Roughly half of all B2B invoices in the United States remain unpaid after the due date, according to Atradius research. Invoice disputes are a common cause. However, if you’re leveraging invoice factoring, disputes can be a little more complicated to unravel and may lead to additional factoring challenges. In this guide, we’ll walk you through why they happen, how they impact your business, who’s responsible for what when there’s a third party involved, and what you can do to address invoice disputes in factoring effectively.

Common Causes of Invoice Disputes

Invoice disputes often arise from a breakdown in clarity regarding documentation, expectations, or execution. Let’s take a look at what’s actually happening behind the scenes when they occur.

Misaligned Expectations or Communication Gaps

When terms, pricing, or deliverables are discussed informally or not documented in full, the client may contest an invoice based on a different interpretation of the agreement.

Incomplete or Inaccurate Documentation

Missing purchase orders, unsigned delivery confirmations, or incorrect invoice details can prevent clients from matching the invoice to their internal records.

Product or Service Delivery Issues

If the client believes goods were damaged, delivered late, or did not meet agreed specifications, they may withhold payment or flag the invoice for review.

Quantity or Pricing Discrepancies

Differences between the invoiced quantity or rate and the original order, regardless of reason, often result in contested invoices, particularly in high-volume industries.

Lack of Internal Approvals

Some clients require purchase approvals or verification steps before accounts payable can process an invoice. If these steps are bypassed, the invoice may be held.

Unfinalized or Informal Agreements

Invoices based on unsigned contracts, email threads, or verbal agreements lack the enforceability needed to avoid client pushback.

Third-Party Involvement

Invoices tied to subcontractors or deliveries made through intermediaries can cause confusion if the client does not recognize the source or relationship.

How Invoice Disputes Impact Funding

Your ability to factor invoices is contingent on the presumed collectability of each invoice. When a dispute arises, that collectability is questioned, at least temporarily. What happens next will depend on the stage of the funding process you’re in and the terms set in your invoice factoring documentation.

What Happens When Invoices Are Disputed Before Funding

During the verification process, your factoring company confirms the invoice is accurate, valid, and accepted by the client. If a client flags an issue during this stage:

- The Invoice is Removed from the Funding Pool: It cannot be funded until the matter is resolved. The process stops there.

- Your Business Leads the Resolution: Unless the issue involves documentation that the factor can correct, your team will be responsible for following up with the client and resolving the dispute.

- No Funds Are at Risk: Because funding never occurred, your existing cash flow is unaffected, though the total amount available may be lower until the dispute is resolved or the invoice is replaced.

What Happens When Invoices Are Disputed After Funding

Occasionally, a client raises concerns after the invoice has already been funded. In those cases:

- Reserve Releases May Be Paused: The factoring company will likely hold back the unpaid portion of the invoice, known as the factoring reserve, until resolution is confirmed.

- Future Advances May Adjust Slightly: If the disputed amount is significant, the factor may temporarily reduce the advance on other invoices until the matter is cleared.

- A Resolution Window is Provided: Most factoring agreements allow a reasonable amount of time, such as ten to 30 days, for your business to work with the client and resolve the issue to help minimize your cash flow impact.

- The Invoice May Shift Back to You: If the dispute cannot be resolved within the agreed-upon timeframe, the factoring company may reclassify the invoice as uncollectible and return responsibility to your business under the terms of your agreement.

