The transportation industry is navigating some of its toughest times on record, with a 30 percent reduction in average rates per mile, as Secured Finance Network reports. This is paired with record-high waits for payment. Whereas transportation businesses once had the luxury of lamenting over 37-day waits for payment, large payers are increasingly pushing their timelines to 120 days, per TT News. How can small to midsized fleets survive in this environment, let alone thrive?

Transportation factoring offers a swift solution, turning those lengthy waits into immediate cash. On this page, we’ll explore how factoring for transportation businesses works and makes managing your expenses easier, supporting your operational freedom and enabling expansion.

Factoring Alleviates Financial Strain by Accelerating Cash Flow

Navigating the financial challenges of the transportation industry requires innovative solutions that address both immediate cash flow needs and long-term stability. Factoring is a pivotal strategy, transforming the way trucking companies manage their finances and operations.

Factoring Turns Invoices into Immediate Cash

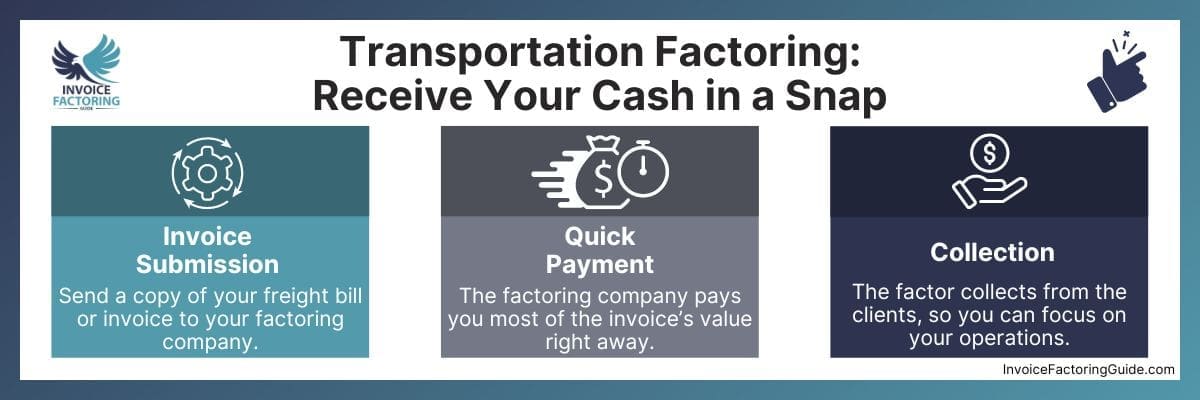

Factoring simplifies the financial management for trucking companies by converting outstanding invoices into immediate cash. This process involves:

- Invoice Submission: Send a copy of your freight bill or invoice to your factoring company.

- Quick Payment: The factoring company pays a large portion of the invoice amount upfront—sometimes as soon as the same day—providing you with immediate cash flow.

- Collection: The factoring company takes on the responsibility of collecting payment directly from the clients, allowing you to focus on your operations instead of chasing payments.

Cash Flow and Financial Stability Improve

The benefits of factoring for transportation businesses extend beyond immediate cash access:

- Enhanced Cash Flow: Provides the necessary funds to meet operational expenses, reducing the stress of payment delays.

- Strategic Flexibility: Factoring lets you choose which invoices to finance, offering control over your financial planning.

- Operational Support: Beyond financing, factoring services often include additional support like fuel advances and load board access, addressing broader operational needs.

Managing Fleet Expenses Becomes Easier

Effective fleet expense management is crucial for maintaining profitability in the competitive transportation industry. Factoring offers a multifaceted solution that extends beyond immediate cash flow improvement, directly impacting how companies manage their operational costs.

Factoring services tailored to specific regions can further enhance your business’s financial management. For instance, if your business operates in areas like Florida, Texas, or Atlanta, you can explore localized factoring solutions that address unique market challenges while providing additional perks like fuel discounts and load-board access.

