Are you considering leveraging invoice factoring but worried that your current invoicing process can’t support it? While it’s true that factoring companies have specific requirements for invoices, and that ensuring yours follow best practices is essential to obtaining fast funding, the good news is that most businesses don’t need a full overhaul. Below, we’ll take a look at how to address invoicing for factoring success, including tips to ensure your process is smooth and efficient and common missteps to avoid.

Efficient Invoicing is Key to Factoring Success

Invoice factoring is a powerful way to improve cash flow, but it works best when your invoicing supports the process. When invoices are submitted promptly and include the right details, it’s easier for your factoring partner to release funds quickly and keep everything running smoothly. A few small adjustments to your invoicing approach can help ensure you meet all factoring company invoicing requirements, reduce invoice payment delays, improve communication, and ensure you get the most out of your factoring relationship.

The Factoring Process and Invoicing Are Intertwined

Factoring allows you to access working capital by turning your unpaid invoices into immediate funding. Once you submit an invoice, your factoring company advances a large portion of its value, often within 24 hours, and holds the remainder in reserve until your customer pays.

Before releasing funds, your factoring partner typically looks for a few key indicators that confirm the invoice is ready to go. During invoice validation, checks are performed to ensure that:

- Delivery Has Been Completed: Your product or service should already be delivered, performed, or fulfilled to meet the terms of the agreement.

- The Invoice is Accurate and Complete: It should include all required details, such as line items, customer information, and reference numbers.

- Supporting Documents Are Provided: Any necessary backup, like signed proof of delivery or timecards, should be attached and easy to review.

Making these details part of your standard process helps your factoring company move quickly and with confidence. The more consistent and thorough your invoicing is, the easier it becomes to access funds without delays.

Accurate Invoicing Keeps Your Cash Flow on Track

Missed details, inconsistent formatting, or missing documentation often mean extra steps before funding can be approved.

- Clear Invoices Speed Up Approvals: When your invoices meet your factoring company’s criteria the first time, it reduces the risk of delays and helps you receive funding sooner.

- Consistency Reduces Back-and-Forth: Standardization and cash flow go hand-in-hand. Using the same format and including the same required details each time helps your factoring partner process invoices more efficiently.

- Ensuring Invoice Accuracy Prevents Payment Disputes: Invoices that are easy to understand and backed by supporting documentation are less likely to be questioned by customers or flagged by your factor.

Common Invoicing Errors Can Slow Down Factoring

Certain mistakes in the factoring invoice process are small and easy to overlook, but can still cause unnecessary delays. To streamline invoice factoring, keep an eye out for the issues below.

Missing or Inaccurate Information

Although simple, this is one of the most common invoice preparation mistakes. Invoices missing details like customer names, PO numbers, or payment terms often require extra verification. This slows down the approval process and may delay funding.

Inconsistent Formatting

If each invoice looks different, your factoring company may need to spend extra time locating key invoice elements. This creates friction and increases the chances of mistakes or follow-ups.

Submitting to the Wrong Contact

Even a perfect invoice can sit untouched if it’s sent to the wrong email or uploaded to the wrong portal. Factoring companies have specific workflows, and misrouted invoices can fall through the cracks.

Unclear or Missing Backup Documentation

Factoring companies often require proof of delivery, timecards, or other supporting documents. When those are missing or unclear, funding may be paused while they wait for clarification.