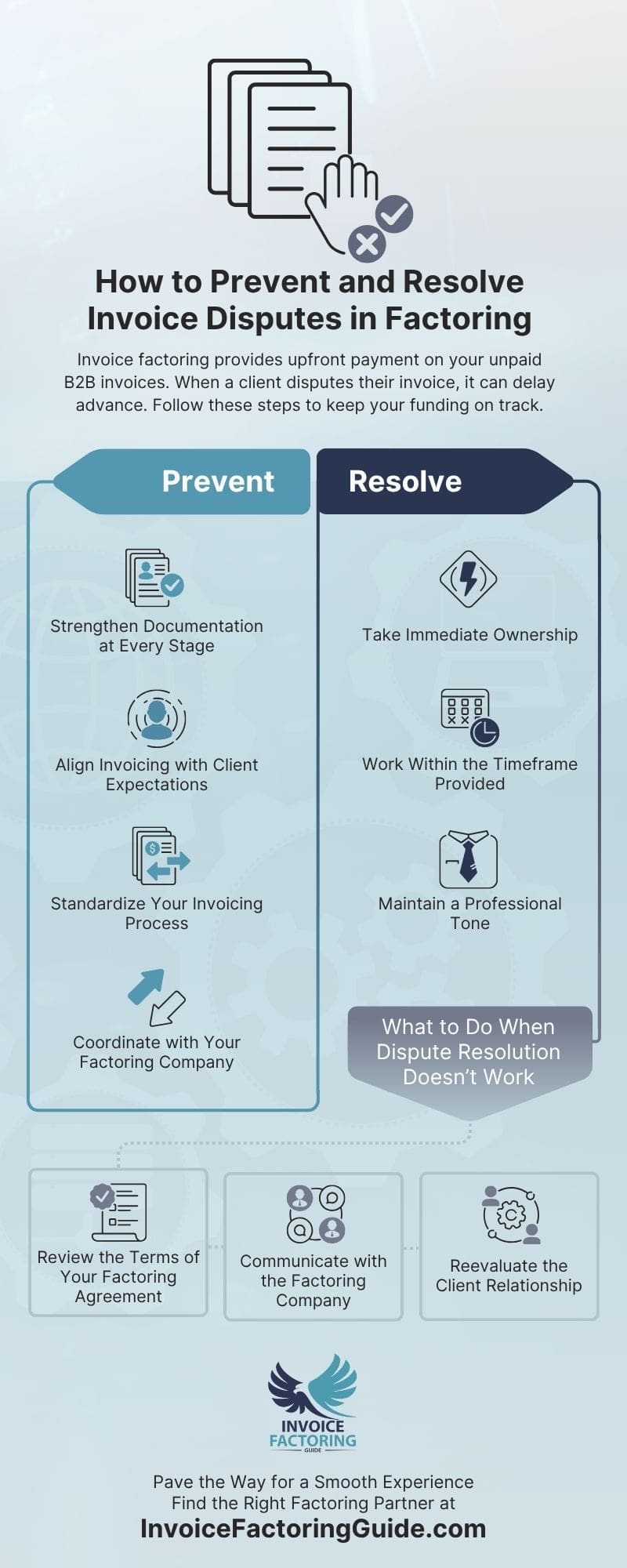

Preventing Invoice Disputes in Factoring

Avoiding invoice disputes begins well before the invoice is issued. When your business is factoring receivables, it is even more important to prioritize clear communication, documentation, and client alignment. The goal is to make every invoice dispute-resistant and fully verifiable. Let’s take a look at what you can do to make that happen.

Strengthen Documentation at Every Stage

- Use Signed Contracts or Confirmed Purchase Orders: Ensure every transaction starts with a written agreement on terms, pricing, and scope of work.

- Keep Records of Delivery or Completion: For product-based businesses, that means signed delivery receipts or electronic confirmations. For service providers, use time logs, completion reports, or milestone approvals.

- Attach Supporting Materials to Invoices: Including backup documentation with each invoice, such as the purchase order, signed receipt, or completion notice, can eliminate confusion and streamline verification.

Align Invoicing with Client Expectations

- Verify Billing Details Before Submission: Confirm that the invoice reflects exactly what the client expects, correct quantities, pricing, and service descriptions.

- Follow the Client’s Internal Process: Some clients require PO numbers, departmental approvals, or specific formats. If your invoice does not match those requirements, it may be flagged, even if the work was completed correctly.

- Avoid Surprises: If anything about the work changes, communicate early and document the update in writing. That includes changes in scope, delivery dates, or pricing.

