Invoice factoring is prized for its fast payouts, but when you have payroll or another large expense looming, knowing your funds will be available “soon” is not enough. In this guide, we’ll explore the full factoring payment process, what happens at each step, issues that can delay payments, and when you can expect cash in your account.

Where Payments Fit in the Factoring Process

Factoring gives your business access to working capital based on work you’ve already completed, but the money doesn’t arrive until specific steps are completed. Each payment is tied to a milestone in the process, from invoice submission to final collection.

Step 1: Submit the Invoice

Everything starts when your business completes a delivery or service and sends the invoice to the factoring company. Depending on your industry, this may also include supporting documents, such as:

- Proof of Delivery: You will likely need a signed bill of lading, delivery receipt, or timesheet showing the work was completed.

- Invoice Copy: The factor will need a clean, customer-facing invoice that matches the agreed-upon terms.

- Rate Confirmation or Contract: Some factors also ask for documentation confirming pricing or scope.

Step 2: Invoice Validation

Validation helps the factor determine whether the invoice is eligible for funding and protects both parties throughout the transaction. The validation process typically involves:

- Customer Verification: This involves confirming that the business being billed is creditworthy and properly matched to the invoice. Many factoring companies do customer credit checks during the initial approval process, which can accelerate this step. In specialized industries, such as trucking and oilfield services, factors may also maintain a list of pre-approved customers to speed up the timeline.

- Work Completion: This involves ensuring that goods or services were delivered as agreed, without open disputes.

- Documentation Review: The factor will confirm that all required documents are present and consistent.

Step 3: Advance Payment is Issued

Once the invoice is validated, the factoring company issues your first payment. This is called the factoring advance, and it typically covers 80 to 95 percent of the invoice value, depending on the risk level and terms of your agreement.

This is the portion your business can access immediately, giving you the ability to:

- Manage Operating Costs: Cover payroll, materials, or fuel.

- Maintain Cash Flow: Keep your business running between jobs or payment cycles.

- Take on New Work: Free up resources to pursue growth opportunities.

- And More: Factoring companies don’t put restrictions on how you can spend your advance, so you can put it to work in whatever makes the most sense for your business.

Step 4: The Factor Waits for Customer Payment

Factoring frees you from chasing invoices. Some factoring companies will even prepare the invoices for you. Then, after the advance is sent, the factoring company takes over the collection process and waits for your customer to pay the invoice. During this time, the remaining unpaid balance, known as the factoring reserve or holdback, is held. It’s typically between five and 20 percent of the invoice value and allows the factor to account for possible short payments, discounts, or disputes.

Step 5: Reserve is Released

Once the factor receives full payment from your customer, the transaction is finalized. The factoring company sends you the remaining balance minus a small factoring fee, which is typically between one and five percent of the invoice’s value.

Here’s what that can look like in practice:

- Invoice Amount: $10,000

- Advance Rate: 90 percent → $9,000 sent up front

- Reserve Held: ten percent → $1,000 set aside

- Factoring Fee: two percent → $200

- Final Reserve Payment: $800 after customer payment is received

How Factoring Companies Pay Clients

Factoring companies use several different methods to deliver funds. The method you choose affects how your business receives its advance and reserve payments, and in some cases, it may influence cost.

Common Payment Methods

Most factoring companies support a few standard delivery options. These are usually selected during onboarding, but some allow you to switch between methods when needed.

- ACH Transfer: Automated clearing house (ACH) payments are a standard bank-to-bank transfer that typically settles in one to two business days. This is the most common method, and it usually does not come with added fees.

- Wire Transfer: When funds are needed urgently, factors may offer wire transfers to get you paid faster. Wire transfers generally arrive the same day but may come with a fee, often between fifteen and forty dollars, depending on the bank.

- Fuel Card or Debit Card Load: Sometimes, factors will load your money onto a card used for business expenses. This is especially popular in the transportation industry, where drivers may need instant access to fuel money while on the road. The fuel card is often paired with fuel discounts. Factoring benefits like this are often overlooked, so be sure to ask if any special services are available.

- Checks by Mail or Pickup: As a final option, some factors may drop a check in the mail for you or even let you pick it up from their headquarters.

Choosing the Right Factoring Payment Method

Each method has tradeoffs. ACH transfers are the most widely used due to their balance of speed and cost. Wire transfers are useful for time-sensitive payments but come at a higher cost. Card loads serve specific industries where immediate access to funds is critical.

Understanding your payment options up front helps you choose the method that best fits your business model. Most factoring companies will walk you through your choices during onboarding and allow you to adjust preferences as your needs change.

Your Timeline for Factoring Payment

Once you’ve submitted an invoice for factoring, the clock starts ticking. While factoring is much faster than waiting on loans or customer payments directly, the funding timeline can still vary depending on several internal and external steps.

