Three out of five small businesses regularly face cash flow issues, according to Forbes. It’s one of the primary reasons businesses turn to factoring. In fact, hundreds of thousands of small businesses choose factoring each year, according to the latest Small Business Credit Report. However, sometimes the first factoring company a business selects is not a good fit, and switching factoring companies is necessary. The process is normally smooth, but there can be bumps along the way, especially if you’re not familiar with the process and everything involved.

In this factoring guide, we’ll explore the steps involved in transitioning to a new factoring company, how to handle coordination with new and existing factoring companies, and tips to make your pivot seamless.

Why Switching Factoring Companies Can Disrupt Cash Flow

Shifting from one factoring company to another can create temporary cash flow turbulence because your funding depends on a chain of processes that must be transferred, verified, and rebuilt. Even if you have strong revenue and reliable customers, the mechanics behind factoring are what keep cash flowing. When those mechanics shift, timing can slip.

Existing Receivables Must Be Released Before the New Company Can Fund

Your current factor typically holds a reserve account and controls open invoices. They will not release those receivables until your obligations with them are fully settled.

If the factor takes several business days to validate balances or process payoffs, your access to cash slows down. For example, some providers require up to five business days to confirm remittances from your customers before releasing reserves.

The New Factor Must Complete Its Own Credit and Compliance Work

Even if you have a clean track record, the incoming provider must conduct fresh due diligence. That includes verifying customer credit, confirming invoice legitimacy, and setting credit limits. If either factor moves slowly, your funding timeline shifts as well.

Customers Need Time to Update Where They Send Payments

Every factor uses a dedicated lockbox or bank account for receiving factoring payments. When you switch, your customers must redirect payments to the new address. Even small delays or invoice routing errors can interrupt cash flow. In fact, industry data shows that more than fifty percent of payment delays stem from administrative errors like outdated remittance instructions.

Payoff Amounts Can Change as Payments Arrive

Your old factor calculates a payoff amount, but that balance fluctuates as customer payments continue to come in. If the payoff is miscalculated or updated late, funding from your new provider can stall until both parties reconcile the numbers.

Old UCC Filings Must Be Cleared Before New Factoring Contracts Can Begin

A factoring company typically files a Universal Commercial Code (UCC) lien to secure its interest in your receivables. Your new provider cannot fund until the old factor releases or subordinates its filing. Some providers handle this within a day, while others take considerably longer, especially if communication is slow.

What Happens During a Factoring Provider Transition

Switching factoring companies involves several components that every business experiences, regardless of how the old account is closed. While the exact sequence varies based on the transition approach, these steps outline the major tasks involved in every factoring partner change.

Initial Application with the New Factoring Company

The process starts when you submit an application to the new factoring company. You typically provide an accounts receivable aging report, recent financial statements, and a customer list. The new factor evaluates this information to confirm that your receivables align with its funding criteria.

Underwriting and Customer Credit Review with the New Factoring Company

Once the application is accepted, the new factor performs underwriting to evaluate risk and understand your receivable patterns.

- Customer Credit Evaluation: The new factor reviews payment histories, credit limits, and potential risk indicators for your customers.

- Receivables Pattern Review: This includes average days to pay, dispute frequency, and the concentration of your sales across customers.

Factoring Agreement Review and Signing the New Contract

When underwriting is completed, the new provider prepares a factoring agreement that outlines advance rates, fees, reserves, and service expectations. Once you sign the agreement, the new factoring relationship is ready to move forward.

Providing Termination Notice to the Old Factoring Company

Your current factoring contract usually requires written notice before you can end the relationship. Although 30 days is common, some agreements require 60 days or more. Once notice is issued, the current provider begins preparing for account closure.

Customer Notification

All transitions include a point at which customers are notified of updated remittance instructions. The exact timing of this step depends on the transition approach. Notices are sent by the new factoring company once it has the legal right to collect future payments.

Cutover to the New Factoring Company

Every transition includes a moment when your business begins submitting new invoices to the new factor. The timing of this step varies depending on the closeout approach, but always marks the operational start of the new funding relationship.

