Nearly four in ten small business owners say they’re not feeling optimistic about the immediate future, according to a recent Thryv survey. Seven in ten say they’re not feeling optimistic about the economy, specifically. The good news is, however, that market fluctuations and uncertainty tend to come in cycles. If your business builds resilience and makes it through the storm, you’ll come out stronger in the end. But the path to overcoming volatility in a fiscal sense isn’t always straightforward. That’s where factoring for financial stability comes in. Give us a few minutes, and we’ll walk you through some of the hidden ways market fluctuations impact small businesses, how invoice factoring addresses them, and how to get started if you decide it’s the right solution for your challenges.

Market Fluctuations Create Many Challenges for Small Businesses

While it may go without saying, large businesses tend to have cash reserves, diversified revenue, and bargaining power that help absorb volatility. Small businesses don’t generally have these things, so the impact of market fluctuations reverberates throughout the business and impacts a multitude of areas.

Customers Pay More Slowly

Savvy businesspeople hold onto their cash for as long as possible, and during times of uncertainty, the behavior tends to become more extreme. You’re likely to see even “good payers” hold off until the due date to pay invoices or even pay late as their own cash flow struggles mount.

Unevenness in Revenue Becomes More Noticeable

The slow payments create a vicious cycle. Your customers pay you later, so the gap between completing work or delivering goods and getting paid widens. Most businesses in this situation start processing their own payables slowly as a result. There’s also less cash available for payroll, supplies, operational needs, and emergencies.

Demand Becomes Unpredictable

As their available funds shift, customers change their buying behavior. Businesses often see major dips when they should be having a strong month. This adds even more pressure to cash flow.

While this can be trying for any business, it hits even harder for those that normally have seasonal swings.

Costs Change Faster Than Prices

Input costs such as fuel, materials, insurance, and labor often rise quickly. This leaves the business in a catch-22, deciding whether to raise prices alongside costs and risk relationships, or to wait it out and hope prices come down again. Cash flow is further strained in the interim.

Access to Credit Tightens

Banks and other traditional lenders prefer certainty. They know that as revenue reduces and cash flow is squeezed, it’s harder to keep up with loan and credit installments. More businesses become insolvent, too. As a result, they lend less often, raise the standards when they do lend, and often take longer to process applications and pay out.

This is all happening at a time when businesses need funding the most and limits the options available.

Planning Horizons Shorten

Long-term forecasting becomes unreliable. Instead of planning on a yearly, quarterly, or even monthly basis, decisions become more immediate and are often centered on survival rather than growth, even if demand exists. Naturally, this creates stress and can change the trajectory of the company’s growth for years to come.

