Trying to figure out how to qualify for factoring? Generally speaking, factoring application requirements are fairly simple, and most businesses with business-to-business (B2B) invoices qualify. However, familiarizing yourself with the process, ensuring your financials are clean, and having some basic documentation ready will streamline your approval more quickly. Below, we’ll walk you through some preliminary steps you can take now to help ensure you can move to the funding phase fast.

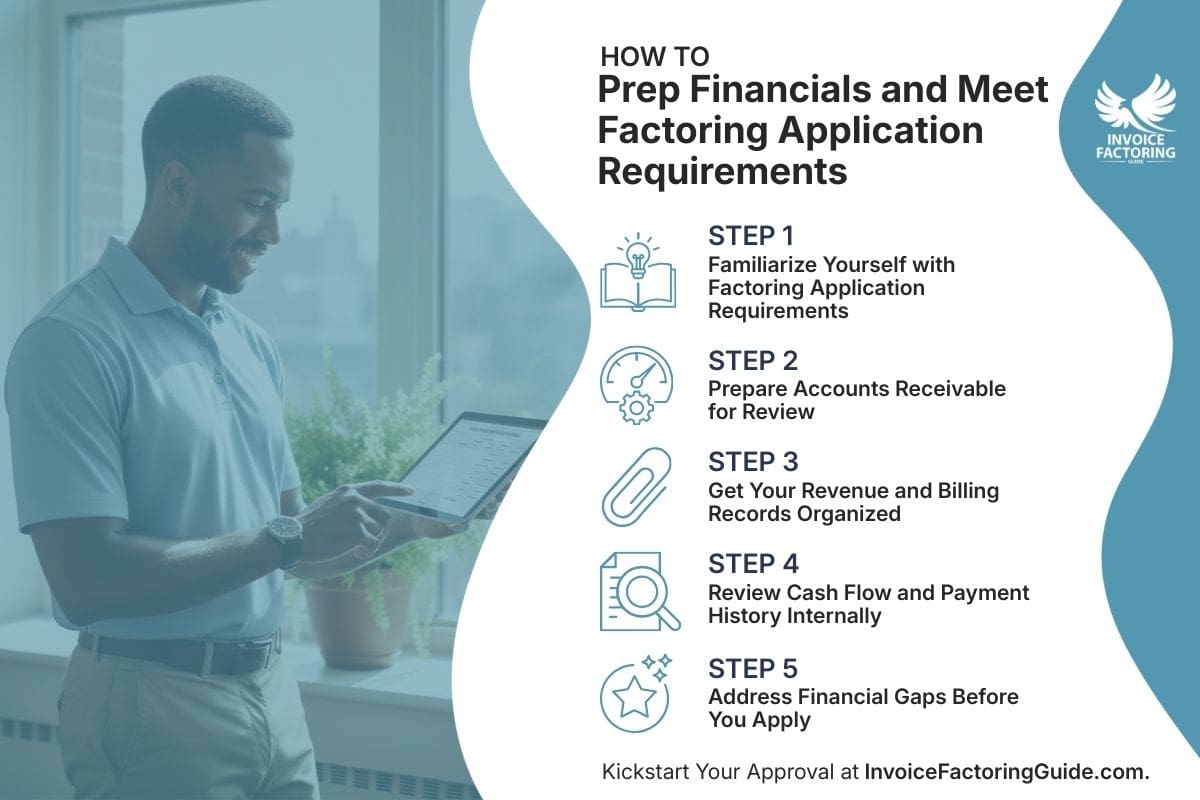

Step 1: Familiarize Yourself with Factoring Application Requirements

Before you begin gathering documents, it helps to understand what factoring companies actually look at during the application process.

Factoring is different from traditional lending. Your credit history and net worth matter less than the quality of your invoices and the payment behavior of your customers. Most requirements focus on your receivables and how reliably they convert to cash.

What Factoring Companies Review

Factoring companies evaluate a few key areas to determine whether your invoices are fundable.

- Invoice Accuracy and Legitimacy: Invoices must reflect completed work, match agreed-upon terms, and be free of disputes.

- Customer Payment Behavior: Your customers’ payment speed and consistency affect approval more than your own credit score.

- Billing Consistency: Standardized billing practices make it easier for factoring companies to verify and process invoices.

Core Financial Documents Needed for Factoring

You’ll need a few common financial documents when you apply for factoring. If you use accounting software like Zoho Books, FreshBooks, or Xero, they should be easy to gather.

- Accounts Receivable Aging: This report shows all open invoices and how long each one has been outstanding.

- Customer Concentration Summary: This document breaks down how much revenue your business receives from each customer, highlighting accounts that make up a significant portion of your receivables.

- Billing and Payment History: These records show when invoices were issued, when payments were received, and how long it typically takes your customers to pay.

- Revenue Reports Tied to Invoicing: These summaries reflect earned revenue and should align directly with the invoices you plan to factor.

Additional Supporting Documents Needed to Determine Factoring Funding Eligibility

In addition to the financial reports and documents covered above, you’ll also need to have some basic business documents ready to avoid delaying the factoring approval process.

