Nearly three in five small businesses struggle with cash flow, according to QuickBooks surveys. It’s not that these businesses aren’t profitable, or even that they’re doing anything wrong. Simply put, when you run a smaller operation and your customers take too long to pay, you experience seasonal shifts, or the business starts growing rapidly, there’s often a gap between when you need to cover essential expenses and when the money comes in from customers. Invoice factoring and business lines of credit are two common solutions to this issue. They both let you secure funds as needed rather than taking out a lump-sum loan. However, there are key differences between them, and there are times when it’s better to choose one over the other. Below, we’ll provide some background information on each, then compare factoring vs. line of credit, so it’s easier to see which is the right fit for your needs.

Business Line of Credit: How it Works and What You Need to Know

A business line of credit is a flexible funding tool that gives you access to a set amount of money that you can draw from as needed. Think of it as a credit card for your business, but with better rates and more flexibility for larger expenses. You only pay interest on the amount you use, and once you repay what you borrowed, your full credit line becomes available again.

How a Business Line of Credit Works

A business line of credit gives you flexible access to funds that you can draw from and repay as needed. Let’s review how it typically functions.

- Credit Limit is Established: If approved, your business is granted access to a revolving pool of funds, such as $50,000.

- Funds Are Drawn as Needed: You can use all or part of the credit line at any time, for any business-related expense.

- Interest Accrues on Amount Used: You only pay interest on the portion you withdraw, not on the full limit.

- Credit Line Replenishes with Repayment: Once you pay back what you borrowed, those funds become available to draw again.

Approval Requirements for a Business Line of Credit

Getting approved for a business line of credit is usually more difficult than qualifying for a credit card, but less demanding than applying for a traditional loan. That said, lenders will still scrutinize your financials closely. Common approval requirements include:

- Established Business History: Most lenders want to see that your business has been operating for at least one to two years.

- Strong Personal and Business Credit Scores: A personal credit score of 680 or higher or a business credit score of at least 75 is typically required, as Bill.com reports.

- Consistent Revenue Streams: Lenders usually require at least $25,000 to $100,000 in annual revenue, depending on the institution.

- Financial Documentation: Be prepared to provide tax returns, bank statements, balance sheets, and profit and loss statements.

- Strong Debt Service Coverage Ratio: Lenders want to see that your business generates enough income to cover its existing debt payments comfortably.

Advantages of a Business Line of Credit

When used strategically, a line of credit can be a valuable financial tool.

- Ongoing Access to Funds: You do not need to reapply each time you need capital, which can be a huge time-saver.

- Interest Only on What You Use: This makes it more affordable than fixed-term loans when you are borrowing in small amounts or infrequently.

- Flexible Repayment Terms: Some lenders allow interest-only payments during the draw period, giving you more breathing room.

- Stronger Cash Flow Management: It can help bridge temporary gaps in receivables or allow you to take advantage of time-sensitive opportunities.

Disadvantages of a Business Line of Credit

While flexible, a line of credit also comes with risks and limitations.

- Difficult Approval Process: Many small businesses are denied due to lack of time in business, poor credit, or inconsistent cash flow.

- Low Credit Limits: Especially if you are a newer business, your approved amount may not be enough to cover significant expenses.

- Fees and Hidden Costs: Some lines come with maintenance fees, draw fees, or inactivity charges, even if you do not use the funds.

- Risk of Overreliance: Because the funds are always available, it is easy to lean on them repeatedly, leading to long-term debt creep.

Invoice Factoring: How it Works and What You Need to Know

Invoice factoring is a funding solution that lets your business turn unpaid customer invoices into immediate working capital. Instead of waiting up to 90 days for your customers to pay, you can get most of the invoice value upfront, often within 24 hours, by selling the invoice to a factoring company.

It’s not a loan. There is no debt to repay. Instead, the factoring company advances you cash and then collects from your customer when the invoice is due.

How Invoice Factoring Works

The factoring process is straightforward.

- You Provide Goods or Services: Your business delivers products or services to a customer and issues an invoice with payment terms.

- You Sell the Invoice to a Factoring Company: The factoring company buys the invoice and advances you up to 95 percent of its value, or sometimes even more, depending on your industry and customer base.

- Customer Pays the Factoring Company: When the invoice comes due, your customer pays the factoring company directly.

- You Receive the Remaining Balance: Once payment is received, the factoring company sends you the remaining amount, minus their fee.

