We’ve all heard horror stories about factoring companies charging hidden fees. While they remain cautionary tales, they’re not so much about what’s being hidden, but rather, what’s misunderstood before signing up. After all, factoring companies are required to tell you what they charge beforehand, and reputable ones make a point of telling you what they are, even though they’re in the contract. But it’s still smart to dig a little deeper before you sign and not rely exclusively on what’s being said verbally. In this guide, we’ll explore questions to ask factoring companies about fees to help ensure you structure your agreement in a way that makes sense for your business.

How Factoring Company Charges Work

Before we get into what fees to ask about in factoring, let’s explore how it works so that it’s easier to follow along and understand where different costs can come into play.

Factoring gives your business fast access to working capital, but how you’re charged can vary widely from one provider to the next. Knowing how those charges are structured helps you make better comparisons and choose terms that support your goals.

Factoring Fees Explained in Plain Terms

When you factor an invoice, you receive a cash advance, usually within two business days. The factoring company then collects payment from your customer and deducts their fee before sending you the remaining balance.

This fee is typically calculated as a percentage of the invoice amount. But that percentage can be applied in different ways, depending on the provider’s pricing model.

Comparing Flat Fees and Time-Based Pricing Models

Most factoring companies use one of two common approaches:

- Flat Rate Model: A single fee covers the full time it takes your customer to pay. It’s easy to forecast and tends to stay consistent month to month.

- Time-Based or Tiered Model: The fee starts lower but increases if your customer takes longer to pay. This structure can offer savings if your clients pay quickly, but it becomes more expensive the longer invoices remain open.

In some cases, you may be able to negotiate a custom fee arrangement based on your volume, industry, or customer profile. These factoring fee structures vary widely, so negotiating factoring fees and asking for options is worthwhile.

Plan Ahead by Understanding Factoring Fees

Your fee model doesn’t just impact how much you pay. It also influences how you manage collections, choose which customers to factor, and handle growth. For instance, flat fees may offer more stability, which helps with budgeting. Meanwhile, tiered models can offer cost savings but require closer tracking of customer payment timelines.

As you evaluate factoring companies, make sure you’re comparing their pricing structures side by side. A lower rate may not actually mean a lower cost once timing, terms, and service expectations are factored in.

Common “Hidden Fees” in Factoring

Most factoring companies are upfront about their base rates. Where confusion often arises is in the supporting fees, or the costs that are outlined in the agreement but easy to overlook if you don’t know what to look for. These are sometimes referred to as “factoring contract hidden costs,” not because they’re concealed, but because they may not be part of the headline rate.

Understanding the full fee structure upfront gives you more control and prevents issues down the road. We’ll review some of the most common fees that get overlooked, but bear in mind that not all factoring companies charge them.

- Invoice Processing or Handling Fees: This is charged per invoice submitted and can add up if you send smaller or frequent invoices.

- ACH or Wire Transfer Fees: These cover the cost of delivering funds. Wire transfers are typically higher, but even ACH fees can affect your margins over time.

- Credit Check or Due Diligence Fees: These may be applied when the factoring company evaluates your customers’ credit to assess repayment risk.

- Renewal or Maintenance Fees: Some providers charge annual fees for account upkeep or renewal, especially with long-term contracts.

- Minimum Volume Fees: If your contract sets a minimum factoring amount each month and you fall short, you may be charged the difference.

- Early Termination Fees: If you decide to exit your factoring agreement early, there may be a charge to do so, especially if you signed a long-term or volume-based contract.

- Reserve Release Fees: Some companies hold back a portion of funds in a reserve account and charge a fee when releasing that reserve after payment is collected.

Each of these charges can be reasonable in the right context. The key is transparency. When you know what questions uncover factoring fees, you can evaluate whether a provider’s full cost aligns with the value they’re offering.