Final Account Closure with the Old Factoring Company

Your old factoring company completes its responsibilities by applying remaining customer payments, reconciling fees and adjustments, and releasing any remaining reserves once the account reaches a zero balance.

UCC Release and Legal Handoff

Once the old factor confirms that the account is fully closed, it files a UCC termination. The new factor then files its own UCC financing statement to secure its interest in your receivables. This filing completes the legal transition.

Transition Approaches and How Each One Works

While every transition includes the same core components, the timing changes depending on how the old account is closed. These are the three primary approaches used across the industry.

Coordinated Buyout Approach

This is the most streamlined approach. The new factoring company pays the balance owed to the old provider, enabling a smooth handoff and minimizing funding gaps.

- Payoff Request: The new factor requests a payoff letter showing the outstanding balance and remaining invoices.

- Balance Paid: The new factor pays the old factor directly or provides funds for you to do so.

- Temporary UCC Subordination: The old factor temporarily subordinates its UCC filing so the new provider can begin funding.

- Customer Notification: The new factor sends updated remittance instructions to your customers.

- Start of New Funding: You begin submitting new invoices to the new factor.

- Old Invoice Collections: The old factor continues collecting the invoices it previously purchased.

- Final Reconciliation: Once the old factor applies the final payments and settles fees, the account reaches a zero balance.

- Final UCC Termination: The old factor files its UCC termination, completing the legal transition.

Natural Runoff or Notice-Period Wind-Down Approach

This approach follows the strict language of the existing factoring contract. There is no buyout, and no new funding occurs until the old factor’s account is fully closed.

- Notice-Period Restrictions: The old factor typically stops accepting new invoices once notice is issued.

- No New Funding: You cannot submit invoices to the new factor until the old factor’s UCC is cleared.

- Invoice Runoff: The old factor continues collecting payments on outstanding invoices.

- Final Reconciliation: When the last payment posts and all fees are settled, the account reaches a zero balance.

- Final UCC Termination: The old factor files its UCC termination.

- Customer Notification: The new factor sends updated remittance instructions after the old UCC is terminated.

- Start of New Funding: You begin submitting new invoices to the new factor.

Hybrid Closeout Approach

This combines elements of both the coordinated buyout and natural runoff approaches. Most invoices pay down naturally, and a small remaining balance is addressed through a targeted buyout.

- Partial Runoff: The majority of invoices pay down during the notice period.

- Targeted Buyout: The new factor pays off the remaining balance to keep the transition moving.

- Temporary UCC Subordination: The old factor temporarily subordinates its UCC filing so the new provider can begin funding.

- Customer Notification: The new factor sends updated remittance instructions to customers.

- Start of New Funding: You begin submitting new invoices to the new provider.

- Old Invoice Collections: The old factor continues collecting any remaining invoices it purchased.

- Final Reconciliation: Once all remaining amounts are settled, the account reaches a zero balance.

- Final UCC Termination: The old factor files its UCC termination, completing the legal handoff.

How to Ensure Business Cash Flow Continuity When Transitioning Between Factoring Providers

Avoiding cash flow gaps and delays in invoice funding during transition requires planning around timing, documentation, and communication. Because each transition approach affects funding differently, your best strategy is to control the parts of the process you can influence. These strategies help ensure your business continues to receive the liquidity it needs with minimal gaps.

