Many business owners believe that, if you’re leveraging invoice factoring, you must factor all your invoices. This simply isn’t true. There are many situations where a business might hand off some of its collections efforts to a factor and still manage some in-house. And while it might seem complicated on the surface, balancing factoring and in-house collection strategies can be as simple as outsourcing some accounting, HR, or IT duties. The key is to make sure the duties are clearly defined and that communication remains open. Give us a few minutes, and we’ll walk you through what makes these setups unique and how to ensure seamless processes if you have a more tailored factoring agreement.

In a Traditional Factoring Arrangement, the Factor Manages Collections

In a traditional factoring arrangement, your business sells outstanding invoices to a factoring company. In return, you receive fast access to most of the invoice value. The factoring company then assumes responsibility for collecting payment from your customer. This setup is common in industries with long payment cycles, such as staffing, manufacturing, or logistics.

The Factoring Process is Simple

Once you’re approved for factoring, the process usually goes something like this:

- Invoice Issuance and Sale: After delivering goods or services, you issue an invoice to your customer. Rather than waiting weeks or months for payment, you sell that invoice to a factoring company.

- Initial Advance: The factoring company advances a large portion of the invoice value, typically between 80 and 90 percent, within one to two business days.

- Collections Management: The factoring company handles all customer outreach and payment collection. This includes follow-up calls, email reminders, and processing payments.

- Final Payment and Fee Deduction: Once your customer pays the full invoice amount, the factoring company releases the remaining balance to you, minus a factoring fee. The fee typically ranges from one to five percent of the invoice amount, depending on volume, customer credit quality, and payment terms.

Communication and Processes Usually Change When You Factor

There are a few key changes businesses experience when they’re factoring.

- Customer Notification: Your customer is informed that the invoice has been assigned to a third party. All payments are directed to the factoring company, not to your business.

- Collections Outsourcing: Your team is not involved in collections for factored invoices. The factoring company takes over all responsibility for follow-up and payment.

- Ongoing Relationship Management: While the factor communicates directly with your customer about payment, your business continues to manage the overall client relationship, including future sales or services.

This Approach is Beneficial for Most Businesses

Even though you’re giving up some control and communication when you factor, businesses are typically happy with the arrangement because it offers many benefits.

- Improved Cash Flow Timing: Access to funds within a day or two can stabilize cash flow and support payroll, supplies, or other operating expenses.

- Reduced Internal Burden: Shifting collections to a third party minimizes the need for a large accounts receivable team. This is a huge benefit for most businesses, considering that a typical SME wastes 14 hours per week chasing invoices, according to QuickBooks.

- Clear Division of Labor: Your business focuses on operations and growth, while the factoring company focuses on getting invoices paid.

Businesses May Still Be Responsible for Collections in Certain Situations

While traditional factoring offers simplicity and speed, not every business uses it in a standard form. Many choose customized agreements that provide more control, greater flexibility, or strategic advantages based on customer relationships or industry requirements. Let’s review some of the most common variations.

Recourse Factoring

This is the most common type of factoring agreement. If your customer does not pay the invoice and you have a recourse factoring agreement, your business is required to buy it back or replace it with another of equal value. Because your business retains the risk of nonpayment, recourse factoring usually comes with lower fees. However, it also means your team may stay involved in credit monitoring, customer follow-up, or resolving disputes to avoid triggering a repurchase.

Non-Notification Factoring

In most cases, the factoring company informs your customers that you’re factoring and asks them to redirect payment to them. In non-notification factoring, however, the factoring company purchases the invoice, but your customer is not told that it has been sold. Communications and collections may remain in your hands, even though the factor now legally owns the receivable. This structure is typically used when businesses want to maintain control of the customer experience, especially in industries like professional services, where trust and discretion are critical.

Spot Factoring

Some businesses only factor individual invoices on an as-needed basis rather than factoring all receivables. Known as spot factoring, it’s often used to cover short-term cash flow needs. Since most of your invoices are still collected in-house, your accounts receivable team remains heavily involved in day-to-day operations.

Industry-Specific Modifications

Some industries require factoring arrangements that deviate from standard terms. In construction, for example, invoices may be tied to milestones, retainage, or pay-when-paid clauses. These complicate collections and require custom agreements. In freight, carriers may factor invoices only from certain shippers with long payment cycles or known credit issues, while managing the rest internally.