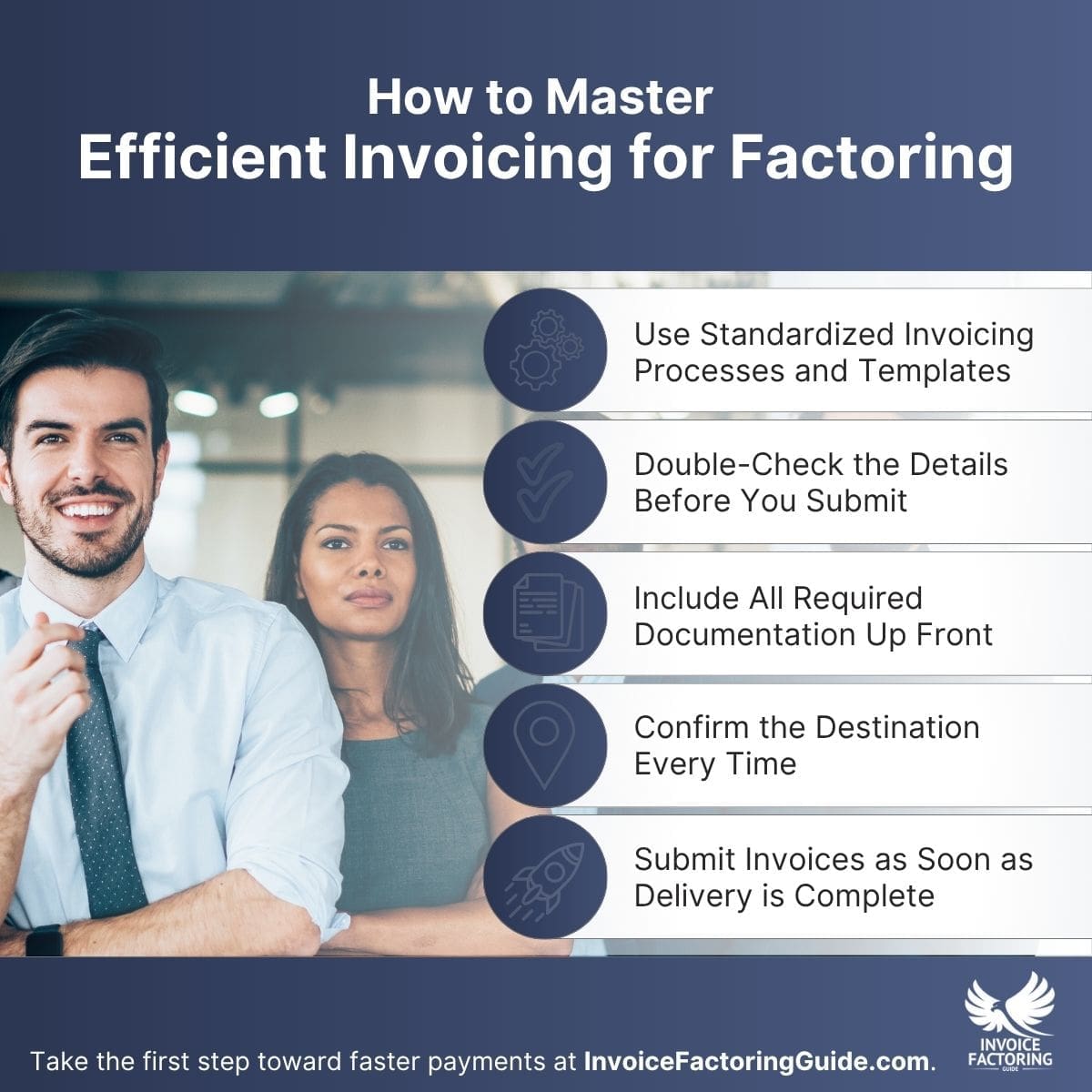

How to Master Efficient Invoicing for Factoring

Once you know what can cause delays, it’s much easier to create a process that addresses the basics of efficient invoicing and supports faster funding.

Use Standardized Invoicing Processes and Templates

Consistency speeds up reviews. A clear, well-structured template helps your factoring partner locate key information quickly. Make sure your invoices always include the same fields in the same layout to avoid unnecessary back-and-forth.

Double-Check the Details Before You Submit

A quick review before hitting send can prevent common issues. Look for missing line items, incorrect amounts, or skipped fields like PO numbers or payment terms. Small oversights can delay funding, even when everything else is in place.

Include All Required Documentation Up Front

Attaching proof of delivery, signed timecards, or other required documents at the time of submission helps your factor process invoices without interruption. Keeping a checklist on hand can help ensure nothing gets missed.

Confirm the Destination Every Time

Factoring companies often have designated portals or contacts for invoice submissions. Make sure your team knows the correct destination and has a reliable process for sending everything where it needs to go.

Submit Invoices as Soon as Delivery is Complete

The sooner your factor receives the invoice and required documents, the sooner they can release funds. Waiting until the end of the week or batching invoices unnecessarily can slow down your entire cash flow cycle.

Bonus Tips for Keeping the Process Running Smoothly

Once your invoicing foundation is solid, the following efficient invoicing tips can help you stay ahead of potential issues and maintain consistency as your business grows.