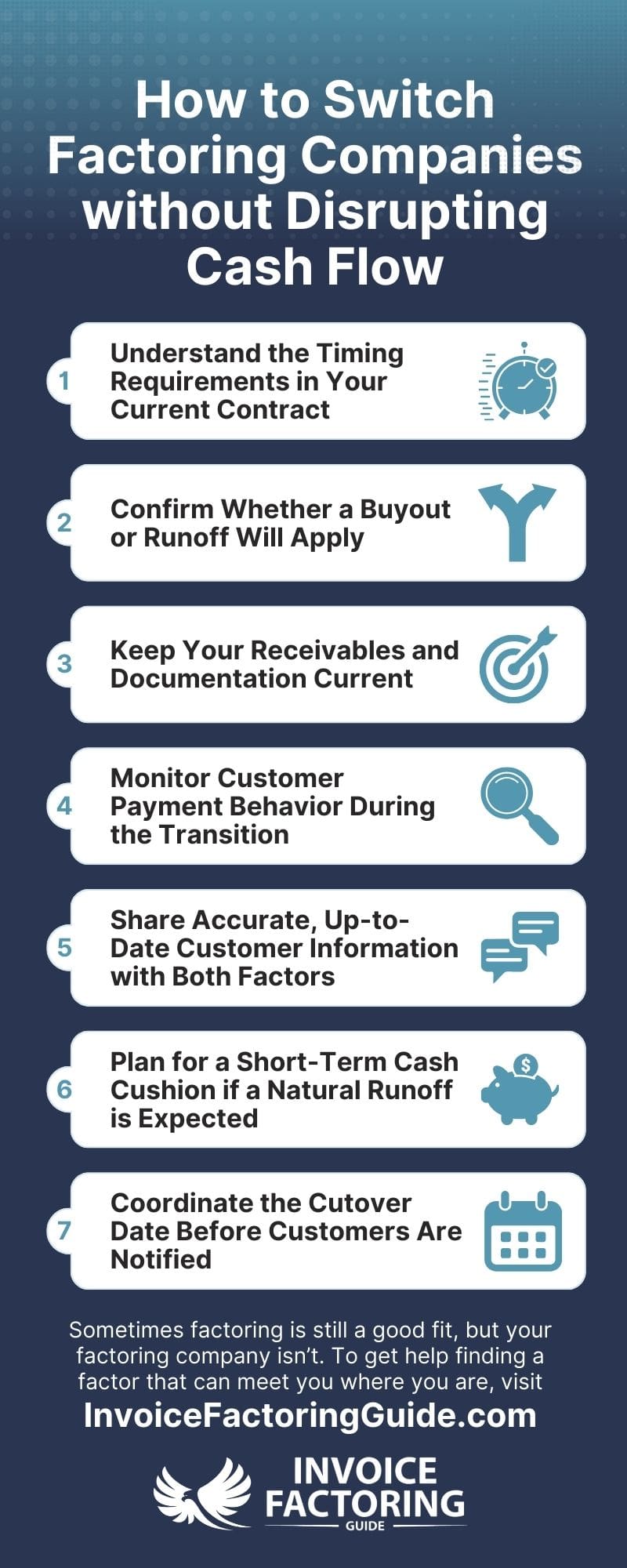

Understand the Timing Requirements in Your Current Contract

Your current factoring agreement has the strongest influence on cash flow continuity. Many contracts require a 30 or 60-day notice period, and some include restrictions on submitting new invoices after notice is given. Getting clarity on these terms helps you anticipate the earliest point at which the new factor can begin funding.

- Contract Review: Carefully review your termination terms so you know when funding will stop and how quickly a transition can progress.

- Timeline Mapping: Build a simple transition timeline based on notice requirements so you can plan around any potential cash flow gaps.

Confirm Whether a Buyout or Runoff Will Apply

Each transition approach affects cash flow differently. A coordinated buyout allows the new factor to begin funding sooner, while a natural runoff may create a period with no funding support.

- Approach Identification: Speak with both factoring companies early to determine if a buyout, natural runoff, or hybrid method will be used.

- Cash Flow Planning: Create a plan based on the selected approach, especially if a natural runoff is expected.

Keep Your Receivables and Documentation Current

Funding delays often occur when invoices or supporting documents require clarification. Keeping your receivables clean makes it easier for the new factor to begin funding without interruption.

- Invoice Accuracy: Make sure invoices are issued promptly, with correct amounts and matching backup documentation.

- Clear Payment Records: Maintain detailed records of payments received so that both factoring companies can reconcile your account efficiently.