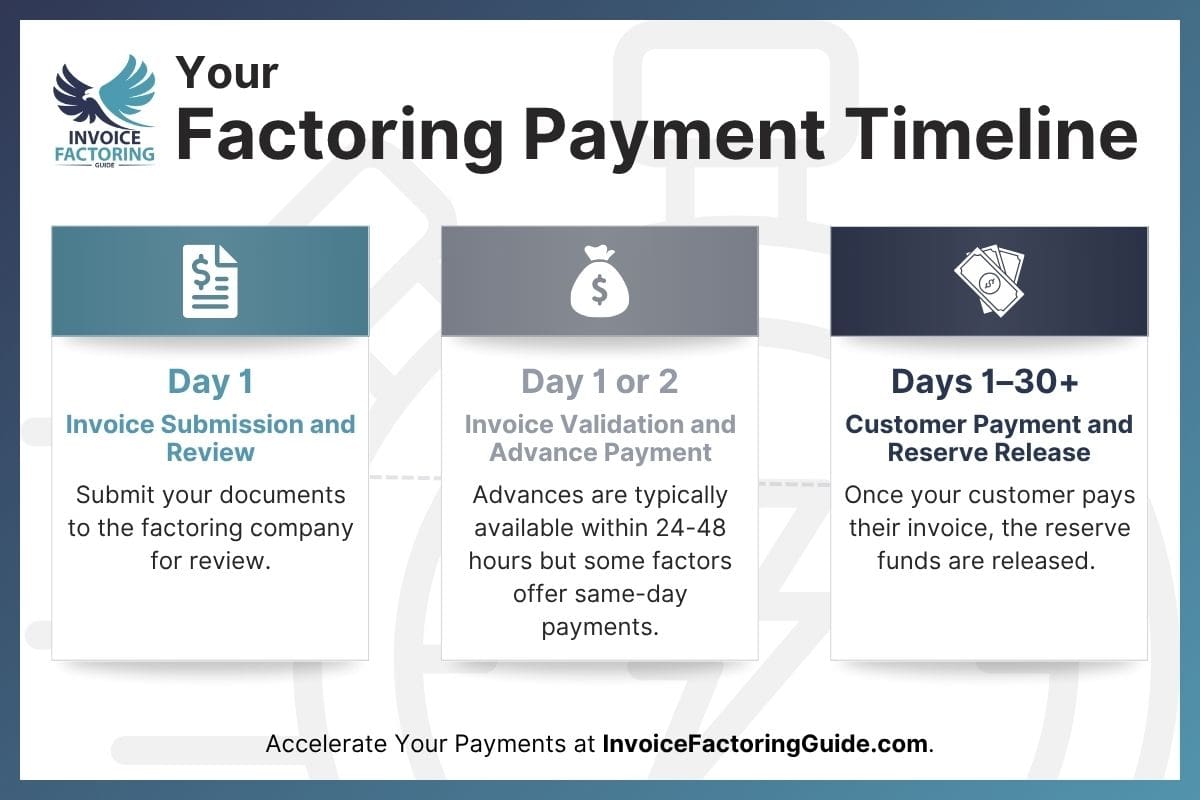

Day 1: Invoice Submission and Review

The process begins when you submit your invoice and any required documentation. If everything is in order, your invoice enters the review and validation stage. For new clients or unfamiliar customers, this step may take longer as the factor confirms creditworthiness and checks for red flags. For established clients, this stage is usually much faster.

Day 1 or 2: Invoice Validation and Advance Payment

Once the invoice is validated, the factoring company releases the advance. The timing of that release depends on your agreement and your chosen delivery method.

For example:

- ACH Transfer: Typically received within one to two business days after the payment is initiated.

- Wire Transfer: Often arrives the same day, but may take longer depending on when the transfer is submitted.

- Card Load: May be processed immediately, depending on the provider.

Some factoring companies fund in the afternoon, others in the morning. Most have a daily cut-off time for processing invoices, and anything submitted after that time rolls over to the next business day.

Days 1–30 (or More): Customer Payment and Reserve Release

After the advance is issued, your customer’s payment terms take effect. If your client operates on net 30 terms, the factoring company will typically receive payment within 30 days from the invoice date.

Once your customer pays the factoring company in full, the reserve is released, minus the factoring fee. If payment is delayed or disputed, the timeline can be extended until the issue is resolved.

Factoring Payment Timeline Example

Here’s what a typical timeline might look like for a business factoring a $10,000 invoice with net 30 payment terms:

- Day 1: Invoice submitted and reviewed

- Day 1 or 2: Advance payment of $9,000 received via ACH

- Days 2–30: Customer payment window

- Day 30: Customer pays the factor

- Day 31: Reserve of $800 released (after deducting $200 fee)

Factors That Impact Speed of Funding and How to Improve It

Understanding the most common sources of delay and knowing how to reduce them can help your business get funded as efficiently as possible.

Invoice Accuracy and Completeness

As mentioned earlier, funding begins only after your invoice and supporting documents are validated. Missing or inconsistent paperwork can delay this step, especially if the factor needs to follow up with your team or your customer to clarify details.

To prevent hold-ups, make sure your invoices are factoring-ready and that all required documents are complete, clearly labeled, and submitted in one package. The cleaner your submission, the faster the review.

Time of Day You Submit

Most factoring companies have a daily processing cut-off. If your invoice comes in late in the afternoon or after business hours, it may not be reviewed until the next day.

