Every April, online searches for “business tax deductions” skyrocket like clockwork, Google Trends data shows. Understandably so. Businesses, especially small businesses, shouldn’t pay more than they actually owe. Unfortunately, most business tax guides overlook potential deductions related to factoring. On this page, we’ll walk you through how factoring and taxes work, plus provide some practical tips for using factoring strategically and making the most of it throughout the year.

Understanding Income Tax in Factoring

When you engage in invoice factoring, your business sells accounts receivable to a factoring company at a discount in exchange for fast cash. This improves working capital without waiting on unpaid invoices, making it a popular solution for small business owners.

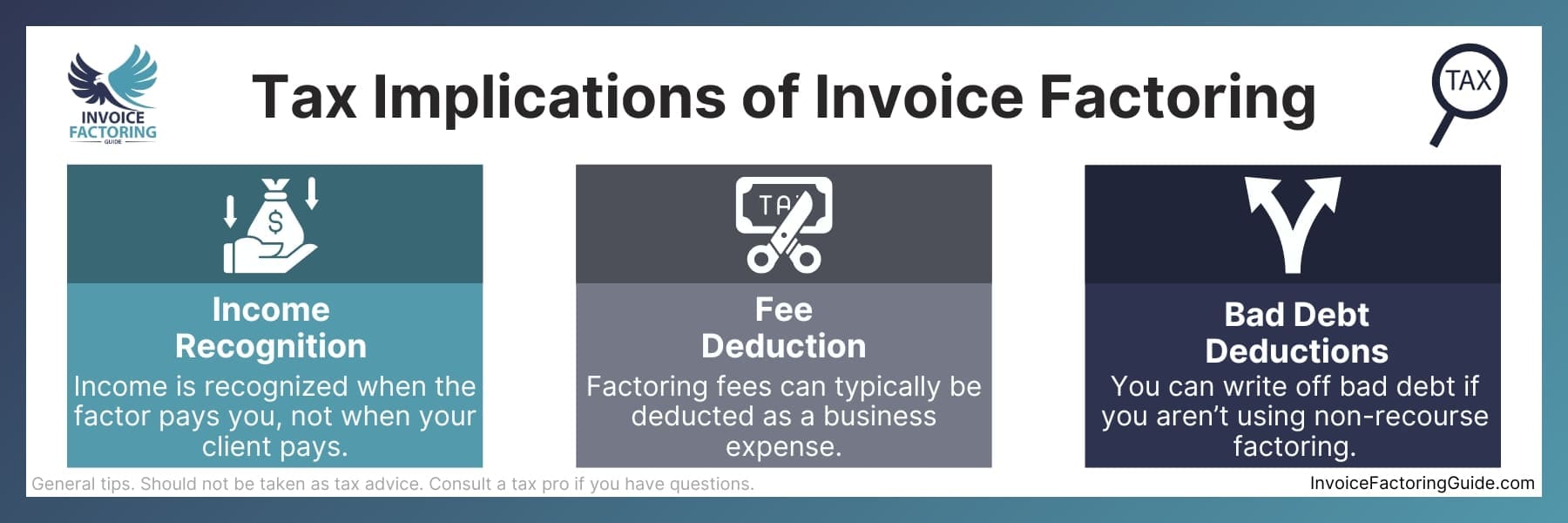

From a tax perspective, the payment from the factoring company is typically treated as business income in the year it is received, per IRS criteria. The invoice amount as income must be reported when received, not when the customer pays, affecting tax reporting and your tax return.

You can often deduct the invoice factoring fees as ordinary and necessary expenses, reducing your tax liability. However, with non-recourse factoring, where the factor assumes risk, you generally can’t claim a bad debt deduction. In recourse agreements, where your business retains ownership of the risk, those deductions may still apply.

Because taxes and factoring are deeply intertwined, work with a professional tax advisor to ensure accurate tax reporting and to maximize the benefits of invoice factoring.

Tax Implications of Invoice Factoring

When it comes to taxes, the primary concern for small business owners should be how factoring influences taxable income. Here’s how it generally works.

Income Recognition

The amount received from the factoring company is considered as income. When you factor an invoice, you’re essentially selling the future income from that invoice to a factoring company. Therefore, the funds you receive are treated as revenue for tax purposes.

