to fund daily operations.

A stronger quick ratio post-factoring means your business has greater flexibility to cover unexpected expenses or capitalize on opportunities without waiting for invoices to clear.

How Factoring Impacts Cash Ratio

The cash ratio isolates cash and cash equivalents from other current assets. Since factoring delivers an immediate cash advance, this ratio usually improves as soon as funding is received.

The increase shows that your company has a larger reserve of liquid assets relative to its short-term debts. Over time, maintaining higher cash ratios supports stronger financial stability and smoother cash management.

How Factoring Impacts Net Working Capital Ratio

The net working capital ratio represents the difference between current assets and current liabilities. Factoring can improve this figure by boosting cash on hand and reducing the uncertainty of outstanding receivables.

When customers pay slowly, cash flow gaps can cause working capital to dip into negative territory. Factoring replaces those delayed payments with predictable advances, helping your business maintain a positive balance and reducing the risk of cash shortages.

Improve Your Liquidity with Invoice Factoring

Factoring gives your business more control over cash flow and creates the flexibility needed to grow with confidence. By turning invoices into immediate working capital, you can cover expenses, strengthen liquidity ratios, and operate without the uncertainty that comes with delayed customer payments.

If improving liquidity is a priority for your business, we can make the process of choosing a factoring company simple by matching you with one that offers competitive rates and a strong track record with businesses like yours. To get started, request a free factoring quote.

FAQs on Factoring and Liquidity

What ratio is best for liquidity?

There isn’t a single ratio that fits every business, but the current ratio is often used as the primary measure of liquidity. It compares your current assets to current liabilities to show whether you can comfortably meet short-term obligations. A ratio above one typically indicates a healthy balance between assets and debts.

How do I get started improving financial metrics with factoring?

Start by reviewing how much of your cash flow is tied up in receivables. If long payment terms are slowing operations, factoring can help release that working capital. The first step toward improving financial stability with factoring is to partner with a provider that offers clear pricing, flexible advance rates, and experience in your industry. Once in place, factoring can help your business maintain liquidity and plan confidently for growth.

Is factoring a good solution for low liquidity?

Yes. Factoring gives your business immediate access to cash tied up in invoices. It strengthens liquidity without adding debt, making it an effective option for companies facing delayed payments or limited access to credit.

Can factoring hurt liquidity?

Not usually. Factoring improves liquidity in most cases, but if funds are used too quickly or fees are high, the benefit can be reduced. Choosing the right factoring partner and managing cash flow wisely ensures a positive impact.

How do I measure liquidity improvement after factoring?

Review key ratios such as the current ratio, quick ratio, and cash ratio before and after factoring. An increase in these figures indicates stronger liquidity and confirms that your funding strategy is improving short-term financial health.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300