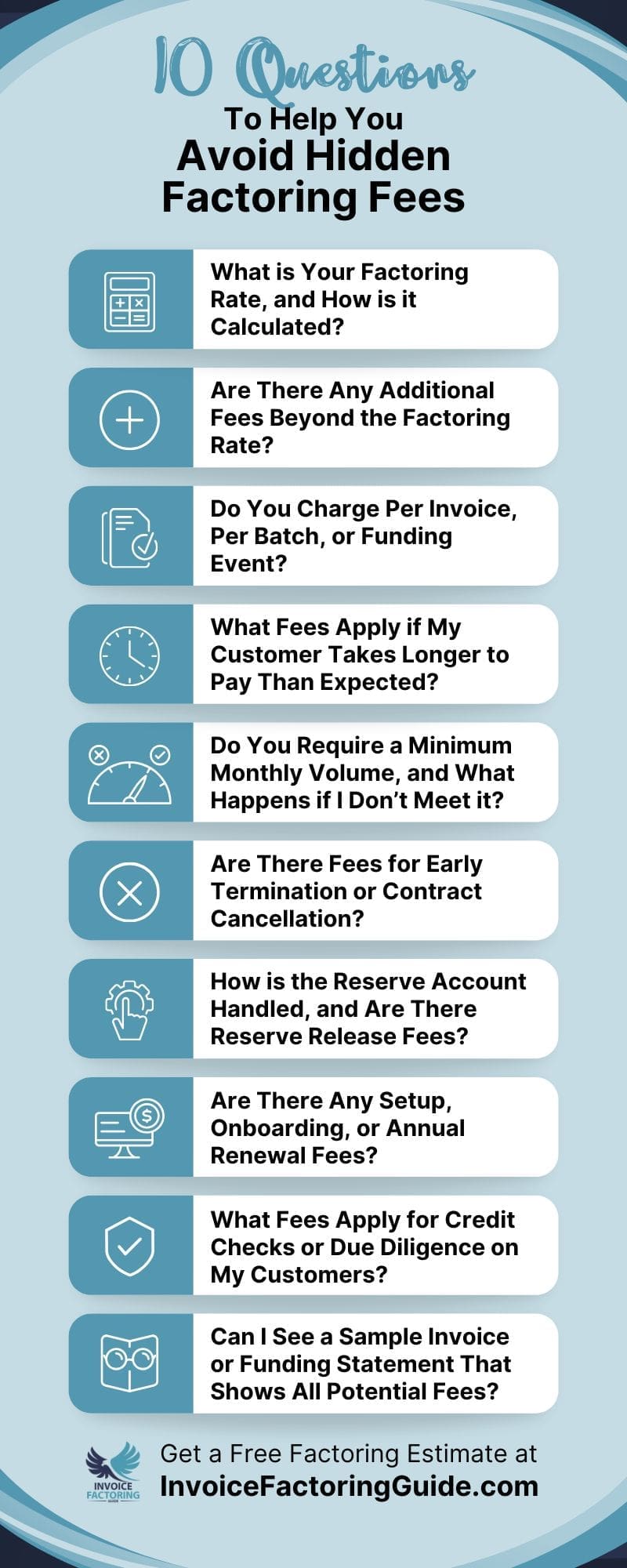

10 Questions to Ask a Factoring Company to Avoid Hidden Fees

Fee transparency starts with asking the right questions. Most factoring companies are happy to explain their pricing because they want you to understand and be prepared, but you may need to guide the conversation to ensure everything is clear. Below, we’ll cover what questions to ask a factoring company to uncover the full cost of service and ensure the provider’s terms support your business goals.

1. What is Your Factoring Rate, and How is it Calculated?

Start with basic factoring fee structure questions. Ask for specifics about how the fee is applied. Some providers charge a flat rate regardless of when your customer pays, while others use a time-based model that increases over time. Understanding the calculation method is the first step to comparing offers accurately.

2. Are There Any Additional Fees Beyond the Factoring Rate?

This question opens the door to everything from wire transfer fees to processing charges. It also gives the provider a chance to walk you through their full pricing structure. If they can’t explain it clearly, that’s a sign to dig deeper.

3. Do You Charge Per Invoice, Per Batch, or Per Funding Event?

Different providers apply charges differently. Some charge a fee for every invoice submitted, others only when funds are disbursed, and a few group invoices together. Understanding how fees are triggered helps you project costs more accurately.