Assign a Point Person for Factoring Submissions and Communication with Factoring Companies

Having one team member oversee invoice prep and submission supports best practices for sharing invoice information. It also promotes clear communication with factors by giving them a consistent point of contact whenever questions arise.

Schedule Regular Process Reviews

Even a solid invoicing system can drift over time. Set aside time each quarter to review your process, identify bottlenecks, and make adjustments. Ongoing optimization of your invoicing process helps ensure that your invoicing stays aligned with your factoring company’s expectations.

Use Software to Automate Invoicing for Factoring

Tools that allow you to automate or pre-fill fields can improve invoice accuracy and save time. Some platforms also let you attach documents or export in formats your factor prefers, making the submission process smoother.

Invoice software for small businesses like QuickBooks, Xero, and FreshBooks offers built-in approval workflows and supports automating invoice tracking. These tools give you better visibility into payment timelines and help prevent submission delays.

Many factoring companies can link with you directly through top invoicing software options, creating a faster, more consistent invoicing process. Adding the right technology in the invoicing process helps you stay organized, scale more easily, and maintain steady access to funding.

Accelerate Your Cash Flow with An Experienced Factoring Partner

Efficient invoicing processes are only one piece of the puzzle. The next is finding a factoring company that has its own strong processes in place to help ensure your invoice approval goes smoothly and you receive your cash quickly. To be matched with vetted pros, request a complimentary rate quote.

FAQs on Efficient Invoicing for Factoring Success

How can I improve invoice accuracy before submission?

Improving invoice accuracy starts with a checklist. Double-check amounts, customer details, PO numbers, and line items before submitting. Automation tools can also help reduce errors and ensure your invoices meet your factor’s requirements the first time.

What are some tips for fast invoice factoring?

Send invoices immediately after delivery, use your factoring company’s preferred format, and include all required documentation. These tips for fast invoice factoring reduce processing delays and help you access funds as quickly as possible.

What are the best practices for invoice factoring?

Best practices for invoice factoring include using consistent formats, submitting complete documentation, communicating clearly with your factoring company, and assigning a dedicated point person. These habits help reduce delays and build trust with your funding partner.

How can I improve invoicing efficiency for factoring?

Look for small process improvements. Submitting invoices on time, using automation tools, and standardizing formats are all ways to improve invoicing efficiency. Clear internal workflows also reduce errors and keep cash flowing steadily.

What does an ideal invoice factoring workflow look like?

An efficient invoice factoring workflow starts with delivery confirmation, followed by prompt invoice generation and submission. Include all required documents and use consistent formatting. This structure makes it easier for factoring companies to process and approve funding quickly.

How do factoring and invoice management work together?

Factoring and invoice management are closely linked. Strong invoice management ensures that your documents are accurate, organized, and submitted on time, exactly what your factoring company needs to release funds quickly and consistently.

What are some efficient factoring strategies I can use?

Efficient factoring strategies include submitting invoices daily instead of batching them, integrating invoicing software, and assigning a team member to oversee the process. These steps help reduce delays and make your funding more predictable.

What should I know about invoice processing for factoring?

Invoice processing for factoring includes validating delivery, creating accurate invoices, and submitting required documents. The smoother your internal process, the faster your factor can approve and release funds.

What helps with reducing invoicing errors before submission?

Reducing invoicing errors starts with a consistent process. Use templates, automate key fields, and review all entries before submission. Even small adjustments can improve accuracy and prevent funding delays.

What are typical factoring invoicing requirements?

Most factoring companies require a valid invoice, proof of delivery or service, and any supporting documents like signed timecards or purchase orders. Meeting factoring invoicing requirements consistently helps ensure faster funding.

How does invoicing and factoring integration work?

Invoicing and factoring integration often happens through accounting or invoicing software. Some platforms connect directly with factoring portals, streamlining submission and reducing manual work. This setup helps ensure your invoices are always submitted correctly and on time.

How are factoring and accounts receivable connected?

Invoice factoring solutions turn your accounts receivable into immediate working capital. Instead of waiting for customers to pay, you submit those receivables to a factoring company and receive a cash advance, improving cash flow and stabilizing operations.

What are common factoring firm invoice procedures?

Factoring firms often follow a standard process: review your invoice and documentation, verify delivery, and release funds based on their advance and reserve terms. Understanding these invoice procedures can help you better align your process for faster turnaround.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300