Have you ever wondered how smaller businesses maintain liquidity even when their invoices are unpaid for days or even months? While large companies typically have access to cash reserves and traditional loans to help bridge these gaps, options for smaller ones are often in short supply. This can create needless friction between the business and its customers and force the business to turn down growth opportunities. If you’re currently in this situation, take heart. You can improve your cash conversion cycle (CCC) to address this situation now and avoid it in the future. We’ll walk you through the fundamentals of a cash conversion cycle, how it works, and ways to improve yours on this page.

What is a Cash Conversion Cycle?

CCC is a fundamental financial metric that measures how long it takes for a business to convert investments in inventory and other resources into cash flows from sales. In simpler terms, it’s the period between when you spend money to produce and stock your products and when you receive cash from selling those products.

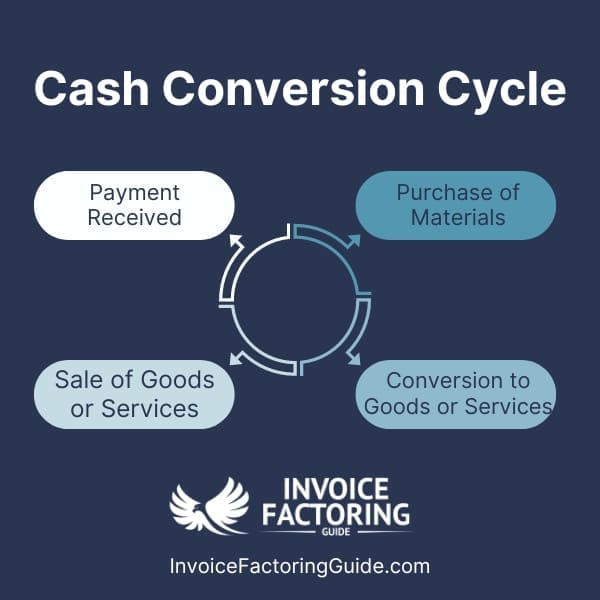

How the Cash Conversion Cycle Works

- Purchase of Inventory: The cycle starts when you purchase raw materials or goods for resale.

- Inventory Conversion: Those materials are then manufactured or prepared for sale, during which they sit as inventory.

- Sales: Eventually, the inventory is sold, typically on credit, which means the customer doesn’t pay immediately at the point of sale.

- Receivables Conversion: You wait to receive payment from customers, which is when the inventory finally turns into cash.

Each of these steps takes time, and your money is tied up during that time. The faster you can move through these steps, the shorter your cash conversion cycle will be, and the more efficiently your business will use its capital.

Calculating Your Cash Conversion Cycle

CCC is calculated using a formula that involves three main components:

- Days Inventory Outstanding (DIO): How long it takes for a company to turn its inventory into sales. It reflects the average number of days the inventory is held before it is sold.

- Days Sales Outstanding (DSO): How long it takes to collect payment after a sale. It indicates the average days it takes to convert receivables into cash.

- Days Payable Outstanding (DPO): The time it takes a company to pay its suppliers. It reflects the average number of days the company delays payment to its vendors.

Cash Conversion Cycle Formula

CCC = DIO + DSO − DPO

Cash Conversion Cycle Calculation Example

Let’s say a company:

- Holds inventory for 60 days on average (DIO)

- Takes 45 days on average to collect payments (DSO)

- Pays its suppliers in 30 days on average (DPO)

The CCC calculation would be: CCC = 60 + 45 − 30.

In this example, the CCC is 75. After accounting for the time it takes to pay suppliers, it takes 75 days from spending cash on producing or buying inventory to receiving money from sales.

Typical Cash Conversion Cycles by Industry

Cash conversion cycles vary significantly by industry. Average CCCs, per Risk Concern research, are as follows:

- Automotive Supply: 18 days

- Construction: 30 days

- Consulting: 35 days

- Energy: 84 days

- Food Manufacturing Distributors: 12 days

- Furniture & Home Decor: 1 day

- Healthcare: 67 days

- Machine Shops: 22 days

- Permanent Staffing: 48 days

- Technology: 9 days

- Temporary Staffing: 48 days

- Trucking: 24 days

The Importance of Efficient Cash Conversion

Efficient cash conversion is vital for businesses, especially small ones, because it directly impacts liquidity, operational efficiency, and overall financial health. Let’s take a look at why it’s so important.

Improved Liquidity

The faster a business can convert its operations into cash, the more liquid it becomes. Higher liquidity means having enough cash on hand to meet short-term obligations like payroll, rent, and inventory purchases. This is crucial for small businesses that may not have extensive lines of credit or large cash reserves.

Reduced Need for Borrowing

By shortening the cash conversion cycle, a company can reduce its dependency on external financing, such as loans or lines of credit. Borrowing can be expensive, with interest payments adding to the company’s costs. Efficient cash conversion allows a business to fund its operations primarily through its own cash flow, which can be more cost-effective and less risky.