Monitor Customer Payment Behavior During the Transition

During a transition, customer payment timing has greater influence on your cash flow than usual. Slow payments can extend the closeout period and delay the point at which the new factor can move forward.

- Proactive Outreach: If certain customers pay slowly, consider sending gentle reminders or confirming expected payment dates.

- Payment Tracking: Keep close track of outstanding invoices so you know how the transition is progressing.

Share Accurate, Up-to-Date Customer Information with Both Factors

Smooth funding depends on having correct remittance details, contracts, and customer data on file. Clear communication reduces the chance of misrouted payments, which can delay both closeout and cutover.

- Customer List Review: Ensure your customer list is complete and up to date before the transition begins.

- Contract Accessibility: Provide both factors with customer contracts or purchase orders if your customers require them for invoice approval.

Plan for a Short-Term Cash Cushion if a Natural Runoff is Expected

A natural runoff can temporarily restrict access to funding because the new provider cannot factor invoices until the old UCC filing is fully terminated. Preparing in advance helps you maintain stability.

- Cash Reserve Planning: Set aside a temporary reserve or delay nonessential expenses if you know a funding gap is likely.

- Operational Adjustments: Consider shifting invoice timing or scheduling payments around the transition period.

Coordinate the Cutover Date Before Customers Are Notified

Customer notices should be timed so that payments route correctly from the beginning of the new relationship. Funding is most stable when cutover and notices are synchronized.

- Aligned Factoring Communication: Work with both factors to confirm a clear date for when new invoices will go to the new provider.

- Customer Confirmation: Ensure customers understand when to begin sending payments to the new remittance address.

Additional Tips and Best Practices for Smooth Factoring Transitions

Preparing for factoring transitions isn’t necessarily complex, and your new factoring company will likely help you stay on top of financial priorities when switching providers. Even still, there are a few best practices you can follow to help ensure your transition goes smoothly.

Give Both Factoring Companies the Same Information at the Start

Accuracy and consistency reduce questions, follow-up requests, and delays later in the process.

- Unified Documentation Set: Provide the same customer lists, aging reports, and supporting documents to both providers at the beginning of the transition.

- Central Point of Contact: Identify a single person in your company who will respond to document requests during the transition.

Ask the New Factor to Outline Its Expected Timeline

A clear roadmap helps set expectations and prevents miscommunication.

- Transition Overview: Request a breakdown of key milestones, including underwriting completion, anticipated closeout timing, and planned customer notification dates.

- Responsibility Clarification: Confirm which tasks belong to your team and which belong to the factor.

Review Invoicing Requirements Before the Cutover

Each factoring company may have different standards for invoice formatting, supporting documents, and submission methods.

- Invoicing Checklist: Ask the new factor for a list of invoice requirements so your team is ready at cutover.

- Internal Alignment: Train your staff on any new submission protocols before the transition date.

Coordinate with Customers Ahead of the Transition When Appropriate

While official notices come from the factoring company, a brief heads-up from you can help customers prepare for changes in remittance instructions.

- Professional Courtesy: Let customers know that a formal notice will be sent and that your remittance details will be updated.

- Clear Expectations: Encourage them to read and update their systems promptly when the formal notice arrives.

Keep Communication Open with Your Current Factor

Cooperation from your existing provider influences how smooth the transition will be, especially during account closeout.

- Status Checks: Request periodic updates on outstanding invoices, expected payment dates, and remaining reserve balances.

- Documentation Requests: Respond quickly when the old factor requests clarification or backup documents.

Verify All Customer Updates After the Notice of Assignment is Sent

Even when notices are delivered, some customers need a reminder or clarification.

- Follow-Up Validation: Check in with key customers to confirm they have updated your remittance information in their systems.

- Internal Tracking: Monitor early payments to ensure they are routing to the correct provider.

Review Outstanding Purchase Orders or Long-Term Contracts

Some customers have contract terms that relate to invoice assignment or require approval before remittance updates.