Customer-Specific Strategy

Businesses often choose to factor invoices selectively based on the nature of the customer. For instance, oilfield services businesses can secure lucrative contracts with multinational energy companies. While the money is good and the customer is likely to pay, they often force businesses to accept 90-day payment terms. The business may selectively factor just these invoices because they want the work but can’t afford to wait. In situations like these, your team may factor selectively or continue managing collections for strategic accounts to preserve relationships or maintain control over communication.

Balancing Factoring with In-House Collection Requires Some Planning

If your business is factoring only some invoices or using a modified agreement, your internal team is still involved in accounts receivable. Balancing means assigning responsibility clearly, maintaining full visibility over collection activity, and preventing missed payments or duplicate outreach. This requires a coordinated effort across systems, teams, and external partners.

Accounts Receivable Best Practices

Follow best practices on every invoice you generate. Consistency strengthens the customer experience, helps ensure you collect all balances promptly, and keeps your financial records healthy, so you can increase factoring later if needed and improve access to other business funding solutions.

Clear Role Assignment

Your team should know which accounts are factored and which are collected in-house. Without this clarity, you risk duplicate outreach or missed follow-ups. A shared tracking system or labeling method can help ensure responsibilities are clearly divided.

Consistent Customer Communication

If your customer communicates with both your team and the factoring company, the messaging needs to be consistent. This is especially important in non-notification agreements, where your team handles collections on behalf of the factor.

Internal Workflow Integration

Factored and non-factored invoices should both flow through your internal accounting or CRM system. This helps your team monitor payment status across all accounts, flag issues early, and coordinate with the factor when needed.

Ongoing Oversight of Factored Accounts

Even after an invoice is sold, your team benefits from tracking payment timelines, identifying disputes, and reviewing how the factoring company interacts with your customers. This helps you protect client relationships and hold the factor accountable for service quality.

Strategic Use of Factoring

Over time, you may adjust which accounts you factor based on how well internal collections perform. If your team consistently shortens days sales outstanding on certain accounts, you might reduce your reliance on factoring in that segment.