- Sample Invoices: These provide a snapshot of how you bill, including structure, payment terms, and line-item detail.

- Proof of Delivery or Service Completion: These documents confirm the work was fulfilled, using delivery receipts, signed work orders, or service logs.

- Contracts or Rate Agreements: These outline the terms, pricing, and scope of work agreed to between you and your customers.

- Basic Business Information: This includes your legal business name, entity structure, and tax identification number used for verification.

Step 2: Prepare Accounts Receivable for a Factoring Eligibility Review

Once you understand what factoring companies look for, the next step is to get your accounts receivable (AR) ready for review. This is one of the most important parts of the application process because your AR report is the foundation of the deal. If it is outdated, unclear, or cluttered with uncollectible invoices, it can slow approval or result in less favorable terms for your business.

Review Your Aging Report

Your aging report should be current, well-organized, and free of stale or disputed invoices. Factoring companies generally focus on invoices that are 30 to 60 days old, though some will consider invoices up to 90 days old if the customer has a solid payment history.

- Remove Uncollectible Invoices: Any invoice that is unlikely to be paid due to disputes, customer insolvency, or aging past 90 days should be removed or clearly marked.

- Separate Paid Invoices: Make sure fully paid invoices do not appear as open. Mistakes like this raise concerns about how reliable your records are.

- Verify Invoice Dates and Terms: Check that due dates, payment terms, and invoice dates reflect the actual agreement with your customer.

Flag Potential Issues Ahead of Time

If you know certain customers are slow to pay or that some invoices have unusual terms, flag them in advance.

- Highlight Known Slow Payers: If a major customer routinely pays after 90 days, make a note of it. Transparency builds trust.

- Disclose Ongoing Disputes: If any invoices are under review or partially withheld, identify those before the factor finds them.

- Note Credit Memos or Adjustments: If you anticipate reductions to invoice amounts, include documentation to explain the change.

Use Consistent Formatting

Your aging report and any supporting documentation should follow a consistent format.

- Use Standard Columns: Include invoice number, customer name, invoice date, due date, total amount, and aging buckets.

- Avoid Manual Edits in the File: Changes should be made in your accounting system and re-exported. Manual edits can trigger questions about data integrity.

- Match Your Invoice Records: Make sure invoice amounts and due dates match your billing system exactly. If they do not, reconcile the difference before submitting.

Step 3: Get Your Revenue and Billing Records Organized

Factoring companies also review the financial activity behind your aging report. That includes how you track revenue, issue invoices, and document the flow of payments. If this information is disorganized or inconsistent, it creates uncertainty around the reliability of your receivables.

Organizing your revenue and billing records in advance gives the factor the clarity they need to assess your business efficiently.

Align Revenue Reports with Invoicing Activity

Factoring companies want to see that your invoiced revenue reflects actual work performed and follows your normal operating rhythm.

- Use a Standard Revenue Report: This should show earned revenue over the past 30 to 90 days, ideally tied to completed work or delivered goods.

- Match Revenue to Invoice Timing: Revenue entries should align with invoice dates and customer payment terms.

- Exclude Unbilled or Deferred Revenue: If revenue has been earned but not yet invoiced, it should be removed from any report submitted with your application.

Ensure Invoices Follow a Consistent Structure

Inconsistent invoicing is one of the most common friction points in the application process. Factors need to quickly understand your billing format so they can verify customer obligations and payment terms.

- Include Standard Invoice Elements: Each invoice should include your business name, customer name, invoice number, date, line items, total, and payment terms.

- Apply Terms Uniformly: If you use Net 30 or Net 45 terms, make sure they are applied consistently unless otherwise agreed in writing.

- Label Credit Memos and Adjustments Clearly: Any credits, refunds, or billing changes should be documented and labeled so they are not mistaken for unpaid balances.

Organize Billing Records for Quick Review

Beyond the invoices themselves, be ready to provide documentation that supports your billing activity.

- Provide Access to Rate Sheets or Contracts: These help verify that your invoice amounts match what was agreed upon.

- Group Invoices by Customer: Sorting by customer makes it easier for the factor to assess payment history and concentration risk.

- Keep Supporting Documents Close: If any invoice requires backup, such as proof of service or a signed time sheet, have that ready in the same folder or file batch.

Step 4: Review Cash Flow and Payment History Internally

Before you submit your application, it is worth taking a closer look at how cash moves through your business. Factoring companies review payment history to understand how consistently your customers pay and how predictable your cash flow is. If your records are unclear or if payment patterns raise questions, you may lose leverage in the approval process.

This step gives you a chance to identify potential concerns before the factoring company points them out.

Identify Cash Flow Gaps or Irregularities

You do not need perfect cash flow to qualify for factoring. But if your records show major delays or unpredictable patterns, it helps to understand why and be ready to explain.

- Spot Gaps Between Revenue and Collection: Look for any delays between when invoices are issued and when payments arrive. Extended gaps may signal issues that need clarification.