Approval Requirements for Invoice Factoring

Compared to traditional financing, invoice factoring has fewer barriers to entry. Approval is based more on the strength of your customers than your own credit score. Typical approval requirements include:

- B2B or B2G Business Model: Factoring is designed for companies that invoice other businesses or government entities, not consumers.

- Unpaid Invoices for Completed Work: You must have verifiable invoices for goods or services already delivered.

- Customers with Reliable Payment Histories: Factoring companies evaluate the creditworthiness of your customers, since they will be the ones paying.

- Basic Documentation: Expect to provide copies of your invoices, customer contracts or purchase orders, and sometimes aging reports.

Advantages of Invoice Factoring

Factoring offers both immediate benefits and long-term financial flexibility.

- Fast Access to Working Capital: You can receive funding in as little as one business day without taking on debt.

- Flexible Qualification Criteria: Your customers’ payment habits matter more than your own credit history.

- Built-In Collections Support: Most factoring companies follow up on payment professionally, saving your team time.

- No New Debt on Your Balance Sheet: Since this is not a loan, it does not increase your liabilities or impact your debt-to-income ratio.

- Scales with Revenue: As your sales and invoices grow, your available funding increases with them.

Disadvantages of Invoice Factoring

While factoring is a powerful tool, some business owners hesitate due to misconceptions or poor past experiences.

- Customer Notification Can Feel Awkward: Your customer will usually be notified that a factoring company is handling the invoice. Be sure to choose a factoring company with experience in your industry that uses soft-touch or white-label communication. Many will act as an extension of your team and maintain your brand voice.

- Costs May Be Higher Than Traditional Loans: Factoring fees typically range from one to five percent of the invoice value, depending on the terms and risk level. Negotiate lower rates based on volume or customer credit quality. You can also reduce costs by opting for recourse factoring or shorter repayment periods.

- Not All Invoices Qualify: If your customer has a history of late payments or disputed charges, their invoices might be rejected. Keep detailed records, avoid billing errors, and prioritize customers with strong payment histories when submitting invoices for factoring.

- Long-Term Contracts and Minimums Can Be Restrictive: Some factoring companies require 12-month contracts or monthly minimums. Look for spot factoring providers that offer month-to-month terms and no volume requirements. These are more common than they used to be.