Deducting Factoring Fees

The fee that the factoring company charges for their service is considered a business expense. These fees can typically be deducted from your taxable income, the IRS notes. It’s essential to keep detailed records of these transactions to report income and expenses accurately during tax time.

Bad Debt and Factoring Types

If you’re using non-recourse factoring, where the factor assumes the risk of non-payment, any bad debt expense that would normally be deductible may not be applicable since the risk is transferred to the factor. In contrast, with recourse factoring, since the risk of non-payment stays with your business, you might still be able to deduct bad debts.

Impact on Taxable Income

Factoring can directly influence your business’s taxable income. By receiving cash up front for invoices, your business receives revenue sooner than it otherwise would have. This can lead to an increase in taxable income for the current tax year. However, in the case of recourse factoring, the associated fees and potential deductions for bad debts can offset some of this taxable income.

It’s also essential to understand that while factoring accelerates cash flow, it doesn’t create additional income. It only changes the timing of when income is received. Therefore, while factoring can affect the amount of taxable income reported in a particular tax year, it doesn’t increase the overall tax burden over time.

For small business owners, it’s critical to work closely with a tax professional to navigate these specifics. Each business’s situation can differ, and tax laws are subject to change, so professional advice is invaluable in maximizing the benefits of factoring while ensuring compliance with tax regulations.

Using Factoring for Strategic Tax Planning

Invoice factoring can be a strategic tool in tax planning for small business owners, offering ways to manage and potentially reduce tax burdens. It’s all about timing and intelligent management of your financials.

Timing Your Factoring for Tax Benefits

By choosing when to factor invoices, businesses can influence which tax year income is recognized. It’s particularly useful for companies anticipating a significant difference in tax rates or taxable income between years.

End-of-Year Factoring Strategies

If you’re facing a lower tax rate this year but expect higher rates next year, you might choose to factor invoices at the end of the current year. This accelerates income recognition, allowing you to take advantage of the lower tax rate now.

When to Delay Factoring for Tax Purposes

Conversely, if you’re already in a high tax bracket this year but anticipate lower income or tax rates next year, delaying factoring until after the new year can move that income to a more favorable tax situation.

Factoring Fees as Deductible Expenses

Factoring fees can reduce your taxable income. These fees are generally considered ordinary and necessary business expenses, making them tax-deductible.

Direct Deduction

Factoring fees can directly reduce taxable income, lowering the overall tax liability. This deduction can offset the increase in taxable income generated by the cash influx from factoring receivables.

Planning and Documentation

To maximize the benefit, ensure accurate tracking and documentation of these fees. This supports your deductions and helps you plan the most advantageous timing for factoring activities in relation to your tax obligations.

Managing Cash Flow to Optimize Tax Payments

Effective cash flow management through factoring can provide the liquidity needed to make timely tax payments, avoiding penalties and interest for late payments. In some jurisdictions, It can allow your business to take advantage of any available tax incentives for early or on-time payments.

Using Factoring to Fund Deductible Investments

The immediate cash from factoring can be reinvested into the business to generate deductible expenses, such as purchasing new equipment, increasing marketing efforts, or hiring staff. These investments not only fuel growth but also increase your business expenses, which can lower your taxable income.

Factoring as a Tool for Tax Compliance

Invoice factoring is not only a financial tool for managing cash flow but also serves as a strategic mechanism for tax compliance and navigating complex tax regulations. By understanding how to utilize factoring effectively, you can ensure your business remains compliant with tax laws while optimizing your financial operations.

Navigating Tax Regulations with Factoring

Factoring can make it easier to navigate tax regulations because much of the reporting is tracked for you, often in an online portal you can access 24/7.

Accurate Income Reporting

Factoring can help your business maintain accurate records of income. Since the transaction involves selling invoices at a discount, the cash received, minus the fees charged by the factoring company, must be reported as income. This practice aligns with the principle of revenue recognition, ensuring that income is accurately reflected in the period it is earned, which is crucial for compliance with tax regulations.

Documentation and Audit Trails

A key aspect of tax compliance is the ability to provide comprehensive documentation of income and expenses. Factoring transactions create a clear trail of documentation, including the original invoices, the factoring agreement, and records of the funds received. This documentation is vital for audits and can help businesses prove their compliance with tax laws.