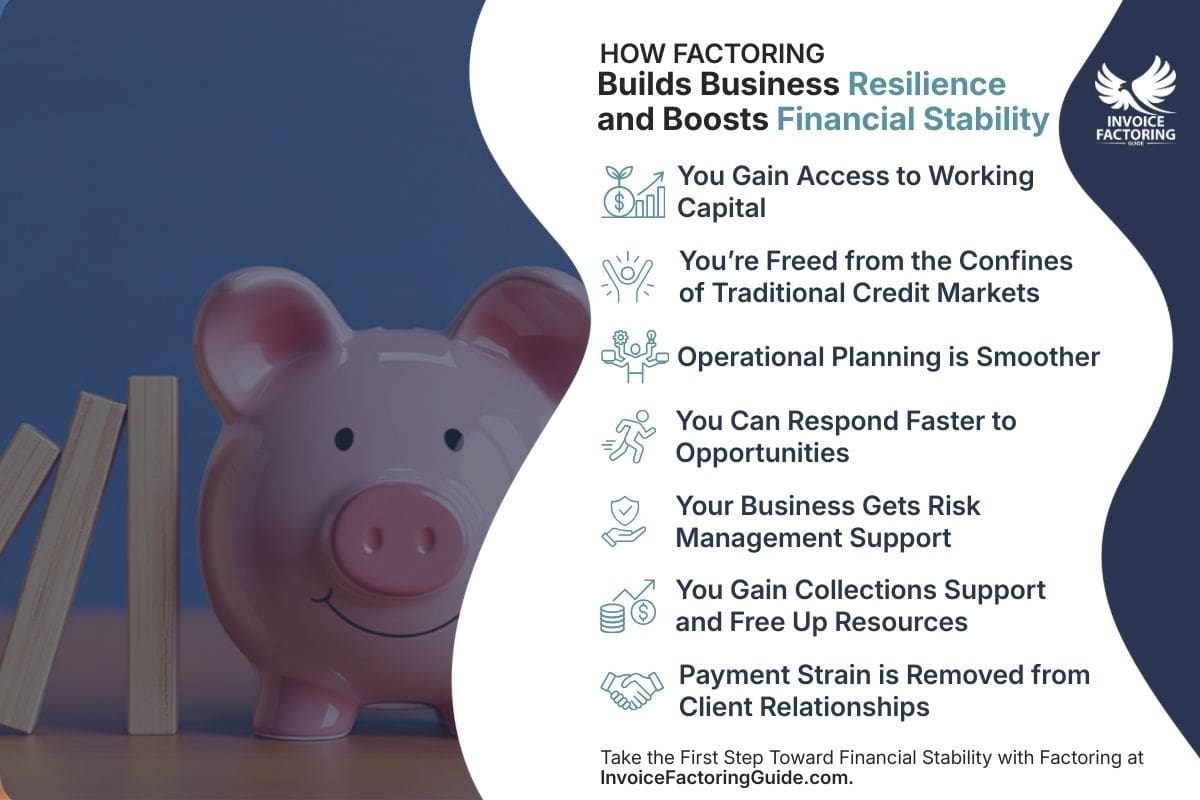

Factoring Helps Businesses Build Resilience and Boosts Financial Stability

Invoice factoring unlocks the capital trapped in your unpaid B2B invoices. It works differently than virtually all other business funding solutions and therefore impacts your company in a multitude of unique ways that support resilience and financial stability.

You Gain Access to Working Capital

First and foremost, factoring provides you with working capital. Although the terms vary based on your factoring contract, it’s usually between 80 and 90 percent of the invoice’s value. By shortening the time it takes to get paid, you eliminate the cash flow gaps caused by delayed client payments.

Some factoring companies can pay you on the same day that you submit your invoice. The cash can be used for payroll, vendor payments, and more, relieving strain across many areas of your business.

You’re Freed from the Confines of Traditional Credit Markets

Generally speaking, just half of the businesses that apply for financing receive the full amount requested, per the latest Small Business Credit Survey. One in five are completely denied financing, and the rest have funding gaps.

This is already problematic for small businesses, but as we touched on earlier, traditional lenders raise the requirements and lend less during times of uncertainty, so even fewer small businesses are funded.

Criteria for loans vary, but they center around things like your business credit score, time in business, and revenue. Factoring doesn’t have these same requirements. Most businesses with B2B invoices can get approved.

Operational Planning is Smoother

Naturally, when your access to working capital improves, and the gap between completing work or delivering goods shortens, it’s easier to plan. But it’s important to note that factoring is flexible. While many businesses use it to streamline cash flow all the time, others leverage spot factoring and selectively factor invoices as needed.

You Can Respond Faster to Opportunities

Roughly 40 percent of small businesses say they’ve had to forgo business opportunities due to cash flow issues, according to Xero surveys. Factoring not only provides the working capital that allows you to say “yes” more often but also provides it quickly. This means you can seize opportunities as they emerge, while competitors are either declining them or trying to free up the cash to move forward. This helps ensure stability today and builds toward a stronger future.

Your Business Gets Risk Management Support

Around eight percent of invoices are written off as bad debt, according to Atradius. Factoring companies typically perform credit checks on your customers before approving advances, which reduces the risk of non-payment considerably. In addition, some factoring companies offer non-recourse factoring, which means the factor absorbs the loss if your customer doesn’t pay in certain situations, such as if the customer becomes insolvent.

You Gain Collections Support and Free Up Resources

When your factoring company accepts an invoice, it also typically takes over the collections process on that invoice. This gives resources like time and money back to your business, so you can focus on strategy and growing your company. If your company is like most, that’s 14 hours per week you’re getting back, according to QuickBooks.

Payment Strain is Removed from Your Client Relationships

None of the options are good when your client isn’t paying promptly, and you need them to. You can tighten your payment window, follow up more often, accept the situation, or stop working with them. At best, these options put pressure on the relationship, and at worst, they involve letting it go.

Factoring offers a third path. Your client can pay based on the agreed-upon terms, and you don’t have to follow up. And, if they really do need more time to pay, you can potentially extend their payment window, too. By relieving their pressure, you can strengthen the relationship and potentially win their business for life.

Many businesses leverage this same approach when closing deals with new clients. To gain favor and lock it in, they offer payment terms that are more comfortable for the client. This approach can help you build a more stable customer base that insulates you from market fluctuations.