Factoring vs. Line of Credit: A Side-by-Side Comparison

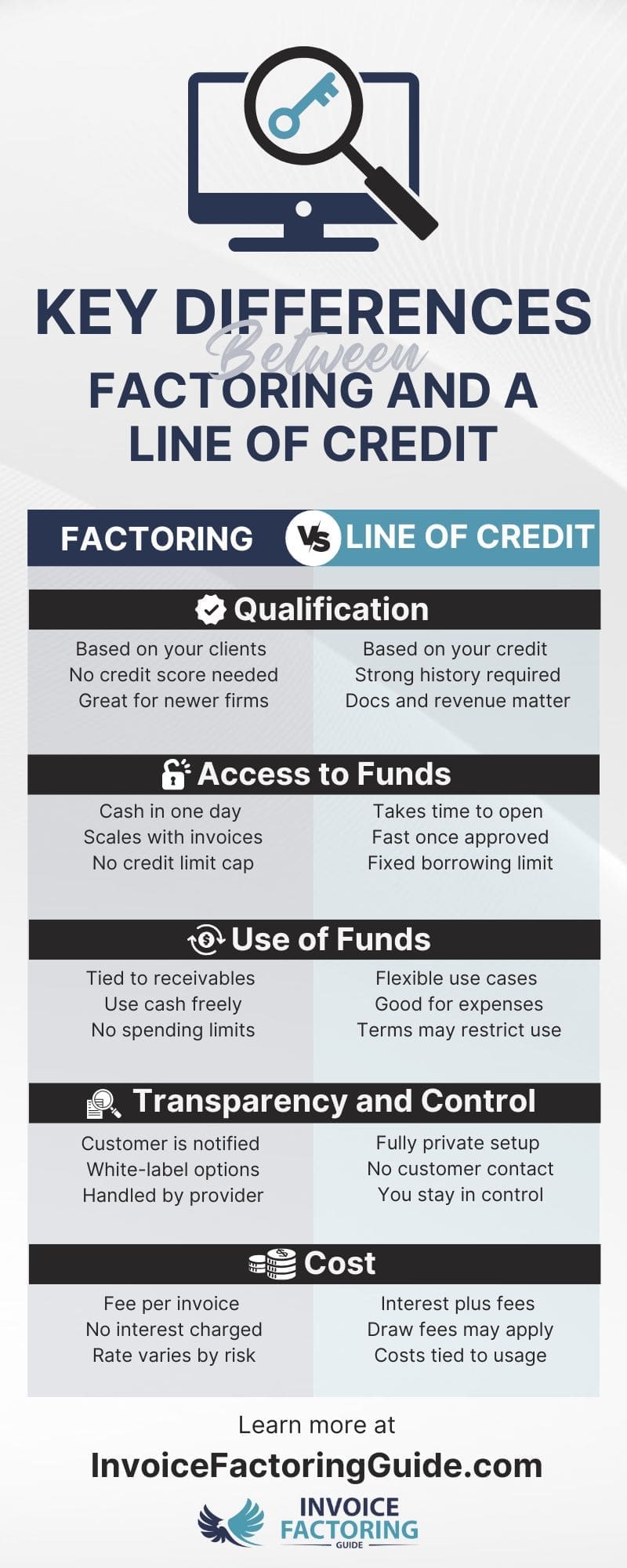

Both invoice factoring and business lines of credit are used to solve cash flow challenges, but they are structured differently and serve different types of businesses. If you’re trying to decide which one is right for your situation, the key is understanding how each one works and what kind of business it’s best suited for. Here’s a closer look at how they compare.

Qualification

With factoring, approval is based largely on your customers’ creditworthiness, not yours. That makes it an accessible option if your business is newer, you have limited credit history, or you have been turned down for other types of funding. If your customers are reputable and tend to pay on time, you are more likely to get approved, even if your own financials are less established.

With a line of credit, your credit score, time in business, and financial performance all come under scrutiny. Lenders want to see that you have a strong credit profile, consistent revenue, and healthy financial ratios. If your business is well-established and your financials are solid, you are more likely to qualify and secure a higher limit.

Access to Funds

With factoring, funds are typically available within 24 hours of invoice submission. You do not need to reapply to access capital, and as long as you are generating invoices and your customers are reliable, your access to funds grows with your sales.

With a line of credit, funding is available as soon as you are approved and draw on your limit. However, the approval process can take several days or even weeks. Once in place, it functions as a revolving line, so you can borrow and repay repeatedly within your credit limit.

Repayment

With factoring, you are not borrowing money. There is no loan and no repayment schedule. Instead, the factoring company advances you most of the invoice value, then collects payment from your customer when the invoice comes due. Their fee is deducted from the final payment they send you.

With a line of credit, you repay whatever amount you draw, along with interest. Repayment typically happens on a monthly basis, and the terms vary depending on the lender. Some lines allow interest-only payments for a time, while others require full repayment within a set number of months.

Use of Funds

With factoring, funding is directly tied to customer invoices. That means it is most useful when you are waiting to be paid and want to unlock working capital from accounts receivable. It can be a smart choice if your business is growing quickly, but cash is tied up in unpaid invoices.

With a line of credit, you can use the funds for almost any business purpose, including payroll, equipment repairs, or unexpected expenses. Since it’s not tied to specific invoices, it gives you more control over how the money is used, but that also requires careful planning to ensure repayment is manageable.

Transparency and Control

With factoring, your customer is usually notified that a third party is managing the invoice. Some business owners worry about how this will be perceived, but many factoring companies offer white-label or soft-touch communication options that maintain your brand reputation. If privacy is important to you, look for providers that specialize in confidential factoring or non-notification agreements.

With a line of credit, your customers are never involved. You remain in full control of customer communication and collections. This setup keeps all funding activity behind the scenes, which some businesses prefer, particularly if brand perception is a concern.

Cost

With factoring, fees typically range from one to five percent of the invoice value, depending on your industry, your customers’ payment history, and the structure of your agreement. While that can be more expensive than a traditional loan, you can reduce costs by factoring only select invoices, negotiating better terms, or choosing customers with faster payment cycles.

With a line of credit, you pay interest only on the funds you draw, and the rate is usually lower than what you would pay with a credit card. However, some lenders charge maintenance fees, draw fees, or early repayment penalties. Be sure to read the fine print and ask for a breakdown of all costs before signing.

Factoring vs. Line of Credit: Which Is Right for You

If your business qualifies for both a line of credit and factoring, the right choice often comes down to your priorities, how quickly you need funds, and what financial challenges you’re trying to solve.

Situations When Factoring Beats a Line of Credit

While a line of credit is helpful for ongoing flexibility, factoring is often the better fit in the scenarios below.

- You Have Cash Flow Gaps Caused by Slow-Paying Customers: If your customers take up to 90 days to pay and it is putting pressure on your ability to meet payroll, purchase inventory, or take on new work, factoring gives you a way to bridge the gap without taking on debt. You get paid on your timeline, not theirs.