- Contract Review: Identify customers who have assignment clauses or unique billing requirements.

- Approval Confirmation: Work with both factors to ensure any approvals or documentation are handled before the cutover.

Document Your Internal Transition Plan

A simple internal plan keeps your operations organized throughout the process.

- Internal Checklist: Outline key tasks, including document preparation, invoice cutoff dates, and system updates.

- Team Communication: Inform all relevant departments, such as accounting, operations, and billing, about the transition timeline.

Retain All Correspondence for Reference

A transition involves multiple parties and many moving parts. Keeping organized records prevents miscommunication.

- Communication Archive: Save emails, notices, payoff letters, and reconciliation statements.

- Invoice Tracking: Keep copies of all invoices that are part of the transition period, whether under the old factor or the new one.

Get Help Finding Your New Factoring Company

Whether you’re considering switching factoring companies due to slow funding, poor communication, or other issues, we can help ease the transition by matching you with vetted factors that will help you navigate the shift and keep your cash flow moving after. To get started, request a complimentary rate quote.

FAQs on Switching Factoring Companies

Can I change factoring companies even if I agreed to a minimum term?

Yes, but you may be required to complete the minimum term or pay early termination fees. Review your contract to confirm specific obligations. Many providers outline minimum time frames to protect their investment, so understanding these terms helps you plan your transition effectively.

Can I change factoring companies if my contract has a termination clause?

Yes. A termination clause sets the rules for ending your agreement, such as notice periods or fees. You can still switch companies, but you must follow the clause exactly. Knowing these terms early helps you avoid delays and prevents issues during account closure.

Will my factoring company let me leave early?

Possibly. Some providers allow early termination through a buyout or negotiated release, while others enforce the full contract term. It depends on your agreement and the company’s policies. Contact your factor directly to confirm options and understand any financial implications tied to leaving early.

What should I look for when reviewing my current factoring contract?

Focus on factoring termination requirements, notice periods, early termination fees, and minimum volume commitments. Also, review reserve policies, dispute handling rules, and any restrictions on invoice submission. Understanding these details helps you plan a smooth transition and prevents surprises during closeout.

How do I know when to switch factoring companies?

Consider switching when funding slows, service quality declines, or contract terms no longer support your operations. Signs include delayed payments, unclear communication, unexpected charges, or difficulty resolving issues. Evaluating performance regularly helps you decide when a change is beneficial.

What are common issues with factoring providers to watch for when choosing factoring companies?

Common issues include slow funding, limited customer service, rigid contract terms, high fees, reserve holdbacks, and strict dispute processes. Reviewing these elements early helps you select a provider that aligns with your workflow and supports steady, predictable funding.

Can you have overlapping agreements with factoring companies?

You generally cannot have overlapping factoring agreements because only one company can hold the security interest in your receivables. Handling overlapping factoring agreements requires clear communication with both providers and a defined transition plan. Most transitions rely on buyouts or runoffs to prevent overlap.

How can I avoid invoice funding delays when switching factoring companies?

Keep your documentation current, respond quickly to requests from both providers, and confirm the transition approach early. Accurate records, clean receivables, and well-timed customer notices help reduce delays and allow the new factor to fund as soon as it has first position.

Who is responsible for communication during factoring transitions?

Both the business and the factoring companies share responsibility. Your role is to provide accurate information and respond promptly to requests. The providers handle customer notices, payoff coordination, and timeline updates. Clear communication helps keep the transition organized.

How do invoice handovers work when switching factoring companies?

Invoice handovers depend on the transition approach. In a buyout, the new factor purchases the old factor’s remaining invoices. In a runoff, the old factor continues collecting. Clear records and matched documentation help both sides reconcile balances and move the transition forward.

How do I go about ensuring smooth invoice portfolio handovers?

Maintain accurate invoice records, confirm supporting documents, and keep communication open with both providers. Align invoice lists early so each company knows which receivables belong to its portfolio. This preparation helps prevent disputes and ensures a clean, orderly handoff.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300