To avoid rollover delays, try to submit invoices early in the business day. This gives the factor time to process your submission before their internal deadline.

Your Customer’s Standing with the Factor

If your customer is already known to the factoring company, the validation process is usually straightforward. But if the customer is new, additional credit checks may be required, which can add time to your first few transactions with that client.

To reduce friction, try to work with customers your factor has already approved. If you’re onboarding a new one, consider alerting your account rep in advance so they can begin the credit review ahead of time.

Delivery Method for the Funds

As previously discussed, the payment method you choose affects how quickly your business receives funds. ACH transfers generally take one to two business days, while wire transfers often arrive the same day but often come with a cost. Some factors also offer card loads for instant access.

To shorten the wait, use wire or card transfers when timing is critical. If your needs are less urgent, ACH can still be an efficient and cost-effective option.

Internal Workflows and Reserve Release Policies

Each factoring company has its own processes for funding and releasing reserves. Some process payments once daily, while others operate in batches throughout the day. In some cases, even after your customer pays, the reserve is not released immediately. It may be held for one to three business days as part of the factor’s internal policy or system constraints.

To align your expectations, ask your factoring company about their funding and reserve release schedule. Clarify whether reserves are released the same day customer payments are received or if there’s a standard holding period.

Service Agreements and Contract Terms

Factoring contracts outline when payments are issued and under what conditions. This includes how long the factor takes to review invoices, when advances are paid, how long reserves are held, and any processing buffers that apply. If your agreement includes a service level agreement (SLA), the timeline may be more clearly defined.

If you’re still in the process of choosing a factoring company, keep a close eye out for this in factoring agreements. Review the funding timeline and reserve policies carefully. If the timeline does not meet your business needs, ask whether certain terms can be adjusted during contract negotiation.

Your Business History with the Factor

Factoring companies move faster when they’re familiar with your business. If you’re new, the process may take a little longer as the factor gets used to your documents and workflows. Over time, that familiarity leads to faster approvals and fewer follow-up requests.

To build efficiency, stay consistent in how you prepare and submit your documents. When your process is predictable, your funding timeline tends to be as well.

Your Payment Terms and the Speed of Client Payments

As mentioned, you receive the advance right away, but the reserve is not released until your client pays the factoring company. Your client is still expected to pay based on the terms you set with them, which is typically anywhere from 30 to 90 days. Naturally, the longer your terms are, the longer it will take to receive the reserve. It’s also worth noting that roughly half of all B2B payments aren’t paid by the due date, according to Atradius. The credit vetting process used by factoring companies can help minimize this for your business, but if your client still pays late, it will slow down the release of your reserve, too.

Find a Factoring Company That Pays Fast

Our network of vetted factoring companies includes factors that offer same-day payments and even some with automated payment processes that can have funds to you within hours, if not minutes, once your account is active. Request a free quote to kickstart the process.

FAQs on the Factoring Payment Process

When do factoring companies pay?

Factoring companies typically issue payment after the invoice is validated. This can happen the same day or within one to two business days. Payment timing depends on your contract terms, when the invoice is submitted, and the method of delivery, such as ACH, wire, or card transfer.

What’s the factoring dispute resolution process for slow payments?

If a customer delays payment or disputes an invoice, the factoring company will contact the client directly to resolve the issue. They may request additional documentation, proof of delivery, or updated terms. Reserve funds are held until the matter is resolved and payment is received in full.

My factoring company pays too slowly. What can I do?

Start by reviewing your contract for funding timelines and reserve policies. You can also ask about earlier processing cut-off times, faster delivery methods, or switching to a dedicated account manager. If delays continue, consider evaluating other factoring companies with better service-level agreements.

Will my bank put a hold on my factoring payment?

It depends on your bank’s policies. ACH transfers are usually available within one to two business days, but some banks place holds on large or unfamiliar deposits. Wire transfers typically post the same day with fewer delays. Contact your bank to confirm how it handles incoming business payments.

How long does it take to get paid by a factoring company?

Most businesses receive their advance within one to two business days after submitting a validated invoice. Some factoring companies offer same-day funding for established clients who submit early and use wire or card transfers. The reserve is paid after your customer pays in full.

Why is my factoring payment delayed?

Delays can happen due to missing paperwork, late-day submissions, new or unapproved customers, or bank processing times. Some factors also hold reserve funds for one to three days after receiving customer payment. Check your contract and submit early to help prevent funding delays.

What affects how fast I get paid through factoring?

Funding speed depends on invoice accuracy, submission timing, your customer’s status with the factor, the delivery method, and your agreement terms. Some factors also delay reserve payments after customer payment clears. Knowing the process helps you identify and fix common bottlenecks.

Do factoring companies pay the same day?

Some factoring companies offer same-day funding if the invoice is submitted early, validated quickly, and delivered by wire or card load. However, standard processing times are usually one to two business days. Reserve payments follow once the customer pays and any holding period ends.

When will I receive the reserve payment from my factor?

Reserve payments are released after your customer pays the factoring company in full. Some factors issue it the same day, while others hold it for one to three business days. Your agreement should outline the reserve release policy, so check those terms if timing is unclear.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300