Leveraging Factoring for Financial Stability is Simple and Strategic

If it sounds like factoring is the right tool to help your business improve financial stability and resilience, getting started with it is straightforward.

The Factoring Approval Process is Fast and Easy

While traditional lending can take weeks or months to secure, factoring approval tends to be faster and easier. And once you’re approved, the impact is often felt the same day. Every factoring company is different, but the general steps in the factoring application process are consistent.

- Submit a Simple Application: Most companies only require basic business information and a few sample invoices to get started. They’re not looking at your credit score or asking for collateral.

- Customer Credit is Reviewed: Since the factoring company is advancing cash based on your receivables, they’ll want to confirm your customers have a good track record of paying their invoices.

- You’re Offered a Contract: Terms vary, but contracts generally outline advance rates, fees, and the types of invoices you can submit.

- You Send Invoices and Get Paid: Once you’re approved and sign the agreement, you can begin submitting invoices. In many cases, you’ll receive funding the same day.

Follow a Few Factoring Best Practices to Maximize the Benefits During Times of Uncertainty

Factoring is already one of the most accessible funding tools for small and mid-sized businesses. But there are ways to use it more strategically, especially when market conditions are changing fast.

- Use it to Stabilize Key Operations: Prioritize factoring invoices that tie directly to your most critical functions, such as payroll, job materials, or vendor relationships. This ensures the basics are covered while you adapt.

- Be Selective with New Customers: If a factoring company is concerned about a client’s credit history, take that as a red flag. You can always take on the work, but consider requesting partial payment up front or limiting exposure.

- Set Terms That Serve You Both: Offering generous terms can help close deals when buyers are hesitant, but only if those terms don’t hurt your cash flow. Factoring gives you room to offer 30 or 60-day terms without delay on your side.

- Use Reporting to Improve Forecasts: Most factoring companies provide reports on payment timelines, outstanding invoices, and customer behavior. During volatile periods, that data can help you make better, faster decisions.

- Stay Flexible: You don’t have to factor everything. Many businesses shift between full-service and selective factoring as market conditions change. Treat it like a tool; one you can dial up or down as needed.

Take the First Step Toward Financial Stability with Factoring

Have more questions, or are you ready to begin the application process? Share a few details about your business and be connected with a factoring specialist.

FAQs on Factoring for Financial Stability and Uncertain Markets

Why do businesses use invoice factoring for economic downturns?

During downturns, payments slow and credit tightens. Businesses use invoice factoring to unlock cash quickly without taking on debt. It bridges the gap between invoicing and payment, supports payroll and operations, and keeps things moving when other funding options are limited or unavailable.

How can factoring help my business during unpredictable times?

Many business owners use navigating uncertainty with factoring as a way to describe how factoring provides stability when customer payments slow down, credit tightens, or planning becomes difficult.

What should I know about using factoring when the market is unstable?

Adapting to market fluctuations with factoring means gaining faster access to capital without relying on traditional loans. It allows your business to move with the market instead of reacting after the fact.

Is factoring a reliable fallback when other funding options fall through?

Some businesses refer to this as factoring as a financial safety net. It gives you quick access to funds you have already earned, which can be crucial when credit lines are frozen or demand shifts suddenly.

Can factoring really improve cash flow?

Yes, improving cash flow with factoring is one of the most common reasons businesses choose it. You get paid shortly after invoicing, so you're no longer stuck waiting thirty to ninety days for funds.

How does factoring help when my business is facing an unpredictable market?

Cash flow stability in volatile markets is difficult to achieve without tools like factoring. Factoring provides predictable access to capital, which helps keep your operations moving during turbulent periods.

What if I need access to cash but don’t qualify for a loan?

Ensuring liquidity with factoring is often more attainable than getting a bank loan. Because approval is based on your customers’ credit, it offers another path to funding when you need it most.

My customers are paying later than usual. Can factoring help?

Yes. Managing cash flow during uncertainty often involves bridging the gap between invoicing and payment. Factoring helps cover expenses while you wait for your customers to pay.

I want to keep money flowing even when sales slow down. Is that possible?

Absolutely. Factoring for cash flow continuity helps businesses keep cash moving, even when revenue is uneven or delayed. You stay on track operationally, even in slower periods.

What should I do when my business revenue suddenly drops?

Many companies use overcoming revenue fluctuations with factoring as part of their response strategy. It gives you breathing room to handle dips without making drastic cuts or taking on debt.

Can factoring help with urgent short-term expenses?

Yes. Short-term liquidity through factoring is common. You receive funds quickly—often on the same day, which makes it a useful option when you need to move fast.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300