4. What Fees Apply if My Customer Takes Longer to Pay Than Expected?

This is especially important with tiered or time-based pricing. Ask what happens if a customer takes 45 or 60 to pay instead of 30. The answer will help you evaluate how well the model fits your customer base.

5. Do You Require a Minimum Monthly Volume, and What Happens if I Don’t Meet it?

Some contracts include a minimum monthly factoring volume. If you don’t hit that number, you may still be charged as if you did. If your revenue fluctuates, this is one to clarify early.

6. Are There Fees for Early Termination or Contract Cancellation?

One of the most overlooked factoring cost questions is what happens when you leave. If you’re testing factoring for the first time or value flexibility, it’s important to know what the exit terms are. Some agreements carry hefty cancellation fees, especially if you signed a longer-term or volume-based contract.

7. How is the Reserve Account Handled, and Are There Reserve Release Fees?

Many factoring companies hold a small percentage of your invoice in reserve until payment is collected. As one of the key questions for factoring companies, always ask how long that reserve is held, when it’s released, and whether there’s a fee involved in getting those funds back.

8. Are There Any Setup, Onboarding, or Annual Renewal Fees?

These fees may be listed in the contract but not discussed in early conversations. Ask directly about any upfront or ongoing charges related to account maintenance or administrative setup.

9. What Fees Apply for Credit Checks or Due Diligence on My Customers?

Factoring companies often evaluate your customers’ creditworthiness before approving invoices. Some providers include this in the base fee, while others pass it along separately. Knowing this helps you plan for it. Be sure to address this when exploring questions on factoring service costs.

10. Can I See a Sample Invoice or Funding Statement That Shows All Potential Fees?

This is one of the most important questions for factoring providers that you can ask. A sample statement allows you to see exactly how charges appear and how funds flow. It’s much easier to compare providers when you can visualize the full transaction.

Quick Tips on How to Spot Hidden Fees in Factoring

Even when everything is disclosed in writing, factoring agreements aren’t always easy to read at a glance. Some fees may be mentioned briefly or buried in footnotes, while others only surface in certain scenarios. This section is designed to help you recognize early signs that more due diligence may be needed.

Look for Vague or Catch-All Language

Phrases like “additional fees may apply” or “as determined by the provider” should prompt follow-up. Ask what those fees are, when they’re charged, and how often they’re used in practice.

Scan for Short Descriptions in Long Contracts

If a critical section, like reserves or termination fees, is addressed in just one sentence, it’s worth slowing down. Brief explanations for high-impact terms are a sign to ask more questions.

Compare the Contract to the Sales Conversation

When you’re working through how to avoid hidden costs in factoring, watch for consistency in language. If the rep described your agreement as “all-inclusive,” but the contract references service charges, handling fees, or tiered structures, request clarification in writing. Misalignment between conversations and documentation can lead to surprises.

Check for Auto-Renewal or Long Notice Periods

Contracts that automatically renew or require 60 to 90 days’ notice to cancel may lock you in longer than expected. These terms often sit near the end of the document, so don’t skim the final pages.

Watch for Reserve Language That Lacks Specifics

If the contract mentions a reserve but doesn’t explain how much is withheld, when it’s released, or whether it earns interest, request those details upfront.

Beware of “No Fee” Claims without Context

If a company advertises no fees outside the factoring rate, ask for that commitment in writing, along with a sample funding breakdown. Genuine simplicity will hold up under scrutiny.

Additional Strategies to Avoid Hidden Fees in Factoring

Now that we’ve covered questions to ask before signing with factoring, let’s explore some additional strategies that can help ensure you’re connecting with transparent factoring companies and can identify factoring service hidden charges when you see them.

Request a Full Fee Schedule in Writing

If you’re trying to figure out how to avoid hidden fees in factoring, the fee schedule is a good place to start. Whereas the sample invoice covered earlier shows how charges appear during a typical transaction, a full fee schedule outlines every potential charge you could face under the contract, even ones that may not apply right away. This full factoring fee breakdown includes fees for optional services, volume adjustments, renewals, or expedited requests. Having it in writing helps you plan for future scenarios and avoid surprises as your business grows.