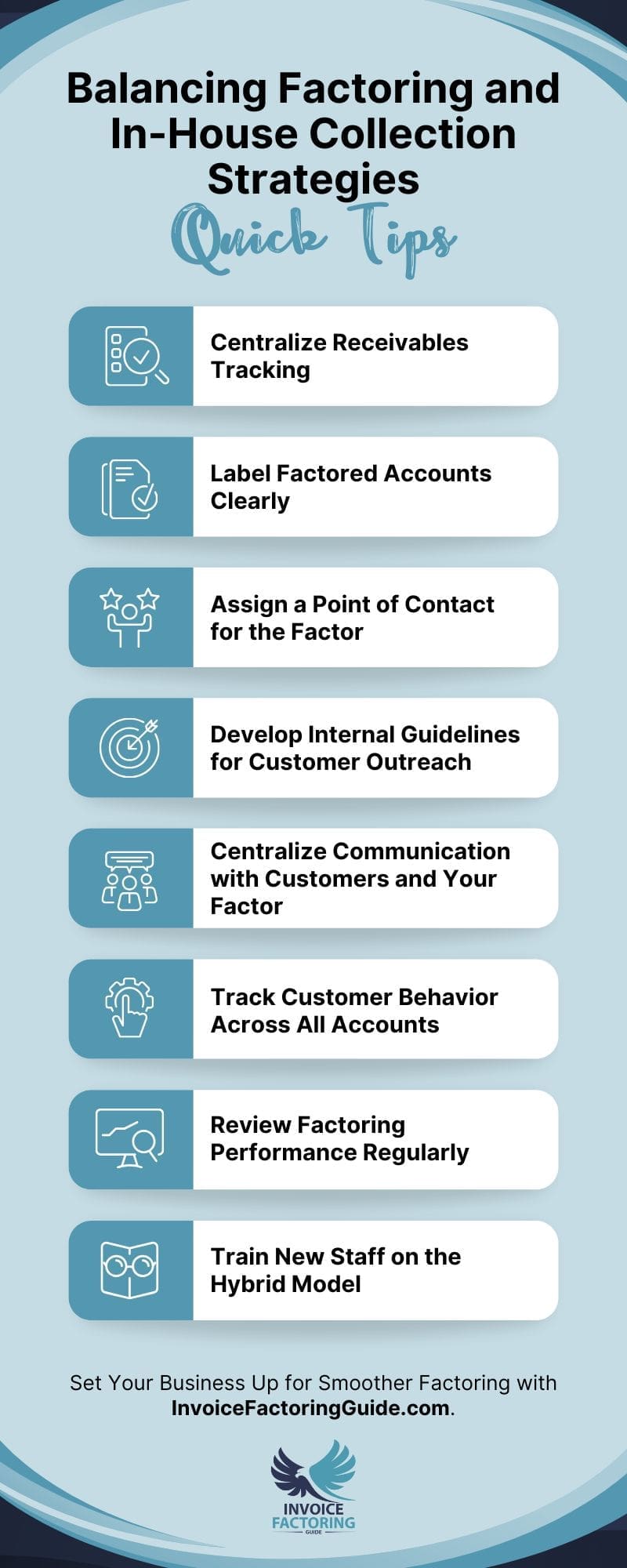

Tips for Balancing Factoring and In-House Collection Strategies

An effective hybrid collections strategy requires defined processes, team training, and full visibility into all accounts, factored and in-house. These tips can help your business improve coordination, reduce confusion, and protect customer relationships while allowing you to maintain steady cash flow.

Centralize Receivables Tracking

Use a single dashboard or software platform to monitor both factored and non-factored invoices. This helps your team avoid missed follow-ups, track aging, and coordinate with the factoring company efficiently.

Label Factored Accounts Clearly

Mark factored invoices in your accounting system so your team knows which ones are being handled externally. This prevents accidental outreach that could confuse your customers or violate your factoring agreement.

Assign a Point of Contact for the Factor

Designate one person or team to manage communication with the factoring company. This ensures consistency, improves accountability, and makes it easier to resolve issues quickly.

Develop Internal Guidelines for Customer Outreach

Set clear rules for when and how your team follows up on non-factored accounts. Include tone, timing, and escalation procedures to protect relationships and improve recovery rates.

Track Customer Behavior Across All Accounts

Even if a customer’s invoices are handled by the factor, your team should still monitor payment patterns and responsiveness. This data helps inform credit decisions, account strategy, and future factoring use.

Review Factoring Performance Regularly

Schedule quarterly or monthly check-ins to evaluate how the factoring relationship is impacting cash flow, customer satisfaction, and internal workload. Use that insight to fine-tune which accounts to factor going forward.

Train New Staff on the Hybrid Model

If your business uses both factoring and in-house collections, make sure onboarding materials and procedures reflect this. Staff should know exactly how to identify account types and follow the correct process.

Develop Your Tailored Invoice Factoring Strategy

Invoice factoring is highly customizable and can adapt to a variety of business needs and goals. If you’re not getting what you need out of your current factoring relationship, or you’re factoring for the first time and want a tailored fit, Invoice Factoring Guide can match you with a suitable factor. To take the first step, request a complimentary rate quote.

FAQs on Balancing Factoring and In-House Collection Strategies

What’s the best way to coordinate with a factoring company and my internal A/R team?

Designate a primary point of contact to manage communication with the factoring company. Make sure internal staff know which accounts are factored and follow consistent procedures for updates, disputes, and account notes. Shared documentation and regular check-ins help align both teams.

How do I prevent duplicate collection efforts when using factoring?

Tag factored invoices clearly in your accounting software and train staff to check those tags before initiating outreach. Use shared notes or activity logs so your team and the factor stay aligned. A single system of record is essential for avoiding overlap.

What internal processes should I update when I start factoring invoices?

Update your invoice workflow, payment tracking, and customer service procedures to account for third-party involvement. Create internal flags to separate factored accounts, and build guidelines for how your team should respond to customer questions about payment and collections.

How can I track factored and non-factored receivables in the same system?

Most accounting software allows you to create custom tags, categories, or customer types. Use these features to separate factored accounts without removing them from your main A/R view. This ensures your team can monitor all open balances in one place.

Do I need a separate collections process for factored and non-factored invoices?

Yes. Factored invoices are managed by the factoring company, while non-factored invoices remain your team’s responsibility. Separate protocols help avoid confusion. Internal collections should follow clear steps for follow-up, escalation, and documentation, distinct from the factor’s process.

How should I divide collection responsibilities between my staff and the factor?

The factoring company should handle communication and collections for any invoice they purchase, unless you're using a non-notification model. Your team should manage all remaining accounts. Document this division of responsibility clearly and make it part of your internal training.

What kind of communication should my customers get when I use factoring and in-house collections?

Customers should receive consistent and professional messaging. If the factor is handling outreach, ensure their tone and practices align with your brand. If your team is involved, use clear templates and escalation rules so all communication supports long-term relationship goals.

Can I still manage customer relationships if the factor handles collections?

Yes. While the factor manages payment, your team still owns the broader relationship. You can maintain regular contact about service, support, and future sales. Choosing a factoring company with a customer-friendly approach helps ensure the relationship remains intact.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300