Standardize Your Invoicing Process

- Create a Consistent Format: Clear, well-formatted invoices reduce the chance of misinterpretation. Include the invoice number, date, payment terms, client reference number, and a breakdown of charges. Consider using SME invoicing software such as Xero, QuickBooks, or Zoho Books to streamline the process.

- Send Invoices Promptly: The longer the delay between delivery and invoicing, the more likely it is that confusion or miscommunication will occur.

- Double-Check for Errors: Small errors, like typos, outdated contact info, or the wrong billing address, can cause unnecessary delays or disputes.

Coordinate with Your Factoring Company

- Review Client Eligibility and Risk Flags: Factoring companies often maintain internal watchlists. Before onboarding a new client, it may be worth checking whether they have a history of slow payments or disputes.

- Understand What the Factor Will Verify: Knowing what the factoring company looks for, such as proof of delivery or client approval, can help you prepare invoices that pass verification without issue.

- Clarify How Disputes Are Handled: While each factor has its own policies, most prefer to be informed early. If a potential issue arises before you invoice, they may be able to advise on next steps.

Resolving Invoice Disputes in Factoring

Even with strong processes in place, disputes can still arise. When they do, swift and structured resolution is essential to protect your relationship with the client and ensure continued access to factoring.

Most of the time, the factoring company will notify you immediately if a dispute is raised. From there, resolution is usually a shared effort, but the lead role belongs to your business.

Take Immediate Ownership

- Contact the Client Promptly: Reach out to understand their concern directly. Whether the issue is with service, pricing, or documentation, your client will expect a timely response.

- Gather Supporting Documentation: Confirm the facts of the transaction. Pull the contract, purchase order, delivery receipt, and any correspondence that supports your position.

- Clarify the Nature of the Dispute: Some issues stem from internal miscommunication on the client side, while others involve genuine disagreement. Understanding the difference will determine your next step.

Work Within the Timeframe Provided

- Start Work Right Away: Use the window stipulated in your contract to resolve the issue with the client before the factoring company reclassifies the invoice or shifts responsibility.

- Communicate Progress: Keep the factoring company informed. If the client agrees to pay after clarification, that is often sufficient for the factor to continue holding the invoice as active.

- Avoid Letting the Dispute Linger: Delayed responses signal risk. Even if the client is slow to reply, regular follow-ups show that your business is actively working toward resolution.

Have a Documented Invoice Dispute Process

- Develop Internal Protocols in Advance: Create a step-by-step process that your team follows when a dispute is reported. This should include who is responsible for follow-up, how documentation is collected, and how updates are shared internally and with the factoring company.

- Stay Consistent: Following a defined process helps avoid confusion, ensures timely action, and builds trust with both the client and the factoring partner.

- Escalate When Necessary: If the issue cannot be resolved at the client level, determine how and when to escalate it to senior leadership, legal counsel, or through formal client dispute channels.

Maintain a Professional Tone

- Keep the Focus on Resolution: Even if the client’s position seems unreasonable, avoid making the dispute personal. Position your communication around shared goals and clarification rather than blame.

- Be Open to Middle Ground: Sometimes, resolving a dispute may mean generating a revised invoice or providing a partial credit. As long as the factoring company is updated and agrees, this can keep payment on track.

What to Do When Dispute Resolution Doesn’t Work

Disputes don’t always have a clean resolution. If a client refuses to pay an invoice and discussions stall, the factoring company will eventually reassign responsibility for the balance to your business. At that point, your focus shifts to maintaining your funding relationship and minimizing long-term impact.

Review the Terms of Your Factoring Agreement

- Understand Your Repurchase Obligations: Most factoring agreements include a clause that allows the factor to require you to repurchase the invoice if it remains unpaid due to client dispute beyond the resolution window.

- Check for Substitution Options: Many factoring companies will accept a replacement invoice of equal or greater value in lieu of repayment. This helps preserve cash flow while maintaining good standing with the factor.