- You Were Turned Down for a Line of Credit or Want to Avoid a Credit Check: Factoring companies focus on your customers’ credit history, not yours. If you are a newer business, have less-than-perfect credit, or want to preserve your credit for other uses, factoring gives you a path forward without impacting your score.

- You Need Fast Access to Working Capital: Bank approvals can take days or weeks. Factoring approvals often take just a few hours, and once you’re set up, funds can be delivered in one business day or less. That speed can make the difference when a tight deadline or opportunity comes up.

- Your Business Is Growing Quickly: Factoring scales with your revenue. As you bring in more sales and issue more invoices, the amount of working capital available to you increases automatically. With a line of credit, you’re limited to the amount originally approved, unless you reapply and undergo another review.

- You Want to Streamline Back-Office Operations: Most factoring companies include professional collections as part of their service, which means you can reduce the time your team spends chasing down payments. Some even offer credit checks on new customers so you can make smarter sales decisions up front.

- You Are in an Industry with Extended Payment Cycles: If you’re in trucking, staffing, construction, manufacturing, or any industry where customers often take longer to pay, factoring is already a common solution. Many companies in these spaces use factoring as a long-term strategy, not just a stopgap.

Get Approved for Invoice Factoring

Factoring is not the right tool for every situation, but when cash flow is tied up in invoices and speed matters more than long-term interest rates, it’s a practical and effective choice. If you’re unsure whether your business is a fit, most factoring companies will review your invoices and customer base at no cost to help you decide. To take the first step, request a complimentary rate quote.

Factoring vs. Line of Credit FAQs

Should I use invoice factoring or get a business line of credit?

If your cash flow challenges stem from unpaid invoices, factoring is likely the better fit. If you want general-purpose access to funds and can qualify based on your credit, a line of credit may be more flexible. Your credit history and funding speed needs also play a role.

What is the difference between a line of credit and invoice factoring?

A line of credit is a revolving loan from a lender that you repay with interest. Factoring is not a loan. You sell invoices to receive upfront cash. With factoring, your customers repay the factoring company. With a line of credit, repayment is your responsibility.

Is factoring more expensive than a line of credit?

Factoring typically costs more than a business line of credit when you compare fees to interest rates, and you immediately pay back any money you draw from your line of credit. However, factoring offers fast access without debt, which adds value for businesses that cannot qualify for traditional financing or need a solution tied directly to accounts receivable. It also comes with perks like collections services and customer credit checks, which can save you time and money.

Is it easier to qualify for factoring or a business line of credit?

Factoring is usually easier to qualify for. Approval depends on your customers’ credit, not yours. A line of credit requires a strong credit profile, financials, and time in business. Startups or companies with limited credit histories often find factoring more accessible.

Which option gives faster access to cash: factoring or line of credit?

Factoring provides faster access to funds, often within one business day of submitting an invoice. A business line of credit takes longer to get approved, sometimes several days or weeks, but once established, it allows fast withdrawals. For immediate cash needs, factoring is typically quicker.

Does factoring or a line of credit affect my credit score more?

A line of credit may impact your credit score, especially if you miss payments or carry high balances. Factoring usually does not affect your credit because it is not a loan. The factoring company evaluates your customers’ credit, not yours, and there is no debt involved.

Which is riskier: factoring or a business line of credit?

A line of credit carries more financial risk because it adds debt and requires monthly repayment. Factoring does not create debt, so it is generally less risky. That said, if your customers fail to pay, you may still be responsible depending on your factoring agreement.

Do factoring companies check your credit like lenders do?

Most factoring companies perform only a soft credit check, or none at all. Their main concern is your customers’ ability to pay. In contrast, lenders offering lines of credit require full credit checks and detailed financial reviews before making a decision.

Can I qualify for factoring if I was denied a line of credit?

Yes. Many businesses that are turned down for a line of credit can qualify for factoring. That is because factoring approval depends on your customers’ credit, not your own. It is a common path for newer businesses or those with inconsistent financials.

Which is better during rapid growth: factoring or line of credit?

Factoring is often a better fit during rapid growth because funding scales with your invoices. As sales increase, so does your access to capital. A line of credit has a fixed limit, which can restrict your ability to respond to new demand or opportunities.

Can I use both factoring and a line of credit at the same time?

Yes, but coordination matters. Some lenders restrict access to factoring if you already have a line of credit secured by receivables. If you plan to use both, be clear with each provider and avoid overlapping collateral to stay compliant with all agreements.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300