Greater Flexibility

Businesses with efficient cash conversion cycles are more agile. They can respond quickly to market opportunities or challenges because they have the cash flow to act immediately. For example, if a supplier offers a discount for early payment or bulk buying, a business with available cash can take advantage of these savings, potentially increasing its competitiveness and profit margins.

Increased Investment Opportunities

Freeing up cash more quickly allows businesses to reinvest in their operations sooner, whether upgrading equipment, expanding product lines, or hiring additional staff. This can accelerate growth and improve the company’s competitive position.

Better Financial Health and Creditworthiness

Lenders and investors often see companies with efficient cash management as lower risks. A strong cash position and a short cash conversion cycle can lead to better credit terms and more favorable interest rates. It may also attract investors looking for financially stable and efficiently managed companies.

Managing Seasonality

Many small businesses experience seasonal fluctuations in sales. An efficient cash conversion cycle helps manage these peaks and troughs by ensuring that cash is available when needed and preventing operational disruptions during slower periods.

Cash Conversion Cycle’s Role in Financial Health

CCC plays a pivotal role in a business’s financial health by indicating how efficiently a company manages its cash flows related to sales, inventory, and payables.

Indicator of Operational Efficiency

The CCC provides insight into a business’s operational efficiency, particularly in managing inventory, receivables, and payables. A shorter CCC typically indicates that a company is turning over its inventory quickly, collecting receivables promptly, and efficiently using its credit terms with suppliers, all of which contribute to operational efficiency.

Predictor of Cash Flow Issues

A long CCC might signal potential cash flow problems. For example, a business might struggle to cover its immediate financial obligations if receivables are slow to convert into cash. Regularly monitoring the CCC helps identify such issues early, allowing corrective actions to be taken before the situation becomes critical.

Enhancement of Financial Stability

Efficiently managing the CCC can stabilize a company’s financial position by ensuring that cash inflows align with outflows. This balance is crucial for maintaining day-to-day operations without resorting to external financing.

Strategies to Improve Your Cash Conversion Cycle

There are many ways to improve your cash conversion cycle. Below, we’ll review a few of the most common.