- Account for Seasonal or Contract-Based Spikes: If revenue fluctuates due to project timing or customer contract terms, make a note so the context is clear.

- Review Large Outstanding Balances: If certain customers consistently carry high balances or delay payment, those patterns may affect approval terms or concentration limits.

Check for Payment Consistency Across Customers

The more consistent your customer payment history, the easier it is to get fast approval and better terms.

- Review Average Days to Pay by Customer: Use your records to estimate how long each customer typically takes to pay after invoicing.

- Flag Deviations from Contract Terms: If a customer regularly pays late despite agreed terms, it helps to disclose that in advance.

- Look for Repeat Payment Adjustments: Frequent credits, short-pays, or corrections may be a sign of internal billing issues or customer pushback.

Prepare to Explain Any Anomalies

If you find anything unusual, document it now. It can help build your credibility and reduce friction.

- Note One-Off Events or Exceptions: Late payments due to customer system changes, personnel turnover, or project delays can usually be explained.

- Disclose Recent Changes in Terms or Contracts: If payment terms were recently renegotiated, include a brief note or copy of the new agreement.

- Document Disputes or Delays Already Resolved: If a customer issue has already been cleared up, include proof to close the loop.

Step 5: Address Financial Gaps Before You Apply

Once you’ve reviewed your receivables, billing, and payment history, you may spot issues that could complicate your application. This step is about correcting what you can and preparing explanations for anything you cannot change. Most financial gaps will not disqualify you from factoring, but ignoring them can delay approval or result in less favorable terms.

Clean Up Any Outstanding Issues You Can Control

Some gaps can be fixed quickly, especially if they stem from outdated records or internal processes.

- Update Aging Reports and Payment Logs: Make sure all payments are recorded and matched correctly to the invoices they cover.

- Remove Dead or Uncollectible Invoices: If an invoice has aged past ninety days with no realistic path to payment, remove it from your active receivables.

- Organize Supporting Documentation: Gather missing contracts, rate sheets, or proof-of-completion docs that were flagged earlier.

Prepare to Explain the Rest

If a gap or inconsistency cannot be fixed, focus on providing a short, factual explanation. Even a short sentence added to your application notes or email can help underwriters make faster, more confident decisions.

- Document Customer-Specific Challenges: Unusual terms or late payments tied to a specific customer should be acknowledged and explained.

- Clarify Past Disputes or Adjustments: If a billing error or payment shortfall has already been resolved, include notes that close the loop.

- Explain Any Temporary Operating Changes: If revenue dipped due to staffing shortages, project delays, or one-time events, put that in context.

Focus on What Strengthens Your Position

Not all financial gaps are negative. Sometimes, this is your chance to highlight things that make your business more attractive to a factoring company.

- Show Consistency Across Your Top Customers: If your biggest accounts pay reliably and on time, call that out.

- Emphasize Clean Billing and Low Dispute Rates: If you rarely issue credits or corrections, that speaks to invoice quality.

- Highlight Recent Improvements: If you’ve upgraded your accounting system, changed your billing cycle, or started offering early payment discounts, those changes may reduce risk from the factor’s perspective.

Kickstart Your Business Factoring Approval

If you’re ready to move forward, the next step is to connect with a factoring specialist. Share a few details about your business to receive a complimentary factoring quote.

FAQs on Factoring Application Requirements and Preparing Business Financials for Factoring

What are the basic factoring requirements?

Factoring approval depends on having clear, valid invoices and creditworthy customers. Most providers look for an updated AR aging report, consistent billing records, and supporting documentation like contracts or delivery confirmations. Your business must also be free of liens that would prevent assignment of receivables to the factoring company.

How do I prepare my business financials for factoring?

Start by organizing your accounts receivable records, making sure invoices are accurate and aging reports are current. Match your revenue and billing data, remove uncollectible balances, and prepare documentation that supports your invoicing. Review customer payment history and be ready to explain any irregularities before you submit your application.

What’s involved in the factoring approval process?

After you submit your application, the factoring company reviews your receivables, billing records, and supporting documents. They assess invoice quality, customer payment behavior, and contract terms. Once approved, you’ll sign an agreement outlining fees and terms. Funding can begin shortly after onboarding and verification are complete.

Do I need financial statements to apply for invoice factoring?

You typically do not need full financial statements, like a balance sheet or income statement, to apply. Most factoring companies focus on receivables-related documents, such as aging reports, billing records, and payment history, rather than your overall financial position.

What does a factoring company look for in your receivables?

Factoring companies look for valid, undisputed invoices backed by consistent customer payment history. They focus on aging, customer concentration, and documentation that confirms the invoice reflects real work completed under agreed terms.Factoring companies look for valid, undisputed invoices backed by consistent customer payment history. They focus on aging, customer concentration, and documentation that confirms the invoice reflects real work completed under agreed terms.

Can I apply for factoring with overdue invoices?

Many factoring companies accept invoices up to 90 days past due, but extremely aged or uncollectible invoices are usually excluded. Clean, recent receivables with predictable payment patterns strengthen your application and lead to better terms.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300