Deducting Factoring Expenses

The fees and charges associated with factoring services are considered business expenses and are generally deductible. Properly accounting for these deductions can significantly impact a business’s taxable income and tax liability. Understanding how to classify and deduct these expenses correctly is essential, and it is a critical component of tax planning and compliance.

Managing Cash Flow for Tax Obligations

Effective cash flow management is crucial for meeting tax obligations on time. Factoring can provide the necessary liquidity for businesses to cover their tax liabilities when they are due, avoiding penalties and interest for late payments. This proactive management of cash flow supports overall tax compliance.

How to Ensure Compliance in Factoring Transactions

Next, let’s examine a few things you can do to help ensure you remain compliant with IRS guidelines.

Familiarize Yourself with IRS Guidelines

As discussed, the IRS has specific guidelines regarding the treatment of factored receivables. It’s essential to follow these guidelines, particularly in how income is reported and how bad debts are treated under different factoring scenarios.

Choose the Right Factoring Type

As mentioned, there are two primary types of factoring agreements—recourse and non-recourse factoring. Each has different implications for risk and bad debt deduction. Understanding the nuances of your factoring agreement is crucial for accurately reporting income and deductions to ensure compliance.

Engage in Regular Reconciliation and Review

Regularly reconciling factored invoices with the corresponding income reported ensures that all transactions are accounted for accurately. This practice helps identify any discrepancies early on and addresses them before they become compliance issues.

Get Professional Advice if Needed

Navigating tax regulations and ensuring compliance with factoring transactions can be complex. Consulting with tax professionals or accountants who understand the intricacies of factoring and tax laws is invaluable. These experts can provide guidance tailored to your business’s specific situation, helping to optimize tax outcomes and ensure compliance.

Practical Steps to Factoring with Tax Considerations

Factoring, when incorporated into your financial strategy with tax considerations in mind, can not only enhance your cash flow but also streamline your tax processes and preparation.

Preparing for Tax Season with Factoring in Mind

First, let’s review some practical steps and tips for integrating factoring into your tax strategy, ensuring you’re well-prepared for tax season and beyond.

Maintain Detailed Records

Keep meticulous records of all factoring transactions, including invoices sold, the amount received, fees paid, and dates of transactions. This documentation is crucial for accurate income reporting and expense deductions.

Understand the Income Recognition Timing

Recognize that the income from sold invoices must be reported in the tax year it’s received, not when the payment from your customer was due. Plan your factoring activities with this timing in mind to manage taxable income effectively.

Classify and Track Factoring Fees

Document all factoring fees as business expenses. These fees are generally tax-deductible, so accurately tracking them can reduce your taxable income.

Consult with a Tax Professional

Given the complexities of tax laws, it’s wise to consult with a tax advisor or accountant who understands factoring. They can provide guidance on reporting requirements and help optimize your tax situation.

Review Your Factoring Agreement

Be clear on whether your factoring agreement is recourse or non-recourse, as this affects the treatment of bad debts and can have tax implications.

Streamlining Your Tax Processes via Factoring

As you move forward and leverage factoring throughout the year, keep the following points in mind.

Leverage Factoring for Steady Cash Flow

Use factoring to ensure you have the cash flow needed to cover tax liabilities on time. This can help avoid penalties and interest for late payments.

Automate Factoring and Tax Records

If possible, use accounting software that can integrate with your factoring company’s reporting. This automation can save time, reduce errors, and simplify the reconciliation process.

Plan for Tax Payments

With the predictable cash flow from factoring, set aside a portion of the funds specifically for tax payments. This helps prevent the scramble to find resources when taxes are due.

Use Factoring to Invest in Tax-Saving Strategies

The immediate cash from factoring can be reinvested in the business, potentially creating additional tax deductions. For example, purchasing new equipment or investing in research and development can offer tax benefits.

Stay Informed on Tax Law Changes

Tax laws and regulations can change, impacting how your factoring transactions are treated. Stay informed on current laws and consult with your tax advisor for any updates that could affect your business.

Make Factoring Part of Your Cash Flow and Tax Strategy

Whether you’d like more control over when your income is recognized or want to accelerate cash flow year-round, invoice factoring can help. To learn more or get started, request a complimentary rate quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300