- Know the Timeline for Chargebacks: If the factoring company determines the invoice is uncollectible, they may offset the balance against your reserve or future advances after a defined period, often 30 to 90 days, depending on the agreement.

Communicate with the Factoring Company

- Provide Full Documentation of Your Efforts: Show that you made a good-faith effort to resolve the dispute. This may include emails, meeting notes, or written confirmation from the client acknowledging the disagreement.

- Explore Alternative Arrangements: If the balance is substantial, some factoring companies may allow a payment plan or other negotiated solution. Open communication increases your chances of flexibility.

- Clarify Whether Collection Efforts Will Continue: In some cases, the factor may continue to pursue payment through commercial collections. In others, the debt may be returned to your business entirely.

Reevaluate the Client Relationship

- Assess Whether the Client Should Remain Active: Chronic disputes or nonpayment may signal deeper issues. Consider whether continued work with the client aligns with your operational and financial goals.

- Document the Final Outcome Internally: Record the outcome of the dispute, the actions taken, and any lessons learned. This helps prevent similar issues and supports any decisions about future credit terms.

- Update Your Risk Monitoring Process: If the client continues doing business with you, consider additional precautions, such as requiring prepayment, shortening payment terms, or flagging their account for manual review before future invoices are submitted for factoring.

Pave the Way for a Smooth Experience with the Right Factoring Partner

Invoice disputes are frustrating, but an experienced factoring partner can make all the difference by guiding you through the process and walking you through your options. If you’d like to be matched with a vetted factoring company, request a free quote.

FAQs on Invoice Disputes in Factoring

Does non-recourse factoring protect me from invoice disputes?

No, non-recourse factoring protects your business if a client fails to pay due to insolvency, such as bankruptcy. It does not cover invoice disputes related to service, delivery, pricing, or quality. Your business is still responsible for resolving client disputes and may need to replace or repay the invoice.

How does factoring dispute resolution work when a client refuses to pay an invoice?

If a client refuses to pay and the issue cannot be resolved, the factoring company may eventually shift responsibility back to your business. At that point, you may need to submit a replacement invoice, repay the balance, or take other steps based on the terms of your agreement.

What happens if my customer disputes an invoice after factoring?

If a client disputes an invoice after it has been funded, the factoring company will typically pause reserve payouts and give your business time to resolve the issue. If the dispute remains unresolved, the factor may reassign responsibility for the invoice to your business in accordance with your agreement.

Can I still get funding if one of my invoices is disputed?

Yes, but not on the disputed invoice. The factoring company will exclude it from the funding pool until the issue is resolved. As long as the rest of your receivables meet verification requirements, you can continue receiving advances on undisputed invoices without interruption.

How long do I have to resolve a dispute with my client in factoring?

Most factoring agreements allow ten to thirty days to resolve a dispute, though the exact timeframe depends on your contract. Keeping the factor updated during that period can help maintain flexibility and prevent reclassification of the invoice as uncollectible.

Will I have to repay the factor if my customer refuses to pay?

Possibly. If the dispute cannot be resolved within the allowed timeframe, the factoring company may require repayment or offset the balance against future funding. Some agreements offer the option to substitute a new invoice instead of making a cash repayment.

Can I replace a disputed invoice with a new one in factoring?

Yes. Many factoring companies allow substitution, meaning you can submit a new, eligible invoice in place of the one under dispute. This helps preserve your cash flow and maintain access to funding while the issue with your client is addressed.

Do invoice disputes hurt my relationship with the factoring company?

Occasional disputes are expected and do not typically affect the relationship if handled promptly. However, frequent or unresolved disputes, especially with the same client, may lead the factoring company to review your funding terms or client eligibility.

What kind of invoice disputes do factoring companies allow?

Factoring companies do not “allow” disputes, but they assess how to proceed when one arises. Service-related, delivery-related, or pricing disputes usually pause funding on the invoice. If the invoice is ineligible or uncollectible, the factor may return responsibility to your business.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300