Review the Sample Contract Carefully

If you’re concerned about avoiding extra costs in factoring, reading the contract seems like an obvious first step. Even still, seven in ten people admit to signing contracts they don’t understand, Adobe reports. Before you sign anything, take time to review the full agreement. Pay close attention to the sections on fees, reserves, and termination clauses. If anything is unclear, ask for clarification in writing.

Watch for Auto-Renewal Clauses

Uncovering hidden charges in factoring means looking ahead. Some agreements renew automatically unless canceled within a specific window. If this applies, set a reminder well before that date to revisit your needs and renegotiate if necessary.

Evaluate How Customer Risk Affects Cost

Some factoring companies adjust fees based on the creditworthiness of your customers. If you add new clients or shift industries, your rates could change. Stay in communication with your provider to confirm what triggers a fee adjustment.

Monitor Statements Regularly

Even if you trust your provider, it’s smart to check your funding statements each month. This helps you catch errors, understand how charges are applied, and flag anything that doesn’t align with your expectations.

Build a Relationship with Your Account Manager

A dedicated point of contact can offer clarity, flag potential issues, and even help you find cost-saving opportunities. Factoring works best when there’s mutual trust and open communication.

Plan Ahead for Growth or Seasonality

If your invoice volume fluctuates, let your factoring company know in advance. This can help you avoid shortfalls against minimum volume thresholds or negotiate temporary adjustments when needed.

Don’t Default to the Lowest Rate

Competitive pricing is important, but your overall experience, including funding speed, service quality, and fee transparency, matters just as much. Choosing a partner who is clear and consistent about charges often pays off in the long run.

Avoid Unexpected Fees in Factoring with a Free Estimate

Ready to find factoring companies with no hidden fees? We’re happy to match you with vetted pros that can provide clear answers when you ask questions about factoring agreement fees. To take the first step, request a free estimate.

FAQs on Avoiding Factoring Company Hidden Fees

What Are Good Factoring Fee Transparency Questions to Ask?

Ask how the fee is calculated, what triggers additional charges, and whether there’s a full fee schedule available. These factoring fee transparency questions help you understand what costs to expect and how the provider applies them in practice, not just what’s advertised.

How Can I Spot Hidden Fees in a Factoring Contract?

Look for short or vague contract sections that reference fees, reserves, or early termination. These are common areas where additional costs appear. Asking direct factoring contract hidden fees questions can help surface charges that aren’t part of the base rate.

What Clarifying Factoring Fees Questions Should I Ask Before Signing?

Ask how reserves work, whether the fee structure changes over time, and if credit check or wire fees apply. These clarifying factoring fees questions give you a clearer picture of the total cost, not just the headline rate.

Are There Questions to Ensure No Hidden Factoring Costs Are Missed?

Yes. Ask for a sample funding statement, a full fee schedule, and a clear explanation of how fees are triggered. These questions to ensure no hidden factoring costs are missed help reveal potential charges that may not come up in initial sales conversations.

How Can I Make Sure a Factoring Company is Being Transparent About Pricing?

Start by asking factoring pricing transparency questions like how the rate is calculated, what extra fees might apply, and when they are charged. A good provider will give clear, consistent answers and provide documentation so you can see exactly how pricing works in practice.

What Fees Should I Look Out for with Invoice Factoring?

Watch for fees beyond the factoring rate, like invoice processing charges, wire transfer fees, credit checks, and early termination penalties. These may be in the contract but not clearly highlighted. Reviewing all terms carefully helps you understand the true cost of factoring.

Can Factoring Companies Charge Me if I Don’t Use Them?

Yes. Some factoring agreements include minimum volume requirements or monthly fees, even if you do not submit invoices. Always ask about minimum usage thresholds and how fees are applied if your business slows down or you stop factoring temporarily.

How Do I Know if a Factoring Company is Hiding Fees?

A lack of itemized pricing, vague contract language, or refusal to provide a sample funding breakdown can be red flags. Ask direct questions, request a full fee schedule, and compare written documentation to what was discussed verbally to spot hidden charges.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300