Factoring Paves the Way for Strategic Allocation of Resources

With the enhanced liquidity provided by factoring, you can allocate resources more effectively, ensuring that critical expenses such as fuel, maintenance, and payroll are promptly addressed. This proactive management of expenses helps avoid potential financial shortfalls and operational disruptions.

You May Qualify for Additional Specialized Services

Factoring services often come with additional benefits that further aid in expense management, including:

- Fuel Advances: As a factoring client, you may qualify for fuel advances that provide cash as soon as you can provide proof your truck is loaded.

- Fuel Discount Programs: Access to fuel discounts can significantly reduce one of your largest variable costs.

- Maintenance and Equipment Savings: Some factoring companies offer discounts on tires and maintenance services, adding to your long-term savings and improving the reliability of your fleet.

- Load Board Access: By providing access to load boards, factoring companies help ensure trucks consistently carry loads, maximize revenue opportunities, and minimize empty miles.

Freight brokers can also benefit from dedicated solutions like factoring for freight brokers, which streamline invoice management and cash flow tailored specifically to their industry needs.

Choosing the Right Factoring Company Maximizes Benefits

Selecting the ideal factoring partner is pivotal for enhancing both financial stability and operational efficiency within the transportation sector. A strategic partnership with the right factoring company extends beyond immediate cash flow benefits, fostering long-term business growth.

If your operations are based in Texas, consider exploring factoring companies in Dallas, Texas that specialize in transportation finance and understand the unique cash flow demands and logistic challenges faced by carriers in the region.

Keep Key Considerations in Mind When Selecting a Factoring Partner

A thoughtful selection process ensures that the factoring company aligns with your business’s unique needs and goals. Essential aspects to evaluate include:

- Industry Expertise: The importance of choosing a partner with a deep understanding of the transportation industry cannot be overstated.

- Transparent Fee Structure: Clarity about fees helps you avoid unexpected costs and leverage factoring more strategically.

- Range of Services: Consider the additional services offered, such as fuel advances and load board access, to gauge how they might support your business operations.

Leverage Specialized Factoring Services for Tailored Benefits and Perks

Partnering with a factoring company that offers specialized services tailored for the transportation industry can give you a competitive edge:

- Fuel Advances and Discount Programs: Minimize major operational costs.

- Maintenance and Equipment Financing: Improve fleet reliability and operational efficiency with access to affordable maintenance and equipment financing.

- Efficient Invoice Management: Leverage professional invoice management to reduce administrative burdens and focus on your core business activities.

Strategic Financial Planning is Your Key to Success

Incorporating factoring into your financial strategy offers a powerful means to enhance liquidity and support growth. This approach allows you to confidently navigate the industry’s cyclical nature and unpredictable payment schedules.

Make the Most of Factoring’s Flexibility

Factoring isn’t all or nothing. You’re in control of which invoices you factor and when. Your available advances also scale with your business as it grows, ensuring the right level of funding for your needs is always close at hand.

Take Control of Your Relationships

Sometimes, trucking firms stick with a broker who offers advance payment, even though it can sometimes mean taking less lucrative assignments. Factoring gives you back the control, so you can secure your preferred load types more often and potentially take on more lucrative contracts.

Leverage Factoring for Long-term Growth and Stability

The integration of factoring services goes beyond immediate financial relief, providing a foundation for long-term business planning and development. With the support of a reliable factoring partner, you can focus on expanding your operations and exploring new opportunities. Many factoring companies offer other forms of business funding as well, so it’s easy to pivot as your needs change and your business grows.

Get a Free Rate Quote from a Transportation Factoring Specialist

In the challenging landscape of the transportation industry, strategic financial planning through factoring can be a game-changer for your business. Factoring not only provides the immediate cash flow needed to keep operations smooth but also supports long-term growth and financial stability. If you’re ready to explore how tailored factoring solutions can meet your unique needs, empower you to take control of your cash flow, and unlock new opportunities for success. Request your free rate quote now.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300