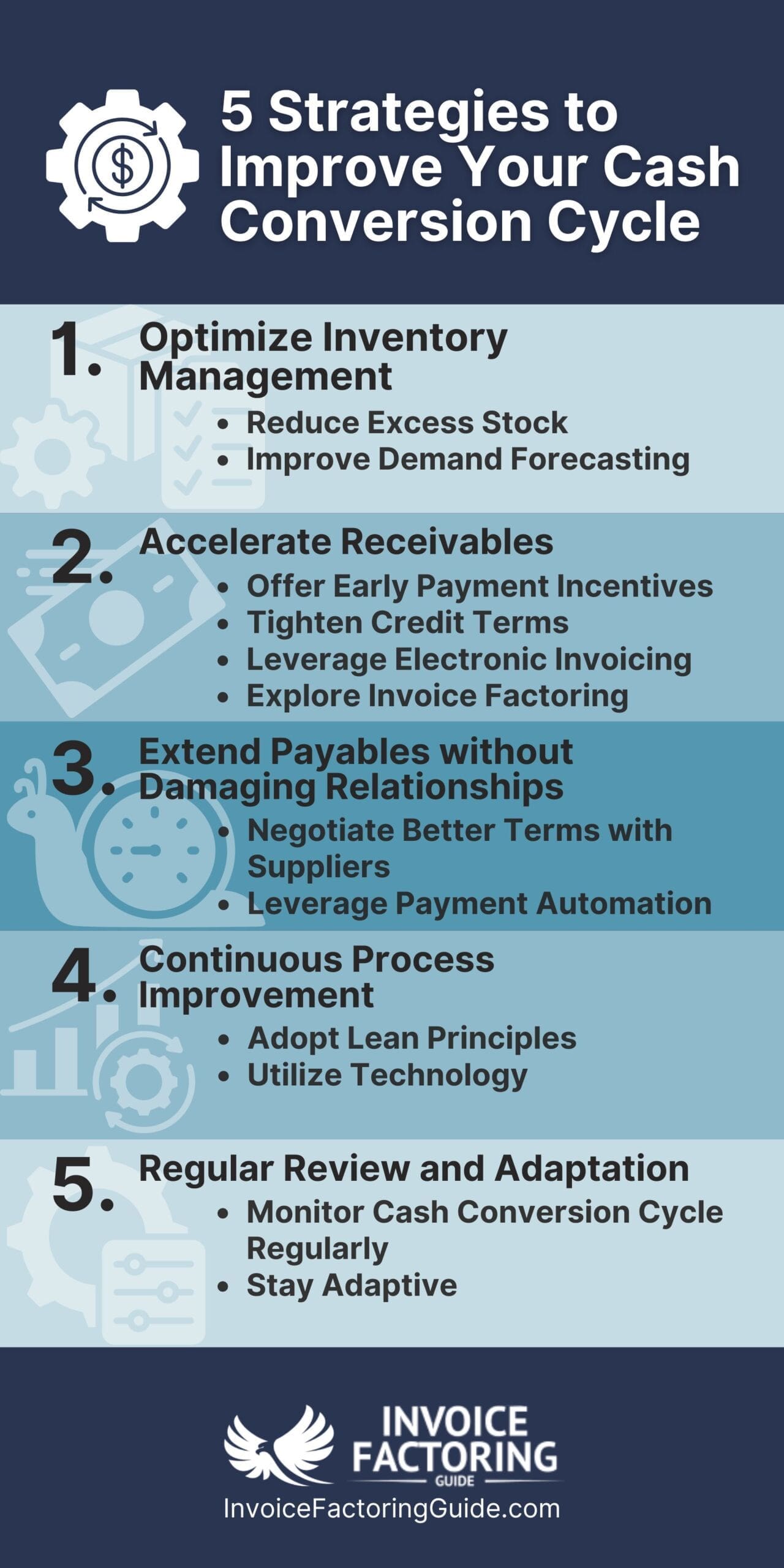

Optimize Inventory Management

- Reduce Excess Stock: Hold only as much inventory as is necessary to meet customer demands without overstocking, which ties up cash unnecessarily.

- Improve Demand Forecasting: Use sales data and market trends to predict customer demand more accurately, helping proactively adjust inventory levels.

Accelerate Receivables

- Offer Early Payment Incentives: Provide discounts to customers who pay their invoices early. This can encourage faster payment, reducing DSO.

- Tighten Credit Terms: Review the credit terms offered to customers and tighten them where possible, particularly for those with a history of late payments.

- Leverage Electronic Invoicing: Switch to electronic invoicing to speed up the billing process. Faster invoicing can lead to faster payments.

Extend Payables without Damaging Relationships

- Negotiate Better Terms with Suppliers: If your business has a good relationship with suppliers, negotiate longer payment terms. This increases your DPO, allowing you to use your cash on hand for longer periods.

- Leverage Payment Automation: Use automated payment systems to schedule payments precisely on their due dates, maximizing your use of cash while avoiding late payments.

Continuous Process Improvement

- Adopt Lean Principles: If applicable, implement lean techniques to minimize waste and reduce production cycles.

- Utilize Technology: Implementing inventory and receivable management software can streamline operations and provide real-time data for better decision-making.

Regular Review and Adaptation

- Monitor CCC Regularly: Keep a close eye on your CCC and its components to spot trends, identify issues, and adjust strategies accordingly.

- Stay Adaptive: Business conditions change, so continuously seek ways to improve operational efficiency and adjust your strategies as new challenges and opportunities emerge.

Implementing Invoice Factoring for Better Cash Flow

Invoice factoring can be an excellent strategy for improving cash flow and managing finances more efficiently. By using factoring, companies sell their invoices, at a discount to a third party, called a factor or factoring company, in exchange for immediate cash.

Factoring as a Tool for Efficient Cash Management

Factoring can significantly enhance cash conversion efficiency and overall financial management.

- Immediate Access to Cash: Factoring provides businesses with quick access to cash, often within 24 to 48 hours. This immediate liquidity is crucial for businesses that need to cover operating expenses, pay employees, or invest in new opportunities before customers can pay their invoices, which can sometimes take 30, 60, or even 90 days.

- Reduction in Collection Times: Since the factor takes over the responsibility of collecting the receivables, businesses can eliminate the time and effort involved in chasing payments. This allows business owners to focus more on core business activities like sales, customer service, and product development.

- Improved Cash Flow Management: With the predictable cash flow that factoring provides, businesses can manage their cash more effectively. Knowing when and how much money they will have at any given time helps with better budgeting and financial planning.

- Avoidance of Debt: Unlike traditional loans, factoring does not create debt on the balance sheet. It is a sale of assets, not a loan, which means it doesn’t affect the debt-to-equity ratio, maintaining the company’s leverage positions.

Factoring’s Role in the Cash Conversion Process

In terms of the cash conversion cycle, factoring primarily impacts the DSO component by converting sales into cash much quicker than if the business had to wait for customers to pay their invoices normally.

- Shortening the Cash Conversion Cycle: By reducing the DSO, factoring can significantly shorten the cash conversion cycle. A shorter CCC means that cash is tied up for less time in the process of converting inventory and receivables into cash, enhancing overall business agility.

- Enabling Growth without Overextending: Factoring can support a company’s growth initiatives by providing the cash flow needed to take on new projects or larger orders without overextending financially. This is particularly beneficial for small businesses that might not have access to other types of financing.

- Flexible Financing Option: Factoring agreements can be scaled according to the company’s sales volume. This flexibility is especially beneficial for businesses experiencing seasonal fluctuations or rapid growth periods.

- Credit Risk Mitigation: Factors often provide additional services, such as credit checks on potential customers, reducing the risk of non-payment. This service is particularly valuable for small businesses that may not have the resources to conduct thorough credit analyses.

Improve Your CCC with Factoring

Whether you’re still trying to get processes in place to shorten your CCC or you’re in an industry with a longer CCC that makes it difficult to make ends meet, factoring can help you close the payment gap by providing you with upfront payment for your B2B invoices. Most businesses qualify, including younger and credit-challenged companies. To take the first step toward improving your CCC with factoring, request a complimentary rate quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300